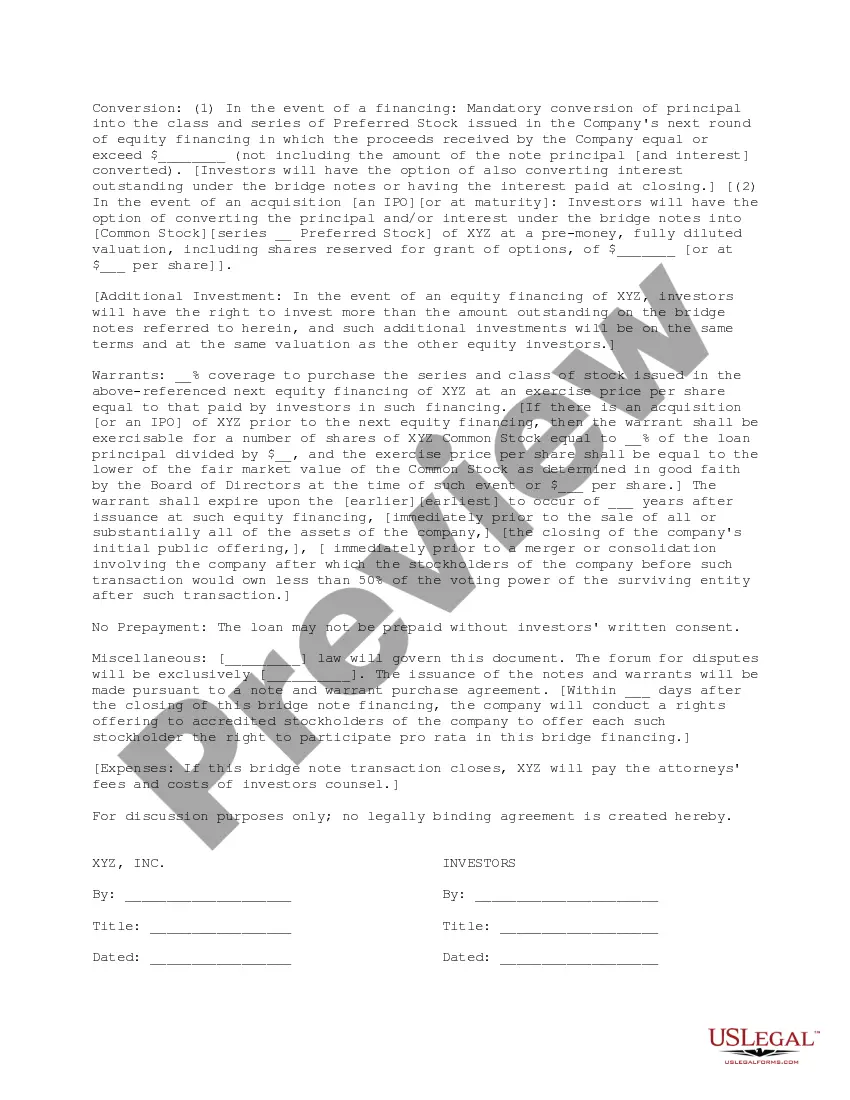

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Bexar Texas Term Sheet for Bridge Financing is a crucial document used in real estate transactions to outline the terms and conditions of a short-term loan. This term sheet is specific to Bexar County, Texas, and serves as a framework for bridge financing, which is typically used to bridge a financial gap between the purchase of a new property and the sale of an existing one. The sheet includes relevant keywords such as bridge financing, Bexar County, Texas, real estate transactions, short-term loan, terms and conditions, purchase, sale, financial gap, and property. Different types of Bexar Texas Term Sheet for Bridge Financing may include: 1. Residential Bridge Financing Term Sheet: This term sheet caters to residential properties, outlining the necessary conditions, loan amounts, interest rates, and repayment terms specific to residential real estate transactions in Bexar County. 2. Commercial Bridge Financing Term Sheet: Designed for commercial properties, this term sheet addresses the distinct requirements and specifications involved in financing commercial real estate within Bexar County. It may highlight factors like lease agreements, tenant occupancy, and potential rental income when determining the bridge loan terms. 3. New Construction Bridge Financing Term Sheet: This term sheet focuses specifically on financing for new construction projects in Bexar County. It includes provisions for loan disbursement based on construction milestones, project timelines, collateral requirements, and repayment schedules customized for the unique nature of new construction in the area. 4. Multifamily Bridge Financing Term Sheet: As the name suggests, this Bridge Financing Term Sheet pertains to financing multifamily properties within Bexar County. It considers factors such as the number of units, rental income, property management, and tenant occupancy rates to determine the loan terms and conditions. 5. Land Acquisition Bridge Financing Term Sheet: This term sheet addresses the financing needs for acquiring undeveloped land in Bexar County. It dictates the loan duration, interest rates, and potential contingent upon factors like zoning requirements, environmental assessments, and potential development plans. Regardless of the specific type, Bexar Texas Term Sheet for Bridge Financing plays a pivotal role in real estate transactions, providing a detailed breakdown of the financial arrangements and obligations between the borrower and lender.Bexar Texas Term Sheet for Bridge Financing is a crucial document used in real estate transactions to outline the terms and conditions of a short-term loan. This term sheet is specific to Bexar County, Texas, and serves as a framework for bridge financing, which is typically used to bridge a financial gap between the purchase of a new property and the sale of an existing one. The sheet includes relevant keywords such as bridge financing, Bexar County, Texas, real estate transactions, short-term loan, terms and conditions, purchase, sale, financial gap, and property. Different types of Bexar Texas Term Sheet for Bridge Financing may include: 1. Residential Bridge Financing Term Sheet: This term sheet caters to residential properties, outlining the necessary conditions, loan amounts, interest rates, and repayment terms specific to residential real estate transactions in Bexar County. 2. Commercial Bridge Financing Term Sheet: Designed for commercial properties, this term sheet addresses the distinct requirements and specifications involved in financing commercial real estate within Bexar County. It may highlight factors like lease agreements, tenant occupancy, and potential rental income when determining the bridge loan terms. 3. New Construction Bridge Financing Term Sheet: This term sheet focuses specifically on financing for new construction projects in Bexar County. It includes provisions for loan disbursement based on construction milestones, project timelines, collateral requirements, and repayment schedules customized for the unique nature of new construction in the area. 4. Multifamily Bridge Financing Term Sheet: As the name suggests, this Bridge Financing Term Sheet pertains to financing multifamily properties within Bexar County. It considers factors such as the number of units, rental income, property management, and tenant occupancy rates to determine the loan terms and conditions. 5. Land Acquisition Bridge Financing Term Sheet: This term sheet addresses the financing needs for acquiring undeveloped land in Bexar County. It dictates the loan duration, interest rates, and potential contingent upon factors like zoning requirements, environmental assessments, and potential development plans. Regardless of the specific type, Bexar Texas Term Sheet for Bridge Financing plays a pivotal role in real estate transactions, providing a detailed breakdown of the financial arrangements and obligations between the borrower and lender.