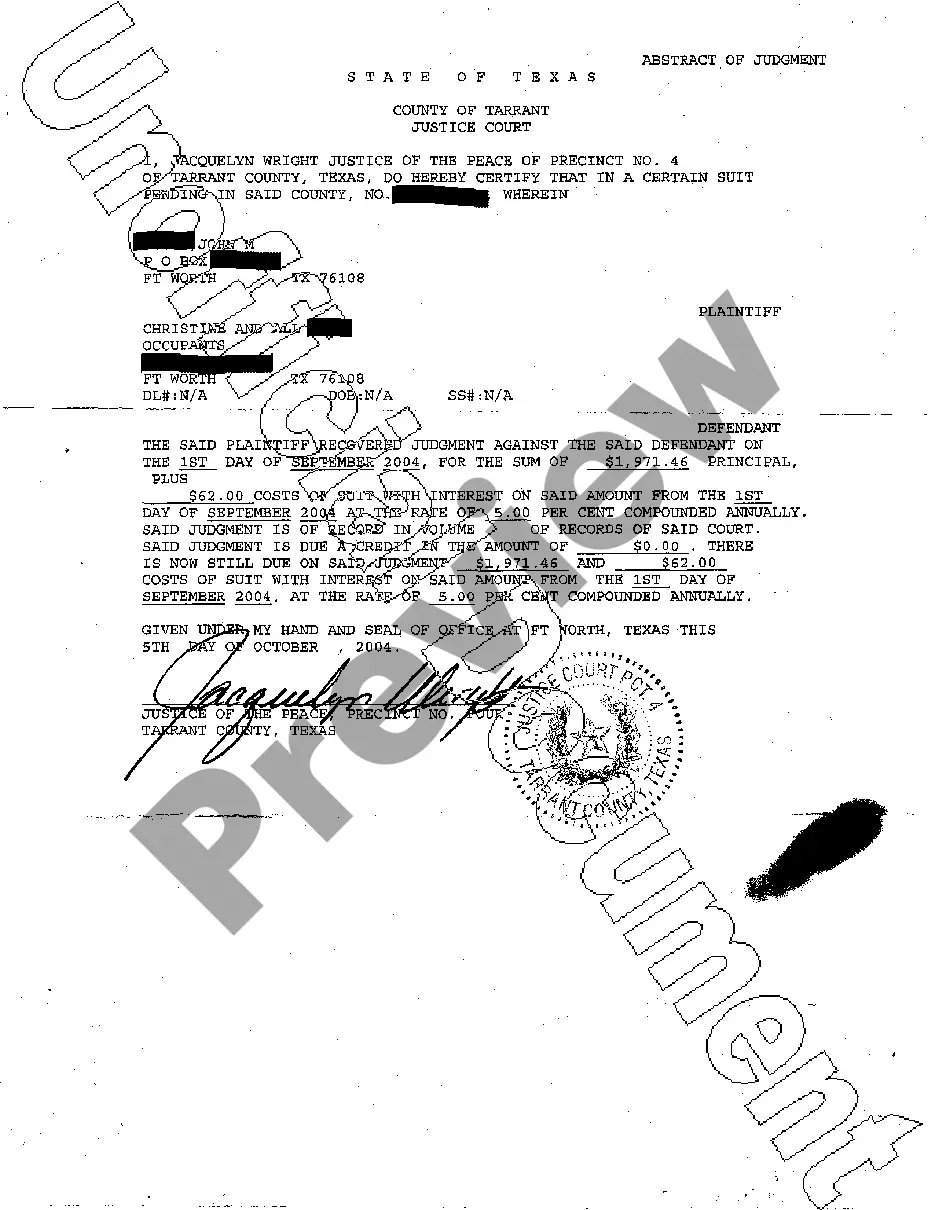

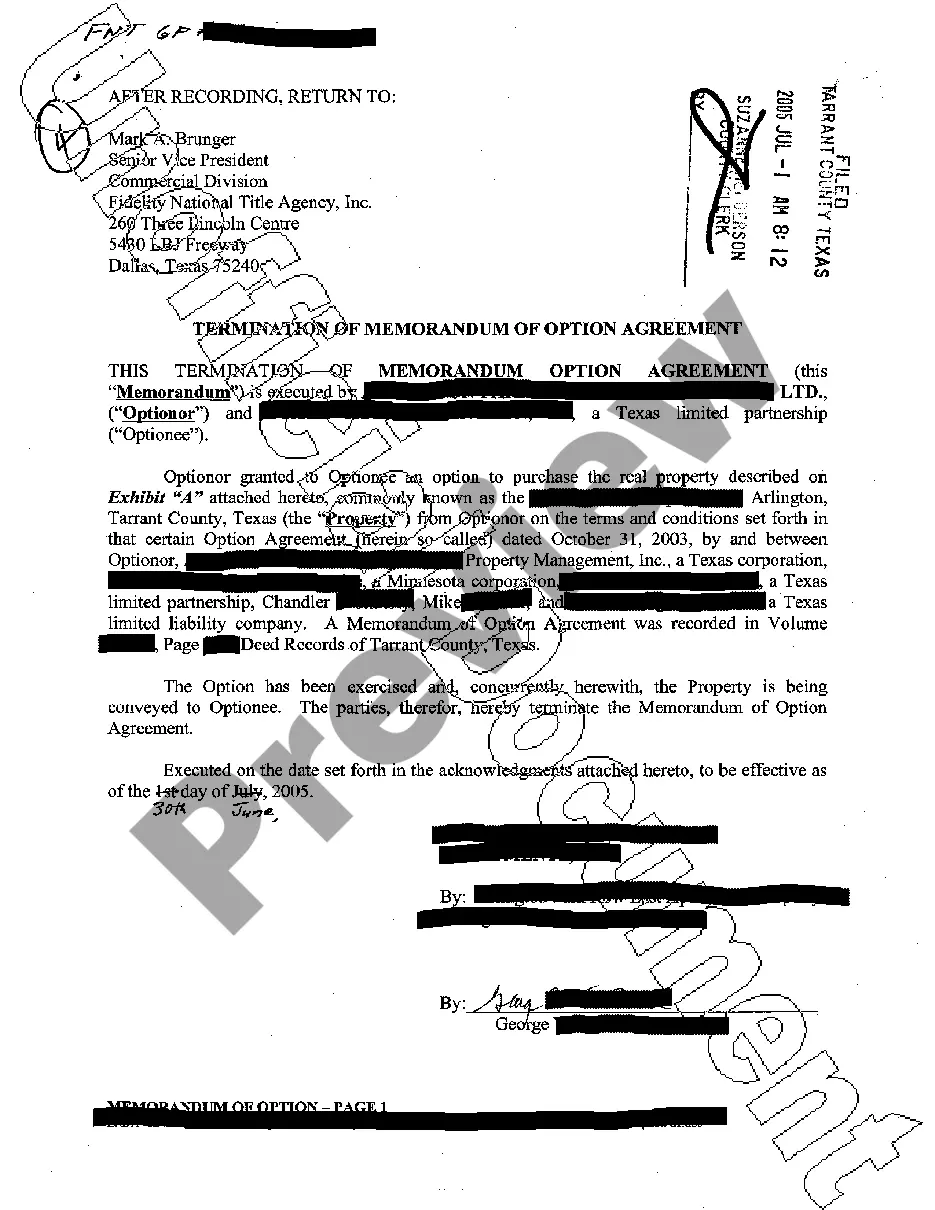

Keywords: Harris Texas, Down Round Term Sheet, types Description: The Harris Texas Down Round Term Sheet is a legal document frequently used in investment and financing transactions, specifically for companies experiencing financial challenges or in need of additional funding. In simple terms, a down round refers to a subsequent funding round in which a company's valuation is lower than in previous rounds. This may occur due to various reasons such as changes in market conditions, company performance, or economic downturns. The Harris Texas Down Round Term Sheet outlines the terms and conditions under which new investors provide capital to the struggling company. This includes details regarding the investment amount, equity stakes, valuation, rights, and other provisions specific to the down round scenario. Let's explore the different types of Harris Texas Down Round Term Sheets: 1. Equity-Based Down Round Term Sheet: This type of term sheet involves a downward adjustment in the company's valuation. New investors acquire equity in the company at a significantly reduced price compared to previous rounds. This allows them to obtain a higher percentage of ownership in the company than earlier investors. 2. Convertible Note Down Round Term Sheet: In this scenario, instead of purchasing equity directly, investors provide financing through convertible notes. These notes later convert into equity at a predetermined conversion price if a down round occurs. This type of term sheet offers investors the potential to convert their investment into equity at a lower valuation. 3. Bridge Financing Down Round Term Sheet: Bridge financing is a short-term financing option utilized to sustain operations until a more substantial funding round is secured. If a company chooses this route while experiencing financial difficulties, a down round term sheet would outline the terms of the bridge financing, including conversion mechanisms, interest rates, maturity dates, and other relevant factors. Regardless of the specific type, the Harris Texas Down Round Term Sheet is essential in documenting the agreed-upon terms between the existing company and incoming investors. It protects the interests of all parties involved while facilitating the company's ability to overcome financial challenges and continue its operations.

Harris Texas Down Round Term Sheet

Description

How to fill out Harris Texas Down Round Term Sheet?

Drafting documents for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Harris Down Round Term Sheet without professional assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Harris Down Round Term Sheet on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Harris Down Round Term Sheet:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!