This stock option plan provides employees with a way to gain ownership in the company for which they work. The plan addresses SARs, stock awards, dividends and divided equivalents, deferrals and settlements, and all other subject matter generally included in stock option plans.

The Chicago Illinois Employee Stock Option Plan (ESOP) is a program designed to provide employees of companies based in Chicago, Illinois, with the opportunity to acquire ownership in their organization. It allows eligible employees to purchase company stock at a predetermined price within a specified timeframe, usually at a discounted rate. The Chicago Illinois ESOP serves as a valuable employee benefit and motivates workers by aligning their interests with the company's success. By owning stock in their employer, employees have a stake in the company's growth and profitability, which can lead to increased dedication, productivity, and loyalty. There are various types of Employee Stock Option Plans available in Chicago, Illinois, providing different structures and benefits to employees. Some notable types include: 1. Non-Qualified Stock Options (SOS): SOS are the most common type of stock options offered by companies. They provide greater flexibility in terms of eligibility requirements, exercise price, and tax treatment. SOS are subject to standard income tax rates upon exercise. 2. Incentive Stock Options (SOS): SOS are primarily offered to key employees and executives, providing them with potential tax advantages. These options offer preferential tax treatment, as the gains are taxed as long-term capital gains if specific holding requirements are met. 3. Restricted Stock Units (RSS): RSS are another form of equity compensation granted to employees. Unlike stock options, RSS do not offer the right to purchase or sell shares but rather represent a promise of future stock delivery. These are commonly used as part of executive compensation packages. 4. Employee Stock Purchase Plans (ESPN): Although not technically a stock option plan, ESPN are popular in Chicago and allow employees to purchase company stock at a discounted price through regular payroll deductions. ESPN typically provide more flexibility and lower risks compared to traditional stock option plans. 5. Performance Stock Options: Performance-based stock options are granted based on specific performance goals established by the company. If employees meet the predefined objectives, they are eligible for exercising the options. Overall, the Chicago Illinois Employee Stock Option Plan serves as a vital mechanism for attracting and retaining talented employees, promoting a sense of ownership, and incentivizing superior performance. The varying types of Sops cater to different employee levels and goals, ensuring that companies in Chicago have options suitable for their specific needs and aspirations.Chicago Illinois Employee Stock Option Plan

Description

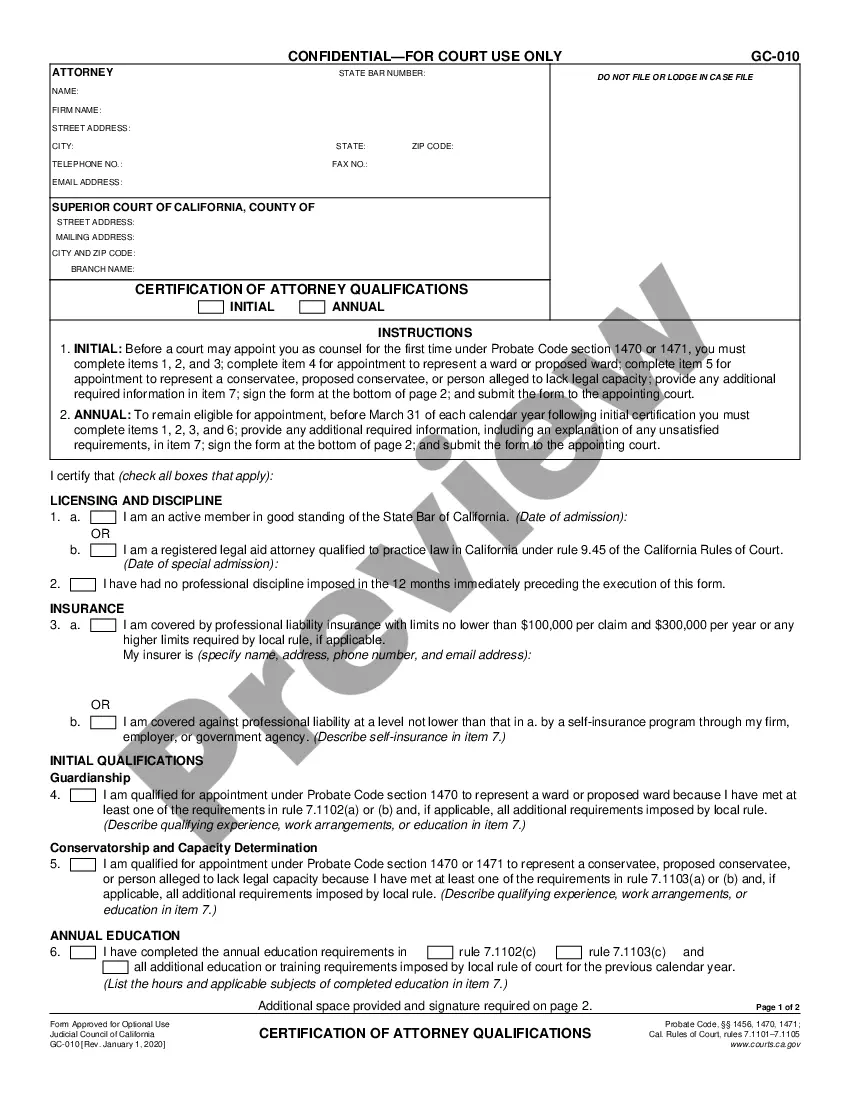

How to fill out Chicago Illinois Employee Stock Option Plan?

Draftwing documents, like Chicago Employee Stock Option Plan, to manage your legal affairs is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for a variety of scenarios and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Chicago Employee Stock Option Plan form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before downloading Chicago Employee Stock Option Plan:

- Ensure that your form is compliant with your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Chicago Employee Stock Option Plan isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start utilizing our website and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!