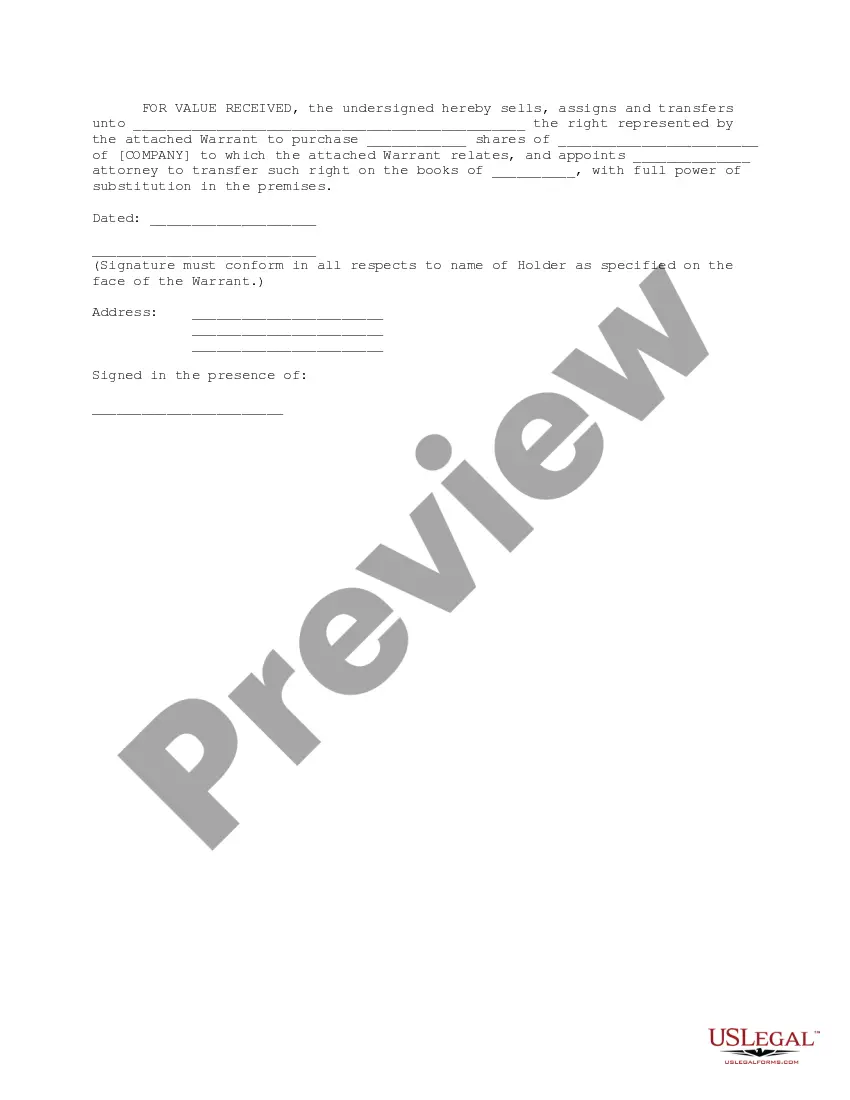

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Hillsborough Florida Bridge Financing Warrant is a financial instrument that provides short-term funding for individuals or businesses who need quick access to capital. This type of financing is commonly used when there is a time gap between the sale of one property and the purchase of another. Bridge financing warrants are specifically designed for residents or businesses located in Hillsborough County, Florida. They offer a flexible solution to bridge the financial gap during real estate transactions, ensuring smooth transitions between properties. Different types of Hillsborough Florida Bridge Financing Warrants include: 1. Residential Bridge Financing Warrant: This type of warrant caters to individuals who are buying or selling residential properties in Hillsborough County, Florida. It is commonly used to bridge the cash flow gap between the sale of a current home and the purchase of a new one. 2. Commercial Bridge Financing Warrant: Designed for businesses involved in commercial real estate transactions, this warrant provides short-term funding to bridge the gap between the sale or purchase of commercial properties in Hillsborough County. It assists in ensuring that businesses can proceed with their operations smoothly while awaiting the closing of a property deal. 3. Construction Bridge Financing Warrant: This type of warrant is specific to construction projects in Hillsborough County, Florida. It provides immediate capital to cover a portion of the construction costs during the project's initial stages. It is particularly beneficial when delays in obtaining traditional construction loans could lead to project setbacks. Hillsborough Florida Bridge Financing Warrants are offered by various financial institutions and private lenders. They typically have shorter repayment periods, higher interest rates, and may require collateral such as real estate or other assets. These warrants provide a temporary financial solution to buyers or sellers, allowing them to bridge the gap until permanent financing options become available. It is advisable to thoroughly research and compare different lenders, as well as consult with financial advisors or real estate professionals, before pursuing Hillsborough Florida Bridge Financing Warrants. This ensures that the terms and conditions align with your specific needs and financial capabilities.Hillsborough Florida Bridge Financing Warrant is a financial instrument that provides short-term funding for individuals or businesses who need quick access to capital. This type of financing is commonly used when there is a time gap between the sale of one property and the purchase of another. Bridge financing warrants are specifically designed for residents or businesses located in Hillsborough County, Florida. They offer a flexible solution to bridge the financial gap during real estate transactions, ensuring smooth transitions between properties. Different types of Hillsborough Florida Bridge Financing Warrants include: 1. Residential Bridge Financing Warrant: This type of warrant caters to individuals who are buying or selling residential properties in Hillsborough County, Florida. It is commonly used to bridge the cash flow gap between the sale of a current home and the purchase of a new one. 2. Commercial Bridge Financing Warrant: Designed for businesses involved in commercial real estate transactions, this warrant provides short-term funding to bridge the gap between the sale or purchase of commercial properties in Hillsborough County. It assists in ensuring that businesses can proceed with their operations smoothly while awaiting the closing of a property deal. 3. Construction Bridge Financing Warrant: This type of warrant is specific to construction projects in Hillsborough County, Florida. It provides immediate capital to cover a portion of the construction costs during the project's initial stages. It is particularly beneficial when delays in obtaining traditional construction loans could lead to project setbacks. Hillsborough Florida Bridge Financing Warrants are offered by various financial institutions and private lenders. They typically have shorter repayment periods, higher interest rates, and may require collateral such as real estate or other assets. These warrants provide a temporary financial solution to buyers or sellers, allowing them to bridge the gap until permanent financing options become available. It is advisable to thoroughly research and compare different lenders, as well as consult with financial advisors or real estate professionals, before pursuing Hillsborough Florida Bridge Financing Warrants. This ensures that the terms and conditions align with your specific needs and financial capabilities.