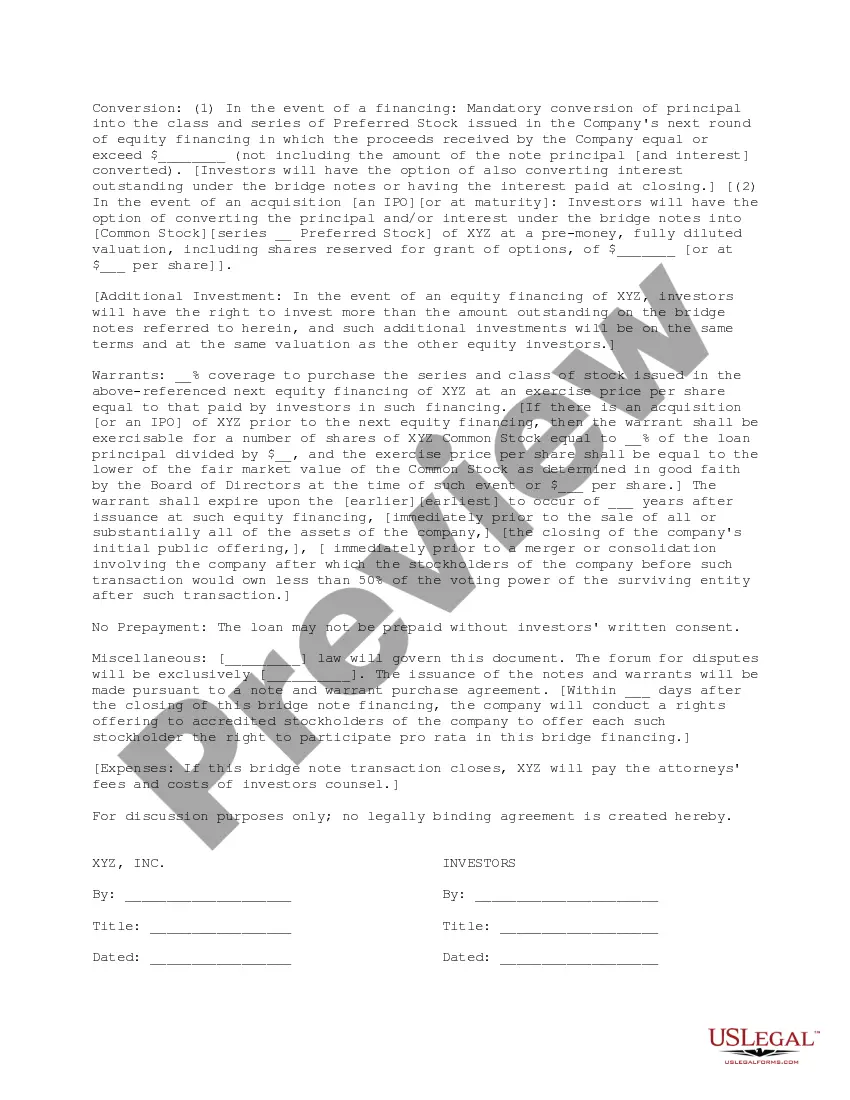

This document is for use in a proposed bridge financing in which the bridge investors are proposing loaning money to the company against delivery of bridge notes and warrants. It includes the kind of note and the conditions for its conversion, as well as the terms of the warrant.

Travis Texas Term Sheet for Bridge Financing serves as a detailed framework outlining the terms and conditions of a bridge loan agreement within the Travis County area, Texas. Bridge financing acts as a short-term financial solution, bridging the gap between the existing and future funding sources. It is commonly utilized by real estate developers, individuals, or businesses seeking immediate access to capital while awaiting long-term funding opportunities. The Travis Texas Term Sheet for Bridge Financing covers key aspects essential for both borrowers and lenders. This document outlines the loan amount, interest rate, repayment schedule, and collateral requirements. The flexibility of bridge financing allows borrowers to secure funds quickly, addressing urgent financing needs. Different types of Travis Texas Term Sheet for Bridge Financing may include: 1. Commercial Bridge Loan Term Sheet: Aimed at business entities or commercial real estate developers requiring short-term funding for various purposes such as property acquisition, renovations, or expansion. 2. Residential Bridge Loan Term Sheet: Tailored specifically for individuals or families in need of immediate financing during a transition period, often between selling an existing home and purchasing a new one. This type of bridge loan helps prevent delays or missed opportunities in the home buying process. 3. Construction Bridge Loan Term Sheet: Geared towards construction companies or developers, this type of loan facilitates ongoing construction projects by providing the necessary funds required to cover expenses until permanent financing is obtained. The Travis Texas Term Sheet for Bridge Financing also includes important clauses related to loan duration, default penalties, prepayment options, and any associated fees. It further outlines potential contingencies for lender or borrower, such as loan extensions or early repayment provisions. By understanding the specific types of bridge financing available in Travis County, Texas, individuals and businesses can make informed decisions based on their unique financial requirements. Implementing bridge financing effectively can help overcome short-term funding obstacles, seize valuable opportunities, and ensure smooth transitions in the borrowing or lending process.Travis Texas Term Sheet for Bridge Financing serves as a detailed framework outlining the terms and conditions of a bridge loan agreement within the Travis County area, Texas. Bridge financing acts as a short-term financial solution, bridging the gap between the existing and future funding sources. It is commonly utilized by real estate developers, individuals, or businesses seeking immediate access to capital while awaiting long-term funding opportunities. The Travis Texas Term Sheet for Bridge Financing covers key aspects essential for both borrowers and lenders. This document outlines the loan amount, interest rate, repayment schedule, and collateral requirements. The flexibility of bridge financing allows borrowers to secure funds quickly, addressing urgent financing needs. Different types of Travis Texas Term Sheet for Bridge Financing may include: 1. Commercial Bridge Loan Term Sheet: Aimed at business entities or commercial real estate developers requiring short-term funding for various purposes such as property acquisition, renovations, or expansion. 2. Residential Bridge Loan Term Sheet: Tailored specifically for individuals or families in need of immediate financing during a transition period, often between selling an existing home and purchasing a new one. This type of bridge loan helps prevent delays or missed opportunities in the home buying process. 3. Construction Bridge Loan Term Sheet: Geared towards construction companies or developers, this type of loan facilitates ongoing construction projects by providing the necessary funds required to cover expenses until permanent financing is obtained. The Travis Texas Term Sheet for Bridge Financing also includes important clauses related to loan duration, default penalties, prepayment options, and any associated fees. It further outlines potential contingencies for lender or borrower, such as loan extensions or early repayment provisions. By understanding the specific types of bridge financing available in Travis County, Texas, individuals and businesses can make informed decisions based on their unique financial requirements. Implementing bridge financing effectively can help overcome short-term funding obstacles, seize valuable opportunities, and ensure smooth transitions in the borrowing or lending process.