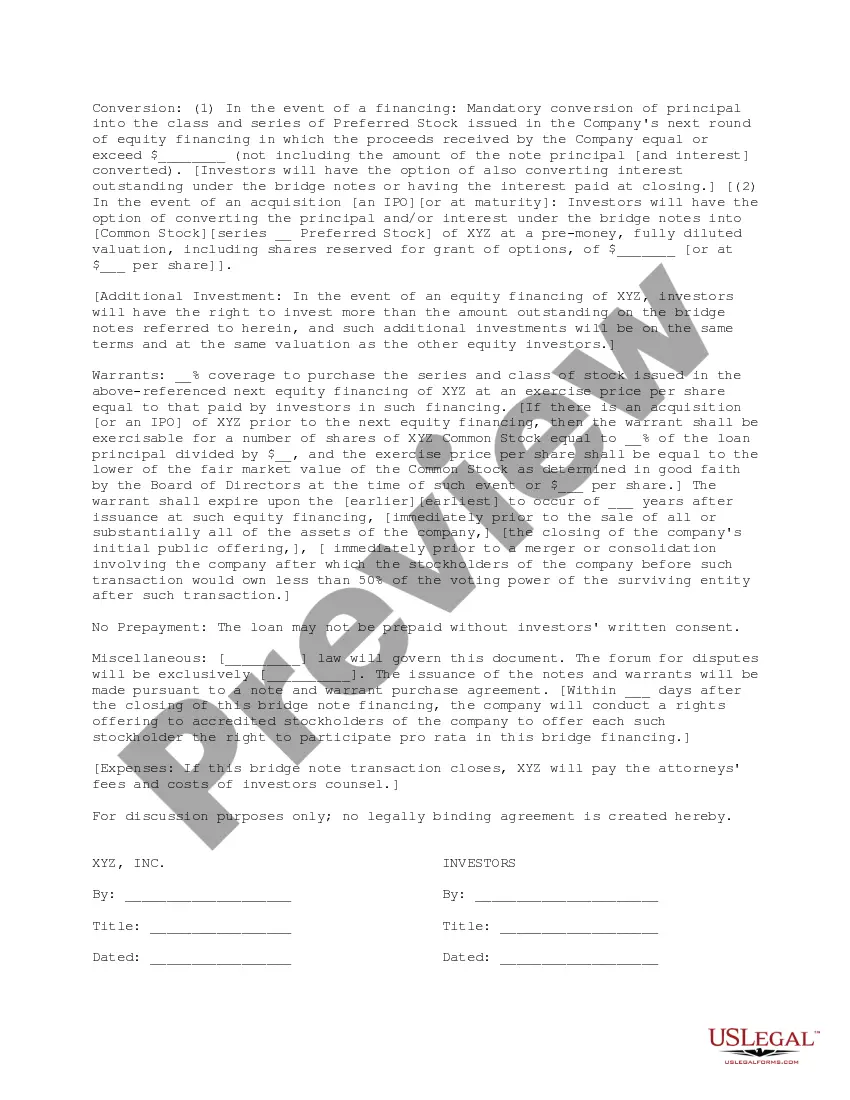

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Cook Illinois is a trusted provider of bridge financing solutions, offering a range of term sheets to accommodate diverse needs. A bridge loan is a short-term financing option that helps businesses overcome temporary financial gaps and fund immediate requirements. Cook Illinois has developed various term sheets for bridge financing, each designed to cater to specific circumstances and funding requirements. One type of Cook Illinois term sheet for bridge financing is the Real Estate Bridge Loan. This term sheet is tailored for real estate investors, developers, or homeowners who require immediate funds to acquire, renovate, or refinance property. The Real Estate Bridge Loan offers flexible repayment options and competitive interest rates, making it an ideal choice for those seeking short-term financing solutions. Another variant is the Business Bridge Loan term sheet. Specifically designed for companies facing temporary financial constraints, this option provides fast access to capital to support ongoing operations, fulfill critical orders, or take advantage of growth opportunities. Cook Illinois understands that businesses often require quick financing solutions to bridge gaps in cash flow, and their Business Bridge Loan term sheet caters to these needs. In addition to these specialized term sheets, Cook Illinois also offers a Custom Bridge Loan term sheet, which can be crafted to meet unique financing requirements. This option allows borrowers to customize the loan amount, repayment schedule, and other terms according to their specific needs, ensuring a tailored financing solution that aligns perfectly with their circumstances. Cook Illinois' term sheets for bridge financing provide transparency and ensure cost-effective solutions for borrowers. With a commitment to excellent customer service, the company aims to simplify the financing process, offering competitive rates, flexible repayment terms, and efficient funding options. Whether a borrower requires real estate or business bridge financing, Cook Illinois provides comprehensive options to help bridge the financial gap during times of need.Cook Illinois is a trusted provider of bridge financing solutions, offering a range of term sheets to accommodate diverse needs. A bridge loan is a short-term financing option that helps businesses overcome temporary financial gaps and fund immediate requirements. Cook Illinois has developed various term sheets for bridge financing, each designed to cater to specific circumstances and funding requirements. One type of Cook Illinois term sheet for bridge financing is the Real Estate Bridge Loan. This term sheet is tailored for real estate investors, developers, or homeowners who require immediate funds to acquire, renovate, or refinance property. The Real Estate Bridge Loan offers flexible repayment options and competitive interest rates, making it an ideal choice for those seeking short-term financing solutions. Another variant is the Business Bridge Loan term sheet. Specifically designed for companies facing temporary financial constraints, this option provides fast access to capital to support ongoing operations, fulfill critical orders, or take advantage of growth opportunities. Cook Illinois understands that businesses often require quick financing solutions to bridge gaps in cash flow, and their Business Bridge Loan term sheet caters to these needs. In addition to these specialized term sheets, Cook Illinois also offers a Custom Bridge Loan term sheet, which can be crafted to meet unique financing requirements. This option allows borrowers to customize the loan amount, repayment schedule, and other terms according to their specific needs, ensuring a tailored financing solution that aligns perfectly with their circumstances. Cook Illinois' term sheets for bridge financing provide transparency and ensure cost-effective solutions for borrowers. With a commitment to excellent customer service, the company aims to simplify the financing process, offering competitive rates, flexible repayment terms, and efficient funding options. Whether a borrower requires real estate or business bridge financing, Cook Illinois provides comprehensive options to help bridge the financial gap during times of need.