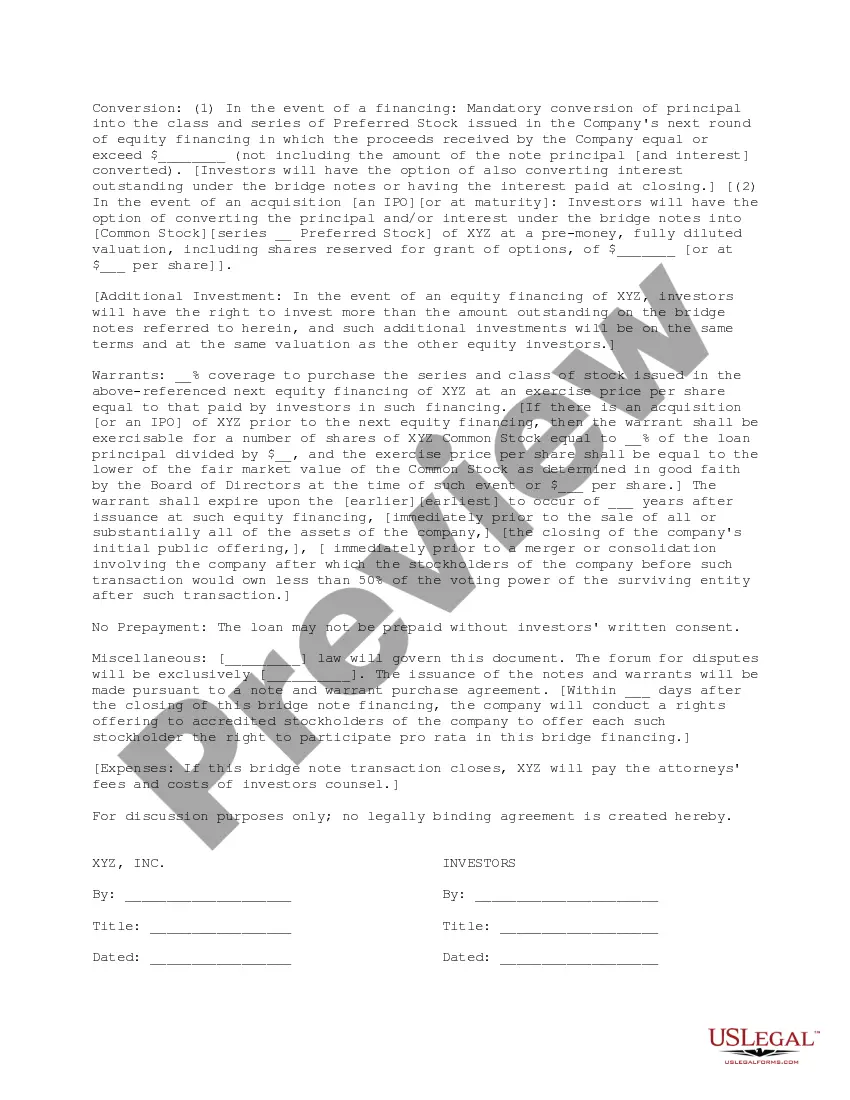

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Alameda California Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a loan provided by a lender to a borrower in Alameda, California. This type of financing is most commonly used when there is a temporary gap in funding, such as during a home sale or when purchasing a new property before selling an existing one. Bridge financing helps borrowers bridge this gap until they can secure a more permanent or long-term financing option. The Alameda California Term Sheet for Bridge Financing includes essential details such as the loan amount, interest rate, repayment terms, collateral, and other relevant provisions. It serves as a preliminary agreement between the lender and borrower before the loan is fully executed. Different types of Alameda California Term Sheet for Bridge Financing may include: 1. Residential Bridge Financing: This type of bridge financing is specifically tailored for individuals or families who are transitioning between homes. It provides short-term funding to cover the purchase of a new home until the current home is sold. 2. Commercial Bridge Financing: Commercial bridge loans are designed for businesses and investors who need immediate capital for a commercial real estate transaction. These loans are commonly used for property development, acquisitions, or refinancing until permanent financing can be secured. 3. Construction Bridge Financing: This type of bridge financing is utilized by developers and contractors to fund the construction or renovation of a property. It covers expenses such as materials, labor, permits, and other construction-related costs until a permanent loan or funding is available. 4. Private Bridge Financing: Private lenders in Alameda, California, offer bridge loans for borrowers who may not qualify for traditional bank financing. These loans often serve as a temporary solution until the borrower can improve their credit profile or fulfill other requirements. 5. Personal Bridge Financing: Personal bridge loans cater to individuals who require short-term funds for personal reasons, such as financing education, medical expenses, or unexpected emergencies. These loans help bridge the financial gap until a more permanent funding solution can be arranged. In summary, the Alameda California Term Sheet for Bridge Financing is a crucial document that outlines the terms and conditions of a temporary loan used to bridge financial gaps in real estate transactions or other personal or business needs. The different types of bridge financing cater to various scenarios such as residential, commercial, construction, private, or personal needs.Alameda California Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a loan provided by a lender to a borrower in Alameda, California. This type of financing is most commonly used when there is a temporary gap in funding, such as during a home sale or when purchasing a new property before selling an existing one. Bridge financing helps borrowers bridge this gap until they can secure a more permanent or long-term financing option. The Alameda California Term Sheet for Bridge Financing includes essential details such as the loan amount, interest rate, repayment terms, collateral, and other relevant provisions. It serves as a preliminary agreement between the lender and borrower before the loan is fully executed. Different types of Alameda California Term Sheet for Bridge Financing may include: 1. Residential Bridge Financing: This type of bridge financing is specifically tailored for individuals or families who are transitioning between homes. It provides short-term funding to cover the purchase of a new home until the current home is sold. 2. Commercial Bridge Financing: Commercial bridge loans are designed for businesses and investors who need immediate capital for a commercial real estate transaction. These loans are commonly used for property development, acquisitions, or refinancing until permanent financing can be secured. 3. Construction Bridge Financing: This type of bridge financing is utilized by developers and contractors to fund the construction or renovation of a property. It covers expenses such as materials, labor, permits, and other construction-related costs until a permanent loan or funding is available. 4. Private Bridge Financing: Private lenders in Alameda, California, offer bridge loans for borrowers who may not qualify for traditional bank financing. These loans often serve as a temporary solution until the borrower can improve their credit profile or fulfill other requirements. 5. Personal Bridge Financing: Personal bridge loans cater to individuals who require short-term funds for personal reasons, such as financing education, medical expenses, or unexpected emergencies. These loans help bridge the financial gap until a more permanent funding solution can be arranged. In summary, the Alameda California Term Sheet for Bridge Financing is a crucial document that outlines the terms and conditions of a temporary loan used to bridge financial gaps in real estate transactions or other personal or business needs. The different types of bridge financing cater to various scenarios such as residential, commercial, construction, private, or personal needs.