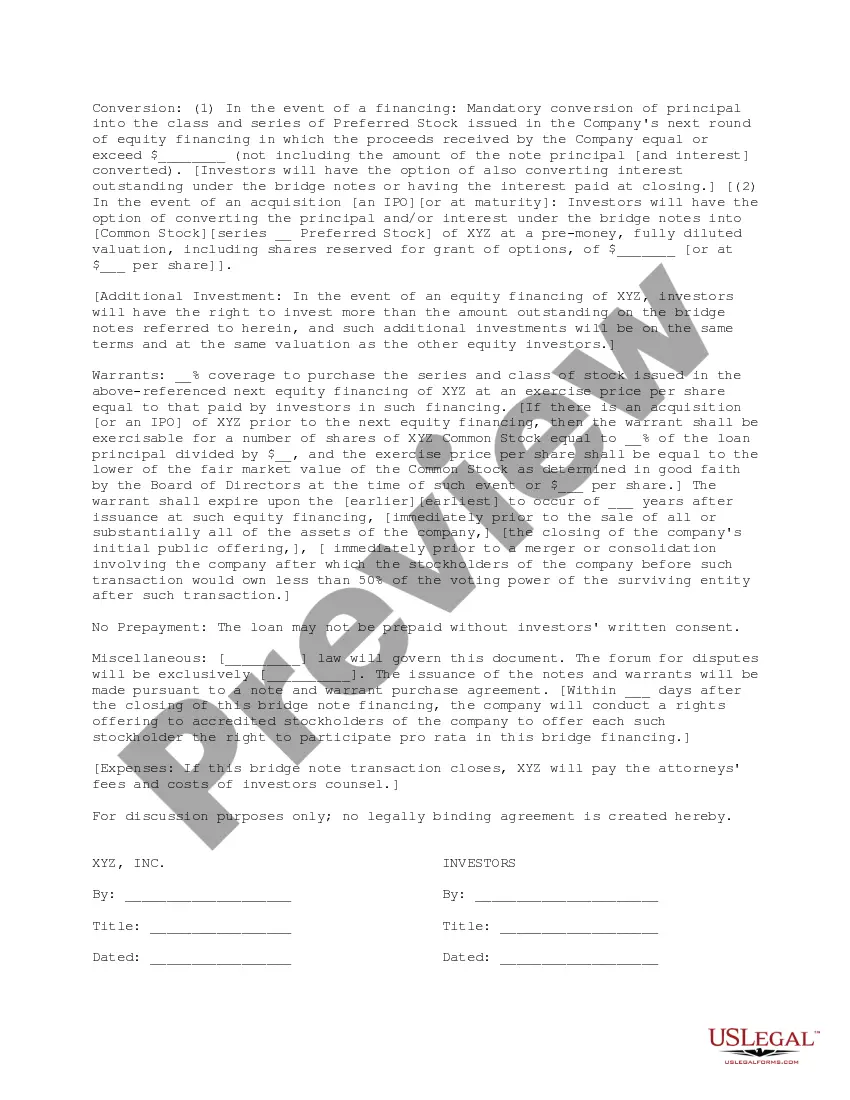

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

A San Antonio Texas Term Sheet for Bridge Financing is a document that outlines the essential terms and conditions of a temporary loan provided by a lender, typically a financial institution or private investor, to bridge the gap between the acquisition or refinancing of a property and obtaining long-term financing. In San Antonio, there are various types of Term Sheets for Bridge Financing tailored to different real estate projects and borrower needs. Here are a few common ones: 1. Commercial Property Bridge Loan Term Sheet: This type of term sheet specifically caters to commercial real estate ventures, such as office buildings, retail spaces, warehouses, or mixed-use developments in San Antonio. It outlines provisions like the loan amount, interest rate, loan term, collateral requirements, and potential prepayment penalties. 2. Residential Bridge Loan Term Sheet: Ideal for individuals or investors looking to purchase or renovate residential properties in San Antonio, this term sheet provides details like loan amount, interest rate, loan-to-value ratio, repayment terms, and any additional fees or costs associated with the loan. It may also cover specific clauses related to owner-occupied properties. 3. Construction Bridge Loan Term Sheet: This type of term sheet is designed for borrowers in San Antonio involved in construction projects, such as building new homes, commercial structures, or redevelopment initiatives. It typically includes specific provisions related to project milestones, draw schedules, inspection requirements, and safeguards to protect the lender's investment. 4. Land Acquisition Bridge Loan Term Sheet: Tailored for San Antonio real estate developers or investors looking to acquire land for future development, this term sheet outlines the terms of the loan, including loan amount, interest rate, collateral required, and any specialized provisions related to zoning, environmental studies, or title issues. Regardless of the specific type of San Antonio Texas Term Sheet for Bridge Financing, some standardized aspects commonly addressed include interest rates (fixed or variable), loan term (typically ranging from a few months to a few years), loan origination fees, loan-to-value ratio, potential prepayment penalties, documentation required, and financial covenants that the borrower must adhere to. These term sheets serve as crucial negotiation tools between the borrower and lender, providing a framework for the agreement and guiding the subsequent loan documentation and closing process. They enable both parties to evaluate the viability and feasibility of the bridge financing, ensuring clarity and transparency in the overall transaction.A San Antonio Texas Term Sheet for Bridge Financing is a document that outlines the essential terms and conditions of a temporary loan provided by a lender, typically a financial institution or private investor, to bridge the gap between the acquisition or refinancing of a property and obtaining long-term financing. In San Antonio, there are various types of Term Sheets for Bridge Financing tailored to different real estate projects and borrower needs. Here are a few common ones: 1. Commercial Property Bridge Loan Term Sheet: This type of term sheet specifically caters to commercial real estate ventures, such as office buildings, retail spaces, warehouses, or mixed-use developments in San Antonio. It outlines provisions like the loan amount, interest rate, loan term, collateral requirements, and potential prepayment penalties. 2. Residential Bridge Loan Term Sheet: Ideal for individuals or investors looking to purchase or renovate residential properties in San Antonio, this term sheet provides details like loan amount, interest rate, loan-to-value ratio, repayment terms, and any additional fees or costs associated with the loan. It may also cover specific clauses related to owner-occupied properties. 3. Construction Bridge Loan Term Sheet: This type of term sheet is designed for borrowers in San Antonio involved in construction projects, such as building new homes, commercial structures, or redevelopment initiatives. It typically includes specific provisions related to project milestones, draw schedules, inspection requirements, and safeguards to protect the lender's investment. 4. Land Acquisition Bridge Loan Term Sheet: Tailored for San Antonio real estate developers or investors looking to acquire land for future development, this term sheet outlines the terms of the loan, including loan amount, interest rate, collateral required, and any specialized provisions related to zoning, environmental studies, or title issues. Regardless of the specific type of San Antonio Texas Term Sheet for Bridge Financing, some standardized aspects commonly addressed include interest rates (fixed or variable), loan term (typically ranging from a few months to a few years), loan origination fees, loan-to-value ratio, potential prepayment penalties, documentation required, and financial covenants that the borrower must adhere to. These term sheets serve as crucial negotiation tools between the borrower and lender, providing a framework for the agreement and guiding the subsequent loan documentation and closing process. They enable both parties to evaluate the viability and feasibility of the bridge financing, ensuring clarity and transparency in the overall transaction.