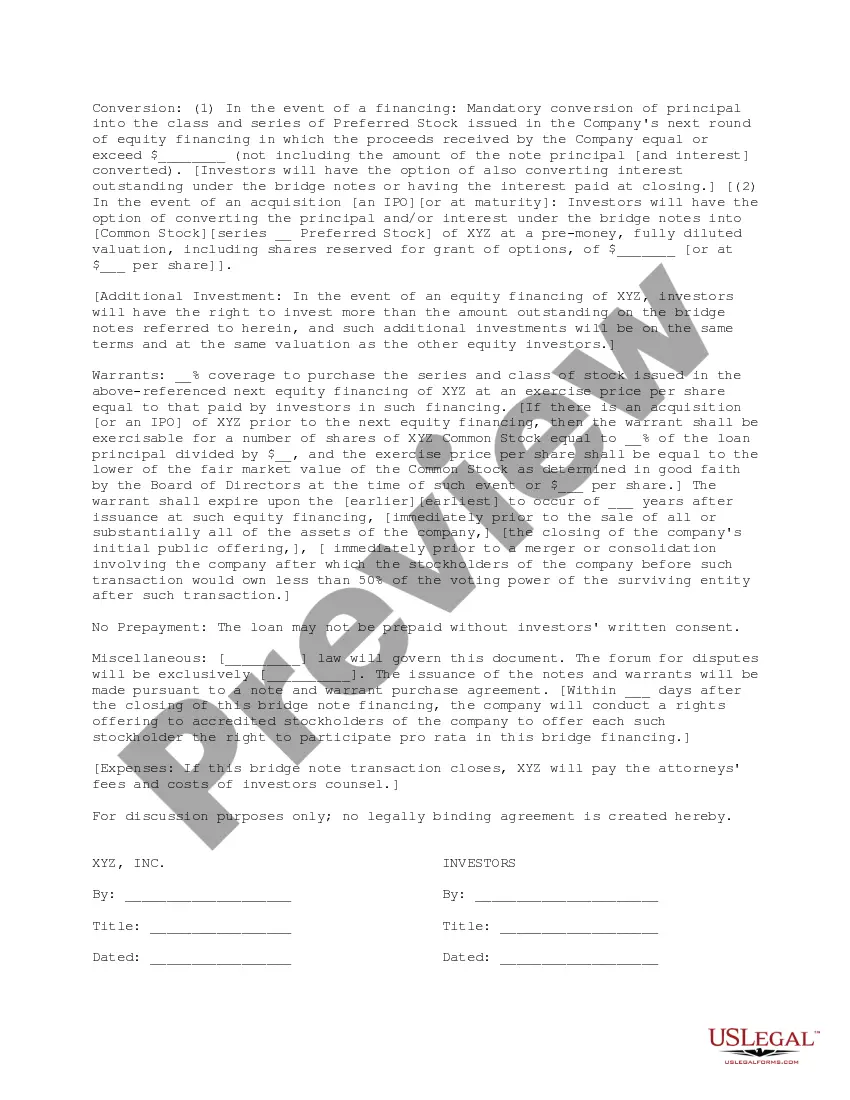

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

A Phoenix Arizona Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a short-term loan provided to bridge a financial gap between two transactions. It serves as a preliminary agreement between the borrower and the lender, outlining the key aspects of the financing arrangement. This type of term sheet is commonly used in real estate and commercial transactions in Phoenix, Arizona. The Phoenix Arizona Term Sheet for Bridge Financing typically includes the following key components: 1. Loan Amount: Specifies the amount of money that will be provided as a bridge loan. This amount varies based on the financial needs of the borrower and the value of the underlying asset. 2. Interest Rate: Outlines the interest rate to be charged on the bridge loan. It may be fixed or variable, and is typically higher than conventional loan rates due to the short-term nature and higher risk. 3. Terms and Duration: Defines the duration of the bridge loan, typically ranging from a few months up to three years. The term sheet specifies the repayment schedule, which may include periodic interest-only payments or full repayment at the end of the term. 4. Collateral: Identifies the collateral that will secure the loan. This could be the property being financed or other assets owned by the borrower. The term sheet specifies the conditions for the release of collateral upon repayment. 5. Fees and Costs: Outlines any fees associated with the bridge loan, such as loan origination fees, commitment fees, appraisal fees, or legal costs. These fees will vary between lenders. 6. Loan-to-Value (LTV) Ratio: Specifies the maximum loan-to-value ratio the lender is willing to provide. LTV is calculated by dividing the loan amount by the appraised value of the collateral property. It helps determine the risk exposure for the lender. 7. Conditions Precedent: Lists any conditions that must be met by the borrower before the loan can be funded. This may include due diligence requirements, title searches, or inspections. Types of Phoenix Arizona Term Sheet for Bridge Financing: 1. Residential Bridge Loan: Specifically designed for individuals or companies looking to finance the purchase or renovation of residential properties. These loans are often used by homebuyers who are selling their current home while purchasing a new one. 2. Commercial Bridge Loan: Aimed at investors or businesses seeking financing for the purchase or improvement of commercial properties. These loans help bridge the gap between the acquisition or improvement of the property and securing long-term financing. 3. Construction Bridge Loan: Geared towards financing construction projects, including ground-up developments or substantial renovations. These loans provide short-term funding for construction costs until long-term financing can be obtained. 4. Bridge-to-Permanent Loan: This type of bridge financing allows borrowers to transition from short-term bridge financing to permanent financing, often in residential or commercial real estate transactions. The term sheet outlines the terms for both the bridge loan and the permanent loan. In conclusion, a Phoenix Arizona Term Sheet for Bridge Financing is a vital document used in short-term lending transactions in the Phoenix, Arizona area. It outlines the terms, conditions, and obligations of the borrower and lender and serves as a precursor to a formal loan agreement. Different types of bridge financing term sheets cater to residential, commercial, construction, or transitional financing needs.A Phoenix Arizona Term Sheet for Bridge Financing is a legal document that outlines the terms and conditions of a short-term loan provided to bridge a financial gap between two transactions. It serves as a preliminary agreement between the borrower and the lender, outlining the key aspects of the financing arrangement. This type of term sheet is commonly used in real estate and commercial transactions in Phoenix, Arizona. The Phoenix Arizona Term Sheet for Bridge Financing typically includes the following key components: 1. Loan Amount: Specifies the amount of money that will be provided as a bridge loan. This amount varies based on the financial needs of the borrower and the value of the underlying asset. 2. Interest Rate: Outlines the interest rate to be charged on the bridge loan. It may be fixed or variable, and is typically higher than conventional loan rates due to the short-term nature and higher risk. 3. Terms and Duration: Defines the duration of the bridge loan, typically ranging from a few months up to three years. The term sheet specifies the repayment schedule, which may include periodic interest-only payments or full repayment at the end of the term. 4. Collateral: Identifies the collateral that will secure the loan. This could be the property being financed or other assets owned by the borrower. The term sheet specifies the conditions for the release of collateral upon repayment. 5. Fees and Costs: Outlines any fees associated with the bridge loan, such as loan origination fees, commitment fees, appraisal fees, or legal costs. These fees will vary between lenders. 6. Loan-to-Value (LTV) Ratio: Specifies the maximum loan-to-value ratio the lender is willing to provide. LTV is calculated by dividing the loan amount by the appraised value of the collateral property. It helps determine the risk exposure for the lender. 7. Conditions Precedent: Lists any conditions that must be met by the borrower before the loan can be funded. This may include due diligence requirements, title searches, or inspections. Types of Phoenix Arizona Term Sheet for Bridge Financing: 1. Residential Bridge Loan: Specifically designed for individuals or companies looking to finance the purchase or renovation of residential properties. These loans are often used by homebuyers who are selling their current home while purchasing a new one. 2. Commercial Bridge Loan: Aimed at investors or businesses seeking financing for the purchase or improvement of commercial properties. These loans help bridge the gap between the acquisition or improvement of the property and securing long-term financing. 3. Construction Bridge Loan: Geared towards financing construction projects, including ground-up developments or substantial renovations. These loans provide short-term funding for construction costs until long-term financing can be obtained. 4. Bridge-to-Permanent Loan: This type of bridge financing allows borrowers to transition from short-term bridge financing to permanent financing, often in residential or commercial real estate transactions. The term sheet outlines the terms for both the bridge loan and the permanent loan. In conclusion, a Phoenix Arizona Term Sheet for Bridge Financing is a vital document used in short-term lending transactions in the Phoenix, Arizona area. It outlines the terms, conditions, and obligations of the borrower and lender and serves as a precursor to a formal loan agreement. Different types of bridge financing term sheets cater to residential, commercial, construction, or transitional financing needs.