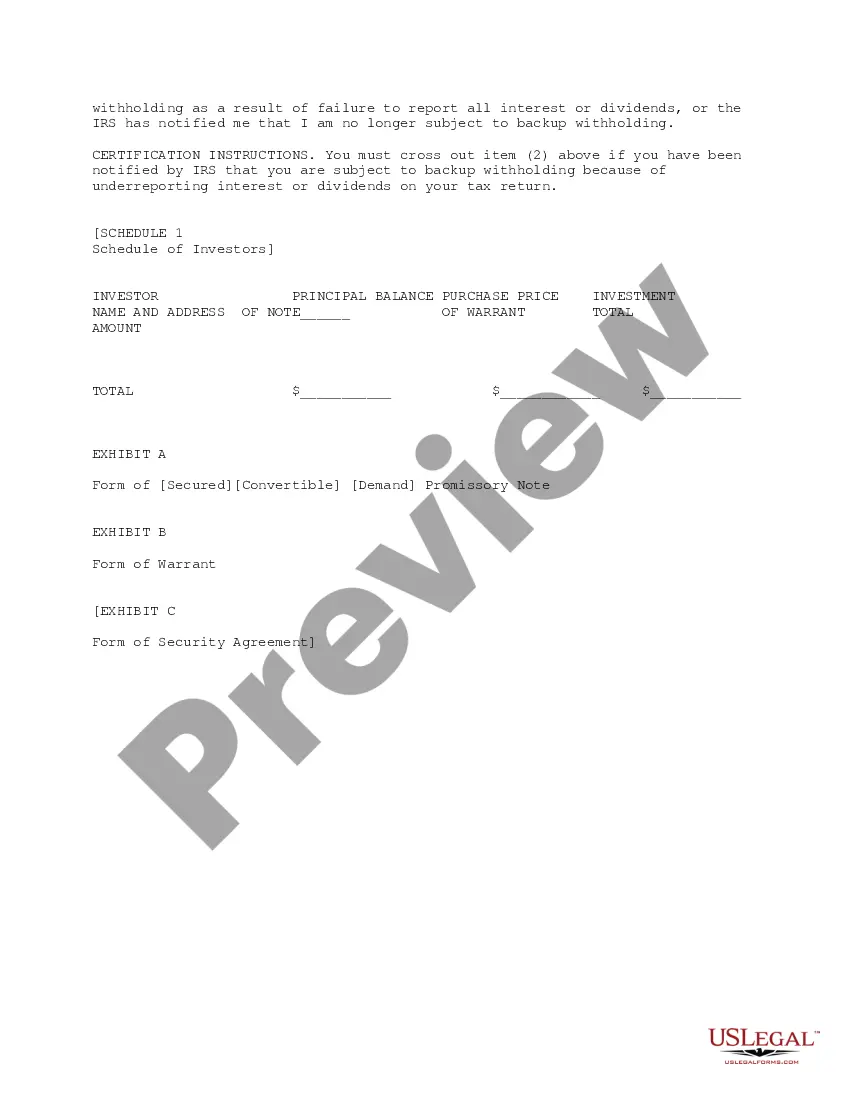

This document is to be used in bridge financing in which the bridge investors are loaning money to the company against delivery of bridge notes, and the company is issuing warrants. The agreement states that the bridge notes will be convertible into equity and specifies conditions when conversion will occur.

A Mecklenburg North Carolina Note and Warrant Purchase Agreement refers to a legally binding contract entered into between a purchaser and an issuer, primarily involving the purchase of promissory notes and warrants issued by entities located within Mecklenburg County, North Carolina. This agreement outlines the terms and conditions, rights, and obligations of both parties involved in the transaction. The Mecklenburg North Carolina Note and Warrant Purchase Agreement serves as a critical instrument in facilitating the acquisition of debt instruments and related securities within the geographical region of Mecklenburg County. This agreement provides a clear framework for the purchase and sale of promissory notes, which signify a financial obligation of the issuer to repay borrowed funds and warrant certificates, granting the holder the right to purchase underlying securities at a predetermined price within a specified period. The agreement typically includes various provisions that define the scope of the transaction, such as the purchase price, payment terms, delivery mechanisms, representations, warranties, and conditions precedent. It may also specify any due diligence requirements, regulatory compliance obligations, and methods of dispute resolution. While the Mecklenburg North Carolina Note and Warrant Purchase Agreement generally refers to a standardized framework encompassing a range of note and warrant purchase transactions, there may be different types of specific agreements depending on the parties involved and the purpose of the transaction. Some common variations may include: 1. Corporate Note and Warrant Purchase Agreement: This type of agreement pertains to the purchase of promissory notes and warrants issued by private or public corporations in Mecklenburg County. 2. Municipal Note and Warrant Purchase Agreement: This agreement encompasses the acquisition of promissory notes and warrants issued by municipal entities within Mecklenburg County. Such issuance soften finance infrastructure projects or public services. 3. Real Estate Note and Warrant Purchase Agreement: This specific type of agreement involves the purchase of promissory notes and warrants issued in connection with real estate transactions within Mecklenburg County. 4. Government Note and Warrant Purchase Agreement: This agreement covers the acquisition of promissory notes and warrants issued by local or state government agencies located in Mecklenburg County, North Carolina. It is crucial for all parties involved in a Mecklenburg North Carolina Note and Warrant Purchase Agreement to carefully review and understand the terms and conditions stated within the agreement. Seeking legal counsel is highly recommended ensuring compliance with applicable laws, protect the rights and interests of both the purchaser and issuer, and facilitate a smooth and successful transaction.A Mecklenburg North Carolina Note and Warrant Purchase Agreement refers to a legally binding contract entered into between a purchaser and an issuer, primarily involving the purchase of promissory notes and warrants issued by entities located within Mecklenburg County, North Carolina. This agreement outlines the terms and conditions, rights, and obligations of both parties involved in the transaction. The Mecklenburg North Carolina Note and Warrant Purchase Agreement serves as a critical instrument in facilitating the acquisition of debt instruments and related securities within the geographical region of Mecklenburg County. This agreement provides a clear framework for the purchase and sale of promissory notes, which signify a financial obligation of the issuer to repay borrowed funds and warrant certificates, granting the holder the right to purchase underlying securities at a predetermined price within a specified period. The agreement typically includes various provisions that define the scope of the transaction, such as the purchase price, payment terms, delivery mechanisms, representations, warranties, and conditions precedent. It may also specify any due diligence requirements, regulatory compliance obligations, and methods of dispute resolution. While the Mecklenburg North Carolina Note and Warrant Purchase Agreement generally refers to a standardized framework encompassing a range of note and warrant purchase transactions, there may be different types of specific agreements depending on the parties involved and the purpose of the transaction. Some common variations may include: 1. Corporate Note and Warrant Purchase Agreement: This type of agreement pertains to the purchase of promissory notes and warrants issued by private or public corporations in Mecklenburg County. 2. Municipal Note and Warrant Purchase Agreement: This agreement encompasses the acquisition of promissory notes and warrants issued by municipal entities within Mecklenburg County. Such issuance soften finance infrastructure projects or public services. 3. Real Estate Note and Warrant Purchase Agreement: This specific type of agreement involves the purchase of promissory notes and warrants issued in connection with real estate transactions within Mecklenburg County. 4. Government Note and Warrant Purchase Agreement: This agreement covers the acquisition of promissory notes and warrants issued by local or state government agencies located in Mecklenburg County, North Carolina. It is crucial for all parties involved in a Mecklenburg North Carolina Note and Warrant Purchase Agreement to carefully review and understand the terms and conditions stated within the agreement. Seeking legal counsel is highly recommended ensuring compliance with applicable laws, protect the rights and interests of both the purchaser and issuer, and facilitate a smooth and successful transaction.