Travis Texas Profit and Loss Statement is a financial document that provides an overview of the revenues, expenses, gains, and losses of a business located in Travis County, Texas. This statement is frequently used by businesses, investors, and financial institutions to assess the profitability and performance of the company during a specific period. The Travis Texas Profit and Loss Statement, also known as the income statement, summarizes the company's revenue sources and details all expenses incurred during a given period, typically monthly, quarterly, or annually. It allows business owners and stakeholders to evaluate the financial health of the organization and make informed decisions regarding its operations. The Travis Texas Profit and Loss Statement typically consists of several key components, including: 1. Revenue: This section encompasses the total amount of income generated from the primary business activities, such as sales of products or services. 2. Cost of Goods Sold (COGS): COGS represents all the direct costs associated with producing the goods or services sold by the company. It includes expenses like raw materials, labor, and manufacturing overhead. 3. Gross Profit: This element is calculated by deducting the COGS from the revenue. Gross profit reflects the profitability of the company's core business operations. 4. Operating Expenses: These are the costs incurred to run the business on a day-to-day basis, excluding the COGS. Operating expenses may include rent, salaries, utilities, marketing, insurance, and other administrative costs. 5. Operating Income: This is derived by subtracting the total operating expenses from the gross profit. Operating income measures the profits generated from regular business activities, excluding non-operating income and expenses. 6. Non-Operating Income and Expenses: This section encompasses income and expenses not directly related to the core business operations, such as interest income, interest expense, gains or losses on the sale of assets, etc. 7. Net Income: Also referred to as the bottom line, net income represents the overall profitability of the company. It is calculated by subtracting non-operating expenses from the operating income. Different types of Travis Texas Profit and Loss Statements can include variations specific to certain industries or businesses. For example, a manufacturing company might have a separate section for inventory valuation or cost of goods manufactured. A retail business might have a segment dedicated to sales returns or discounts offered. These variations depend on the unique requirements and nature of the business. In summary, the Travis Texas Profit and Loss Statement is a crucial financial tool that provides a comprehensive overview of a company's revenues, expenses, gains, and losses. It helps in evaluating performance, making financial decisions, and establishing strategies to improve profitability.

Travis Texas Profit and Loss Statement

Description

How to fill out Travis Texas Profit And Loss Statement?

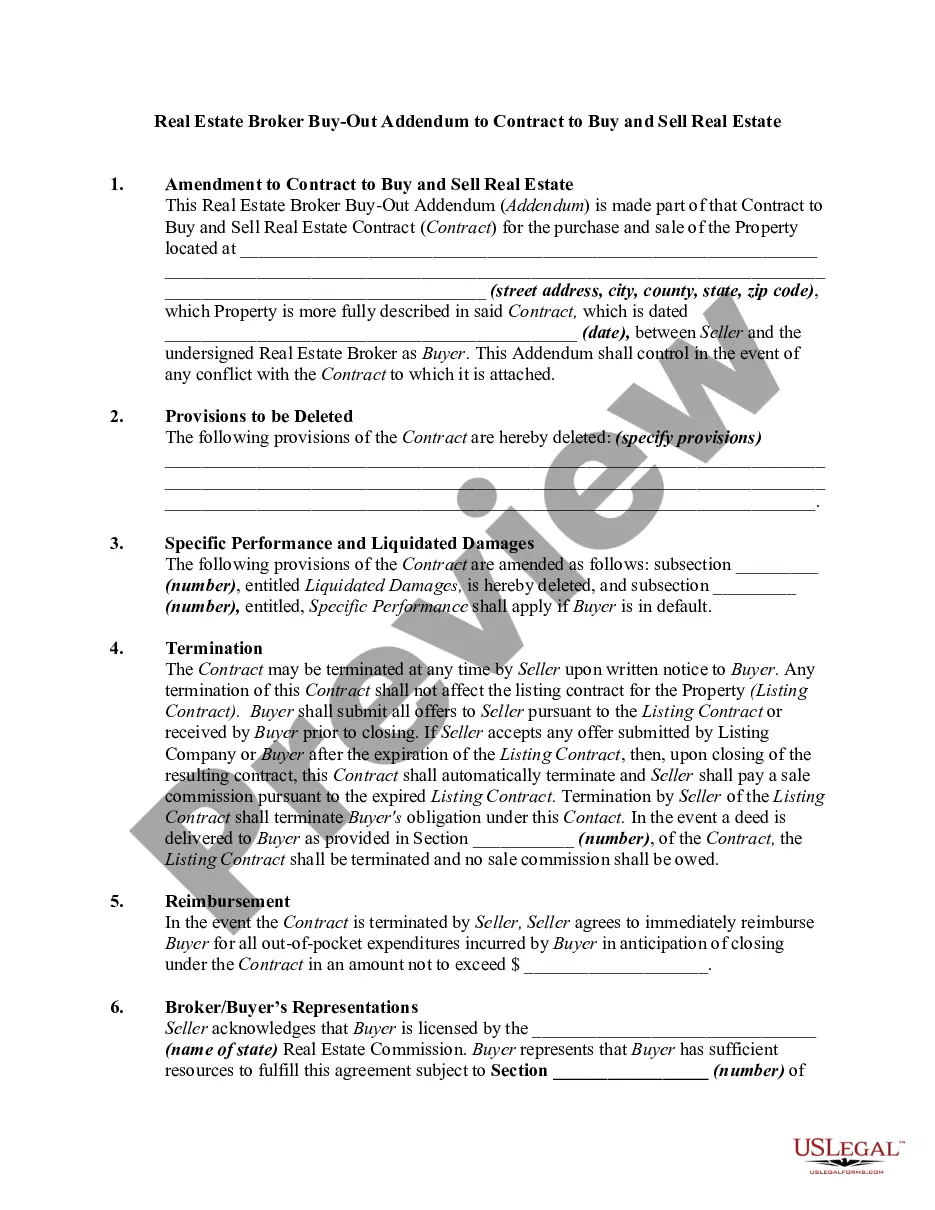

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Travis Profit and Loss Statement suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Apart from the Travis Profit and Loss Statement, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Travis Profit and Loss Statement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Travis Profit and Loss Statement.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

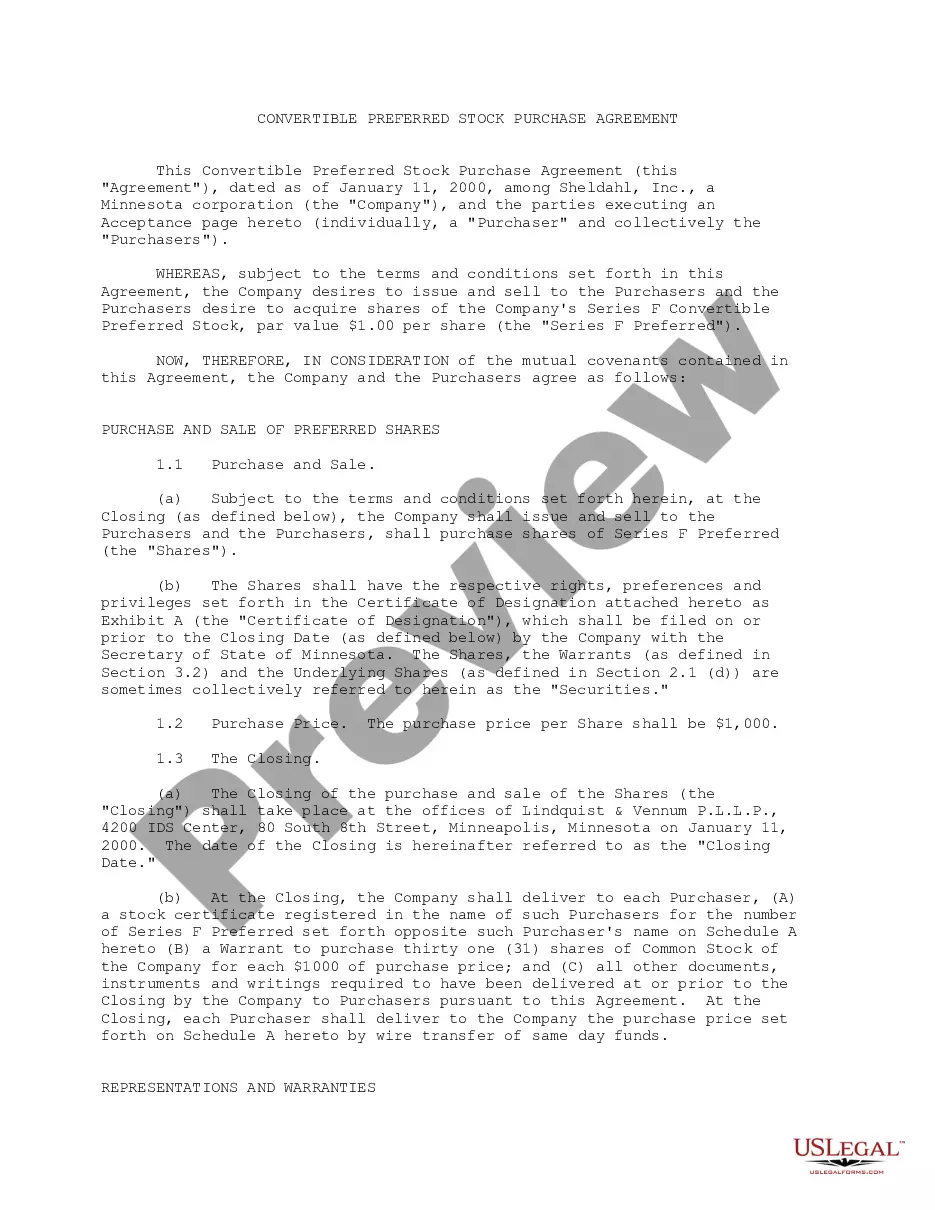

To create your P&L manually, you need to gather all relevant information. This includes items of income and expenses. This information can be derived from invoices, receipts, credit card statements, and bank account transactions.

The P & L statement contains uniform categories of sales and expenses. The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit. These are categories that you, too, will use when constructing a P & L statement.

The IRS requires sole proprietors to use Profit or Loss From Business (Sole Proprietorship) (Schedule C (Form 1040)), to report either income or loss from their businesses.

The P&L is found in the annual financial reports that all publicly traded companies are required by law to issue and distribute to shareholders. 1feff Annual financial reports include a company's P&L statement, balance sheet, and a statement of cash flow. Financial statements are found on a company's website.

The IRS self-employed year-to-date profit and loss statement requirements are reported in Form 1040--Schedule C Profit or Loss from Business. On this statement, you need to report your gross income from self-employment and your gross expenses.

How to Write a Profit and Loss Statement Step 1 Track Your Revenue.Step 2 Determine the Cost of Sales.Step 3 Figure Out Your Gross Profit.Step 4 Add Up Your Overhead.Step 5 Calculate Your Operating Income.Step 6 Adjust for Other Income and/or Expenses.Step 7 Net Profit: The Bottom Line.

By law, if your business is a limited company or a partnership whose members are limited companies, you must produce a profit and loss account for each financial year.

To create your P&L manually, you need to gather all relevant information. This includes items of income and expenses. This information can be derived from invoices, receipts, credit card statements, and bank account transactions.

How Do I Create a P&L? Choose a Format. Decide which profit and loss template format you'll use. Download the Template. Download your free profit and loss template from FreshBooks in seconds. Enter Revenue. Add your revenue numbers in the appropriate field. Enter Expenses.Calculate Net Income.Determine Profitability.

More info

This is a list of the companies at Travis County that filed statements with the Texas Comptroller of Public Accounts on behalf of their subsidiaries and associated entities

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.