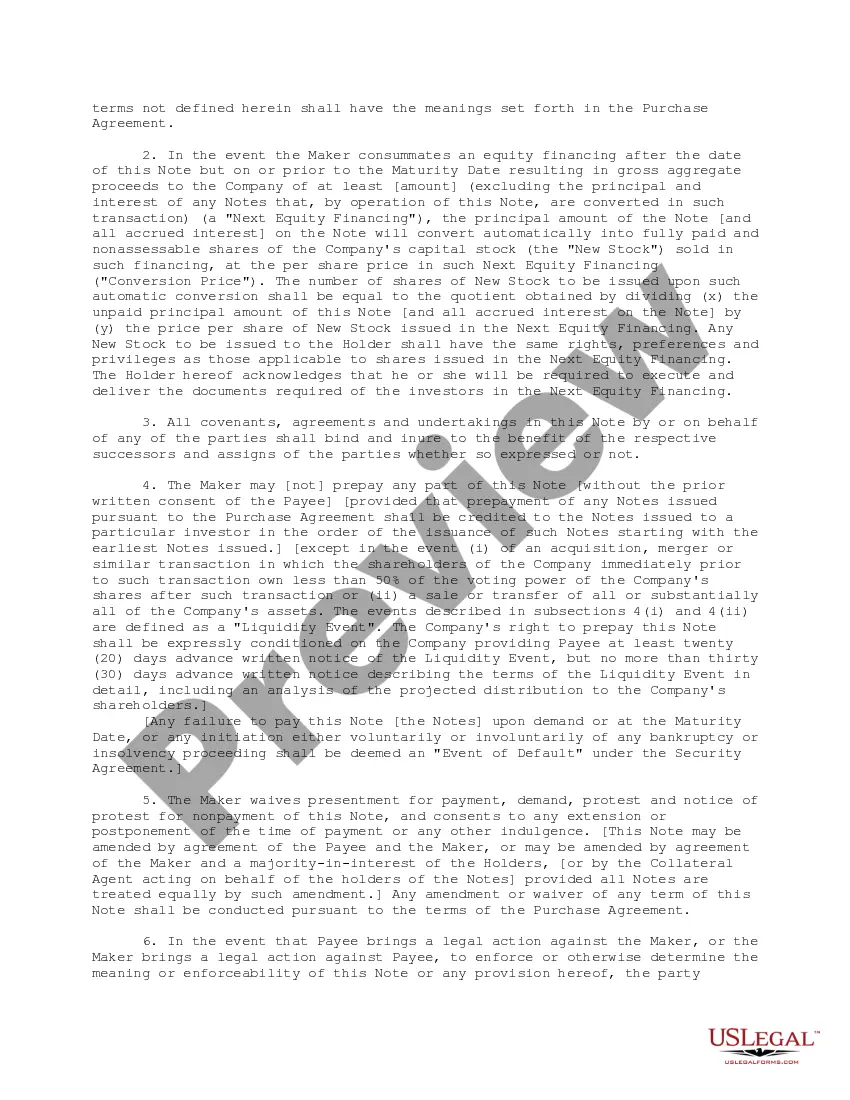

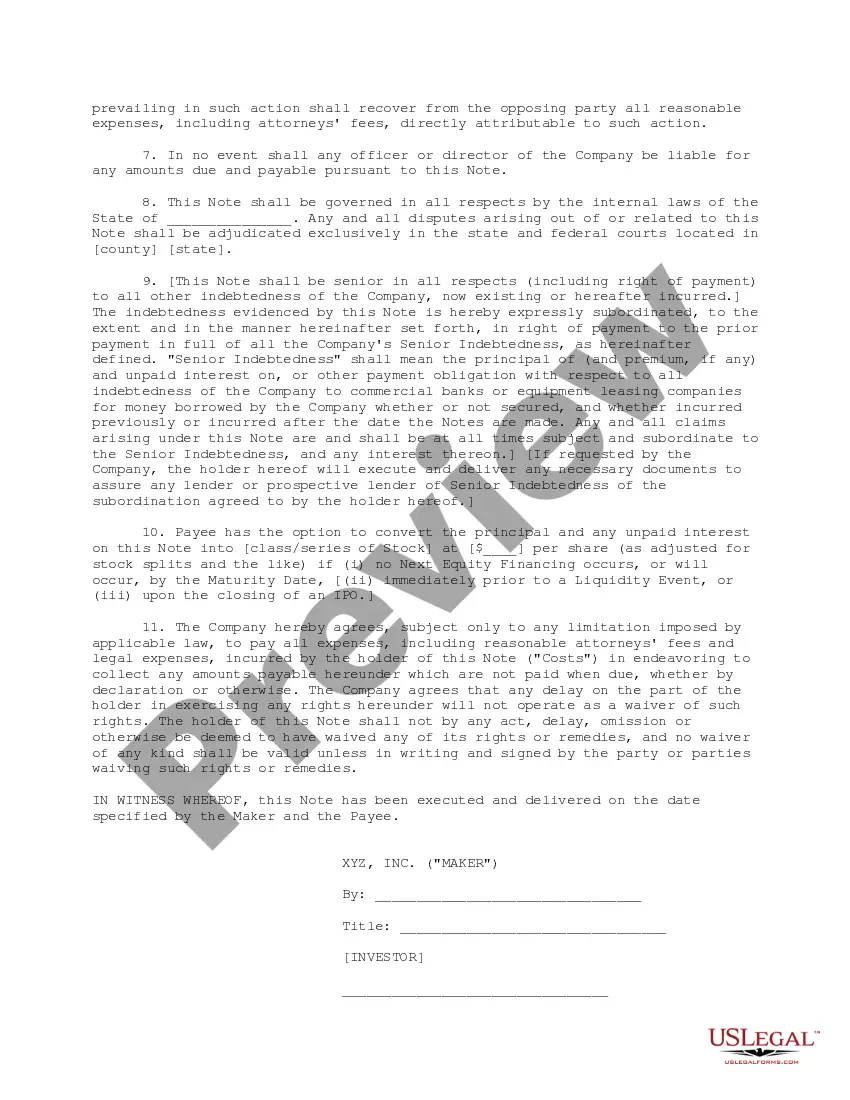

This Bridge Financing Demand Note is to be used in bridge financing when the bridge investors are loaning money to the company on a repayment on demand basis. The form of note can be changed to be secured or unsecured.

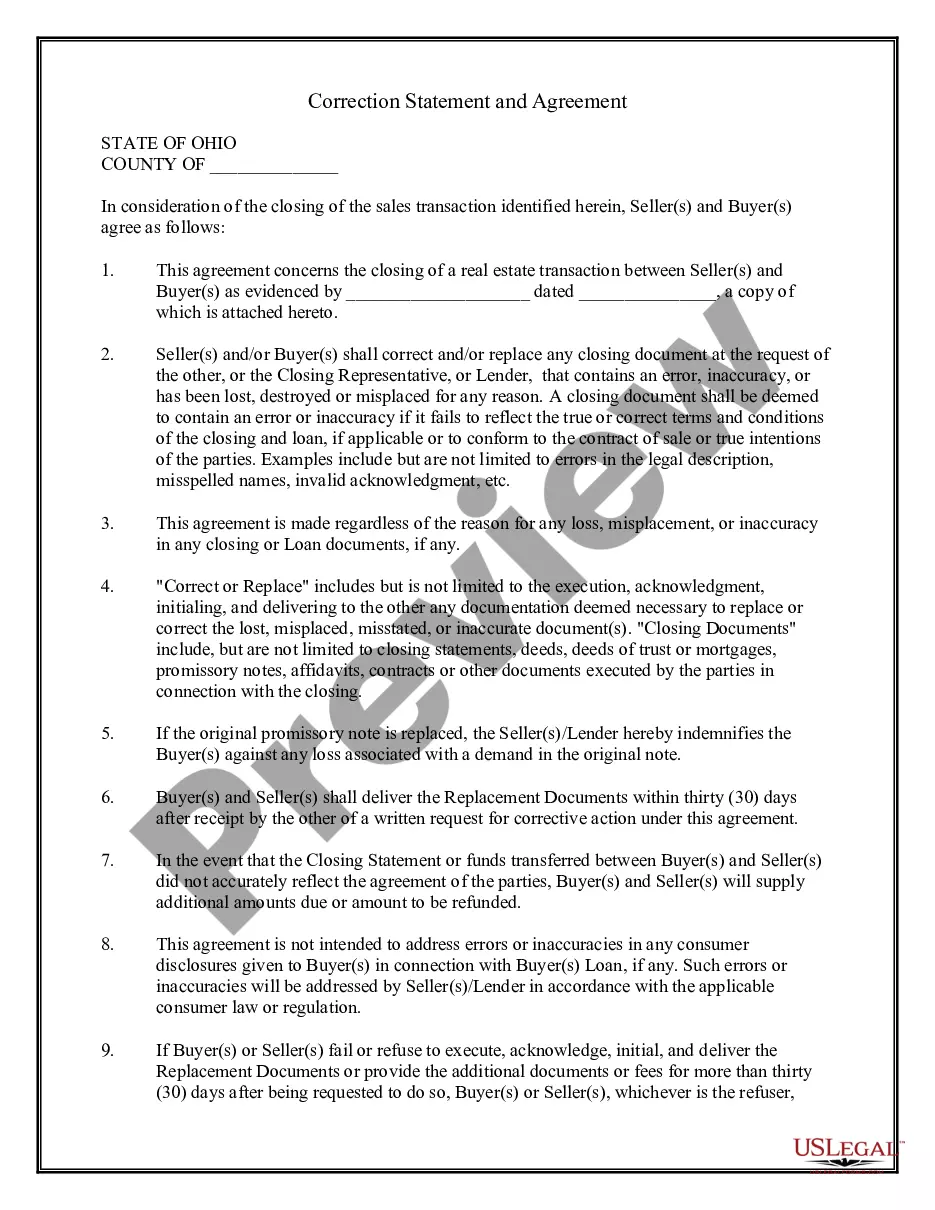

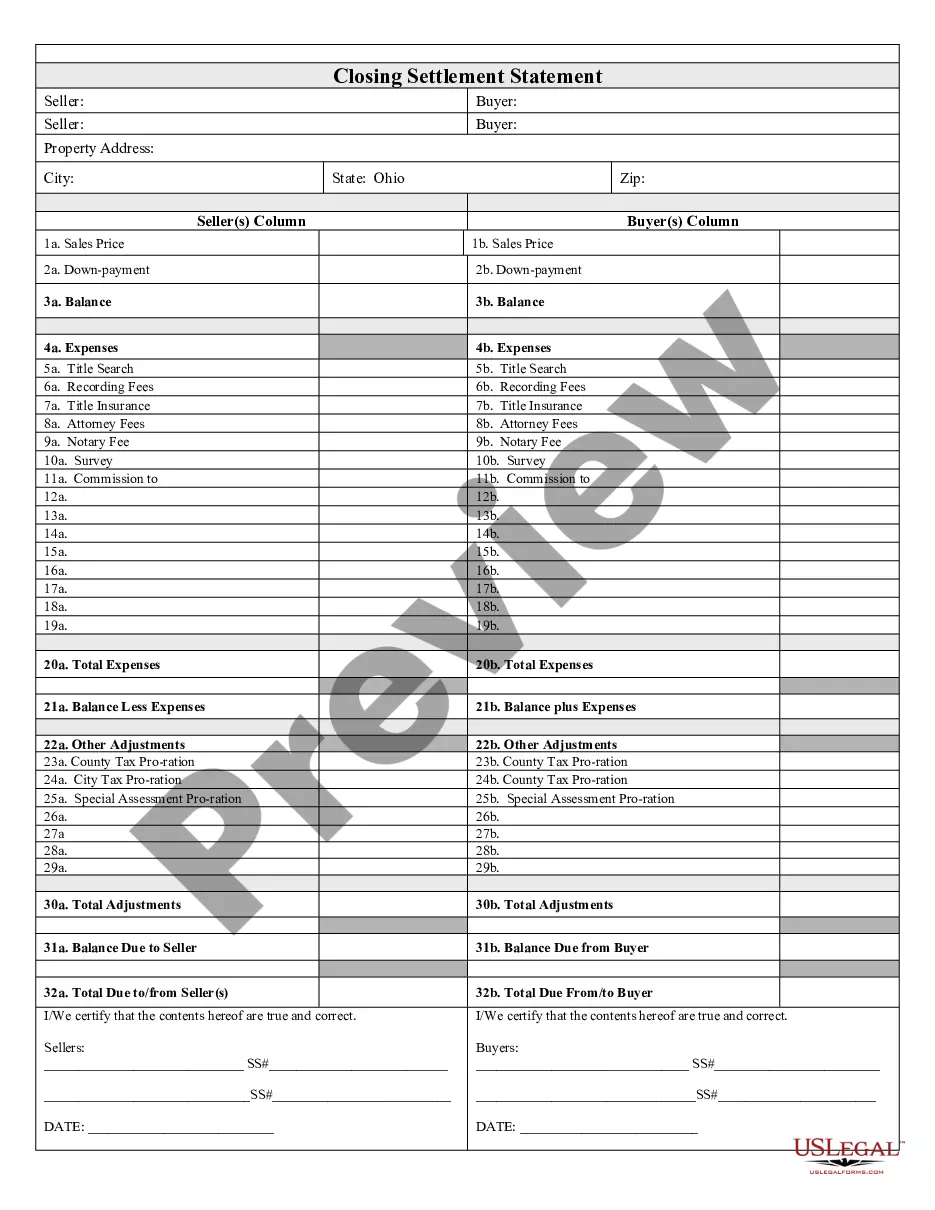

Maricopa Arizona Bridge Financing Demand Note: A Comprehensive Overview and Types Maricopa, Arizona, a rapidly growing city located in Pinal County, has seen a surge in real estate development and investment opportunities. To facilitate smooth real estate transactions, Maricopa offers Bridge Financing Demand Notes, which act as an essential financial instrument for short-term loans within the real estate industry. Bridge Financing Demand Notes are legal documents used to secure temporary financing between the sale of a property and the acquisition of a new one. These notes bridge the gap between the existing property's sale and the purchase of a new property, providing the borrower with quick access to funds for down payments or other immediate financial needs. These demand notes are typically designed to provide short-term financing solutions, allowing borrowers to swiftly close deals while optimizing their real estate investments. Unlike conventional mortgages, Maricopa Arizona Bridge Financing Demand Notes are not long-term loans; they are specifically tailored to bridge the gap during property transitions, construction, or other real estate-related projects. Maricopa Arizona Bridge Financing Demand Notes offer several advantages to borrowers. Firstly, they provide flexible repayment terms, usually ranging from a few months to a couple of years. This flexibility allows borrowers to repay the loan when the property is sold or when they secure long-term financing. Additionally, these notes often have fast approval processes, enabling borrowers to secure financing promptly and seize lucrative investment opportunities. There are various types of Maricopa Arizona Bridge Financing Demand Notes, each catering to specific real estate situations: 1. Residential Bridge Financing Demand Note: Targeted towards homeowners who intend to sell their current property and purchase a new one simultaneously. This type of demand note allows the borrower to access funds for a down payment on a new home while the sale of the existing property is in progress. 2. Commercial Bridge Financing Demand Note: Designed for commercial real estate investors or businesses seeking short-term financing to bridge gaps between property acquisitions or mortgage refinancing. This type of demand note facilitates seamless transitions, ensuring minimal disruption to operations or investment plans. 3. Construction Bridge Financing Demand Note: Suited for developers or individuals engaged in construction projects, this type of demand note assists in covering construction costs until long-term financing options, such as construction loans, become available. It allows borrowers to start construction promptly to avoid delays in project completion. In conclusion, Maricopa Arizona Bridge Financing Demand Notes provide a vital financial tool for real estate investors, homeowners, and businesses seeking short-term financing solutions. With their flexibility, quick approval, and various types tailored to specific needs, these demand notes enable borrowers to bridge the financing gap and maximize their real estate opportunities in the vibrant city of Maricopa, Arizona.Maricopa Arizona Bridge Financing Demand Note: A Comprehensive Overview and Types Maricopa, Arizona, a rapidly growing city located in Pinal County, has seen a surge in real estate development and investment opportunities. To facilitate smooth real estate transactions, Maricopa offers Bridge Financing Demand Notes, which act as an essential financial instrument for short-term loans within the real estate industry. Bridge Financing Demand Notes are legal documents used to secure temporary financing between the sale of a property and the acquisition of a new one. These notes bridge the gap between the existing property's sale and the purchase of a new property, providing the borrower with quick access to funds for down payments or other immediate financial needs. These demand notes are typically designed to provide short-term financing solutions, allowing borrowers to swiftly close deals while optimizing their real estate investments. Unlike conventional mortgages, Maricopa Arizona Bridge Financing Demand Notes are not long-term loans; they are specifically tailored to bridge the gap during property transitions, construction, or other real estate-related projects. Maricopa Arizona Bridge Financing Demand Notes offer several advantages to borrowers. Firstly, they provide flexible repayment terms, usually ranging from a few months to a couple of years. This flexibility allows borrowers to repay the loan when the property is sold or when they secure long-term financing. Additionally, these notes often have fast approval processes, enabling borrowers to secure financing promptly and seize lucrative investment opportunities. There are various types of Maricopa Arizona Bridge Financing Demand Notes, each catering to specific real estate situations: 1. Residential Bridge Financing Demand Note: Targeted towards homeowners who intend to sell their current property and purchase a new one simultaneously. This type of demand note allows the borrower to access funds for a down payment on a new home while the sale of the existing property is in progress. 2. Commercial Bridge Financing Demand Note: Designed for commercial real estate investors or businesses seeking short-term financing to bridge gaps between property acquisitions or mortgage refinancing. This type of demand note facilitates seamless transitions, ensuring minimal disruption to operations or investment plans. 3. Construction Bridge Financing Demand Note: Suited for developers or individuals engaged in construction projects, this type of demand note assists in covering construction costs until long-term financing options, such as construction loans, become available. It allows borrowers to start construction promptly to avoid delays in project completion. In conclusion, Maricopa Arizona Bridge Financing Demand Notes provide a vital financial tool for real estate investors, homeowners, and businesses seeking short-term financing solutions. With their flexibility, quick approval, and various types tailored to specific needs, these demand notes enable borrowers to bridge the financing gap and maximize their real estate opportunities in the vibrant city of Maricopa, Arizona.