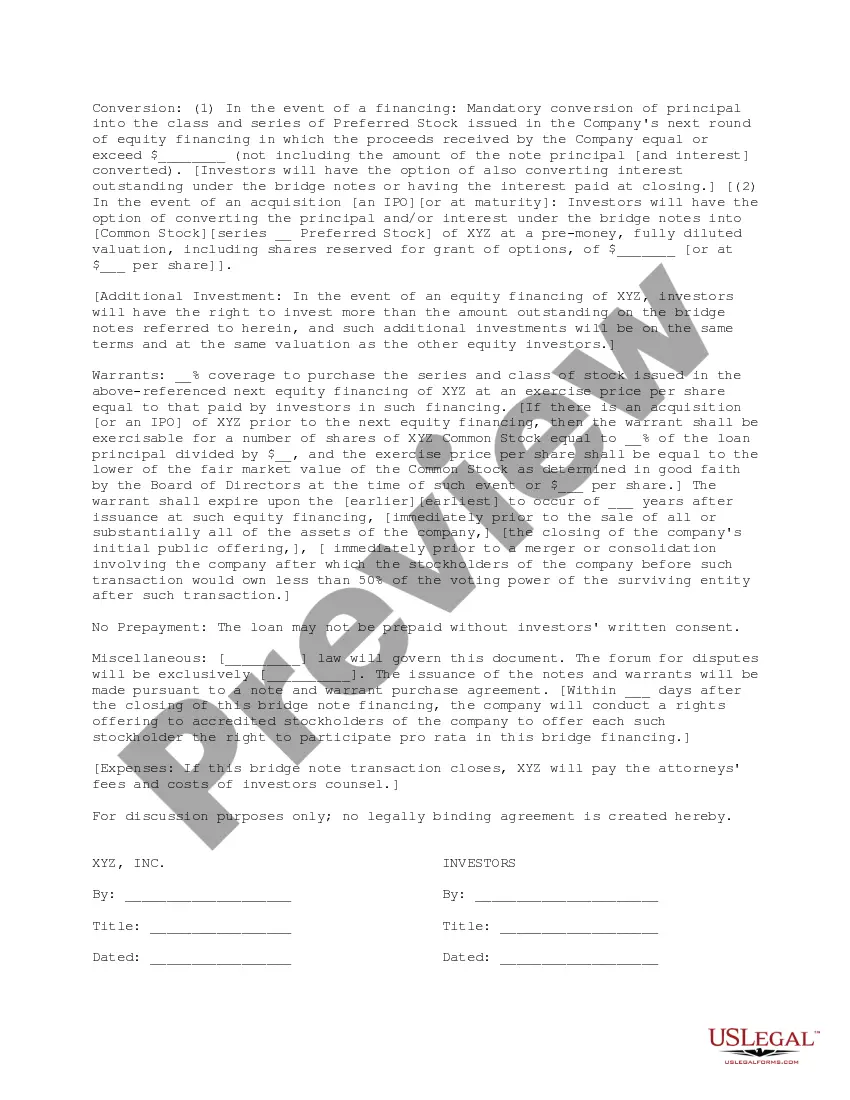

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Houston Texas Term Sheet for Bridge Financing

Description

How to fill out Term Sheet For Bridge Financing?

A document protocol consistently accompanies every legal action you undertake.

Establishing a corporation, applying for or accepting employment, transferring title, and various other life scenarios require you to prepare official paperwork that varies from jurisdiction to jurisdiction.

This is why having everything consolidated in one location is incredibly beneficial.

US Legal Forms represents the most extensive online repository of current federal and state-specific legal documents.

Select the file format and download the Houston Term Sheet for Bridge Financing onto your device. Utilize it as necessary: print it or complete it electronically, sign it, and file it wherever required. This is the most straightforward and trustworthy method to procure legal documents. All templates available in our library are professionally crafted and confirmed for compliance with local laws and regulations. Organize your documentation and manage your legal matters effectively with US Legal Forms!

- Here, you can conveniently locate and acquire a document for any personal or business objective utilized in your area, including the Houston Term Sheet for Bridge Financing.

- Finding samples on the platform is exceptionally straightforward.

- If you already hold a subscription to our library, Log In to your account, locate the sample using the search bar, and click Download to save it on your device.

- Subsequently, the Houston Term Sheet for Bridge Financing will be available for future access in the My documents section of your profile.

- If you are encountering US Legal Forms for the first time, adhere to this simple guide to acquire the Houston Term Sheet for Bridge Financing.

- Ensure you have reached the correct page containing your regional form.

- Utilize the Preview mode (if available) and sift through the template.

- Examine the description (if present) to verify that the form caters to your requirements.

- Search for an alternate document via the search tab if the sample does not suit you.

- Click Buy Now upon finding the necessary template.

- Select the suitable subscription plan, then Log In or register for an account.

- Choose the preferred payment method (via credit card or PayPal) to proceed.

Form popularity

FAQ

Yes, Texas allows bridge loans, providing a flexible option for short-term financing needs. These loans can help you secure funding quickly while you await longer-term financing or the sale of a property. When dealing with bridge loans, having a clear understanding of the Houston Texas Term Sheet for Bridge Financing is crucial. This document outlines the key terms and conditions, ensuring a smoother transaction.

Several key elements are important in a term sheet. You should focus on terms related to financial obligations, stakeholder rights, and timelines. Clarity in these areas helps ensure all parties understand their commitments and reduces potential disputes. A comprehensive Houston Texas Term Sheet for Bridge Financing outlines these critical components effectively.

Most people pay off their bridge loan with money from the sale of their current home, but there are other repayment options. Bridge loans may be structured in a number of different ways but commonly have a balloon payment at the end where the full amount is due by a certain date.

Bridge loans provide short-term cash flow. For example, a homeowner can use a bridge loan to purchase a new home before selling their existing one.

Bridging lenders typically require collateral in the form of property. Loans can be secured on the value of one property for several combined properties. The lender and borrower will enter into an agreement whereby the service provider takes ownership of the property in the event that the loan is not repaid as agreed.

These are typically short-term loans offered for 12 months. However, based on the customer profile and discretion of the bank, it may be extended up to 2 years. The maximum repayment tenure one can obtain is 5 years. Though bridge loans are a quick solution for fast liquidity, they have their drawbacks too.

Sound finances: To be approved for a bridge loan typically requires strong credit and stable finances. Lenders may set minimum credit scores and debt-to-income ratios. Generally speaking, if your financial situation is shaky, it could be difficult to get a bridge loan.

Bridge loan requirements Equity. You'll need at least 20% equity in your current home. Affordability. You'll need enough income to qualify for up to three house payments. Housing market. If your home is in a sluggish housing market.Good to excellent credit.

A bridge loan is a short-term loan used to bridge the gap between buying a home and selling your previous one. Sometimes you want to buy before you sell, meaning you don't have the profit from the sale to apply to your new home's down payment.

Bridging loans are usually offered for between 1-18 months, with the loan repayable in full at the end of the term. Unlike other forms of borrowing the monthly interest is often rolled into the loan, meaning there are no repayments to make during the term of the loan.