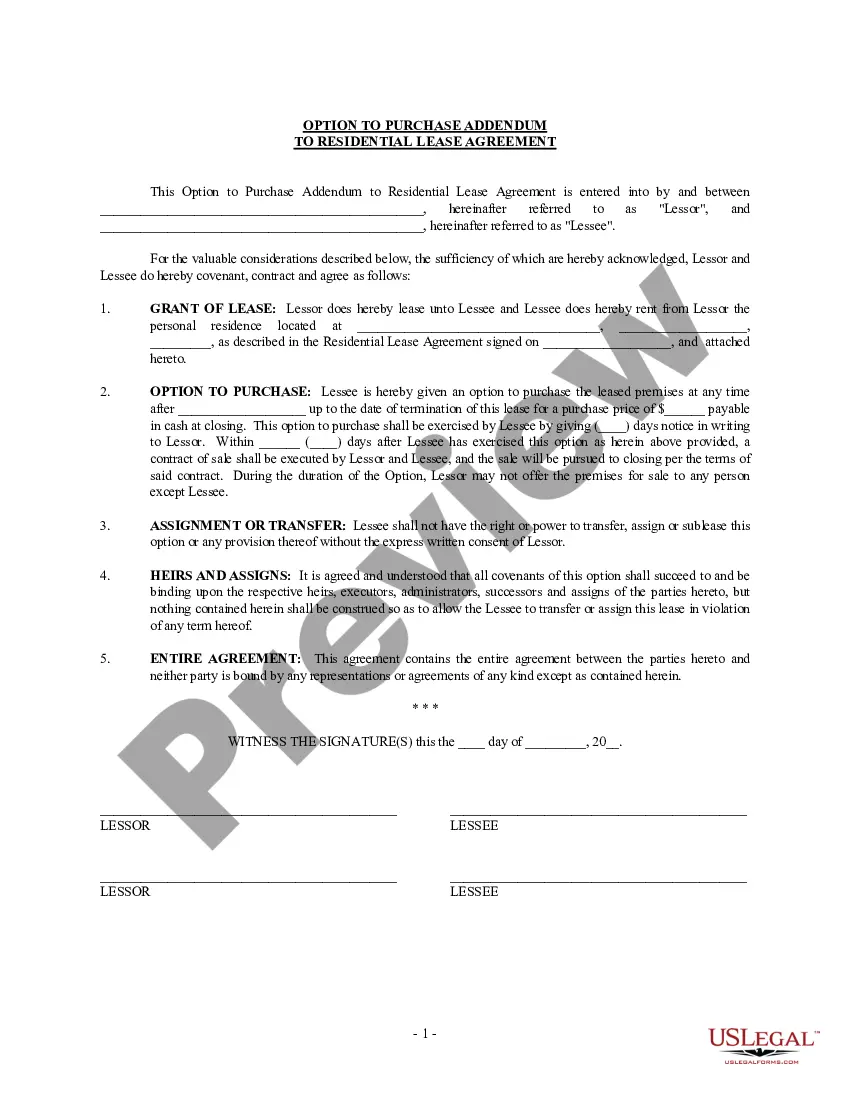

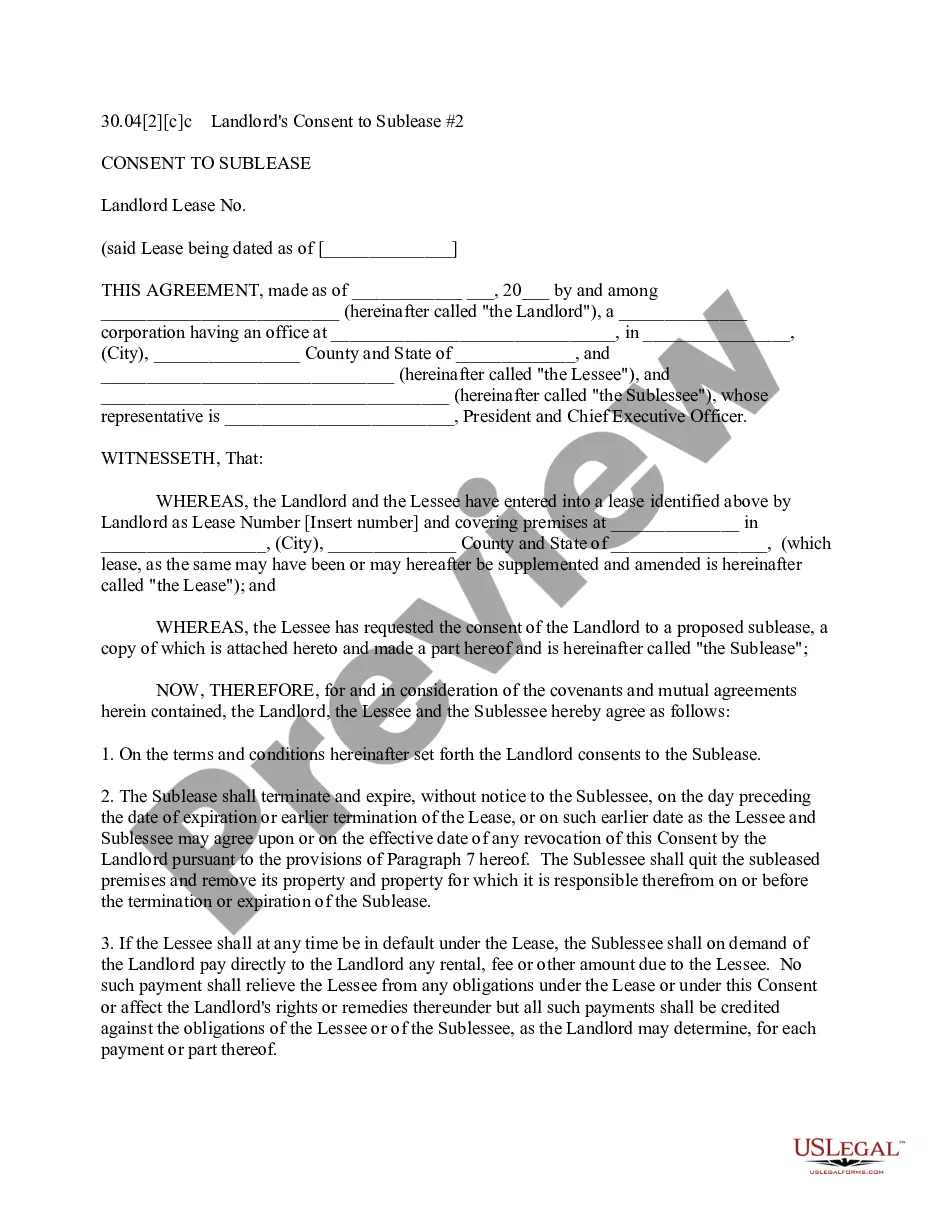

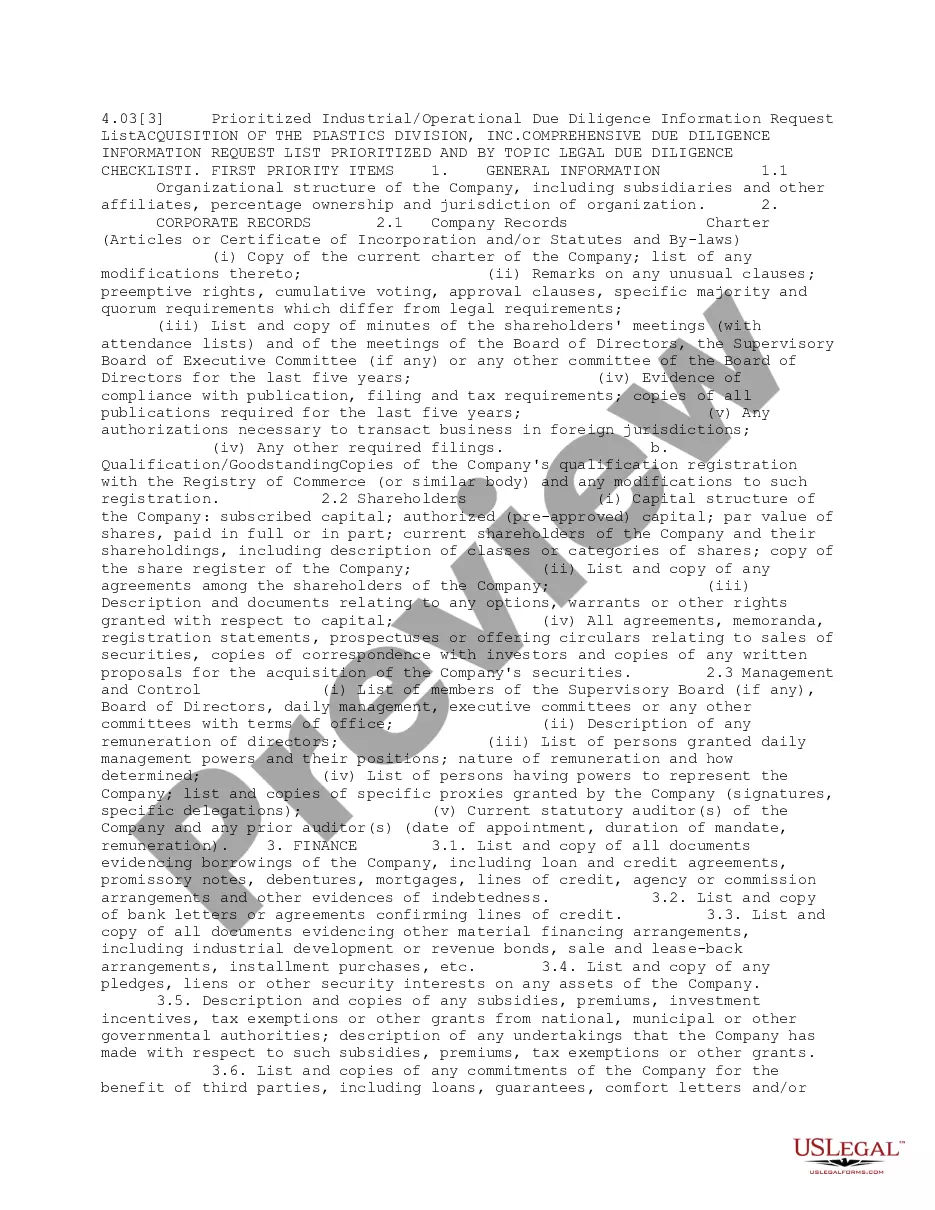

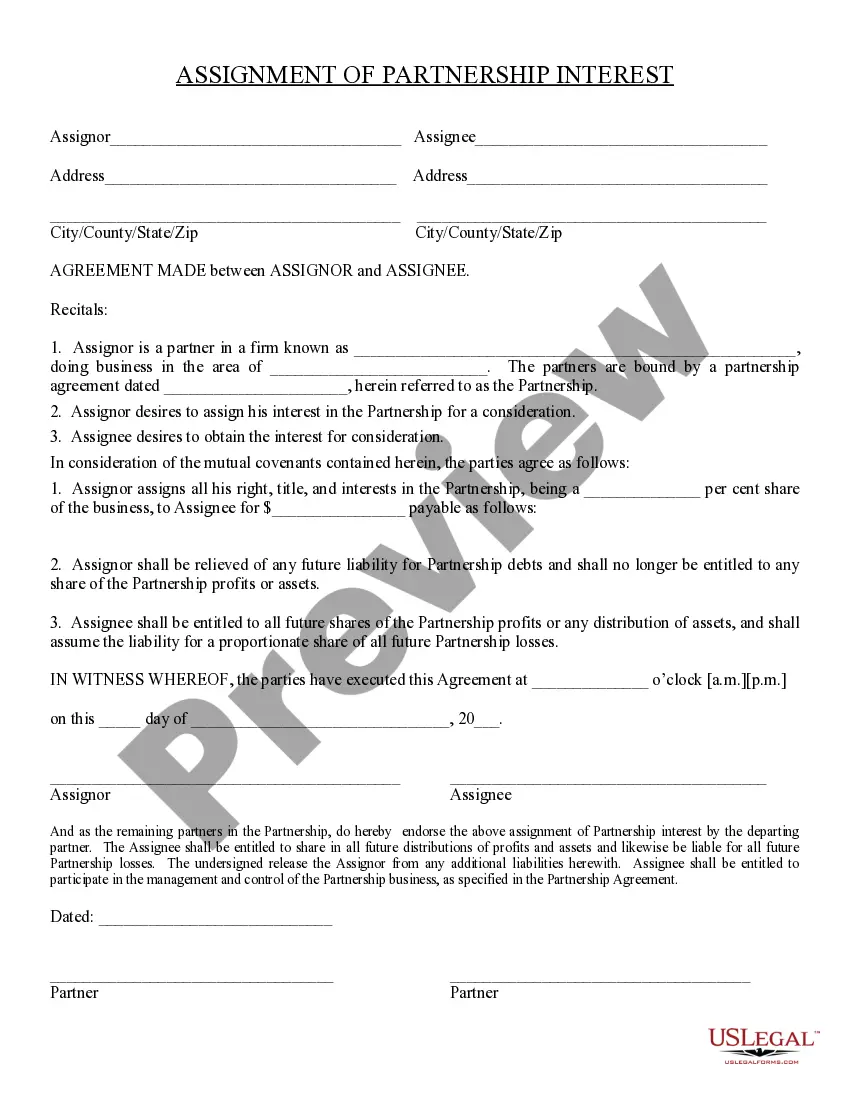

Suffolk New York Partnership Interest refers to a legal concept where two or more parties join forces to form a partnership for conducting business activities in Suffolk County, New York. This partnership interest represents an individual's or entity's share of ownership or investment in a particular partnership. Suffolk County, located on Long Island in New York, is known for its vibrant economy and diverse range of industries. Individuals or organizations who wish to engage in business ventures within this county often enter into partnership agreements to leverage resources, skills, and expertise. There are various types of partnership interests that one can possess in Suffolk, New York. These include: 1. General Partnership Interest: In a general partnership, all partners participate in managing the business operations while sharing both the profits and liabilities. Each partner has a proportional interest in the partnership, which can be analyzed by their capital contribution or agreed-upon terms. 2. Limited Partnership Interest: Limited partnership interest involves two types of partners: general partners who manage the business and assume personal liability, and limited partners who invest capital but have limited involvement in managerial decisions and liability. Limited partners typically receive a share of the profits and losses based on their investment percentage. 3. Limited Liability Partnership (LLP) Interest: LLP interest grants partners limited liability protection, shielding them from personal responsibility for the partnership's debts or obligations. Laps are often formed by professionals like lawyers, accountants, and architects who work together but want to be protected from their partners' negligence or misconduct. 4. Joint Venture Partnership Interest: Joint ventures differ from general and limited partnerships as they are formed for a specific project or a limited period. In this type of partnership, multiple parties contribute resources or expertise to pursue mutual business objectives. The distribution of profits or losses is generally determined through a mutually agreed-upon arrangement. These partnership interests facilitate the establishment of successful business ventures in Suffolk County, enabling entrepreneurs to pool resources, share risks, and achieve strategic growth. By leveraging diverse skills, financial contributions, and local market knowledge, partnerships in Suffolk, New York, drive economic development and foster innovation across various sectors such as hospitality, healthcare, technology, agriculture, and more.

Suffolk New York Partnership Interest

Description

How to fill out Suffolk New York Partnership Interest?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Suffolk Partnership Interest suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Apart from the Suffolk Partnership Interest, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Suffolk Partnership Interest:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Suffolk Partnership Interest.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!