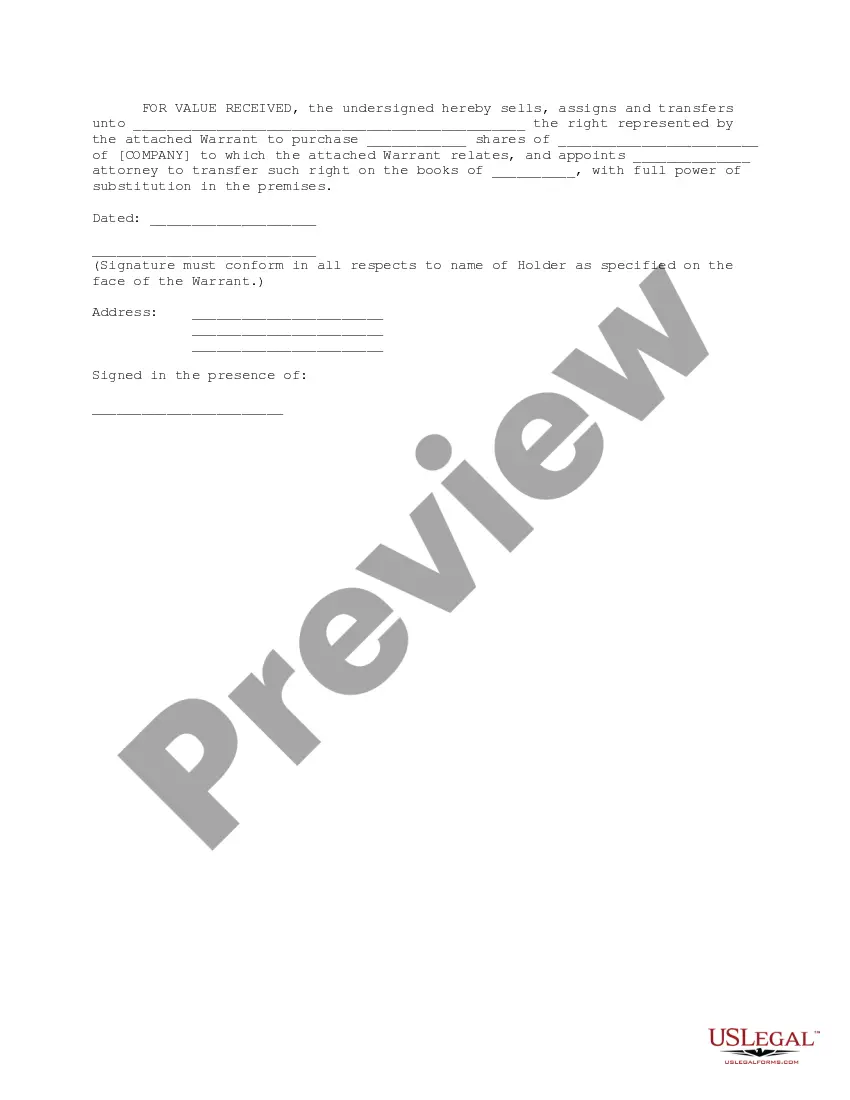

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Mecklenburg North Carolina Bridge Financing Warrant is a financial instrument commonly used in real estate transactions in Mecklenburg County, North Carolina. It serves as a short-term funding solution for individuals or businesses seeking immediate capital to bridge the gap between the sale of an existing property and the purchase of a new one. This type of warrant acts as collateral, granting the lender the right to purchase shares of stock or other underlying assets at a specified price within a predetermined timeframe. Bridge financing warrants in Mecklenburg, North Carolina may come in different forms based on varying terms and conditions. Some common types include: 1. Standard Mecklenburg North Carolina Bridge Financing Warrant: This is the basic form of a warrant, providing the lender the right to buy a predefined quantity of shares at a specific price within a set period. The exercise price and expiration date are included in the terms. 2. Convertible Bridge Financing Warrants: These warrants enable the lender to convert the debt into equity. If the borrower fails to repay the loan within the agreed-upon timeframe, the lender can convert the warrant into shares of the borrower's company at a predetermined conversion ratio. 3. Renewal Bridge Financing Warrants: This type of warrant provides the borrower with an option to extend the loan term by exercising the warrant. By paying a predetermined amount, the borrower can extend the financing period until a later date. 4. Callable Mecklenburg North Carolina Bridge Financing Warrant: In this scenario, the lender reserves the right to call back the warrant before its expiration date. If the borrower doesn't repay the loan within a specified timeframe, the lender can exercise this option and demand earlier repayment. 5. Prefunded Bridge Financing Warrants: These warrants are issued with the underlying stock already owned by the lender. It eliminates the exercise price and allows the warrant to be immediately exercisable without requiring the purchase of additional shares. It is crucial to consult with financial professionals or legal experts in Mecklenburg, North Carolina, before engaging in any bridge financing warrant transactions. Understanding the specific terms, risks, and benefits associated with each type of warrant is essential to make informed decisions to meet individual financial needs.Mecklenburg North Carolina Bridge Financing Warrant is a financial instrument commonly used in real estate transactions in Mecklenburg County, North Carolina. It serves as a short-term funding solution for individuals or businesses seeking immediate capital to bridge the gap between the sale of an existing property and the purchase of a new one. This type of warrant acts as collateral, granting the lender the right to purchase shares of stock or other underlying assets at a specified price within a predetermined timeframe. Bridge financing warrants in Mecklenburg, North Carolina may come in different forms based on varying terms and conditions. Some common types include: 1. Standard Mecklenburg North Carolina Bridge Financing Warrant: This is the basic form of a warrant, providing the lender the right to buy a predefined quantity of shares at a specific price within a set period. The exercise price and expiration date are included in the terms. 2. Convertible Bridge Financing Warrants: These warrants enable the lender to convert the debt into equity. If the borrower fails to repay the loan within the agreed-upon timeframe, the lender can convert the warrant into shares of the borrower's company at a predetermined conversion ratio. 3. Renewal Bridge Financing Warrants: This type of warrant provides the borrower with an option to extend the loan term by exercising the warrant. By paying a predetermined amount, the borrower can extend the financing period until a later date. 4. Callable Mecklenburg North Carolina Bridge Financing Warrant: In this scenario, the lender reserves the right to call back the warrant before its expiration date. If the borrower doesn't repay the loan within a specified timeframe, the lender can exercise this option and demand earlier repayment. 5. Prefunded Bridge Financing Warrants: These warrants are issued with the underlying stock already owned by the lender. It eliminates the exercise price and allows the warrant to be immediately exercisable without requiring the purchase of additional shares. It is crucial to consult with financial professionals or legal experts in Mecklenburg, North Carolina, before engaging in any bridge financing warrant transactions. Understanding the specific terms, risks, and benefits associated with each type of warrant is essential to make informed decisions to meet individual financial needs.