This form is an Excel spreadsheet that can be used to calculate startup costs for a new business. It includes itemized categories for funding and costs, and is a valuable tool to help plan the financial aspects of your new business.

Houston Texas Business Startup Costs

Description

How to fill out Business Startup Costs?

Drafting legal documents can be tedious. Furthermore, if you choose to hire a lawyer to create a business contract, ownership transfer documents, prenuptial agreement, divorce forms, or the Houston Business Startup Expenses Spreadsheet, it might be quite expensive.

So what is the most effective method to conserve time and money while generating valid forms that fully adhere to your state and local laws? US Legal Forms is an ideal option, whether you're looking for templates for personal or commercial use.

Don't worry if the form doesn't meet your needs - search for the right one in the header. Click Buy Now when you locate the required sample and choose the most suitable subscription. Log In or create an account to pay for your subscription. Complete the payment using a credit card or PayPal. Select the document format for your Houston Business Startup Expenses Spreadsheet and save it. Once done, you can print it and fill it out by hand or upload the template to an online editor for quicker and more convenient completion. US Legal Forms allows you to reuse all the documents you’ve ever obtained multiple times - you can find your templates in the My documents tab in your profile. Give it a try today!

- US Legal Forms boasts the most comprehensive online repository of state-specific legal documents, offering users the latest and professionally reviewed templates for any situation all in one location.

- Thus, if you require the latest version of the Houston Business Startup Expenses Spreadsheet, you can easily access it on our platform.

- Getting the documents requires minimal time.

- Those who already have an account should verify that their subscription is current, Log In, and select the template by clicking the Download button.

- If you haven't yet subscribed, here's how to acquire the Houston Business Startup Expenses Spreadsheet.

- Browse through the page to confirm there is a template for your area.

- Review the form description and utilize the Preview option, if available, to ensure it's the document you need.

Form popularity

FAQ

When considering Houston Texas Business Startup Costs, entrepreneurs should anticipate several key expenses. These include legal fees, permits, licenses, equipment, inventory, and marketing costs. Additionally, you might need to budget for insurance and an office space, depending on your business type. Utilizing platforms like USLegalForms can help streamline the process, making it easier to handle legal requirements and reducing some of those initial startup costs.

Starting a business on a budget is possible in Texas. Consider structuring a limited liability company (LLC) as it offers protection without high startup costs. Utilize online resources to draft documents and file your business, keeping Houston Texas business startup costs low. Platforms like US Legal Forms can provide affordable templates and support to get your venture off the ground.

Yes, you typically need a specific license or permit to operate a small business in Texas. The type of license depends on your business activities and location. Research local regulations to ensure you meet all requirements related to Houston Texas business startup costs. Using platforms like US Legal Forms can simplify the licensing process and guide you through the necessary steps.

To write off startup costs for your business, first ensure that you classify eligible expenses according to IRS regulations. You can deduct up to $5,000 in the first year, with the rest amortized over 15 years. Documenting these costs accurately is crucial for a smooth tax filing process. U.S. Legal Forms can assist in understanding the necessary steps for writing off your Houston Texas business startup costs effectively.

To account for startup costs, first classify them into startup and operational categories. Maintain detailed records of all incurred expenses, as they will be essential when preparing your tax documentation. Understanding how to report these costs accurately can significantly impact your financial statements and tax liabilities as you start your Houston Texas business. Leveraging resources provided by U.S. Legal Forms can simplify this accounting process.

In accounting, startup costs should be identified as either capital expenses or operating expenses. Typically, you can deduct up to $5,000 in startup costs in the first year, and the remaining amounts can be amortized over 15 years. Accurate categorization ensures compliance and helps manage your financial statements effectively. Utilizing platforms like U.S. Legal Forms can provide additional guidance in this aspect as you navigate Houston Texas business startup costs.

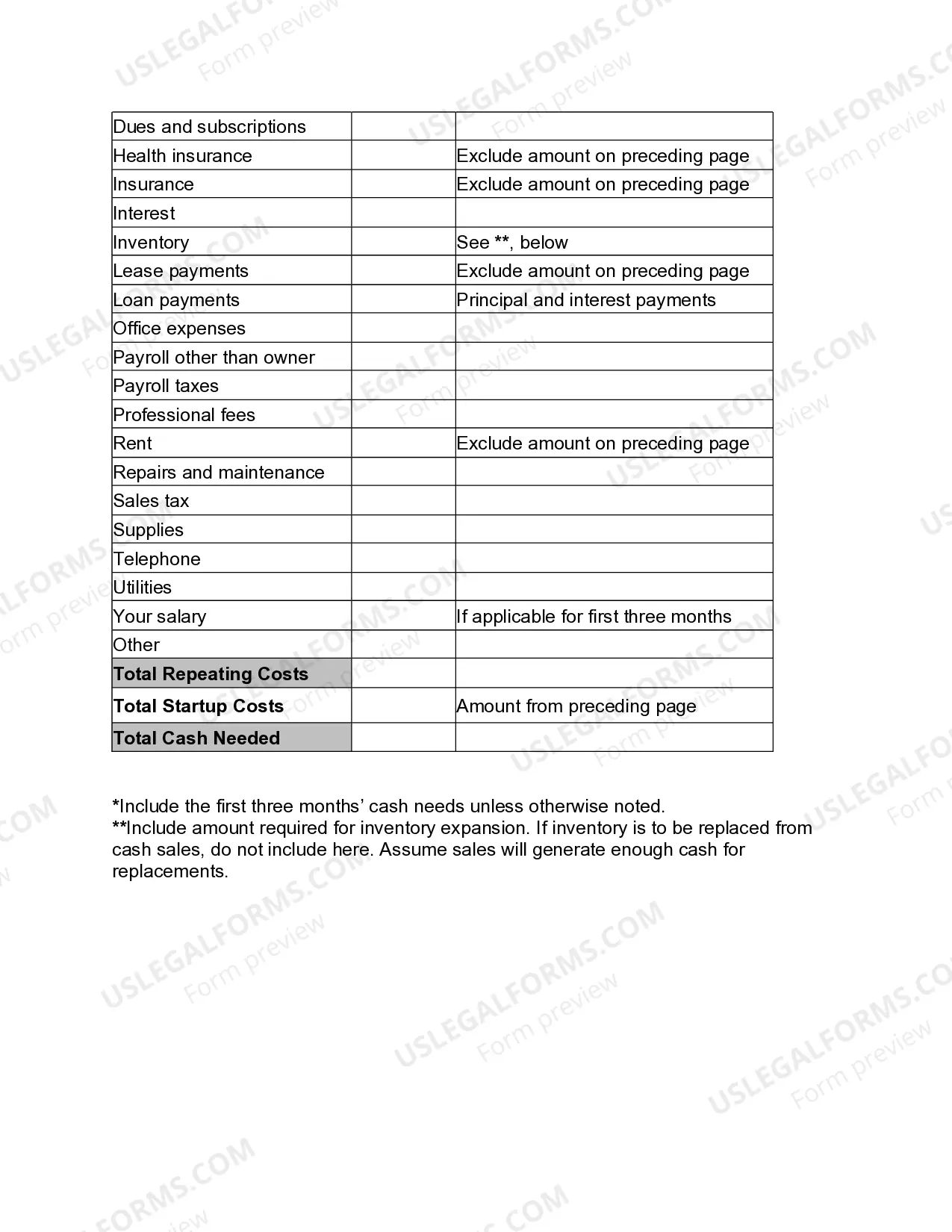

To calculate your business startup costs, list all potential expenses you anticipate before opening your business. This includes one-time costs like registration fees and recurring costs like rent and utilities. Use detailed estimates to create a comprehensive budget, which can help you assess how much funding you will need for your Houston Texas business startup. Detailed planning lays the foundation for financial success.

Yes, you can write off business startup costs on your taxes. In Houston, Texas, these costs include expenses for setting up your business, like legal fees, equipment, and market research. Keep meticulous records of these expenses to ensure a smooth filing process. This write-off can provide significant financial relief as you establish your Houston Texas business.