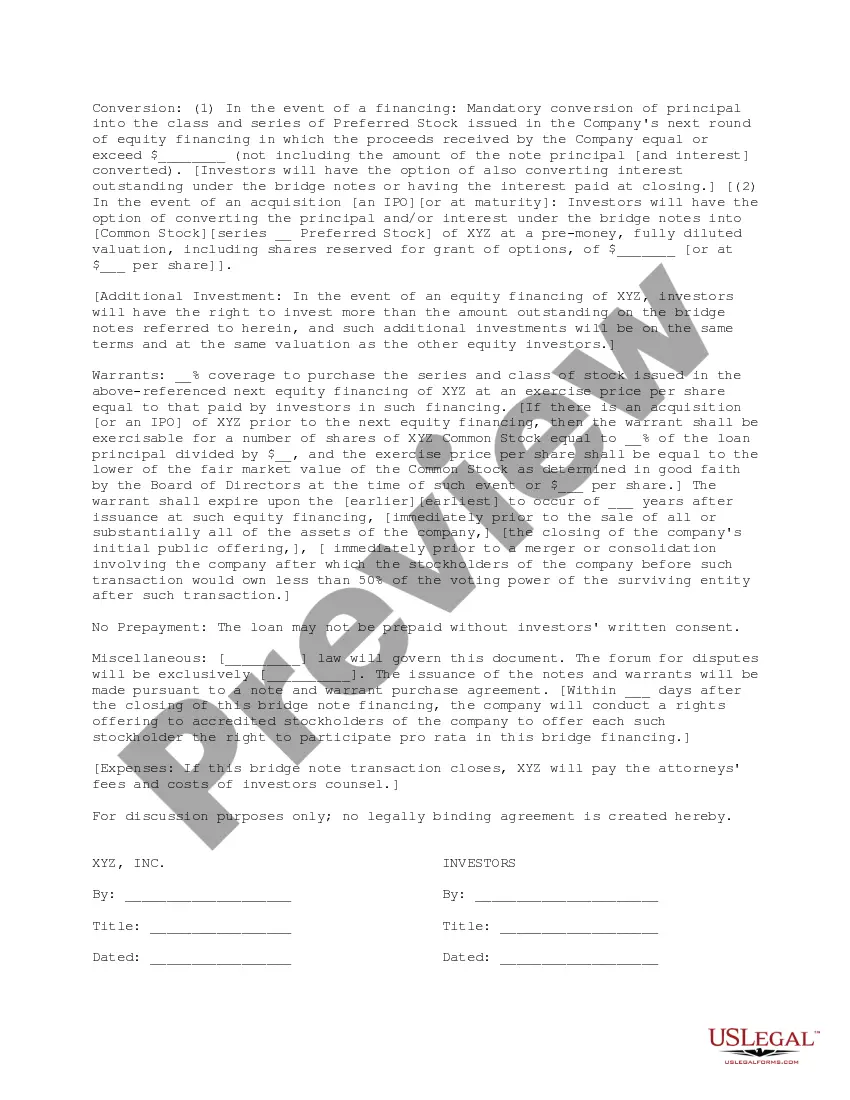

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

A Bronx New York Term Sheet for Bridge Financing is a document that outlines the terms and conditions of a short-term loan provided to facilitate the purchase or refinancing of a property in the Bronx, New York. This type of financing is commonly used when a borrower needs immediate funds to bridge the gap between the purchase of a new property or the sale of an existing one. The Bronx New York Term Sheet for Bridge Financing typically includes important details such as loan amount, interest rate, loan duration, and repayment terms. It also outlines any fees or penalties associated with the loan. The term sheet is typically prepared by the lender and presented to the borrower as an offer. There are different types of Bronx New York Term Sheets for Bridge Financing available, including: 1. Standard Bridge Financing: This is the most common type of bridge financing and is suitable for borrowers who need short-term financing while waiting for the sale of their existing property. The term sheet defines the amount, interest rate, and repayment terms, along with any additional requirements or conditions. 2. Construction Bridge Financing: Designed for borrowers who require funds for construction or renovation projects in the Bronx, this type of term sheet outlines the loan amount, interest rate, and repayment terms specific to construction financing. It may include provisions such as disbursements tied to project milestones. 3. Purchase Bridge Financing: This term sheet is tailored for borrowers aiming to purchase a new property in the Bronx before selling their existing one. It includes the loan amount, interest rate, and repayment terms, as well as any additional conditions related to the purchase and sale agreement. 4. Refinancing Bridge Financing: For borrowers looking to refinance their current mortgage or commercial loan, this term sheet specifies the loan amount, interest rate, and repayment terms relevant to refinancing. It may also outline any additional requirements or conditions set by the lender. In summary, a Bronx New York Term Sheet for Bridge Financing serves as a vital agreement between the lender and borrower, providing a detailed description of the loan terms and conditions. It is essential for both parties to review and understand all the provisions of the term sheet before proceeding with the bridge financing.A Bronx New York Term Sheet for Bridge Financing is a document that outlines the terms and conditions of a short-term loan provided to facilitate the purchase or refinancing of a property in the Bronx, New York. This type of financing is commonly used when a borrower needs immediate funds to bridge the gap between the purchase of a new property or the sale of an existing one. The Bronx New York Term Sheet for Bridge Financing typically includes important details such as loan amount, interest rate, loan duration, and repayment terms. It also outlines any fees or penalties associated with the loan. The term sheet is typically prepared by the lender and presented to the borrower as an offer. There are different types of Bronx New York Term Sheets for Bridge Financing available, including: 1. Standard Bridge Financing: This is the most common type of bridge financing and is suitable for borrowers who need short-term financing while waiting for the sale of their existing property. The term sheet defines the amount, interest rate, and repayment terms, along with any additional requirements or conditions. 2. Construction Bridge Financing: Designed for borrowers who require funds for construction or renovation projects in the Bronx, this type of term sheet outlines the loan amount, interest rate, and repayment terms specific to construction financing. It may include provisions such as disbursements tied to project milestones. 3. Purchase Bridge Financing: This term sheet is tailored for borrowers aiming to purchase a new property in the Bronx before selling their existing one. It includes the loan amount, interest rate, and repayment terms, as well as any additional conditions related to the purchase and sale agreement. 4. Refinancing Bridge Financing: For borrowers looking to refinance their current mortgage or commercial loan, this term sheet specifies the loan amount, interest rate, and repayment terms relevant to refinancing. It may also outline any additional requirements or conditions set by the lender. In summary, a Bronx New York Term Sheet for Bridge Financing serves as a vital agreement between the lender and borrower, providing a detailed description of the loan terms and conditions. It is essential for both parties to review and understand all the provisions of the term sheet before proceeding with the bridge financing.