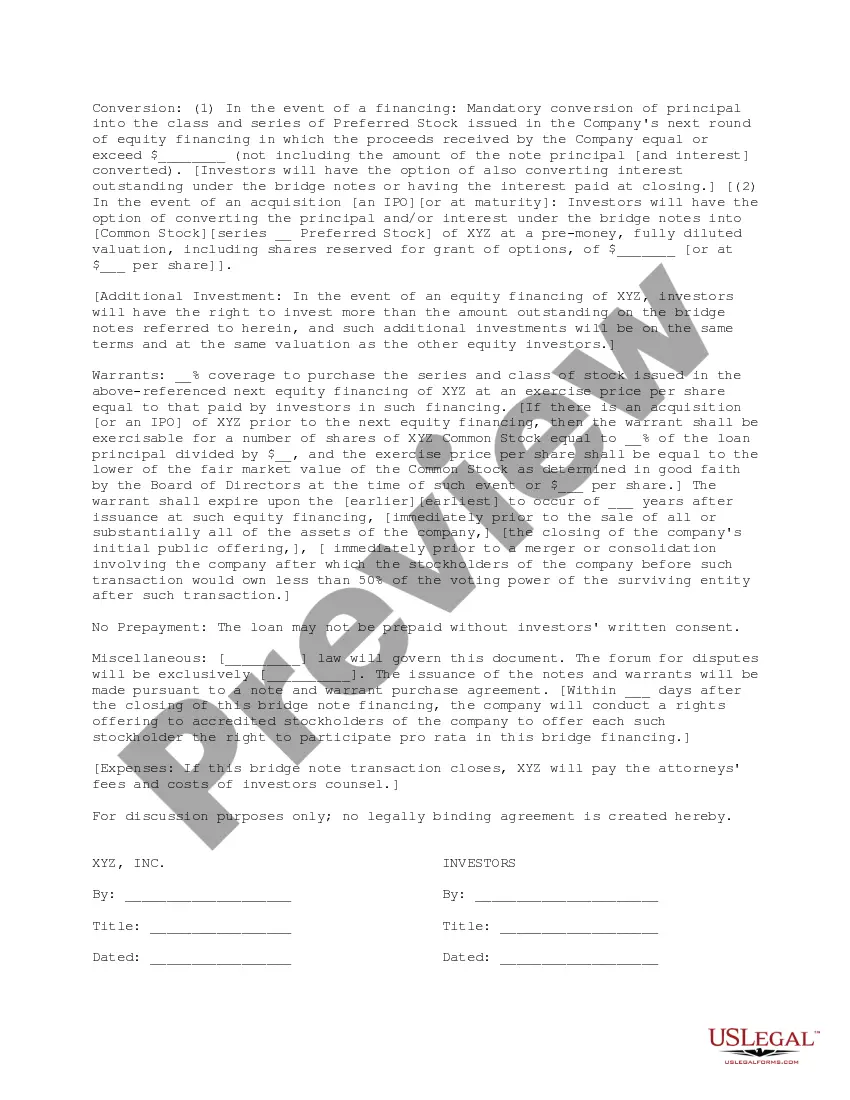

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

A Santa Clara California Term Sheet for Bridge Financing is a comprehensive document outlining the terms and conditions of a bridge loan specifically targeted towards properties and businesses located in Santa Clara, California. Bridge financing is a short-term loan option designed to bridge the gap between two larger financial transactions, typically in real estate acquisitions or business expansions. In Santa Clara, there are several types of term sheets available for bridge financing, each catering to specific needs and requirements. These variations include: 1. Real Estate Bridge Financing Term Sheet: This type of term sheet is specifically tailored for real estate transactions in Santa Clara. It outlines the loan amount, interest rates, loan-to-value (LTV) ratio, repayment terms, and other crucial details pertaining to the loan, ensuring smooth transitions between property acquisitions or refinancing. 2. Commercial Bridge Loan Term Sheet: This variation of the term sheet is aimed at facilitating bridge financing for commercial properties in Santa Clara, such as office buildings, retail spaces, or industrial facilities. It includes essential aspects like loan duration, potential extension options, interest calculations, prepayment penalties, and other terms unique to commercial real estate transactions. 3. Business Bridge Loan Term Sheet: Ideal for entrepreneurs or business owners in Santa Clara, this term sheet highlights the terms and conditions for securing bridge financing to meet short-term capital needs. It outlines the loan amount, duration, repayment terms, interest rates, collateral requirements, and possibly any necessary personal guarantees from the business owner or partners. 4. Acquisition Bridge Loan Term Sheet: This type of term sheet focuses on bridge financing options available to individuals or companies seeking to acquire an existing business or property within Santa Clara. It provides detailed information on loan sizing, financial covenants, due diligence requirements, potential earn-outs, and other relevant terms essential for successful acquisitions. 5. Construction Bridge Financing Term Sheet: This specific term sheet caters to bridge loans sought for construction projects within Santa Clara. It covers critical aspects of the financing like loan disbursement schedules, project timelines, interest reserve requirements, inspection and draw processes, completion guarantees, and contingency provisions. These different types of Santa Clara California Term Sheets for Bridge Financing ensure that borrowers have access to loan structures suitable for their varying needs and circumstances. With thorough understanding and utilization of the right term sheet, individuals and businesses can secure timely bridge financing solutions to navigate their financial bridge gaps effectively.A Santa Clara California Term Sheet for Bridge Financing is a comprehensive document outlining the terms and conditions of a bridge loan specifically targeted towards properties and businesses located in Santa Clara, California. Bridge financing is a short-term loan option designed to bridge the gap between two larger financial transactions, typically in real estate acquisitions or business expansions. In Santa Clara, there are several types of term sheets available for bridge financing, each catering to specific needs and requirements. These variations include: 1. Real Estate Bridge Financing Term Sheet: This type of term sheet is specifically tailored for real estate transactions in Santa Clara. It outlines the loan amount, interest rates, loan-to-value (LTV) ratio, repayment terms, and other crucial details pertaining to the loan, ensuring smooth transitions between property acquisitions or refinancing. 2. Commercial Bridge Loan Term Sheet: This variation of the term sheet is aimed at facilitating bridge financing for commercial properties in Santa Clara, such as office buildings, retail spaces, or industrial facilities. It includes essential aspects like loan duration, potential extension options, interest calculations, prepayment penalties, and other terms unique to commercial real estate transactions. 3. Business Bridge Loan Term Sheet: Ideal for entrepreneurs or business owners in Santa Clara, this term sheet highlights the terms and conditions for securing bridge financing to meet short-term capital needs. It outlines the loan amount, duration, repayment terms, interest rates, collateral requirements, and possibly any necessary personal guarantees from the business owner or partners. 4. Acquisition Bridge Loan Term Sheet: This type of term sheet focuses on bridge financing options available to individuals or companies seeking to acquire an existing business or property within Santa Clara. It provides detailed information on loan sizing, financial covenants, due diligence requirements, potential earn-outs, and other relevant terms essential for successful acquisitions. 5. Construction Bridge Financing Term Sheet: This specific term sheet caters to bridge loans sought for construction projects within Santa Clara. It covers critical aspects of the financing like loan disbursement schedules, project timelines, interest reserve requirements, inspection and draw processes, completion guarantees, and contingency provisions. These different types of Santa Clara California Term Sheets for Bridge Financing ensure that borrowers have access to loan structures suitable for their varying needs and circumstances. With thorough understanding and utilization of the right term sheet, individuals and businesses can secure timely bridge financing solutions to navigate their financial bridge gaps effectively.