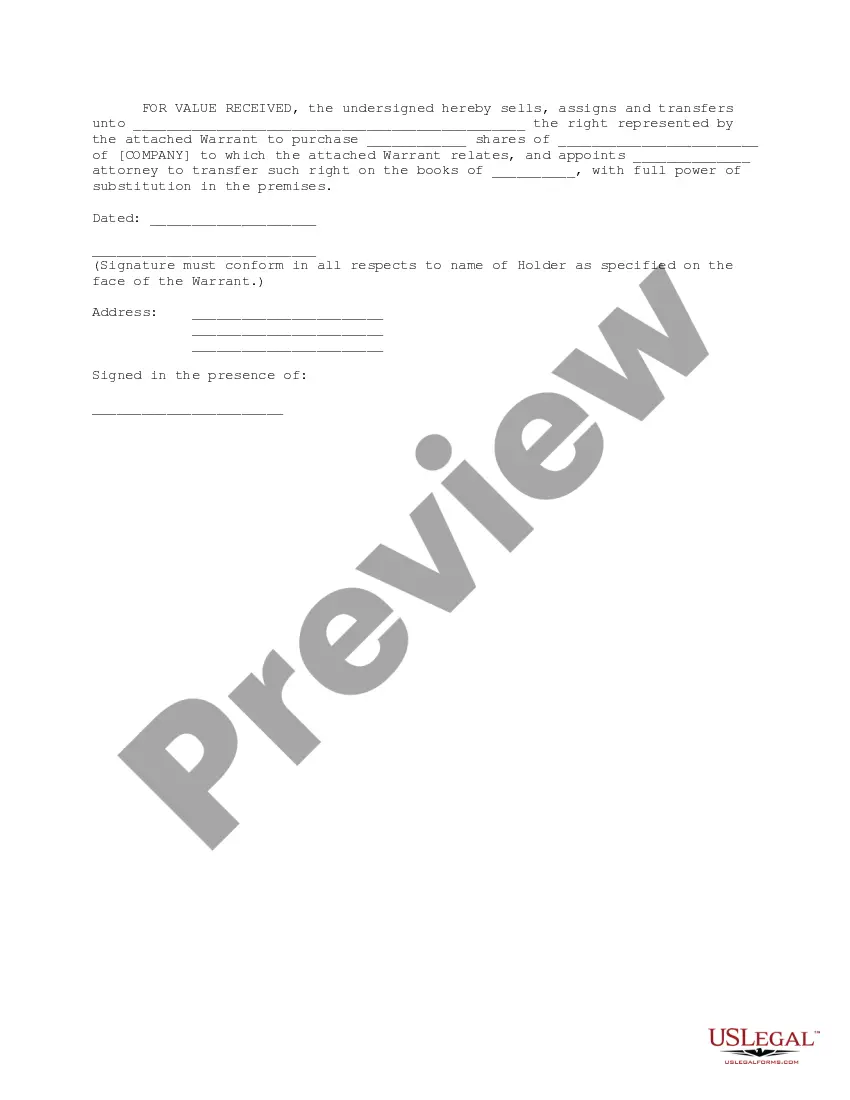

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Alameda California Bridge Financing Warrant is a type of financial instrument that provides short-term funding to bridge the gap between the purchase of a new property and the sale of an existing one. It offers an opportunity for individuals or businesses in Alameda, California, to access necessary funds quickly, enabling them to proceed with their real estate transactions without delay. Bridge financing warrants are typically offered by banks, credit unions, or private lenders, and they come with a predetermined interest rate and repayment schedule. The warrant serves as a guarantee for the lender, securing the loan with the borrower's property or assets until it is repaid in full. There are two main types of Alameda California Bridge Financing Warrants: 1. Residential Bridge Financing Warrant: This type of warrant is specifically designed for individuals or families who need temporary financing to purchase a new home while their existing property is still on the market. It allows homeowners to buy their dream homes without having to wait for the sale of their current property. Once the existing property is sold, the proceeds are used to repay the bridge loan. 2. Commercial Bridge Financing Warrant: This type of warrant is tailored to businesses or investors who require immediate capital for commercial real estate transactions. It enables them to bridge the financial gap between acquiring a new property or project and securing long-term financing. Commercial bridge financing warrants are commonly used for properties such as office buildings, retail centers, or apartment complexes. In conclusion, Alameda California Bridge Financing Warrants provide temporary funding solutions for both residential and commercial real estate transactions. They allow borrowers in Alameda, California, to overcome financial obstacles and seize investment opportunities without waiting for their properties to sell. Whether it's a residential or commercial property, bridge financing warrants offer a flexible and efficient means to bridge the gap and facilitate the smooth completion of real estate transactions.Alameda California Bridge Financing Warrant is a type of financial instrument that provides short-term funding to bridge the gap between the purchase of a new property and the sale of an existing one. It offers an opportunity for individuals or businesses in Alameda, California, to access necessary funds quickly, enabling them to proceed with their real estate transactions without delay. Bridge financing warrants are typically offered by banks, credit unions, or private lenders, and they come with a predetermined interest rate and repayment schedule. The warrant serves as a guarantee for the lender, securing the loan with the borrower's property or assets until it is repaid in full. There are two main types of Alameda California Bridge Financing Warrants: 1. Residential Bridge Financing Warrant: This type of warrant is specifically designed for individuals or families who need temporary financing to purchase a new home while their existing property is still on the market. It allows homeowners to buy their dream homes without having to wait for the sale of their current property. Once the existing property is sold, the proceeds are used to repay the bridge loan. 2. Commercial Bridge Financing Warrant: This type of warrant is tailored to businesses or investors who require immediate capital for commercial real estate transactions. It enables them to bridge the financial gap between acquiring a new property or project and securing long-term financing. Commercial bridge financing warrants are commonly used for properties such as office buildings, retail centers, or apartment complexes. In conclusion, Alameda California Bridge Financing Warrants provide temporary funding solutions for both residential and commercial real estate transactions. They allow borrowers in Alameda, California, to overcome financial obstacles and seize investment opportunities without waiting for their properties to sell. Whether it's a residential or commercial property, bridge financing warrants offer a flexible and efficient means to bridge the gap and facilitate the smooth completion of real estate transactions.