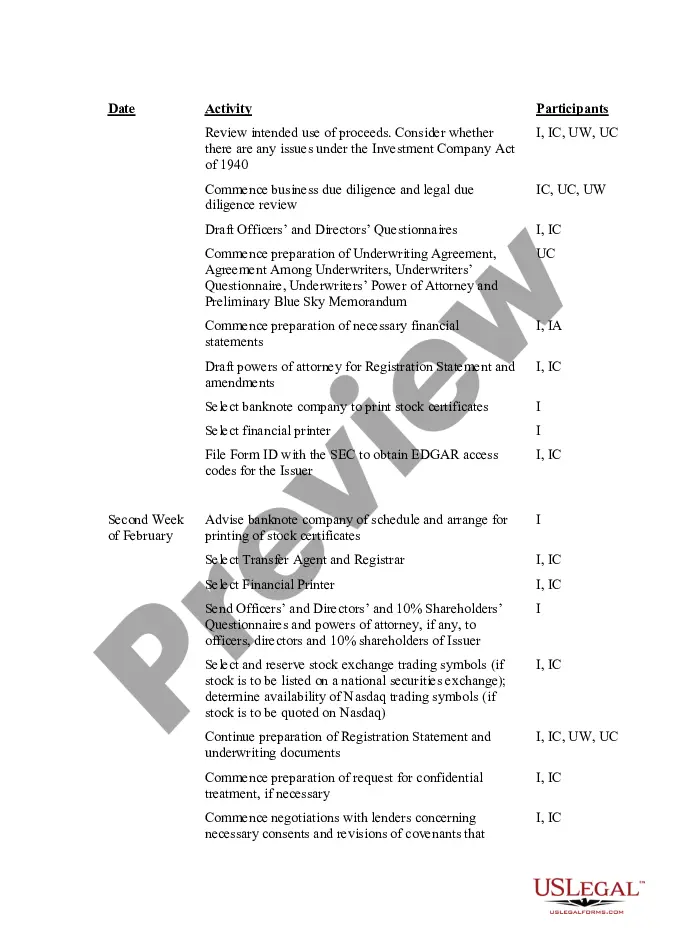

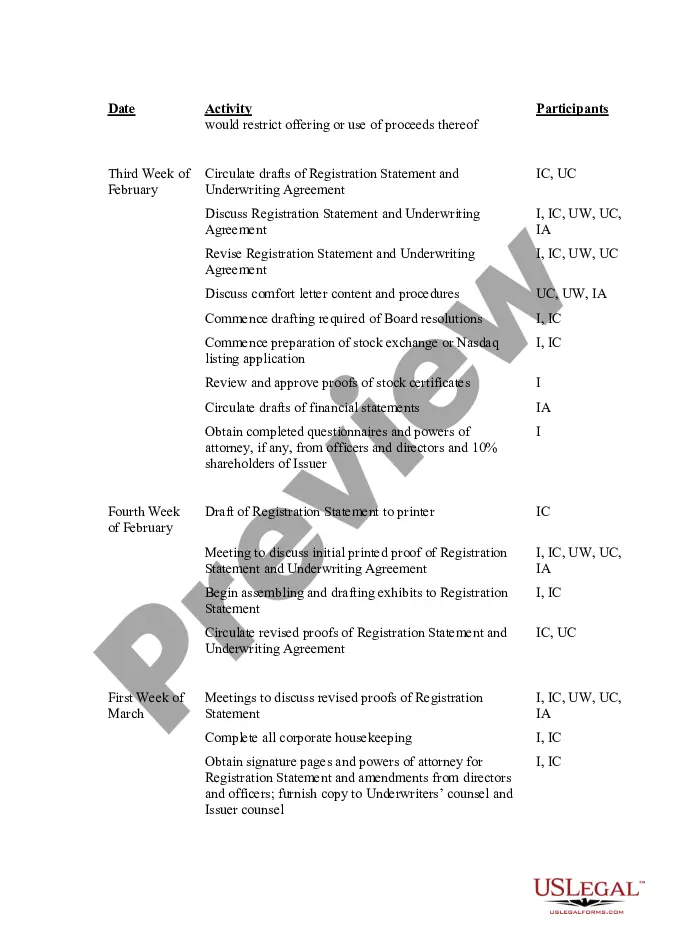

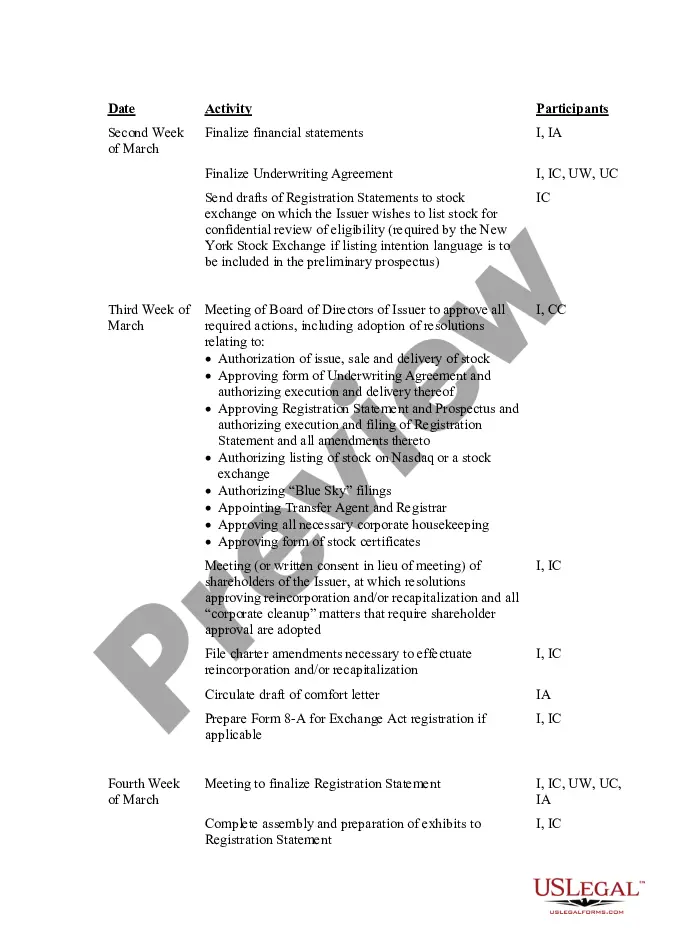

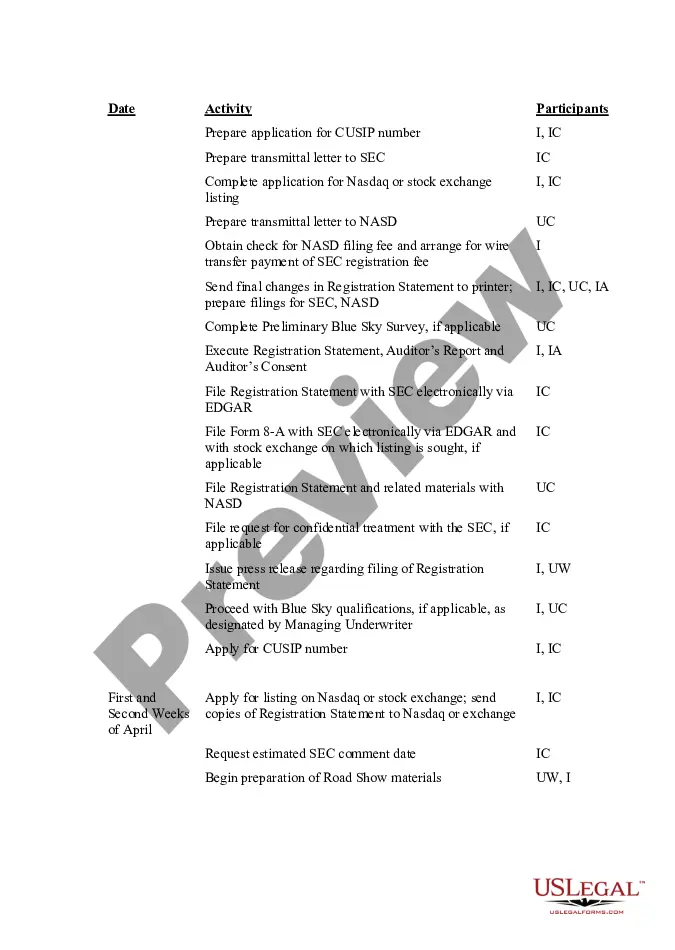

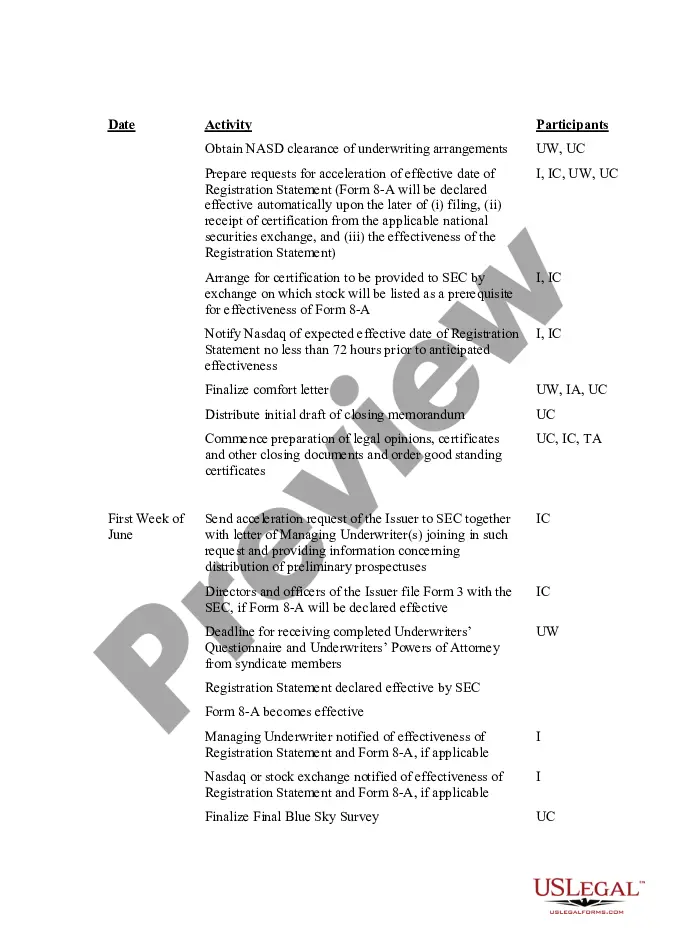

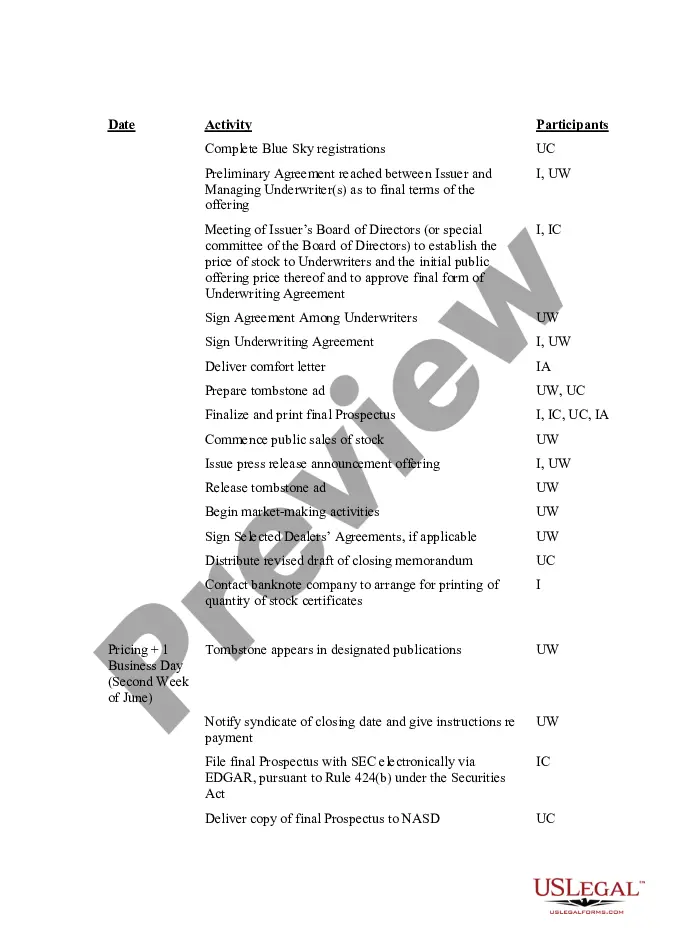

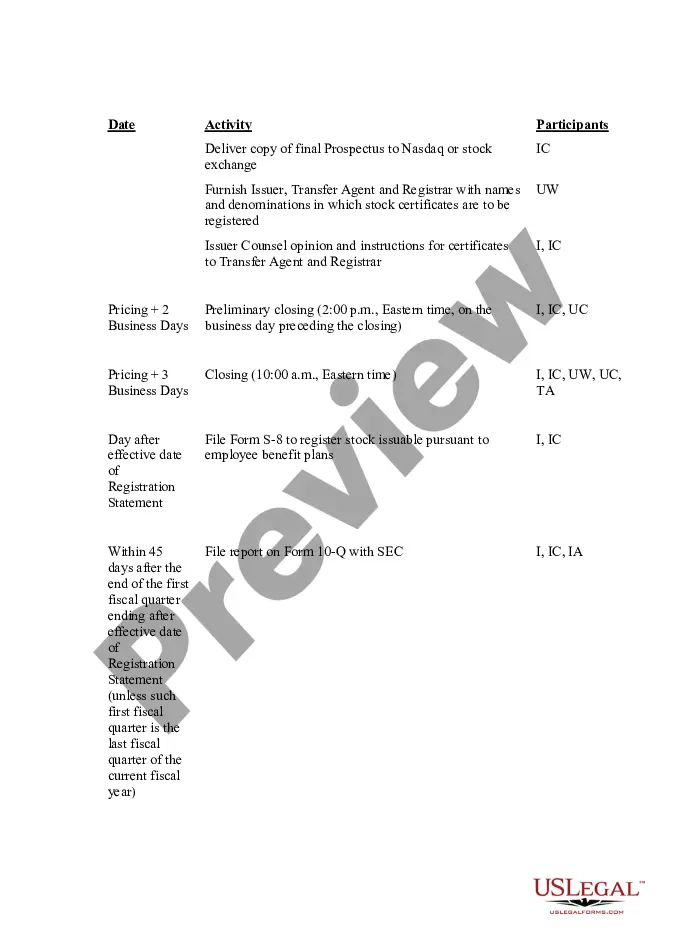

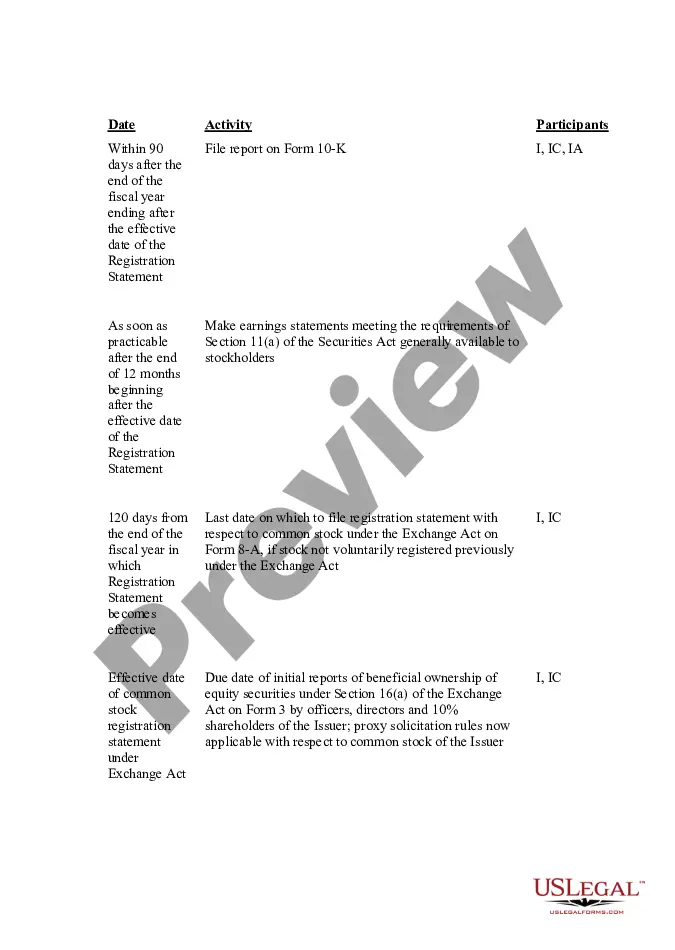

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Miami-Dade Florida IPO Time and Responsibility Schedule, also referred to as the Initial Public Offering schedule, is a detailed plan outlining the timeline and various responsibilities associated with organizing and executing IPOs in Miami-Dade County, Florida. This schedule acts as a comprehensive guide to ensure a smooth and transparent process for companies looking to go public in the region. The Miami-Dade Florida IPO Time and Responsibility Schedule plays a crucial role in coordinating the efforts of all involved parties, including the issuing company, underwriters, lawyers, auditors, regulators, and investors. It outlines the key milestones, tasks, and deadlines that need to be met to satisfy legal and regulatory requirements, gain investor confidence, and maximize the success of the IPO. This schedule encompasses multiple stages, from the initial decision to pursue an IPO to the post-offering activities. Some main types of Miami-Dade Florida IPO Time and Responsibility Schedule include: 1. pre-IPO Planning: - Internal assessment and readiness evaluation — Selection and engagement of underwriters, auditors, and legal counsel — Preparation of accurate financial statements and disclosures — Evaluating market conditions and timing the IPO accordingly — Regulatory compliance assessment and documentation 2. Registration and Documentation: — Drafting and filing the registration statement with the Securities and Exchange Commission (SEC) — Coordinating with underwriters and legal counsel to finalize prospectus, offering memorandum, and other offering documents — Conducting due diligence and ensuring accurate and complete disclosures 3. Marketing and Investor Relations: — Developing an investor relations strategy and communication plan — Organizing roadshows and investor presentations — Engaging with potential investors, institutional buyers, and analysts — Responding to investor inquiries and managing communication during the offering period 4. Pricing and Final Preparations: — Determining the offer price and number of shares to be issued — Coordinating with underwriters to finalize the pricing and allocation process — Ensuring compliance with SEC regulations and stock exchange requirements — Conducting pre-offering meetings and executing final preparations 5. Post-Offering Activities: — Facilitating the distribution and listing of shares — Coordinating with transfer agents and stock exchanges — Managing investor relations and ongoing disclosure obligations — Complying with reporting requirements and corporate governance standards The Miami-Dade Florida IPO Time and Responsibility Schedule is crucial for both the issuing companies and the participating professionals to streamline the IPO process and ensure all tasks are completed within the specified timeframes. Following this schedule diligently helps lay the foundation for a successful IPO launch, attracting investors and paving the way for the company's growth in the public market.Miami-Dade Florida IPO Time and Responsibility Schedule, also referred to as the Initial Public Offering schedule, is a detailed plan outlining the timeline and various responsibilities associated with organizing and executing IPOs in Miami-Dade County, Florida. This schedule acts as a comprehensive guide to ensure a smooth and transparent process for companies looking to go public in the region. The Miami-Dade Florida IPO Time and Responsibility Schedule plays a crucial role in coordinating the efforts of all involved parties, including the issuing company, underwriters, lawyers, auditors, regulators, and investors. It outlines the key milestones, tasks, and deadlines that need to be met to satisfy legal and regulatory requirements, gain investor confidence, and maximize the success of the IPO. This schedule encompasses multiple stages, from the initial decision to pursue an IPO to the post-offering activities. Some main types of Miami-Dade Florida IPO Time and Responsibility Schedule include: 1. pre-IPO Planning: - Internal assessment and readiness evaluation — Selection and engagement of underwriters, auditors, and legal counsel — Preparation of accurate financial statements and disclosures — Evaluating market conditions and timing the IPO accordingly — Regulatory compliance assessment and documentation 2. Registration and Documentation: — Drafting and filing the registration statement with the Securities and Exchange Commission (SEC) — Coordinating with underwriters and legal counsel to finalize prospectus, offering memorandum, and other offering documents — Conducting due diligence and ensuring accurate and complete disclosures 3. Marketing and Investor Relations: — Developing an investor relations strategy and communication plan — Organizing roadshows and investor presentations — Engaging with potential investors, institutional buyers, and analysts — Responding to investor inquiries and managing communication during the offering period 4. Pricing and Final Preparations: — Determining the offer price and number of shares to be issued — Coordinating with underwriters to finalize the pricing and allocation process — Ensuring compliance with SEC regulations and stock exchange requirements — Conducting pre-offering meetings and executing final preparations 5. Post-Offering Activities: — Facilitating the distribution and listing of shares — Coordinating with transfer agents and stock exchanges — Managing investor relations and ongoing disclosure obligations — Complying with reporting requirements and corporate governance standards The Miami-Dade Florida IPO Time and Responsibility Schedule is crucial for both the issuing companies and the participating professionals to streamline the IPO process and ensure all tasks are completed within the specified timeframes. Following this schedule diligently helps lay the foundation for a successful IPO launch, attracting investors and paving the way for the company's growth in the public market.