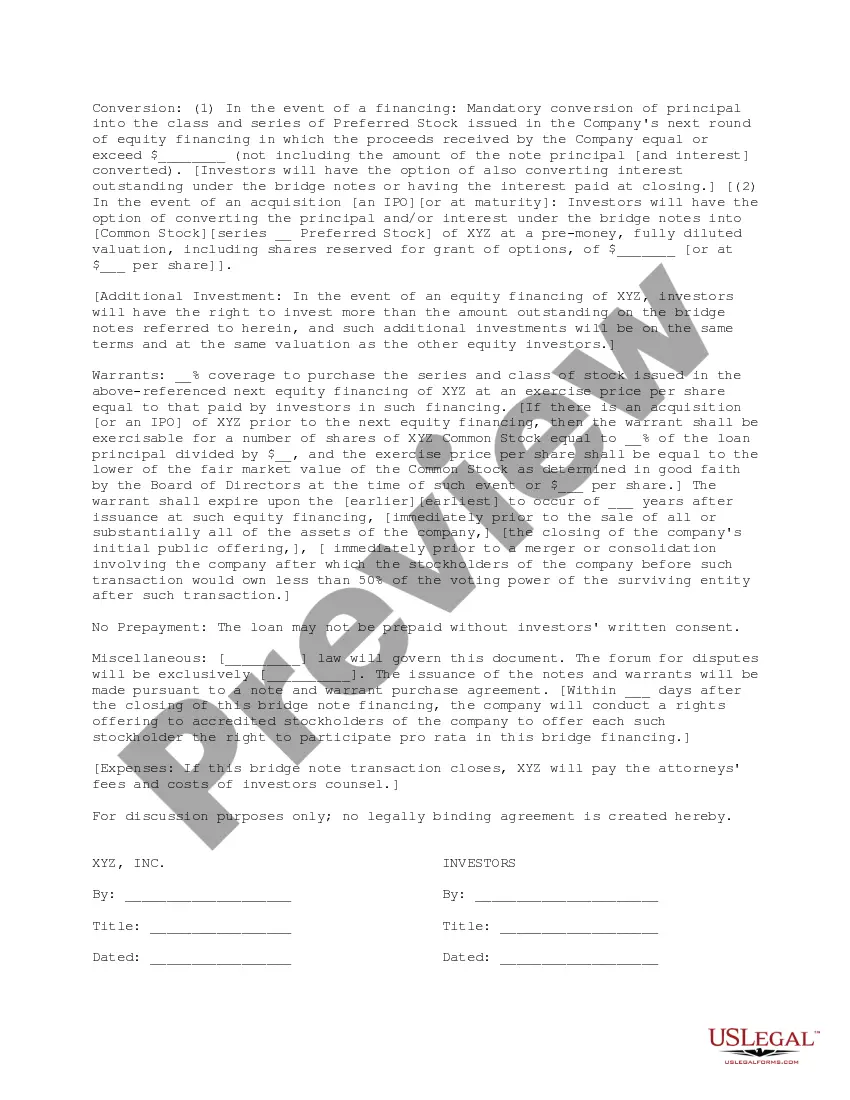

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Fairfax Virginia Term Sheet for Bridge Financing provides a comprehensive outline of terms and conditions for a bridge financing transaction in Fairfax, Virginia. This document serves as an agreement between the borrower and the lender, detailing the specifics of the loan arrangement. Bridge financing, also known as gap financing or swing loans, is a short-term financing option that fills the gap between the end of one loan and the start of another. The Fairfax Virginia Term Sheet for Bridge Financing typically includes key information such as loan amount, interest rate, maturity date, repayment terms, collateral requirements, and any associated fees. This term sheet acts as a precursor to the final loan agreement and helps both parties understand the structure and intentions of the loan. It can be customized based on the unique requirements of the borrower and lender. Different types of Fairfax Virginia Term Sheets for Bridge Financing may exist, catering to specific purposes or industries. These may include: 1. Commercial Real Estate Bridge Financing Term Sheet: This type of term sheet focuses on bridge financing options for commercial real estate projects in Fairfax, Virginia. It may include details on property types, loan-to-value ratios, rental income, and potential exit strategies. 2. Residential Bridge Loan Term Sheet: Geared towards individuals or companies seeking bridge financing for residential properties in Fairfax, Virginia. This term sheet may encompass information related to loan amounts, property appraisal, borrower qualifications, and repayment plans. 3. Construction Bridge Funding Term Sheet: For borrowers involved in construction projects, this term sheet targets bridge financing needs during the construction phase. It can include specifics regarding progress milestones, draw schedules, inspection requirements, and lien waivers. 4. Small Business Bridge Loan Term Sheet: Aimed at small business owners in Fairfax, Virginia, this type of term sheet outlines bridge financing options for various business purposes. It may include factors such as business revenue, credit history, cash flow projections, and personal guarantees. Regardless of the specific type, a Fairfax Virginia Term Sheet for Bridge Financing serves as an important tool for both lenders and borrowers. It ensures transparency, facilitates negotiation, and acts as a foundation for the final loan agreement. It is crucial for all parties involved to carefully review the term sheet's provisions and seek legal advice if necessary.Fairfax Virginia Term Sheet for Bridge Financing provides a comprehensive outline of terms and conditions for a bridge financing transaction in Fairfax, Virginia. This document serves as an agreement between the borrower and the lender, detailing the specifics of the loan arrangement. Bridge financing, also known as gap financing or swing loans, is a short-term financing option that fills the gap between the end of one loan and the start of another. The Fairfax Virginia Term Sheet for Bridge Financing typically includes key information such as loan amount, interest rate, maturity date, repayment terms, collateral requirements, and any associated fees. This term sheet acts as a precursor to the final loan agreement and helps both parties understand the structure and intentions of the loan. It can be customized based on the unique requirements of the borrower and lender. Different types of Fairfax Virginia Term Sheets for Bridge Financing may exist, catering to specific purposes or industries. These may include: 1. Commercial Real Estate Bridge Financing Term Sheet: This type of term sheet focuses on bridge financing options for commercial real estate projects in Fairfax, Virginia. It may include details on property types, loan-to-value ratios, rental income, and potential exit strategies. 2. Residential Bridge Loan Term Sheet: Geared towards individuals or companies seeking bridge financing for residential properties in Fairfax, Virginia. This term sheet may encompass information related to loan amounts, property appraisal, borrower qualifications, and repayment plans. 3. Construction Bridge Funding Term Sheet: For borrowers involved in construction projects, this term sheet targets bridge financing needs during the construction phase. It can include specifics regarding progress milestones, draw schedules, inspection requirements, and lien waivers. 4. Small Business Bridge Loan Term Sheet: Aimed at small business owners in Fairfax, Virginia, this type of term sheet outlines bridge financing options for various business purposes. It may include factors such as business revenue, credit history, cash flow projections, and personal guarantees. Regardless of the specific type, a Fairfax Virginia Term Sheet for Bridge Financing serves as an important tool for both lenders and borrowers. It ensures transparency, facilitates negotiation, and acts as a foundation for the final loan agreement. It is crucial for all parties involved to carefully review the term sheet's provisions and seek legal advice if necessary.