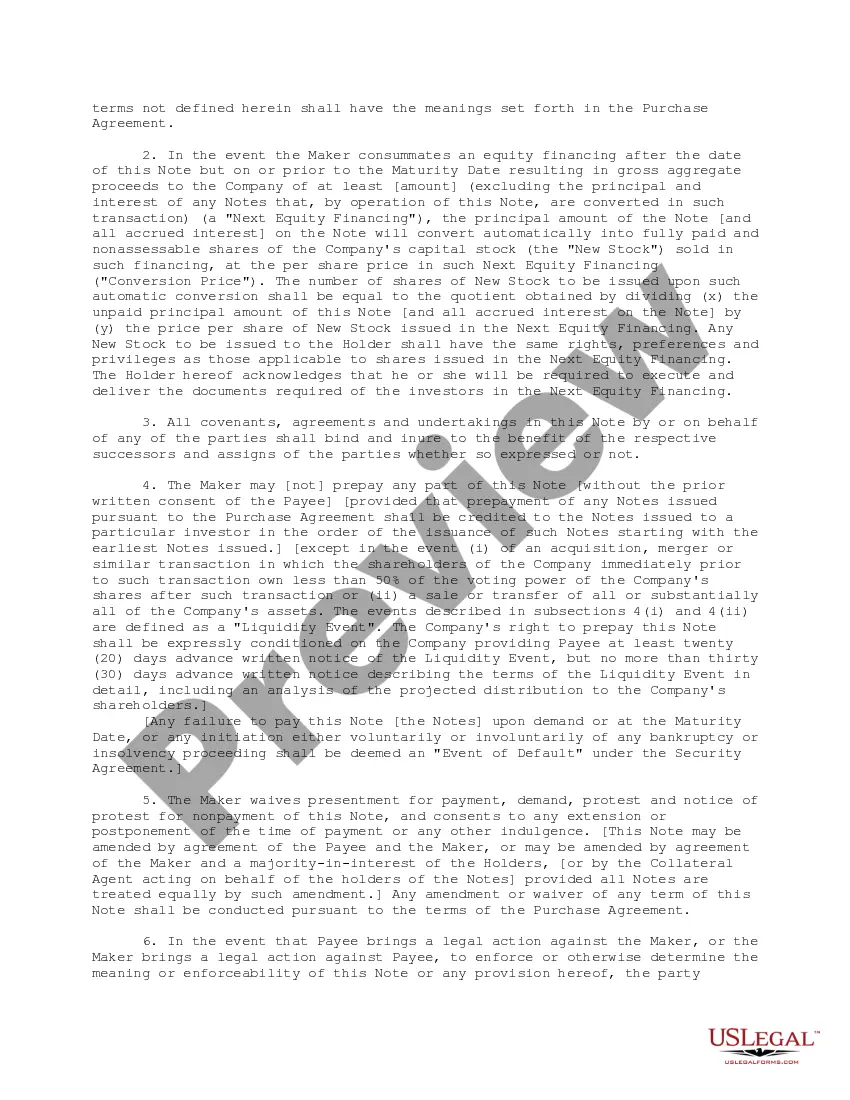

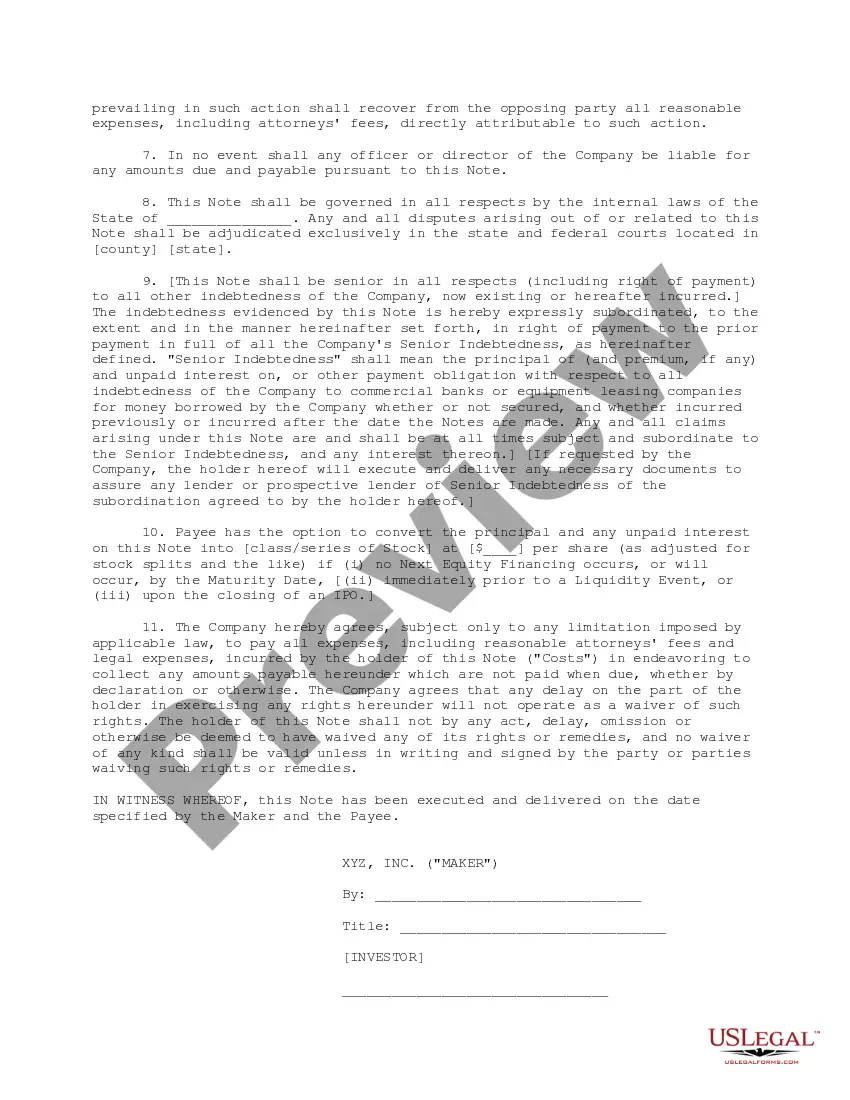

This Bridge Financing Demand Note is to be used in bridge financing when the bridge investors are loaning money to the company on a repayment on demand basis. The form of note can be changed to be secured or unsecured.

Cuyahoga Ohio Bridge Financing Demand Note serves as a useful financial instrument that bridges the gap between short-term borrowing needs and the availability of long-term financing options for borrowers in the Cuyahoga County, Ohio area. This demand note is specifically designed to provide flexible and quick financing solutions for various projects and investments, such as real estate development, infrastructure improvements, business expansion, and more. The Cuyahoga Ohio Bridge Financing Demand Note presents an attractive avenue for borrowers seeking temporary funding, as it allows them to access capital without the need for a lengthy loan application process typically associated with traditional financing options. Instead, borrowers can expediently secure funds by issuing this demand note to qualified investors or financial institutions in the Cuyahoga County area. With its wide array of applications, Cuyahoga Ohio Bridge Financing Demand Note offers different types to suit specific borrowing needs. Some key types of Cuyahoga Ohio Bridge Financing Demand Notes include: 1. Real Estate Bridge Financing Demand Note: This type of demand note is tailored to meet the short-term financing requirements of real estate projects, such as property acquisitions, rehabilitation, or construction. It assists borrowers in securing funds quickly, allowing them to bridge the gap until long-term financing becomes available. 2. Infrastructure Bridge Financing Demand Note: Designed for public works projects, this demand note caters to the funding needs of infrastructure developments, including road and bridge construction, utility installations, or transportation system enhancements. It enables government agencies or private entities to sustain project progression before securing long-term financing. 3. Business Expansion Bridge Financing Demand Note: Entrepreneurs and business owners can leverage this type of demand note to acquire temporary capital for expanding their existing operations, launching a new product line, or scaling up their business. It facilitates quick access to funds, ensuring that growth opportunities are not missed due to delays in securing long-term financing. 4. Emergency Funding Bridge Financing Demand Note: This demand note addresses urgent financial needs that arise unexpectedly, such as natural disasters or unforeseen business challenges. It provides immediate liquidity to borrowers, enabling them to sustain operations or address critical situations without undue delays. In conclusion, the Cuyahoga Ohio Bridge Financing Demand Note refers to a versatile financial instrument that meets the short-term funding requirements of various projects and investments in Cuyahoga County. Its different types cater to specific borrowing needs, ensuring borrowers can secure quick and efficient financing solutions to bridge the gap until long-term financing options become available.Cuyahoga Ohio Bridge Financing Demand Note serves as a useful financial instrument that bridges the gap between short-term borrowing needs and the availability of long-term financing options for borrowers in the Cuyahoga County, Ohio area. This demand note is specifically designed to provide flexible and quick financing solutions for various projects and investments, such as real estate development, infrastructure improvements, business expansion, and more. The Cuyahoga Ohio Bridge Financing Demand Note presents an attractive avenue for borrowers seeking temporary funding, as it allows them to access capital without the need for a lengthy loan application process typically associated with traditional financing options. Instead, borrowers can expediently secure funds by issuing this demand note to qualified investors or financial institutions in the Cuyahoga County area. With its wide array of applications, Cuyahoga Ohio Bridge Financing Demand Note offers different types to suit specific borrowing needs. Some key types of Cuyahoga Ohio Bridge Financing Demand Notes include: 1. Real Estate Bridge Financing Demand Note: This type of demand note is tailored to meet the short-term financing requirements of real estate projects, such as property acquisitions, rehabilitation, or construction. It assists borrowers in securing funds quickly, allowing them to bridge the gap until long-term financing becomes available. 2. Infrastructure Bridge Financing Demand Note: Designed for public works projects, this demand note caters to the funding needs of infrastructure developments, including road and bridge construction, utility installations, or transportation system enhancements. It enables government agencies or private entities to sustain project progression before securing long-term financing. 3. Business Expansion Bridge Financing Demand Note: Entrepreneurs and business owners can leverage this type of demand note to acquire temporary capital for expanding their existing operations, launching a new product line, or scaling up their business. It facilitates quick access to funds, ensuring that growth opportunities are not missed due to delays in securing long-term financing. 4. Emergency Funding Bridge Financing Demand Note: This demand note addresses urgent financial needs that arise unexpectedly, such as natural disasters or unforeseen business challenges. It provides immediate liquidity to borrowers, enabling them to sustain operations or address critical situations without undue delays. In conclusion, the Cuyahoga Ohio Bridge Financing Demand Note refers to a versatile financial instrument that meets the short-term funding requirements of various projects and investments in Cuyahoga County. Its different types cater to specific borrowing needs, ensuring borrowers can secure quick and efficient financing solutions to bridge the gap until long-term financing options become available.