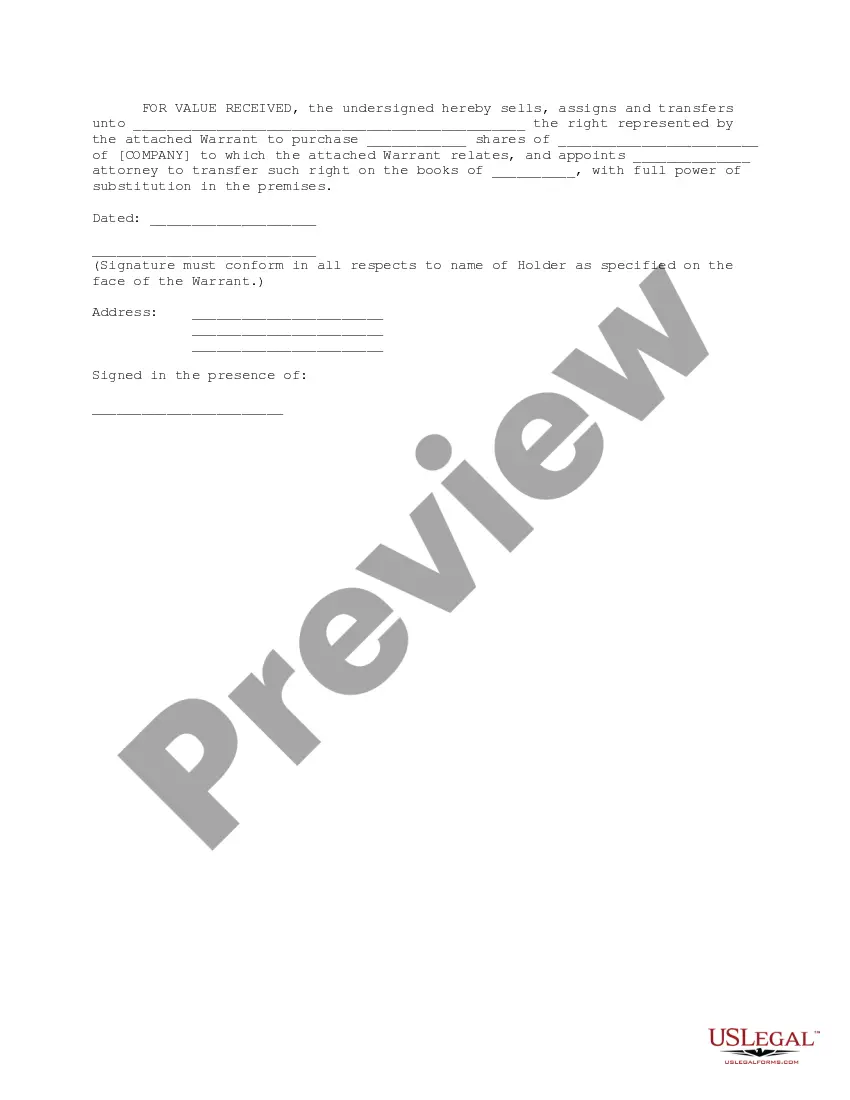

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Los Angeles California Bridge Financing Warrant: A Detailed Description and Types Los Angeles, California, is known for its vibrant real estate market, attracting numerous property investors and entrepreneurs. To facilitate these transactions, various financial tools are available, including the Los Angeles California Bridge Financing Warrant. This specialized financial instrument serves as a short-term funding option for those seeking to purchase or refinance a property, especially when there is a time-sensitive need to bridge the gap between two transactions. Bridge Financing in Los Angeles is often used to secure funds quickly, providing temporary financing until permanent financing can be arranged. Whether for residential or commercial properties, the aim is to unlock the potential of an investment opportunity without delays caused by traditional loan procedures. Los Angeles California Bridge Financing Warrants enable borrowers to access substantial capital, often with less stringent criteria compared to traditional lenders. Key features and benefits associated with this financial tool may include: 1. Flexibility: Bridge financing often allows for flexible terms and conditions, supporting various property types such as single-family homes, apartment buildings, retail spaces, or even land development projects. 2. Speed: Bridge loans are designed to be obtained swiftly — sometimes within a matter of days – reducing wait times and enabling borrowers to capitalize on time-sensitive real estate opportunities. 3. Interest-Only Payments: Many bridge financing options offer interest-only payments during the loan term, allowing borrowers to manage cash flow effectively, as principal payments are deferred until the loan matures. 4. Credit Flexibility: Los Angeles California Bridge Financing Warrants consider the potential of the underlying asset more heavily than the borrower's credit history, making it an attractive option for individuals with less-than-ideal credit scores. Different types of Los Angeles California Bridge Financing Warrants may include: 1. Residential Bridge Loans: These bridge loans aid in the purchase or refinance of residential properties in Los Angeles, offering short-term capital to bridge the gap until long-term financing is secured. 2. Commercial Bridge Loans: Ideal for commercial properties, this type of bridge loan facilitates acquisitions, refinancing, or construction projects. Borrowers can access funds quickly, allowing them to capitalize on commercial real estate opportunities. 3. Construction Bridge Loans: Designed for real estate developers and investors, construction bridge loans help finance new construction projects until long-term project financing can be arranged. These loans provide flexibility and speed, essential in the fast-paced construction industry. 4. Fix-and-Flip Bridge Loans: Tailored for real estate investors involved in buying, renovating, and quickly selling properties, these bridge loans provide short-term financing to cover acquisition costs, renovation expenses, and carrying costs until the property is sold. In conclusion, Los Angeles California Bridge Financing Warrants are a flexible and efficient financing solution for individuals and businesses aiming to capitalize on real estate opportunities in the Los Angeles area. With various types available, borrowers can choose the most suitable option based on their specific needs and goals. The availability of these loans ensures that investors can act quickly, seize valuable opportunities, and maximize their returns to the dynamic Los Angeles real estate market.Los Angeles California Bridge Financing Warrant: A Detailed Description and Types Los Angeles, California, is known for its vibrant real estate market, attracting numerous property investors and entrepreneurs. To facilitate these transactions, various financial tools are available, including the Los Angeles California Bridge Financing Warrant. This specialized financial instrument serves as a short-term funding option for those seeking to purchase or refinance a property, especially when there is a time-sensitive need to bridge the gap between two transactions. Bridge Financing in Los Angeles is often used to secure funds quickly, providing temporary financing until permanent financing can be arranged. Whether for residential or commercial properties, the aim is to unlock the potential of an investment opportunity without delays caused by traditional loan procedures. Los Angeles California Bridge Financing Warrants enable borrowers to access substantial capital, often with less stringent criteria compared to traditional lenders. Key features and benefits associated with this financial tool may include: 1. Flexibility: Bridge financing often allows for flexible terms and conditions, supporting various property types such as single-family homes, apartment buildings, retail spaces, or even land development projects. 2. Speed: Bridge loans are designed to be obtained swiftly — sometimes within a matter of days – reducing wait times and enabling borrowers to capitalize on time-sensitive real estate opportunities. 3. Interest-Only Payments: Many bridge financing options offer interest-only payments during the loan term, allowing borrowers to manage cash flow effectively, as principal payments are deferred until the loan matures. 4. Credit Flexibility: Los Angeles California Bridge Financing Warrants consider the potential of the underlying asset more heavily than the borrower's credit history, making it an attractive option for individuals with less-than-ideal credit scores. Different types of Los Angeles California Bridge Financing Warrants may include: 1. Residential Bridge Loans: These bridge loans aid in the purchase or refinance of residential properties in Los Angeles, offering short-term capital to bridge the gap until long-term financing is secured. 2. Commercial Bridge Loans: Ideal for commercial properties, this type of bridge loan facilitates acquisitions, refinancing, or construction projects. Borrowers can access funds quickly, allowing them to capitalize on commercial real estate opportunities. 3. Construction Bridge Loans: Designed for real estate developers and investors, construction bridge loans help finance new construction projects until long-term project financing can be arranged. These loans provide flexibility and speed, essential in the fast-paced construction industry. 4. Fix-and-Flip Bridge Loans: Tailored for real estate investors involved in buying, renovating, and quickly selling properties, these bridge loans provide short-term financing to cover acquisition costs, renovation expenses, and carrying costs until the property is sold. In conclusion, Los Angeles California Bridge Financing Warrants are a flexible and efficient financing solution for individuals and businesses aiming to capitalize on real estate opportunities in the Los Angeles area. With various types available, borrowers can choose the most suitable option based on their specific needs and goals. The availability of these loans ensures that investors can act quickly, seize valuable opportunities, and maximize their returns to the dynamic Los Angeles real estate market.