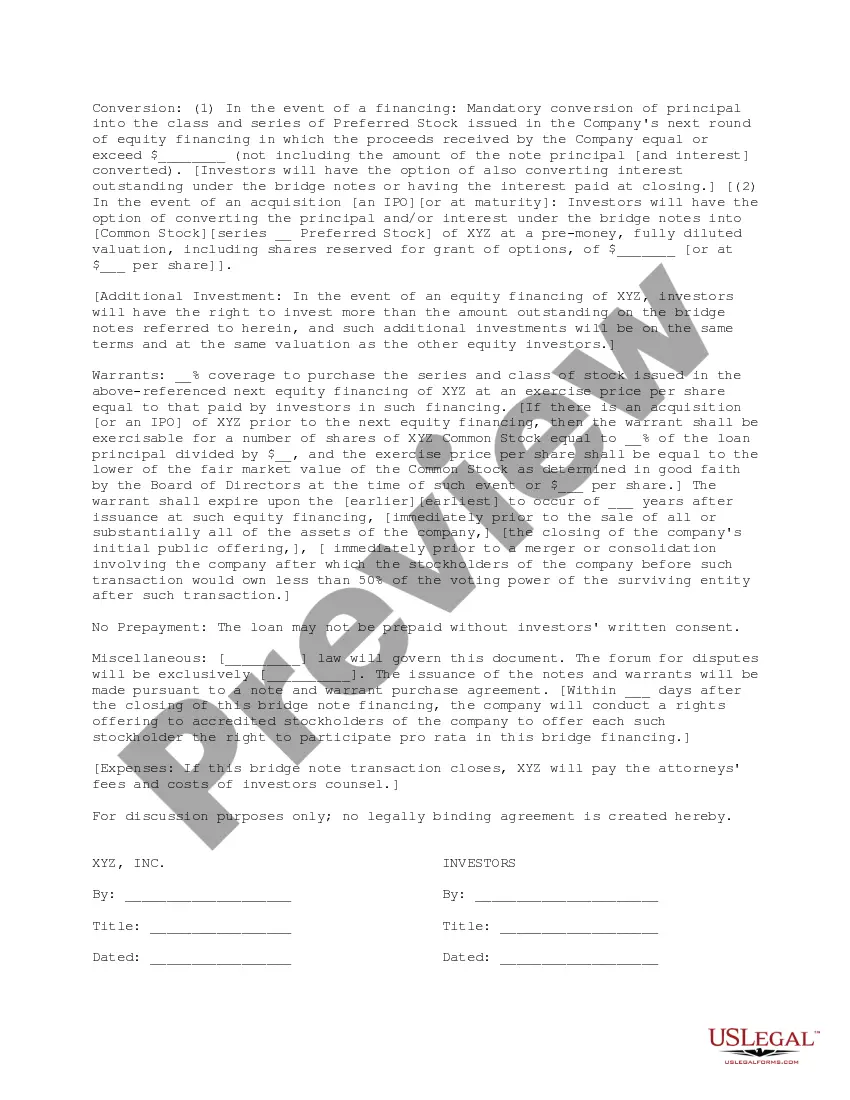

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Nassau New York Term Sheet for Bridge Financing: A Nassau New York Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions for a short-term loan used to bridge the gap between the immediate need for funds and the long-term financing solution. Bridge financing is typically utilized by individuals, businesses, or real estate developers who require immediate capital to finance a project or purchase while awaiting permanent financing or the sale of an asset. The Nassau New York Term Sheet for Bridge Financing contains various key elements and provisions that govern the loan agreement. It outlines the loan amount, interest rates, repayment terms, collateral requirements, and any other conditions set by the lender. This document acts as a preliminary agreement between the lender and the borrower and is typically followed by the creation of a formal loan agreement. Different types of Nassau New York Term Sheets for Bridge Financing may include: 1. Real Estate Bridge Financing Term Sheet: This type of term sheet caters specifically to real estate developers and investors who require short-term funding for property acquisitions, renovations, or development projects. It outlines details specific to the real estate industry, such as loan-to-value ratios, construction timelines, and exit strategies. 2. Business Bridge Financing Term Sheet: This term sheet is designed for businesses seeking immediate funding to meet operating expenses, expansion plans, or working capital requirements. It may include provisions related to business cash flow, inventory valuations, and projected sales figures. 3. Personal Bridge Financing Term Sheet: Individuals, such as homeowners or investors, may require bridge financing for personal reasons such as purchasing a new home before selling their existing one or investing in time-sensitive opportunities. This term sheet may include provisions related to personal creditworthiness, asset valuation, and repayment sources. Nassau New York Term Sheets for Bridge Financing are typically customizable to the specific needs of the borrower and lender. It is crucial for both parties to thoroughly review and negotiate the terms outlined in the term sheet before proceeding with the loan agreement to ensure clarity and transparency in their financial arrangement. Engaging professional legal counsel and financial advisors familiar with the local Nassau New York laws is advisable to ensure compliance with applicable regulations and to protect the interests of all parties involved.Nassau New York Term Sheet for Bridge Financing: A Nassau New York Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions for a short-term loan used to bridge the gap between the immediate need for funds and the long-term financing solution. Bridge financing is typically utilized by individuals, businesses, or real estate developers who require immediate capital to finance a project or purchase while awaiting permanent financing or the sale of an asset. The Nassau New York Term Sheet for Bridge Financing contains various key elements and provisions that govern the loan agreement. It outlines the loan amount, interest rates, repayment terms, collateral requirements, and any other conditions set by the lender. This document acts as a preliminary agreement between the lender and the borrower and is typically followed by the creation of a formal loan agreement. Different types of Nassau New York Term Sheets for Bridge Financing may include: 1. Real Estate Bridge Financing Term Sheet: This type of term sheet caters specifically to real estate developers and investors who require short-term funding for property acquisitions, renovations, or development projects. It outlines details specific to the real estate industry, such as loan-to-value ratios, construction timelines, and exit strategies. 2. Business Bridge Financing Term Sheet: This term sheet is designed for businesses seeking immediate funding to meet operating expenses, expansion plans, or working capital requirements. It may include provisions related to business cash flow, inventory valuations, and projected sales figures. 3. Personal Bridge Financing Term Sheet: Individuals, such as homeowners or investors, may require bridge financing for personal reasons such as purchasing a new home before selling their existing one or investing in time-sensitive opportunities. This term sheet may include provisions related to personal creditworthiness, asset valuation, and repayment sources. Nassau New York Term Sheets for Bridge Financing are typically customizable to the specific needs of the borrower and lender. It is crucial for both parties to thoroughly review and negotiate the terms outlined in the term sheet before proceeding with the loan agreement to ensure clarity and transparency in their financial arrangement. Engaging professional legal counsel and financial advisors familiar with the local Nassau New York laws is advisable to ensure compliance with applicable regulations and to protect the interests of all parties involved.