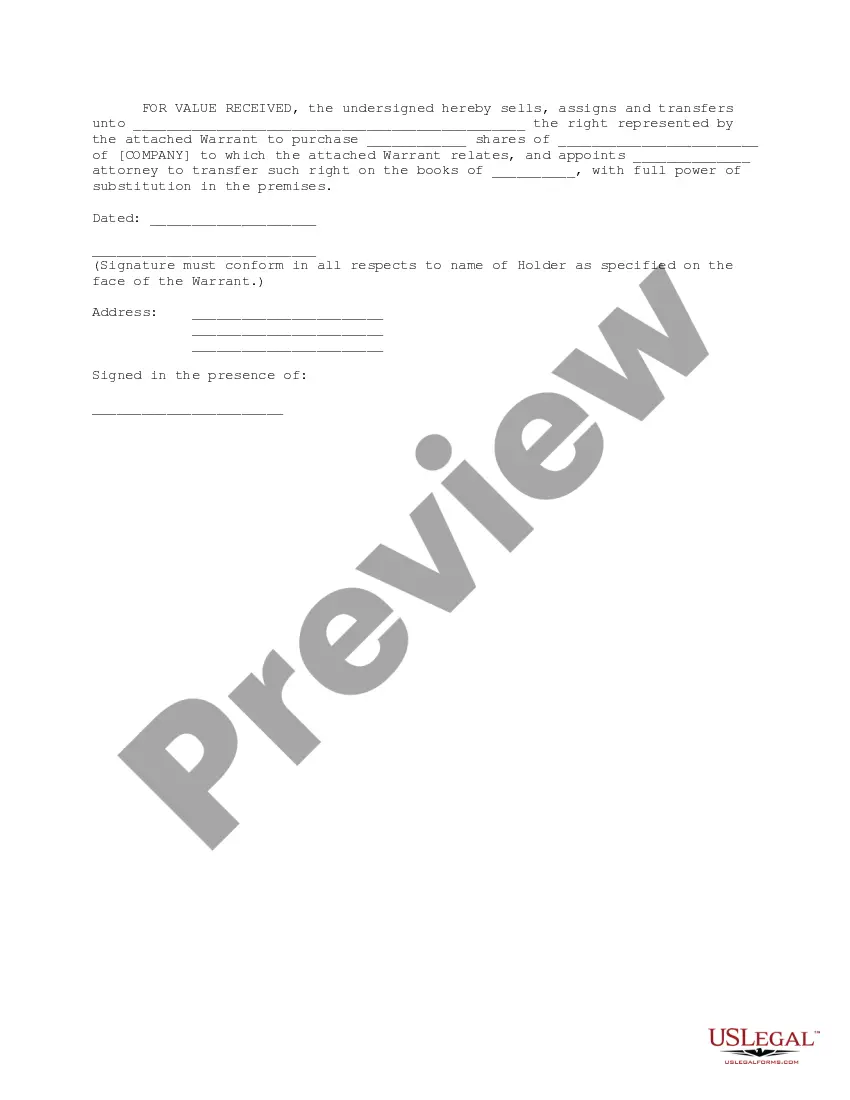

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Santa Clara California Bridge Financing Warrant is a financial instrument used in real estate transactions to provide short-term funding for acquiring or renovating a property. It is specifically designed to bridge the gap between the purchase of a new property and the sale of an existing one. This type of financing is most commonly used in Santa Clara County, located in the Bay Area of California. Bridge financing warrants in Santa Clara California serve as a guarantee for the lender, allowing them to exercise the right to purchase equity or shares in the property if the borrower fails to meet specific obligations or repayment terms. These warrants provide security to the lender by giving them the option to convert the loan into an ownership stake in cases where the borrower defaults on the repayment or other agreed-upon conditions. There are two main types of Santa Clara California Bridge Financing Warrants: 1. Standard Bridge Financing Warrant: This type of warrant follows the usual terms and conditions of bridge financing, wherein the lender retains the right to convert the loan into equity or ownership shares in the property. 2. Equity Participation Bridge Financing Warrant: This warrant allows the lender to participate in the property's appreciation. Instead of converting the loan into a fixed number of equity shares, the lender receives a percentage of the property's future value. Both types of Bridge Financing Warrants aim to provide short-term financing solutions for borrowers who are temporarily in need of additional funds to complete a real estate transaction. These warrants often come with specific terms and conditions, including a fixed repayment period, interest rates, and conversion options for the lender. In Santa Clara California, where the real estate market is highly competitive and fast-paced, Bridge Financing Warrants offer a viable solution for investors or homeowners seeking immediate funds to seize profitable opportunities, such as purchasing a new property while awaiting the sale of their existing one. These warrants provide flexibility and an alternative to traditional bank loans, enabling borrowers to access the necessary funds quickly, often within a matter of weeks.Santa Clara California Bridge Financing Warrant is a financial instrument used in real estate transactions to provide short-term funding for acquiring or renovating a property. It is specifically designed to bridge the gap between the purchase of a new property and the sale of an existing one. This type of financing is most commonly used in Santa Clara County, located in the Bay Area of California. Bridge financing warrants in Santa Clara California serve as a guarantee for the lender, allowing them to exercise the right to purchase equity or shares in the property if the borrower fails to meet specific obligations or repayment terms. These warrants provide security to the lender by giving them the option to convert the loan into an ownership stake in cases where the borrower defaults on the repayment or other agreed-upon conditions. There are two main types of Santa Clara California Bridge Financing Warrants: 1. Standard Bridge Financing Warrant: This type of warrant follows the usual terms and conditions of bridge financing, wherein the lender retains the right to convert the loan into equity or ownership shares in the property. 2. Equity Participation Bridge Financing Warrant: This warrant allows the lender to participate in the property's appreciation. Instead of converting the loan into a fixed number of equity shares, the lender receives a percentage of the property's future value. Both types of Bridge Financing Warrants aim to provide short-term financing solutions for borrowers who are temporarily in need of additional funds to complete a real estate transaction. These warrants often come with specific terms and conditions, including a fixed repayment period, interest rates, and conversion options for the lender. In Santa Clara California, where the real estate market is highly competitive and fast-paced, Bridge Financing Warrants offer a viable solution for investors or homeowners seeking immediate funds to seize profitable opportunities, such as purchasing a new property while awaiting the sale of their existing one. These warrants provide flexibility and an alternative to traditional bank loans, enabling borrowers to access the necessary funds quickly, often within a matter of weeks.