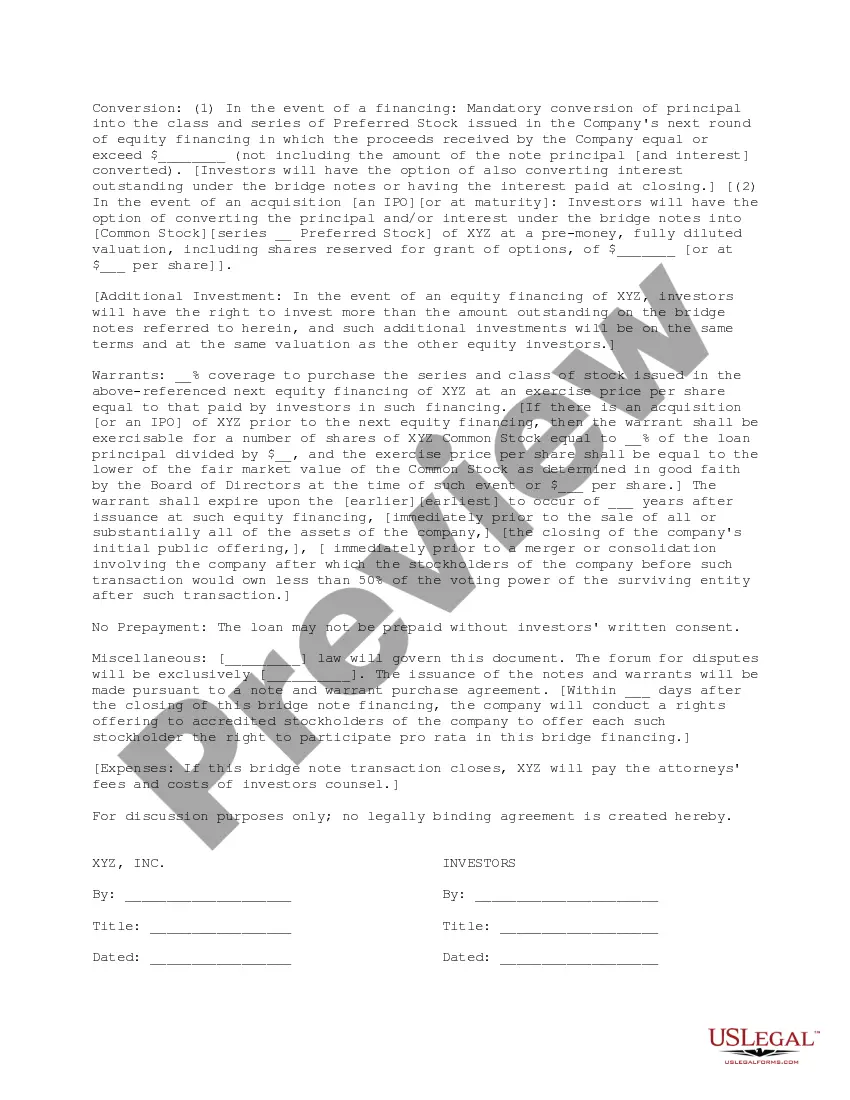

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

A Dallas Texas Term Sheet for Bridge Financing refers to a document outlining the terms and conditions of a short-term loan provided by a lender to bridge the gap between the purchase of a new property and the sale of an existing one in the Dallas, Texas area. This type of financing is commonly used by real estate investors and developers who require immediate funds to acquire, renovate, or develop a property while waiting for a long-term loan or the sale of another property. The Dallas Texas Term Sheet for Bridge Financing typically includes important details regarding the loan, such as the loan amount, interest rate, loan term, repayment terms, and any fees or penalties involved. This document acts as an initial agreement between the borrower and the lender and serves as a basis for the final loan agreement. There can be different types of Dallas Texas Term Sheets for Bridge Financing, depending on various factors and specific requirements. Some common types include: 1. Residential Bridge Financing Term Sheet: This type of term sheet is tailored for individuals or investors looking to bridge the gap between the purchase of a new home and the sale of their current residence. It contains provisions specific to residential properties, such as loan-to-value ratios, loan terms, and interest rates suitable for residential real estate. 2. Commercial Bridge Financing Term Sheet: Commercial term sheets are designed for businesses or investors seeking short-term financing for commercial properties such as office buildings, retail spaces, or industrial complexes. These term sheets might have different provisions, including higher loan amounts, longer loan terms, and tailored interest rates for commercial ventures. 3. Construction Bridge Financing Term Sheet: Construction projects often require bridge financing to cover construction costs until permanent financing or the sale of the completed project occurs. This term sheet would include provisions related to construction timelines, draw schedules, and specific requirements for funding the construction phase. Investors and borrowers in the Dallas, Texas area should ensure they carefully review and understand the terms and conditions mentioned in the term sheet before proceeding with the loan. It is advised to consult with legal and financial professionals to ensure all aspects of the bridge financing are properly addressed and negotiated to safeguard their interests.A Dallas Texas Term Sheet for Bridge Financing refers to a document outlining the terms and conditions of a short-term loan provided by a lender to bridge the gap between the purchase of a new property and the sale of an existing one in the Dallas, Texas area. This type of financing is commonly used by real estate investors and developers who require immediate funds to acquire, renovate, or develop a property while waiting for a long-term loan or the sale of another property. The Dallas Texas Term Sheet for Bridge Financing typically includes important details regarding the loan, such as the loan amount, interest rate, loan term, repayment terms, and any fees or penalties involved. This document acts as an initial agreement between the borrower and the lender and serves as a basis for the final loan agreement. There can be different types of Dallas Texas Term Sheets for Bridge Financing, depending on various factors and specific requirements. Some common types include: 1. Residential Bridge Financing Term Sheet: This type of term sheet is tailored for individuals or investors looking to bridge the gap between the purchase of a new home and the sale of their current residence. It contains provisions specific to residential properties, such as loan-to-value ratios, loan terms, and interest rates suitable for residential real estate. 2. Commercial Bridge Financing Term Sheet: Commercial term sheets are designed for businesses or investors seeking short-term financing for commercial properties such as office buildings, retail spaces, or industrial complexes. These term sheets might have different provisions, including higher loan amounts, longer loan terms, and tailored interest rates for commercial ventures. 3. Construction Bridge Financing Term Sheet: Construction projects often require bridge financing to cover construction costs until permanent financing or the sale of the completed project occurs. This term sheet would include provisions related to construction timelines, draw schedules, and specific requirements for funding the construction phase. Investors and borrowers in the Dallas, Texas area should ensure they carefully review and understand the terms and conditions mentioned in the term sheet before proceeding with the loan. It is advised to consult with legal and financial professionals to ensure all aspects of the bridge financing are properly addressed and negotiated to safeguard their interests.