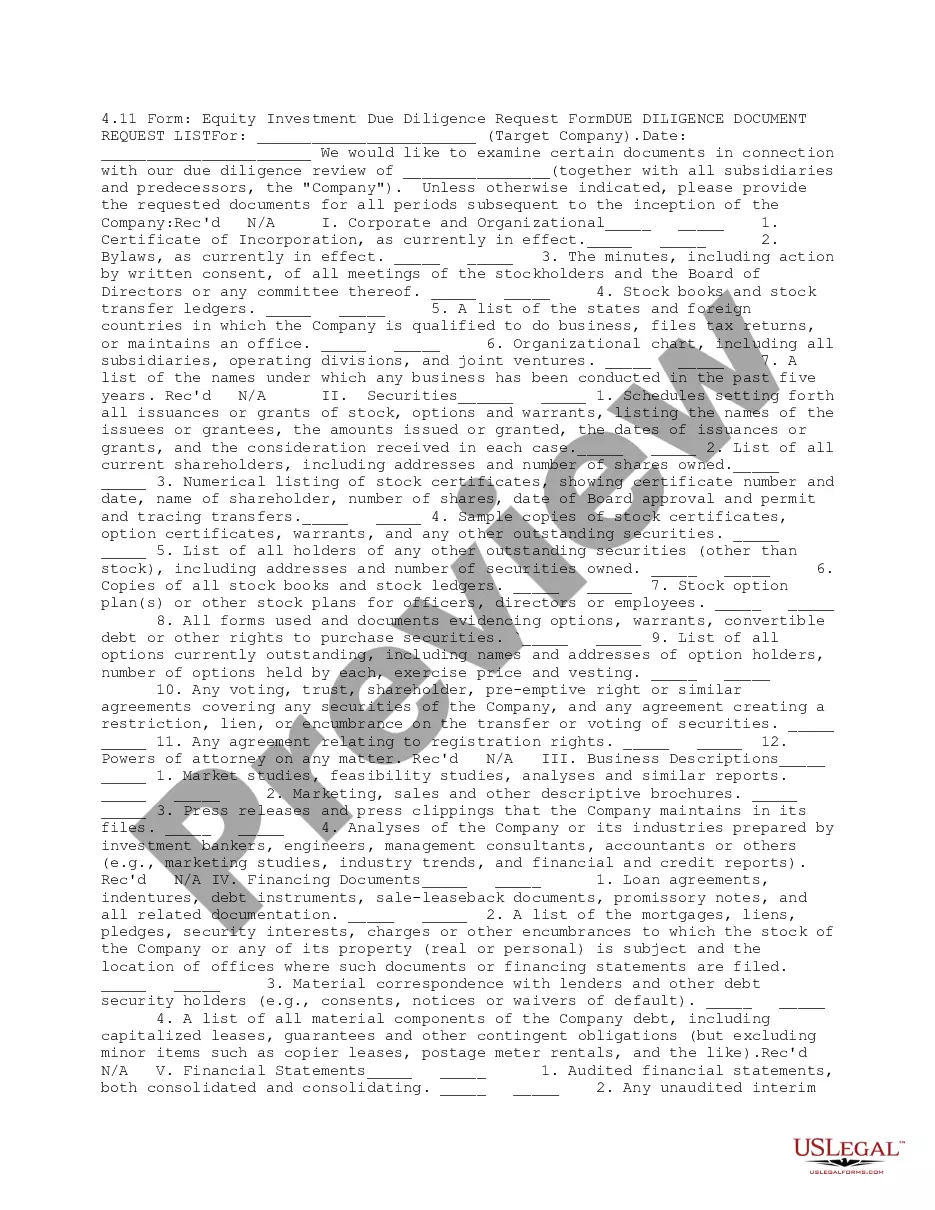

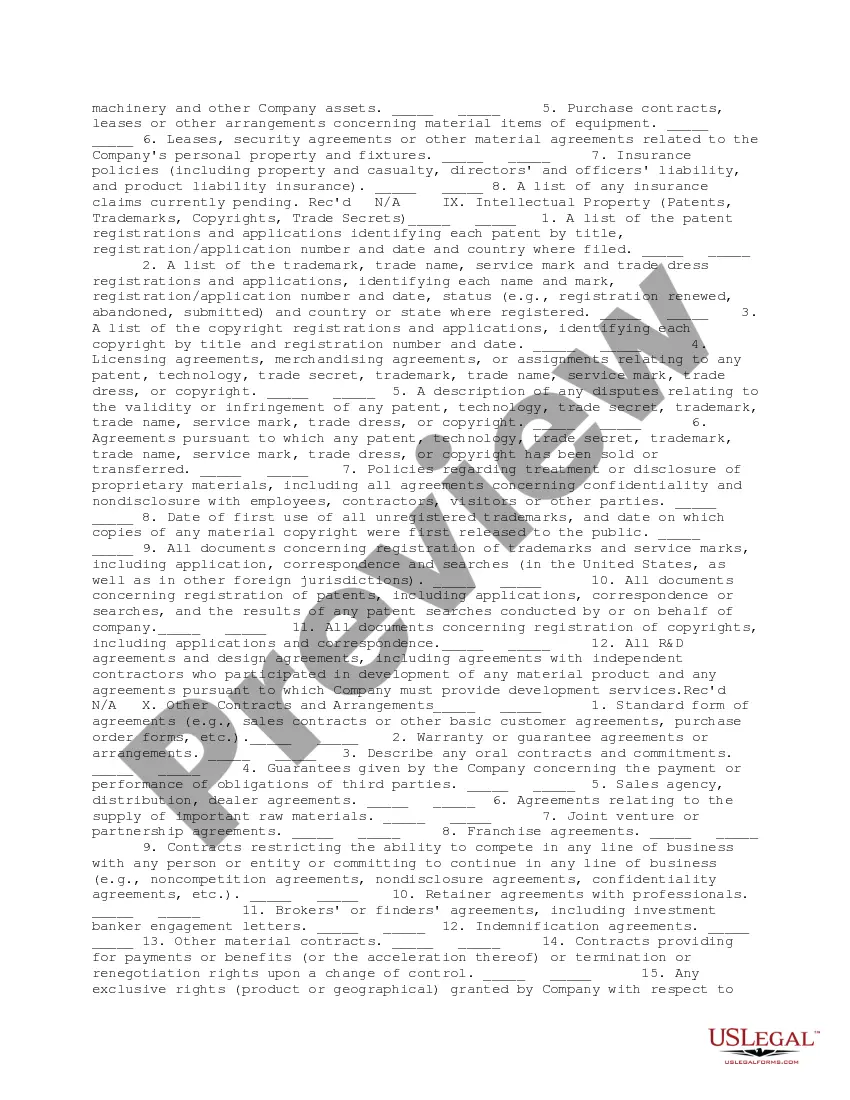

This is a due diligence document request list requesting certain documents to be used in the due diligence review. It asks for corporate and organizational documents, securities documents, business descriptions, financing documents, and other documents necessary for the due diligence review.

San Jose California Equity Investment Due Diligence Request Form is a document that allows investors to gather and analyze information before making investment decisions. This form is essential for individuals or organizations planning to invest in equities within the San Jose area of California. By utilizing this form, investors can assess the potential risks and benefits associated with an equity investment opportunity, enabling them to make informed decisions about allocating their financial resources. The San Jose California Equity Investment Due Diligence Request Form covers various areas essential to the due diligence process. It typically includes sections such as: 1. Company Overview: This section focuses on capturing detailed information about the company offering the equity investment opportunity. It includes the company's name, address, contact details, history, mission, vision, and management team. 2. Financial Information: This section aims to gather comprehensive financial data of the company. It may include annual reports, financial statements, balance sheets, profit and loss statements, cash flow statements, and any other relevant financial documents. By examining this information, investors can assess the company's financial health, performance, and growth potential. 3. Legal and Compliance: Here, investors request information about any legal disputes, litigation, pending regulatory approvals, or compliance issues that may impact the investment. This section also covers the company's legal structure, ownership details, intellectual property rights, and licenses. 4. Market Analysis: This segment concentrates on collecting market research and analysis conducted for the specific investment opportunity. Investors seek data related to market size, competition, industry trends, target market demographics, and growth projections to evaluate the feasibility and sustainability of the investment. 5. Risk Assessment: This section enables investors to identify and assess potential risks associated with the investment opportunity. It may cover risks related to market volatility, competitors, technological advancements, regulatory changes, or any other factors that may affect the investment's profitability. 6. Exit Strategy: Investors request information about the company's exit strategy, which outlines how they plan to divest their equity investment in the future. Understanding the exit strategy is crucial to ensure alignment and compatibility with the investor's own investment goals. Different types or variations of San Jose California Equity Investment Due Diligence Request Forms may exist, depending on the company or investment-specific requirements. For example, there may be forms tailored for specific industries like technology, real estate, or healthcare. Furthermore, variations may arise based on the unique preferences of individual investors or investment firms. These forms streamline the due diligence process, allowing investors to gather all pertinent information efficiently. By carefully examining the responses and documents provided, investors can make well-informed decisions regarding equity investments in San Jose, California.San Jose California Equity Investment Due Diligence Request Form is a document that allows investors to gather and analyze information before making investment decisions. This form is essential for individuals or organizations planning to invest in equities within the San Jose area of California. By utilizing this form, investors can assess the potential risks and benefits associated with an equity investment opportunity, enabling them to make informed decisions about allocating their financial resources. The San Jose California Equity Investment Due Diligence Request Form covers various areas essential to the due diligence process. It typically includes sections such as: 1. Company Overview: This section focuses on capturing detailed information about the company offering the equity investment opportunity. It includes the company's name, address, contact details, history, mission, vision, and management team. 2. Financial Information: This section aims to gather comprehensive financial data of the company. It may include annual reports, financial statements, balance sheets, profit and loss statements, cash flow statements, and any other relevant financial documents. By examining this information, investors can assess the company's financial health, performance, and growth potential. 3. Legal and Compliance: Here, investors request information about any legal disputes, litigation, pending regulatory approvals, or compliance issues that may impact the investment. This section also covers the company's legal structure, ownership details, intellectual property rights, and licenses. 4. Market Analysis: This segment concentrates on collecting market research and analysis conducted for the specific investment opportunity. Investors seek data related to market size, competition, industry trends, target market demographics, and growth projections to evaluate the feasibility and sustainability of the investment. 5. Risk Assessment: This section enables investors to identify and assess potential risks associated with the investment opportunity. It may cover risks related to market volatility, competitors, technological advancements, regulatory changes, or any other factors that may affect the investment's profitability. 6. Exit Strategy: Investors request information about the company's exit strategy, which outlines how they plan to divest their equity investment in the future. Understanding the exit strategy is crucial to ensure alignment and compatibility with the investor's own investment goals. Different types or variations of San Jose California Equity Investment Due Diligence Request Forms may exist, depending on the company or investment-specific requirements. For example, there may be forms tailored for specific industries like technology, real estate, or healthcare. Furthermore, variations may arise based on the unique preferences of individual investors or investment firms. These forms streamline the due diligence process, allowing investors to gather all pertinent information efficiently. By carefully examining the responses and documents provided, investors can make well-informed decisions regarding equity investments in San Jose, California.