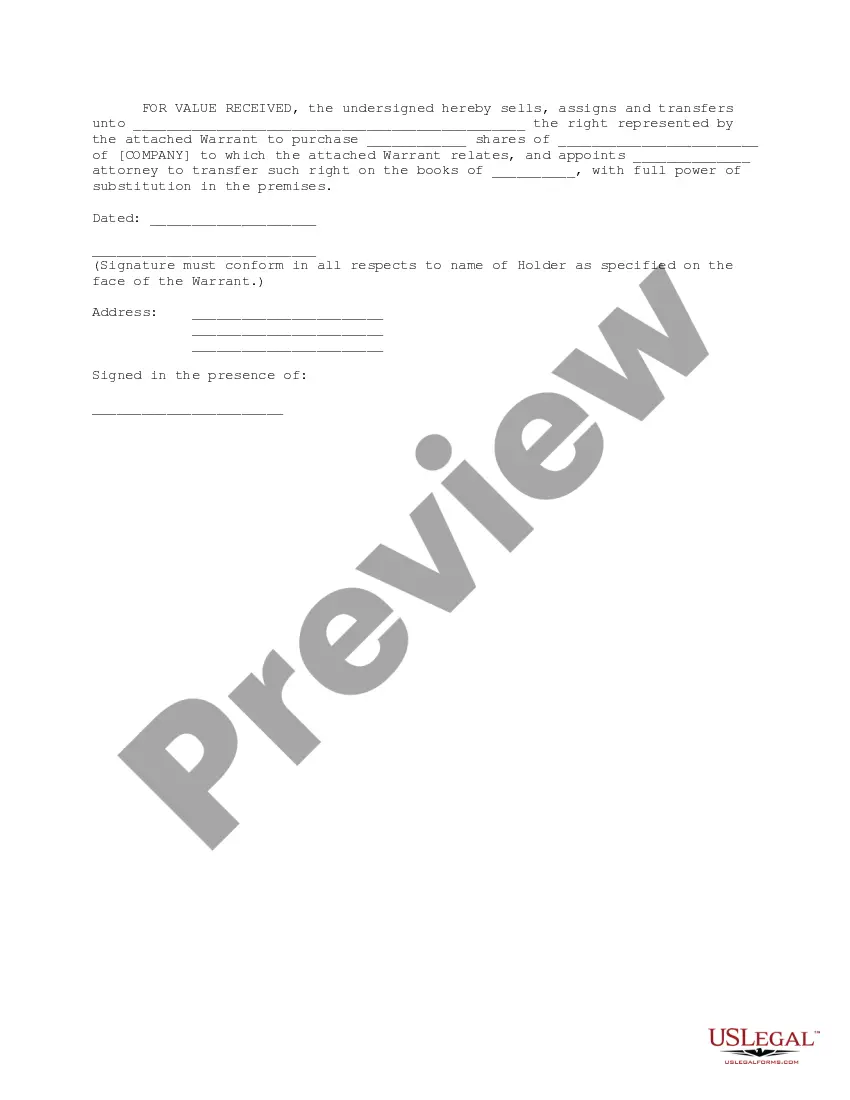

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Lima Arizona Bridge Financing Warrant is a financial instrument used in the real estate and lending industry to facilitate short-term financing for property transactions. It is specifically tailored for individuals or businesses seeking bridge loans to cover the gap between the purchase of a new property and the sale of an existing one. This financing option serves as a temporary solution, providing borrowers with immediate access to funds for various purposes like down payments, renovations, or other expenses related to the purchase or refinancing of properties. Lima Arizona Bridge Financing Warrants are commonly used by real estate investors, developers, and homeowners looking for a swift financial solution during transitional periods. The Lima Arizona Bridge Financing Warrant is typically secured by a lien on the property being purchased or the one intended for sale. The collateral ensures the lender's security in case of default or unforeseen circumstances which could prevent repayment. The loan terms and interest rates may vary depending on factors such as the borrower's creditworthiness, the value of the collateral, and the loan amount requested. There are different types of Lima Arizona Bridge Financing Warrants available, including: 1. Residential Bridge Warrants: Specifically designed for homeowners who are purchasing a new home before selling their existing property. This type of warrant allows borrowers to make a down payment on the new home without waiting for the sale of their current home. 2. Commercial Bridge Warrants: Aimed at commercial property investors and businesses, this type of warrant enables borrowers to fund the purchase or refinance of commercial properties while waiting for the sale or permanent financing to be secured. It helps bridge the gap between short-term and long-term financing options. 3. Construction Bridge Warrants: These are ideal for real estate developers or individuals looking to build or renovate a property. Construction bridge warrants provide access to funds necessary to start the project and cover expenses until a construction loan or permanent financing is obtained. In conclusion, Lima Arizona Bridge Financing Warrants serve as a valuable tool for individuals and businesses seeking temporary financial assistance during real estate transactions. With different types available, borrowers can choose the warrant that suits their specific needs and circumstances.Lima Arizona Bridge Financing Warrant is a financial instrument used in the real estate and lending industry to facilitate short-term financing for property transactions. It is specifically tailored for individuals or businesses seeking bridge loans to cover the gap between the purchase of a new property and the sale of an existing one. This financing option serves as a temporary solution, providing borrowers with immediate access to funds for various purposes like down payments, renovations, or other expenses related to the purchase or refinancing of properties. Lima Arizona Bridge Financing Warrants are commonly used by real estate investors, developers, and homeowners looking for a swift financial solution during transitional periods. The Lima Arizona Bridge Financing Warrant is typically secured by a lien on the property being purchased or the one intended for sale. The collateral ensures the lender's security in case of default or unforeseen circumstances which could prevent repayment. The loan terms and interest rates may vary depending on factors such as the borrower's creditworthiness, the value of the collateral, and the loan amount requested. There are different types of Lima Arizona Bridge Financing Warrants available, including: 1. Residential Bridge Warrants: Specifically designed for homeowners who are purchasing a new home before selling their existing property. This type of warrant allows borrowers to make a down payment on the new home without waiting for the sale of their current home. 2. Commercial Bridge Warrants: Aimed at commercial property investors and businesses, this type of warrant enables borrowers to fund the purchase or refinance of commercial properties while waiting for the sale or permanent financing to be secured. It helps bridge the gap between short-term and long-term financing options. 3. Construction Bridge Warrants: These are ideal for real estate developers or individuals looking to build or renovate a property. Construction bridge warrants provide access to funds necessary to start the project and cover expenses until a construction loan or permanent financing is obtained. In conclusion, Lima Arizona Bridge Financing Warrants serve as a valuable tool for individuals and businesses seeking temporary financial assistance during real estate transactions. With different types available, borrowers can choose the warrant that suits their specific needs and circumstances.