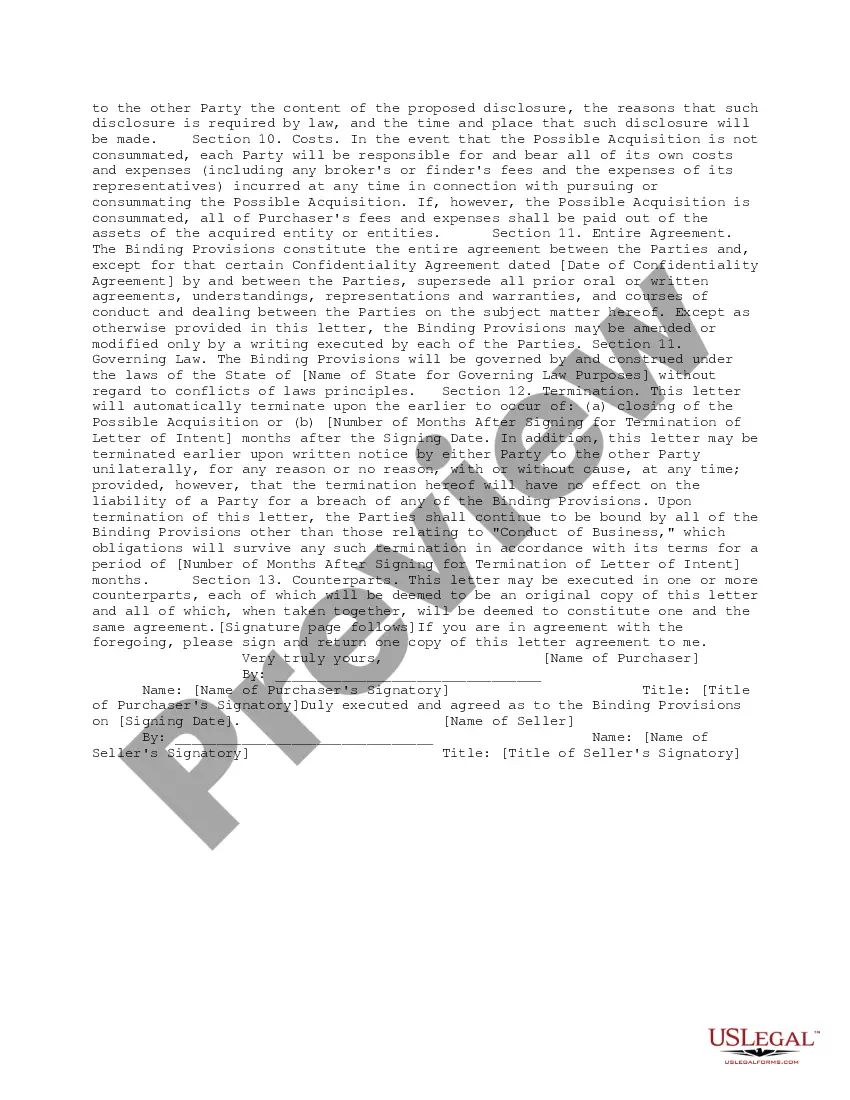

This is aletter of intent for stock acquisition. It can be used by the counsel for either the seller or purchaser and confirms the discussions to date between the seller and the purchaser. It discusses all matters in principal and binding agreements between the two parties.

A Bexar Texas Simple Letter of Intent for Stock Acquisition is a legal document that expresses a party's intention to purchase or acquire stocks from another party in Bexar County, Texas. This letter serves as a preliminary agreement between the buyer and the seller, outlining the major terms and conditions of the stock acquisition. It lays the foundation for further negotiations and due diligence before finalizing the transaction. The Bexar Texas Simple Letter of Intent for Stock Acquisition typically includes the following key elements: 1. Parties involved: The letter identifies the buyer and seller, providing their legal names and contact information. This ensures clarity regarding the entities involved in the stock acquisition process. 2. Description of stock: The specific stocks to be acquired are clearly defined, including the company name, stock symbol, and quantity. This information helps avoid confusion and ensures accurate identification of the stocks. 3. Purchase price: The letter outlines the proposed purchase price per share or total consideration for the acquisition. This may include any additional terms, such as payment schedule or adjustment mechanisms based on due diligence findings. 4. Due diligence: The letter acknowledges that the acquisition is subject to the completion of satisfactory due diligence by both parties. It may stipulate the scope and duration of due diligence, ensuring comprehensive assessment of the stocks' underlying assets, financials, and legal aspects. 5. Confidentiality and exclusivity: The agreement may include provisions regarding confidentiality and exclusivity, prohibiting the disclosure of sensitive information related to the acquisition. This safeguards both parties' interests and maintains the integrity of the transaction. 6. Conditions precedent: The letter may outline certain conditions that must be fulfilled before proceeding with the acquisition. These could include regulatory approvals, obtaining consents, or the execution of a definitive purchase agreement. 7. Non-binding nature: It is important to note that the Bexar Texas Simple Letter of Intent for Stock Acquisition is typically non-binding. It serves as a starting point for negotiations, and the terms and conditions mentioned within are subject to change based on further discussions. It is worth mentioning that while the Bexar Texas Simple Letter of Intent for Stock Acquisition provides a general framework, there might be other variations or customized versions of this document to suit different circumstances or specific industries. These could include letters of intent for acquisitions within specific sectors like technology, healthcare, or real estate, each tailored to address niche considerations within those industries.A Bexar Texas Simple Letter of Intent for Stock Acquisition is a legal document that expresses a party's intention to purchase or acquire stocks from another party in Bexar County, Texas. This letter serves as a preliminary agreement between the buyer and the seller, outlining the major terms and conditions of the stock acquisition. It lays the foundation for further negotiations and due diligence before finalizing the transaction. The Bexar Texas Simple Letter of Intent for Stock Acquisition typically includes the following key elements: 1. Parties involved: The letter identifies the buyer and seller, providing their legal names and contact information. This ensures clarity regarding the entities involved in the stock acquisition process. 2. Description of stock: The specific stocks to be acquired are clearly defined, including the company name, stock symbol, and quantity. This information helps avoid confusion and ensures accurate identification of the stocks. 3. Purchase price: The letter outlines the proposed purchase price per share or total consideration for the acquisition. This may include any additional terms, such as payment schedule or adjustment mechanisms based on due diligence findings. 4. Due diligence: The letter acknowledges that the acquisition is subject to the completion of satisfactory due diligence by both parties. It may stipulate the scope and duration of due diligence, ensuring comprehensive assessment of the stocks' underlying assets, financials, and legal aspects. 5. Confidentiality and exclusivity: The agreement may include provisions regarding confidentiality and exclusivity, prohibiting the disclosure of sensitive information related to the acquisition. This safeguards both parties' interests and maintains the integrity of the transaction. 6. Conditions precedent: The letter may outline certain conditions that must be fulfilled before proceeding with the acquisition. These could include regulatory approvals, obtaining consents, or the execution of a definitive purchase agreement. 7. Non-binding nature: It is important to note that the Bexar Texas Simple Letter of Intent for Stock Acquisition is typically non-binding. It serves as a starting point for negotiations, and the terms and conditions mentioned within are subject to change based on further discussions. It is worth mentioning that while the Bexar Texas Simple Letter of Intent for Stock Acquisition provides a general framework, there might be other variations or customized versions of this document to suit different circumstances or specific industries. These could include letters of intent for acquisitions within specific sectors like technology, healthcare, or real estate, each tailored to address niche considerations within those industries.