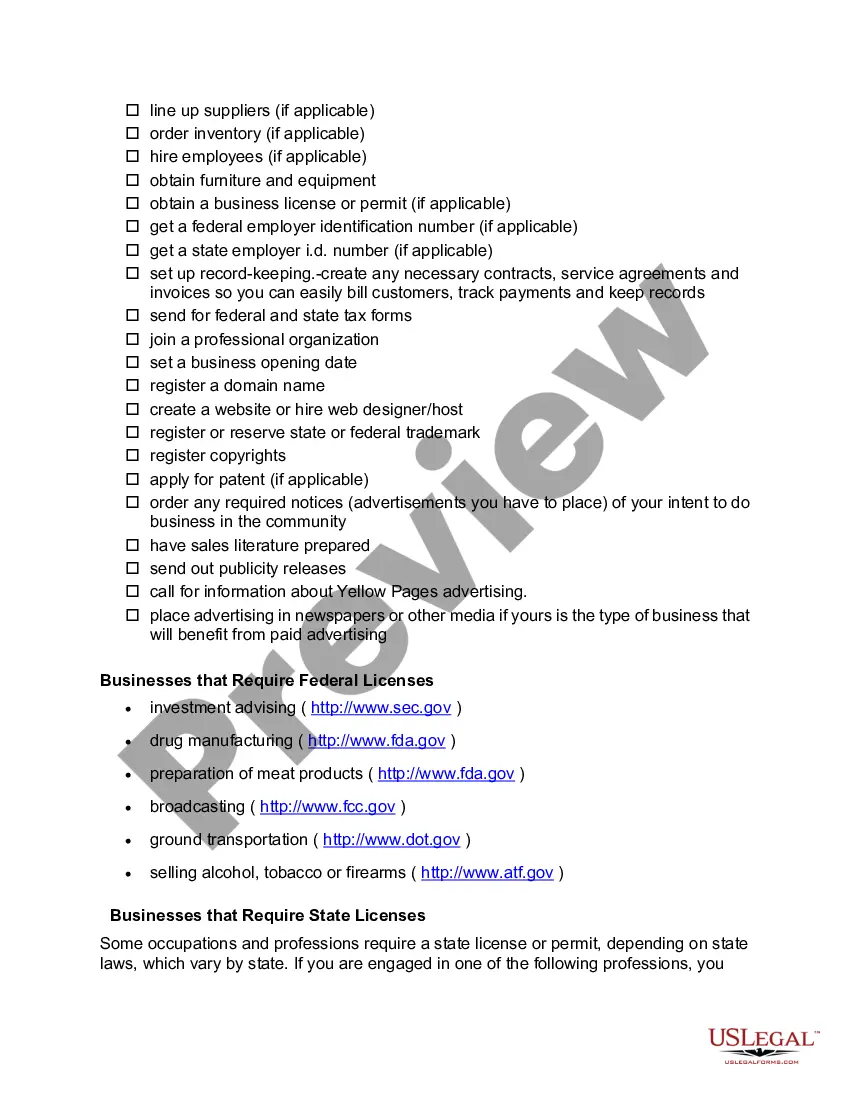

This form is a handy checklist for the owner of a new business to use as a helpful tool in forming a new business. The form covers the stages of background planning, initial business transactions, and initial tasks that need to be accomplished to get the business up and running smoothly.

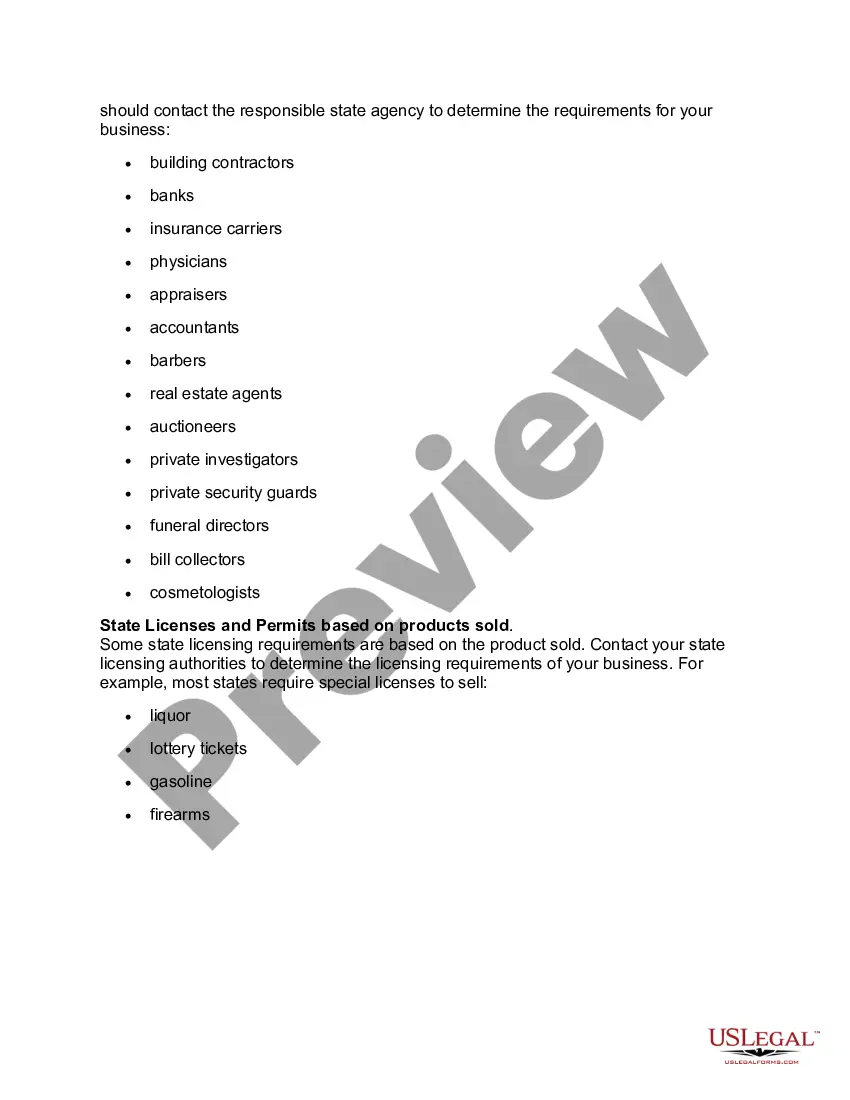

Cook Illinois is a state-specific checklist that provides entrepreneurs with a comprehensive guideline for starting up a new business in Illinois. This checklist is specifically tailored to address the unique requirements and regulations of starting a business in the Cook County area. By following this checklist, entrepreneurs can ensure that they have all the necessary permits, licenses, and registrations needed to operate their business seamlessly. The Cook Illinois Checklist for Starting Up a New Business covers various aspects of starting a business, including legal requirements, permits and licenses, tax obligations, and other crucial steps. It offers detailed information on each requirement, ensuring that entrepreneurs have a clear understanding of what is needed to establish their business in compliance with state and county regulations. One of the important elements highlighted in this checklist is the legal structure of the business. It provides guidance on choosing the appropriate legal entity, such as sole proprietorship, partnership, corporation, or limited liability company (LLC), depending on the nature and objectives of the business. Another key component covered in the Cook Illinois Checklist is obtaining the necessary permits and licenses. It outlines the specific permits required for different types of businesses, such as retail, food establishments, professional services, and more. It also provides links and resources to the relevant licensing authorities, making it easier for entrepreneurs to access the necessary forms and applications. Additionally, the checklist includes information on tax obligations and registrations. It guides entrepreneurs on registering for state and local taxes, obtaining an Employer Identification Number (EIN), and understanding the tax obligations related to sales tax, payroll tax, and income tax. Furthermore, the Cook Illinois Checklist for Starting Up a New Business also covers essential steps outside of legal and regulatory requirements. It provides insights into market research and analysis, business planning, budgeting, financing options, and marketing strategies. These additional steps help entrepreneurs set a solid foundation for their business and increase their chances of success in the competitive market. It is important to note that while the Cook Illinois Checklist for Starting Up a New Business is applicable to all businesses in the Cook County area, there might be additional industry-specific requirements or regulations that businesses need to fulfill. For example, food establishments may have to comply with specific health and safety regulations, while construction businesses may require additional permits and certifications. Overall, the Cook Illinois Checklist for Starting Up a New Business is a valuable resource that provides entrepreneurs with a step-by-step guide to navigate the process of starting a business in Cook County. By following this checklist, entrepreneurs can ensure that they have completed all the necessary tasks and requirements to launch their business successfully.Cook Illinois is a state-specific checklist that provides entrepreneurs with a comprehensive guideline for starting up a new business in Illinois. This checklist is specifically tailored to address the unique requirements and regulations of starting a business in the Cook County area. By following this checklist, entrepreneurs can ensure that they have all the necessary permits, licenses, and registrations needed to operate their business seamlessly. The Cook Illinois Checklist for Starting Up a New Business covers various aspects of starting a business, including legal requirements, permits and licenses, tax obligations, and other crucial steps. It offers detailed information on each requirement, ensuring that entrepreneurs have a clear understanding of what is needed to establish their business in compliance with state and county regulations. One of the important elements highlighted in this checklist is the legal structure of the business. It provides guidance on choosing the appropriate legal entity, such as sole proprietorship, partnership, corporation, or limited liability company (LLC), depending on the nature and objectives of the business. Another key component covered in the Cook Illinois Checklist is obtaining the necessary permits and licenses. It outlines the specific permits required for different types of businesses, such as retail, food establishments, professional services, and more. It also provides links and resources to the relevant licensing authorities, making it easier for entrepreneurs to access the necessary forms and applications. Additionally, the checklist includes information on tax obligations and registrations. It guides entrepreneurs on registering for state and local taxes, obtaining an Employer Identification Number (EIN), and understanding the tax obligations related to sales tax, payroll tax, and income tax. Furthermore, the Cook Illinois Checklist for Starting Up a New Business also covers essential steps outside of legal and regulatory requirements. It provides insights into market research and analysis, business planning, budgeting, financing options, and marketing strategies. These additional steps help entrepreneurs set a solid foundation for their business and increase their chances of success in the competitive market. It is important to note that while the Cook Illinois Checklist for Starting Up a New Business is applicable to all businesses in the Cook County area, there might be additional industry-specific requirements or regulations that businesses need to fulfill. For example, food establishments may have to comply with specific health and safety regulations, while construction businesses may require additional permits and certifications. Overall, the Cook Illinois Checklist for Starting Up a New Business is a valuable resource that provides entrepreneurs with a step-by-step guide to navigate the process of starting a business in Cook County. By following this checklist, entrepreneurs can ensure that they have completed all the necessary tasks and requirements to launch their business successfully.