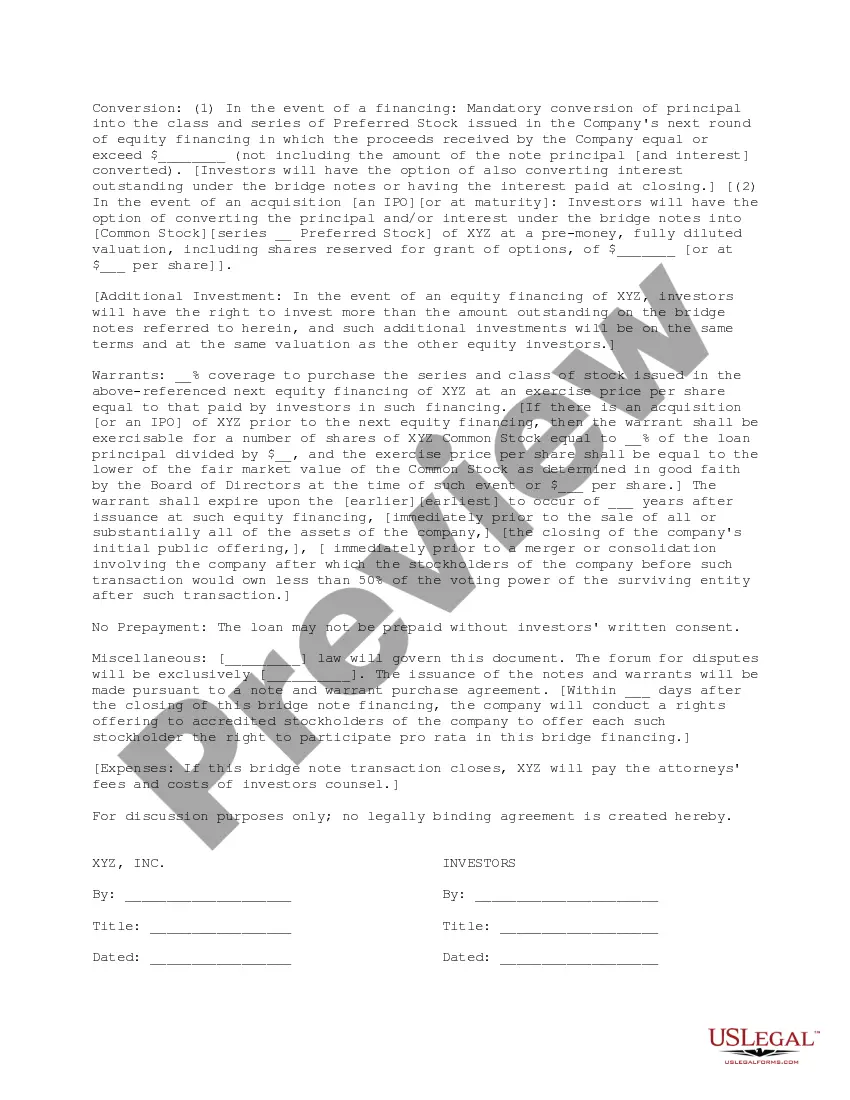

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Oakland, Michigan Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a short-term loan used to bridge the gap between two larger financial transactions in the Oakland, Michigan area. It acts as an agreement between the lender and the borrower, specifying the terms including loan amount, interest rates, repayment terms, and other important details. In Oakland, Michigan, there are several types of term sheets for bridge financing available, including: 1. Residential Property Bridge Financing: This type of bridge financing term sheet is specifically designed for residential real estate transactions in Oakland, Michigan. It helps homeowners or real estate investors to secure temporary financing for purchasing a new property before selling their existing one. 2. Commercial Property Bridge Financing: This term sheet is tailored for commercial property transactions in Oakland, Michigan. It assists business owners or investors in obtaining short-term financing to bridge the gap between the purchase of a new commercial property and the sale of an existing one. 3. Construction Bridge Financing: This type of bridge financing term sheet is designed for individuals or businesses involved in construction projects in Oakland, Michigan. It provides temporary funding to cover construction costs before long-term financing can be obtained. 4. Small Business Bridge Financing: This term sheet caters to small businesses in Oakland, Michigan, seeking short-term funding to bridge financial gaps. It helps entrepreneurs meet working capital needs during periods of transition or growth. Key elements typically included in an Oakland, Michigan Term Sheet for Bridge Financing may encompass the following: 1. Loan Amount: Specifies the amount of money that will be provided as a bridge loan to the borrower. 2. Interest Rates: States the interest rate charged on the bridge loan, which may be fixed or variable. 3. Repayment Terms: Outlines the duration and terms for loan repayment, including installments or a lump sum payment at the end of the term. 4. Collateral: Identifies the assets or property that will serve as collateral for securing the bridge loan. 5. Fees: States any upfront or ongoing fees associated with the bridge financing, such as origination fees or prepayment penalties. 6. Conditions: Outlines any additional conditions or requirements that need to be fulfilled by the borrower before the loan is approved. An Oakland, Michigan Term Sheet for Bridge Financing plays a crucial role in facilitating short-term funding for various purposes, allowing individuals and businesses in the area to access capital quickly and bridge their financial gaps effectively.Oakland, Michigan Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a short-term loan used to bridge the gap between two larger financial transactions in the Oakland, Michigan area. It acts as an agreement between the lender and the borrower, specifying the terms including loan amount, interest rates, repayment terms, and other important details. In Oakland, Michigan, there are several types of term sheets for bridge financing available, including: 1. Residential Property Bridge Financing: This type of bridge financing term sheet is specifically designed for residential real estate transactions in Oakland, Michigan. It helps homeowners or real estate investors to secure temporary financing for purchasing a new property before selling their existing one. 2. Commercial Property Bridge Financing: This term sheet is tailored for commercial property transactions in Oakland, Michigan. It assists business owners or investors in obtaining short-term financing to bridge the gap between the purchase of a new commercial property and the sale of an existing one. 3. Construction Bridge Financing: This type of bridge financing term sheet is designed for individuals or businesses involved in construction projects in Oakland, Michigan. It provides temporary funding to cover construction costs before long-term financing can be obtained. 4. Small Business Bridge Financing: This term sheet caters to small businesses in Oakland, Michigan, seeking short-term funding to bridge financial gaps. It helps entrepreneurs meet working capital needs during periods of transition or growth. Key elements typically included in an Oakland, Michigan Term Sheet for Bridge Financing may encompass the following: 1. Loan Amount: Specifies the amount of money that will be provided as a bridge loan to the borrower. 2. Interest Rates: States the interest rate charged on the bridge loan, which may be fixed or variable. 3. Repayment Terms: Outlines the duration and terms for loan repayment, including installments or a lump sum payment at the end of the term. 4. Collateral: Identifies the assets or property that will serve as collateral for securing the bridge loan. 5. Fees: States any upfront or ongoing fees associated with the bridge financing, such as origination fees or prepayment penalties. 6. Conditions: Outlines any additional conditions or requirements that need to be fulfilled by the borrower before the loan is approved. An Oakland, Michigan Term Sheet for Bridge Financing plays a crucial role in facilitating short-term funding for various purposes, allowing individuals and businesses in the area to access capital quickly and bridge their financial gaps effectively.