The Harris Texas Certificate of Amendment to Certificate of Incorporation is a legal document filed to make changes and modifications to an existing certificate of incorporation for businesses in Harris County, Texas. This certificate is an essential aspect of company governance, serving as evidence of alterations made to an organization's fundamental principles, structure, or name. The Harris Texas Certificate of Amendment to Certificate of Incorporation allows companies to adapt to evolving circumstances, growth, or changes in their business plans. It provides a transparent record of any revisions made, ensuring compliance with state laws and regulations. This document helps maintain accurate, up-to-date information about the company's key details, giving stakeholders, investors, and regulators a reliable source of information. Keywords: Harris Texas, Certificate of Amendment, Certificate of Incorporation, legal document, changes, modifications, existing, business, Harris County, governance, principles, structure, name, adapt, circumstances, company, growth, business plans, record, compliance, state laws, regulations, accurate, up-to-date, information, stakeholders, investors, regulators, reliable source. Different types of Harris Texas Certificate of Amendment to Certificate of Incorporation may include: 1. Name Change Amendment: This type of amendment is filed when a company decides to change its legal name. It involves updating the certificate of incorporation to reflect the newly chosen name for the business. 2. Share Structure Amendment: These amendments pertain to changes in the authorized capital, the number of authorized shares, or modifications to the stock classes and their associated rights and privileges. 3. Purpose Amendment: Companies may file this type of amendment when they want to broaden or narrow down their business purpose or expand their operations into new areas or industries. 4. Registered Agent Amendment: In cases where a company wants to change its registered agent, this type of amendment is filed to update the certificate of incorporation with the new agent's information. 5. Address Amendment: Companies relocating their principal place of business or registered office would file this amendment to update their address information on the certificate of incorporation. 6. Merger or Acquisition Amendment: This amendment is filed when a company intends to merge with or acquire another entity, reflecting the resulting changes to the company's structure and ownership. Note: The specific types of amendments may vary in different jurisdictions, and it is essential to consult the relevant laws and regulations of Harris County, Texas, for accurate information on the available types of amendments.

Harris Texas Certificate of Amendment to Certificate of Incorporation

Description

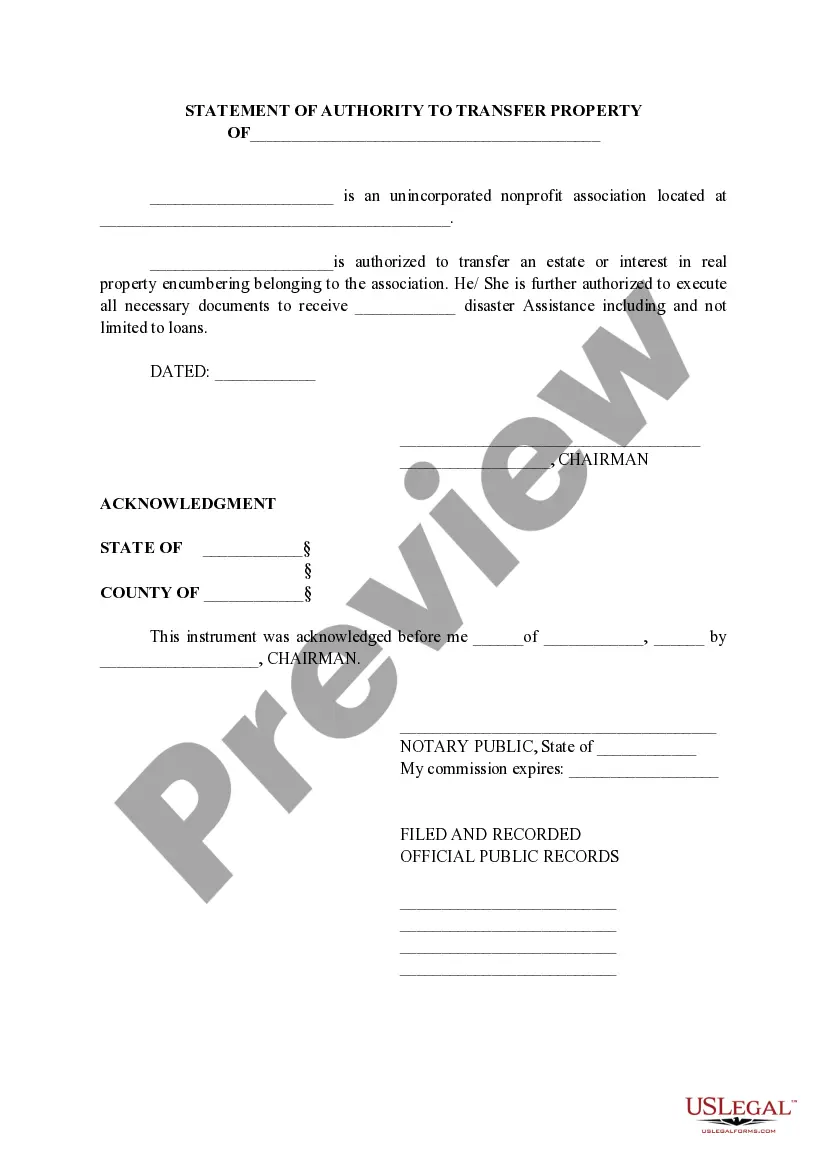

How to fill out Harris Texas Certificate Of Amendment To Certificate Of Incorporation?

Are you looking to quickly create a legally-binding Harris Certificate of Amendment to Certificate of Incorporation or maybe any other document to take control of your personal or corporate matters? You can go with two options: hire a legal advisor to write a legal document for you or draft it entirely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive professionally written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant document templates, including Harris Certificate of Amendment to Certificate of Incorporation and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, carefully verify if the Harris Certificate of Amendment to Certificate of Incorporation is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Harris Certificate of Amendment to Certificate of Incorporation template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!