This memorandum offers an overview of the Initial Public Offering ("IPO") for a high-tech company. It addresses issues relating to the company, its disclosure policy, stock plans, insider trading policies and other "big picture" aspects of going public.

Harris Texas Comprehensive Pre-IPO Memo for High-Tech Companies

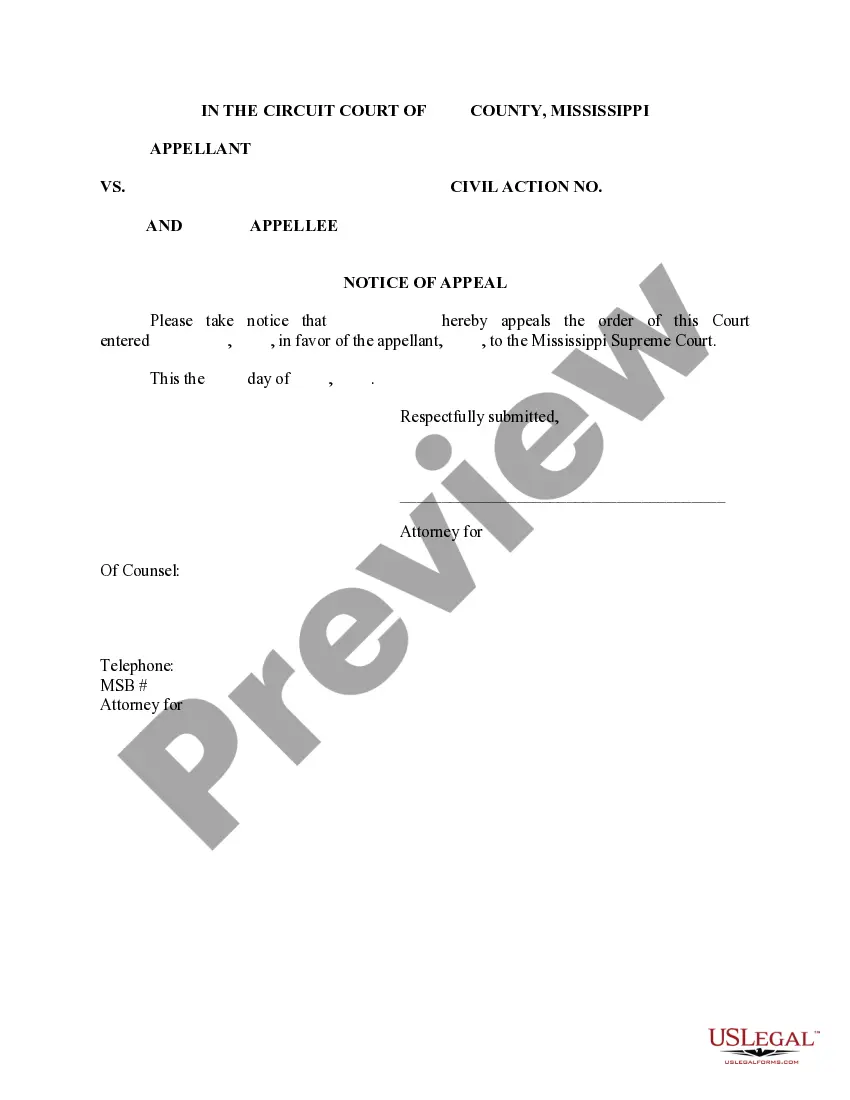

Description

How to fill out Comprehensive Pre-IPO Memo For High-Tech Companies?

How long does it typically require for you to draft a legal document.

Considering that each state has its own laws and regulations for every life situation, locating a Harris Comprehensive Pre-IPO Memo for High-Tech Companies that meets all regional requirements can be challenging, and hiring a professional attorney is frequently costly.

Many online platforms provide the most commonly used state-specific templates for download, but utilizing the US Legal Forms library is exceptionally advantageous.

Sign up for an account on the platform or Log In to continue to payment options. Make the payment via PayPal or with your credit card. Change the file format if necessary. Click Download to save the Harris Comprehensive Pre-IPO Memo for High-Tech Companies. Print the document or use any preferred online editor to fill it out electronically. Regardless of how many times you need to utilize the purchased template, you can access all the samples you’ve ever downloaded in your profile by navigating to the My documents tab. Give it a go!

- US Legal Forms boasts the most extensive online collection of templates, categorized by states and areas of application.

- In addition to the Harris Comprehensive Pre-IPO Memo for High-Tech Companies, you can access any particular form necessary to operate your business or personal affairs, ensuring compliance with your local requirements.

- Professionals verify all samples for their relevance, so you can trust that your documents will be prepared accurately.

- Using the service is quite simple.

- If you already possess an account on the platform and your subscription is current, you just need to Log In, choose the required sample, and download it.

- You can store the document in your profile at any time subsequently.

- If you are new to the platform, you will need to perform a few additional steps before acquiring your Harris Comprehensive Pre-IPO Memo for High-Tech Companies.

- Examine the content on the page you're viewing.

- Review the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you are confident in the selected document.

- Choose the subscription plan that best fits your needs.

Form popularity

FAQ

Contact banks, non-banking financial institutions, and accounting firms. Find out if they know of any private companies that are planning to issue pre-IPO stocks. Attend startup pitch events and competitions and look for promising companies that you can invest in.

Once you click on the Pre-apply option, fill in the required details and click to continue. 6. Your Pre- application for IPO will be created and you will see a UPI Mandate message stating the date on which you will receive UPI mandate notification to block your bid amount.

You can place orders for certain stocks before their initial public offering using your Robinhood app. An initial public offering (IPO) is a company's first sale of stock to the public. We offer pre-IPO orders for a small selection of stocks, and won't support pre-IPO orders for every company that lists on the market.

What Is an S-1 IPO Form? An S-1 Form is the initial registration that is filed with the SEC when a company first goes public, generally before the initial public offering, or IPO. You may sometimes hear this form referred to as the registration form, since it registers the company with the SEC.

Investors look to the information a company supplies in its SEC Form S-1 filing to make a decision about whether or not they want to invest in its stock during an initial public offering.

1 registration statement: The primary document for filing the IPO. It is made up of two parts: The prospectus and private information that is not required to be disclosed to investors, but must be reported to the EC. It also includes the expected IPO date.

Annexure no.Particulars4Copy of Prospectus (soft copy also in CD )5Certified true copy of any additions of material contracts and documents from the date of filing of DRHP (soft copy also)6All due diligence certificates filed with SEBI by Merchant bankers7SEBI observations and reply to the said observation16 more rows

The following outline should give you an idea of all the steps involved: Step#1: Appointment of investment bankers/underwriters.Step#2: Registration for IPO.Step#3: Cooling-off period.Step#4: Application to stock exchange.Step#5: Creating a buzz.The timing. The process. Step#6.

Ask Around. Banks, accounting firms, and other loaning establishments often have a working directory of private client companies who are looking for investors. If you've invested in the past, get in touch with your stockbroker or investment adviser so you can find pre-IPO tech startups worth investing in.

Here are five ways to invest in Pre-IPO shares: Consult with a stockbroker or advisory firm specializing in capital raising and pre-IPO shares. Consult with your local bankers about companies looking for investments. Monitor the financial news for details about startups or companies looking to go public.