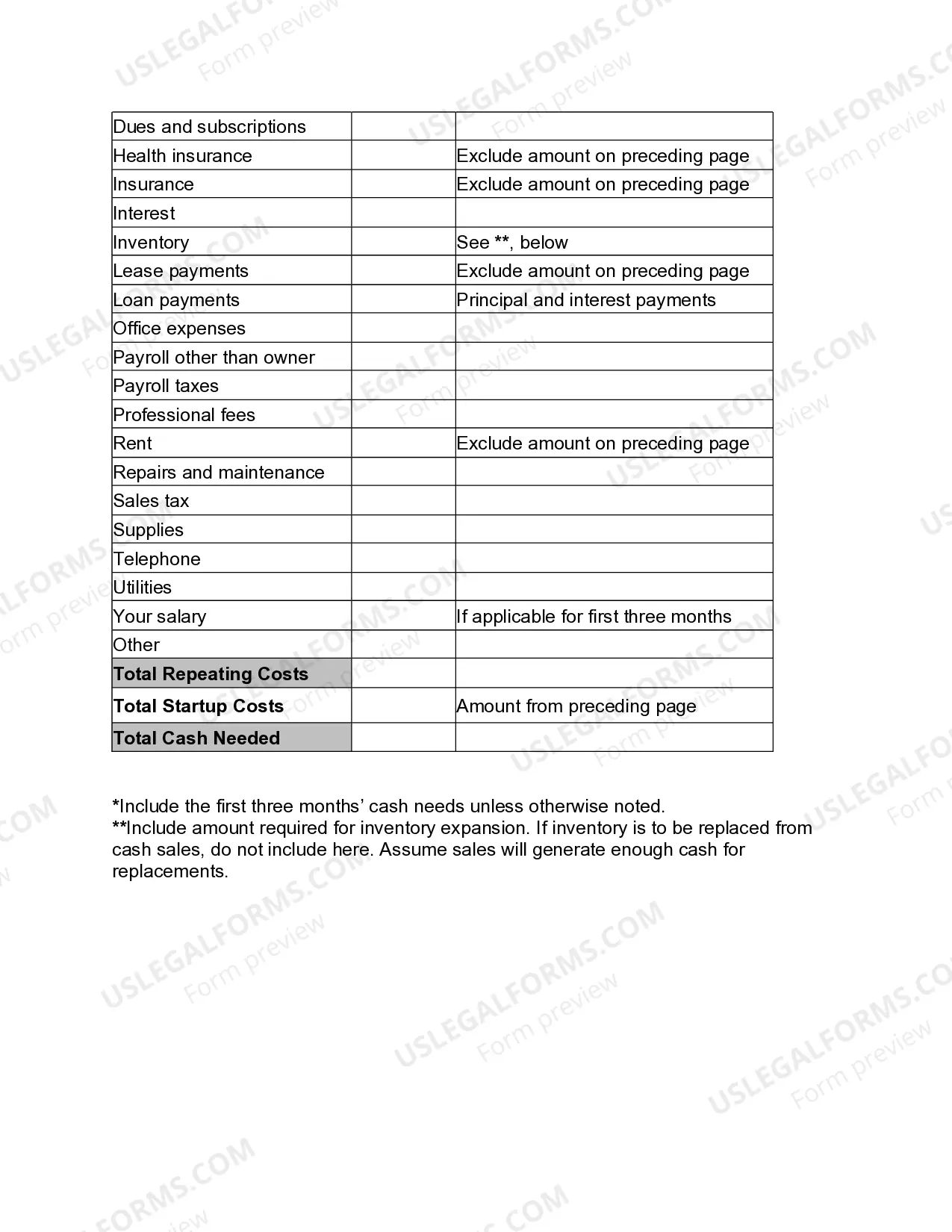

This form is an Excel spreadsheet that can be used to calculate startup costs for a new business. It includes itemized categories for funding and costs, and is a valuable tool to help plan the financial aspects of your new business.

The Suffolk New York Business Startup Costs Spreadsheet is a comprehensive tool designed to help entrepreneurs and small business owners in Suffolk County, New York estimate, track, and analyze the various expenses associated with starting a business. It is an essential resource that enables individuals to plan their finances and make informed decisions during the crucial initial phase of their venture. This spreadsheet contains multiple tabs, each dedicated to different categories of startup costs that are typically incurred when launching a business in Suffolk County. These categories may include: 1. Legal and Regulatory Costs: This section covers expenses related to obtaining business licenses, permits, and legal documentation required by local, state, and federal authorities. 2. Office Setup Expenses: It contains costs associated with setting up a physical office or workspace, including furniture, equipment, fixtures, and renovations if necessary. 3. Technology and Equipment: This tab focuses on technological investments such as computers, software, servers, telecommunications, and other necessary equipment needed to operate the business. 4. Marketing and Advertising: This category encompasses all promotional activities, including brand development, website design, advertising campaigns, social media marketing, signage, and any other marketing expenses. 5. Inventory and Supplies: For businesses involved in selling physical products, this section assists in estimating costs related to inventory, raw materials, packaging, shipping supplies, or any goods required for daily operations. 6. Employee Costs: This tab outlines salaries, wages, employee benefits, training, and recruitment expenses if the business intends to hire personnel at the startup stage. 7. Utilities and Rent: This category covers costs associated with renting or leasing a space for the business, as well as utility bills such as electricity, water, heating, and internet services. 8. Insurance and Legal Fees: This section helps estimate costs related to business insurance policies, liability coverage, and legal services required for contracts, agreements, and intellectual property protection. 9. Miscellaneous Expenses: This tab provides space for any other costs not covered by the previous categories, such as travel expenses, professional fees, professional development, or other miscellaneous startup expenditures. By utilizing the Suffolk New York Business Startup Costs Spreadsheet, entrepreneurs gain a comprehensive overview of their financial obligations while starting a business in Suffolk County. It allows them to assess the feasibility, budget, and plan their startup accordingly, ultimately increasing their chances of success in the competitive business landscape.The Suffolk New York Business Startup Costs Spreadsheet is a comprehensive tool designed to help entrepreneurs and small business owners in Suffolk County, New York estimate, track, and analyze the various expenses associated with starting a business. It is an essential resource that enables individuals to plan their finances and make informed decisions during the crucial initial phase of their venture. This spreadsheet contains multiple tabs, each dedicated to different categories of startup costs that are typically incurred when launching a business in Suffolk County. These categories may include: 1. Legal and Regulatory Costs: This section covers expenses related to obtaining business licenses, permits, and legal documentation required by local, state, and federal authorities. 2. Office Setup Expenses: It contains costs associated with setting up a physical office or workspace, including furniture, equipment, fixtures, and renovations if necessary. 3. Technology and Equipment: This tab focuses on technological investments such as computers, software, servers, telecommunications, and other necessary equipment needed to operate the business. 4. Marketing and Advertising: This category encompasses all promotional activities, including brand development, website design, advertising campaigns, social media marketing, signage, and any other marketing expenses. 5. Inventory and Supplies: For businesses involved in selling physical products, this section assists in estimating costs related to inventory, raw materials, packaging, shipping supplies, or any goods required for daily operations. 6. Employee Costs: This tab outlines salaries, wages, employee benefits, training, and recruitment expenses if the business intends to hire personnel at the startup stage. 7. Utilities and Rent: This category covers costs associated with renting or leasing a space for the business, as well as utility bills such as electricity, water, heating, and internet services. 8. Insurance and Legal Fees: This section helps estimate costs related to business insurance policies, liability coverage, and legal services required for contracts, agreements, and intellectual property protection. 9. Miscellaneous Expenses: This tab provides space for any other costs not covered by the previous categories, such as travel expenses, professional fees, professional development, or other miscellaneous startup expenditures. By utilizing the Suffolk New York Business Startup Costs Spreadsheet, entrepreneurs gain a comprehensive overview of their financial obligations while starting a business in Suffolk County. It allows them to assess the feasibility, budget, and plan their startup accordingly, ultimately increasing their chances of success in the competitive business landscape.