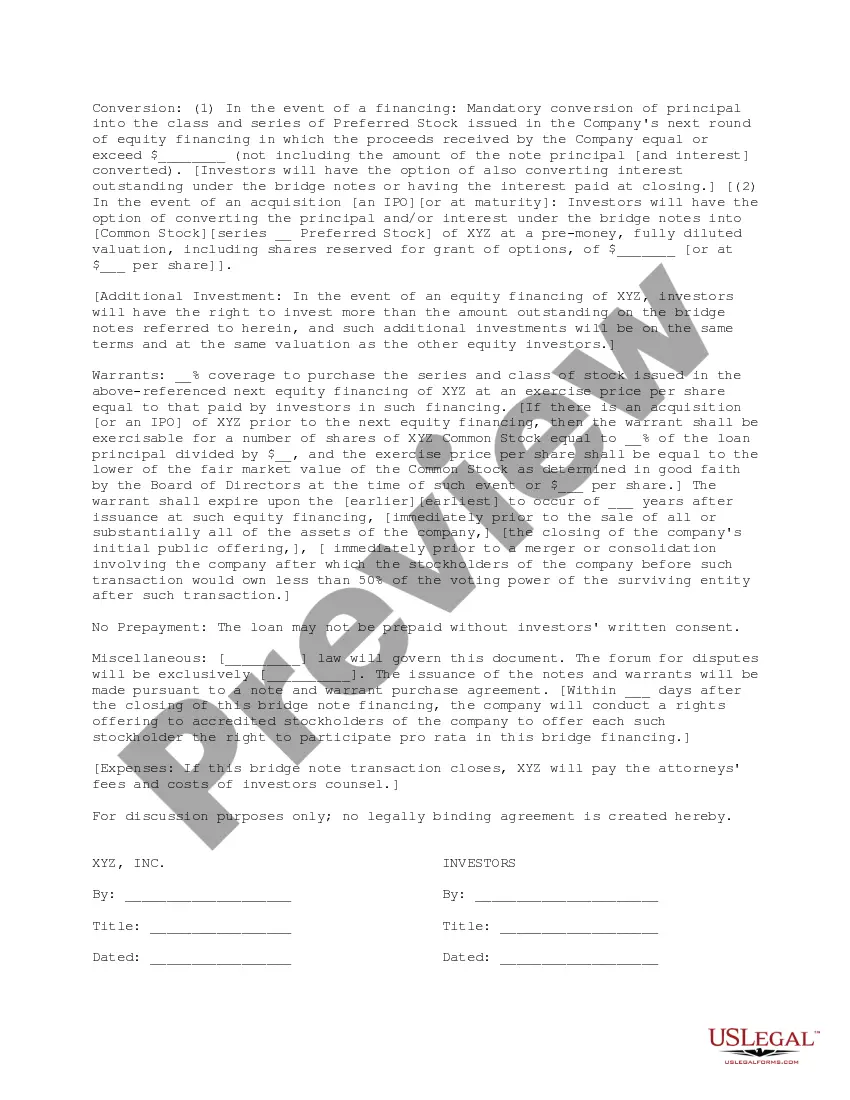

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Mecklenburg County, located in the state of North Carolina, offers various options for individuals and businesses seeking bridge financing. A term sheet for bridge financing serves as a detailed document outlining the terms and conditions of the loan. It provides a comprehensive understanding of the financial arrangement between the borrower and the lender. In Mecklenburg County, there are two primary types of term sheets for bridge financing: residential bridge loans and commercial bridge loans. Each type caters to specific borrowing needs, depending on the purpose of the loan. Residential Bridge Loans: 1. Purchase Bridge Loan: Mecklenburg County offers a purchase bridge loan term sheet to assist individuals in purchasing a new residential property while awaiting the sale of their current home. This short-term financing option enables borrowers to secure their dream home without being burdened by the timing constraints of property sales. 2. Renovation Bridge Loan: Homeowners in Mecklenburg County looking to undertake extensive renovations or repairs can benefit from the renovation bridge loan term sheet. This type of bridge financing allows homeowners to access funds quickly, enabling them to commence the renovation project immediately. Commercial Bridge Loans: 1. Purchase Bridge Loan: Mecklenburg County's commercial bridge loan term sheet supports businesses in acquiring new commercial properties while awaiting the sale of existing assets or securing long-term financing. This financing option ensures that businesses can move forward with growth opportunities without waiting for lengthy conventional loan approvals. 2. Renovation Bridge Loan: Businesses seeking to renovate or upgrade their current commercial facilities can utilize Mecklenburg County's renovation bridge loan term sheet. By providing immediate access to capital, this financing option enables businesses to enhance their premises and operations promptly, boosting their competitiveness in the market. The Mecklenburg North Carolina term sheet for bridge financing includes various key elements. These may include the loan amount, interest rates, repayment terms, loan-to-value ratio, loan origination fees, maximum loan term, prepayment penalties, and other applicable fees. This comprehensive document acts as a roadmap, guiding borrowers and lenders through the bridge financing process while ensuring transparency and clear expectations for both parties. It is important for borrowers and lenders in Mecklenburg County to thoroughly review and understand the specific terms outlined in the term sheet before proceeding with the bridge financing arrangement. This allows for informed decision-making and ensures that all parties involved are on the same page regarding their obligations, rights, and expectations throughout the loan term.Mecklenburg County, located in the state of North Carolina, offers various options for individuals and businesses seeking bridge financing. A term sheet for bridge financing serves as a detailed document outlining the terms and conditions of the loan. It provides a comprehensive understanding of the financial arrangement between the borrower and the lender. In Mecklenburg County, there are two primary types of term sheets for bridge financing: residential bridge loans and commercial bridge loans. Each type caters to specific borrowing needs, depending on the purpose of the loan. Residential Bridge Loans: 1. Purchase Bridge Loan: Mecklenburg County offers a purchase bridge loan term sheet to assist individuals in purchasing a new residential property while awaiting the sale of their current home. This short-term financing option enables borrowers to secure their dream home without being burdened by the timing constraints of property sales. 2. Renovation Bridge Loan: Homeowners in Mecklenburg County looking to undertake extensive renovations or repairs can benefit from the renovation bridge loan term sheet. This type of bridge financing allows homeowners to access funds quickly, enabling them to commence the renovation project immediately. Commercial Bridge Loans: 1. Purchase Bridge Loan: Mecklenburg County's commercial bridge loan term sheet supports businesses in acquiring new commercial properties while awaiting the sale of existing assets or securing long-term financing. This financing option ensures that businesses can move forward with growth opportunities without waiting for lengthy conventional loan approvals. 2. Renovation Bridge Loan: Businesses seeking to renovate or upgrade their current commercial facilities can utilize Mecklenburg County's renovation bridge loan term sheet. By providing immediate access to capital, this financing option enables businesses to enhance their premises and operations promptly, boosting their competitiveness in the market. The Mecklenburg North Carolina term sheet for bridge financing includes various key elements. These may include the loan amount, interest rates, repayment terms, loan-to-value ratio, loan origination fees, maximum loan term, prepayment penalties, and other applicable fees. This comprehensive document acts as a roadmap, guiding borrowers and lenders through the bridge financing process while ensuring transparency and clear expectations for both parties. It is important for borrowers and lenders in Mecklenburg County to thoroughly review and understand the specific terms outlined in the term sheet before proceeding with the bridge financing arrangement. This allows for informed decision-making and ensures that all parties involved are on the same page regarding their obligations, rights, and expectations throughout the loan term.