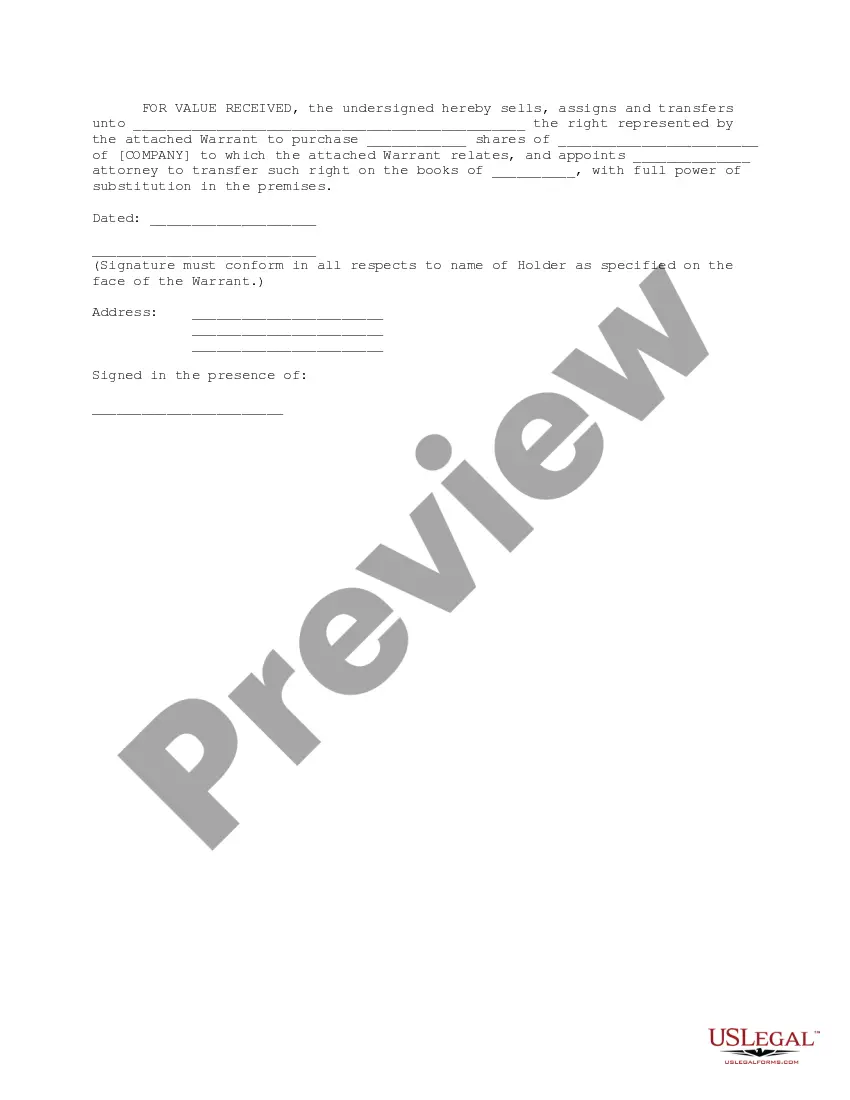

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Philadelphia Pennsylvania Bridge Financing Warrant refers to a specific type of financial instrument that provides short-term funding to bridge the gap between the purchase of a new property and the sale of an existing one in Philadelphia, Pennsylvania. This type of financing is commonly used in real estate transactions to ensure smooth transitions and expedite deal closures. Bridge financing warrants in Philadelphia, Pennsylvania, offer flexibility and convenience for both individuals and businesses seeking to purchase or invest in real estate. These warrants are typically backed by the property being financed and provide the borrower with immediate access to capital before the full funding is obtained from permanent financing sources such as mortgages or loans. There are several types of Philadelphia Pennsylvania Bridge Financing Warrant available: 1. Residential Bridge Financing Warrant: This type of warrant is specifically designed to assist individuals or families who need immediate funds to purchase a new home while their existing property is still in the process of being sold. It provides the necessary capital to bridge the financial gap until the proceeds from the sale are received. 2. Commercial Bridge Financing Warrant: Aimed at businesses and investors, this bridge financing option helps facilitate the acquisition of commercial properties. It enables entrepreneurs to bridge the financial time gap between purchasing a property and securing long-term commercial loans or arranging other forms of permanent financing. 3. Construction Bridge Financing Warrant: This warrant caters to developers or individuals involved in construction projects seeking interim financing to cover construction costs, property acquisition, and other related expenses until the project is completed or until long-term financing can be secured. 4. Rehabilitation Bridge Financing Warrant: This type of warrant is utilized when property owners or real estate investors need immediate capital to renovate, repair, or upgrade a property located in Philadelphia, Pennsylvania. It allows for quick access to funds, enabling timely completion of the renovation process before securing long-term financing. 5. Land Bridge Financing Warrant: Meant for those interested in purchasing undeveloped land or vacant lots, this type of warrant enables buyers to secure the necessary funding for land acquisition until long-term financing options become available. Philadelphia Pennsylvania Bridge Financing Warrant acts as a financial lifeline for individuals, businesses, and investors in the Philadelphia real estate market, allowing them to navigate the complex process of property transactions smoothly. With its various types, bridge financing warrants address different needs and scenarios, providing a solution for those seeking short-term capital to bridge the funding gap during property transactions in the City of Brotherly Love.Philadelphia Pennsylvania Bridge Financing Warrant refers to a specific type of financial instrument that provides short-term funding to bridge the gap between the purchase of a new property and the sale of an existing one in Philadelphia, Pennsylvania. This type of financing is commonly used in real estate transactions to ensure smooth transitions and expedite deal closures. Bridge financing warrants in Philadelphia, Pennsylvania, offer flexibility and convenience for both individuals and businesses seeking to purchase or invest in real estate. These warrants are typically backed by the property being financed and provide the borrower with immediate access to capital before the full funding is obtained from permanent financing sources such as mortgages or loans. There are several types of Philadelphia Pennsylvania Bridge Financing Warrant available: 1. Residential Bridge Financing Warrant: This type of warrant is specifically designed to assist individuals or families who need immediate funds to purchase a new home while their existing property is still in the process of being sold. It provides the necessary capital to bridge the financial gap until the proceeds from the sale are received. 2. Commercial Bridge Financing Warrant: Aimed at businesses and investors, this bridge financing option helps facilitate the acquisition of commercial properties. It enables entrepreneurs to bridge the financial time gap between purchasing a property and securing long-term commercial loans or arranging other forms of permanent financing. 3. Construction Bridge Financing Warrant: This warrant caters to developers or individuals involved in construction projects seeking interim financing to cover construction costs, property acquisition, and other related expenses until the project is completed or until long-term financing can be secured. 4. Rehabilitation Bridge Financing Warrant: This type of warrant is utilized when property owners or real estate investors need immediate capital to renovate, repair, or upgrade a property located in Philadelphia, Pennsylvania. It allows for quick access to funds, enabling timely completion of the renovation process before securing long-term financing. 5. Land Bridge Financing Warrant: Meant for those interested in purchasing undeveloped land or vacant lots, this type of warrant enables buyers to secure the necessary funding for land acquisition until long-term financing options become available. Philadelphia Pennsylvania Bridge Financing Warrant acts as a financial lifeline for individuals, businesses, and investors in the Philadelphia real estate market, allowing them to navigate the complex process of property transactions smoothly. With its various types, bridge financing warrants address different needs and scenarios, providing a solution for those seeking short-term capital to bridge the funding gap during property transactions in the City of Brotherly Love.