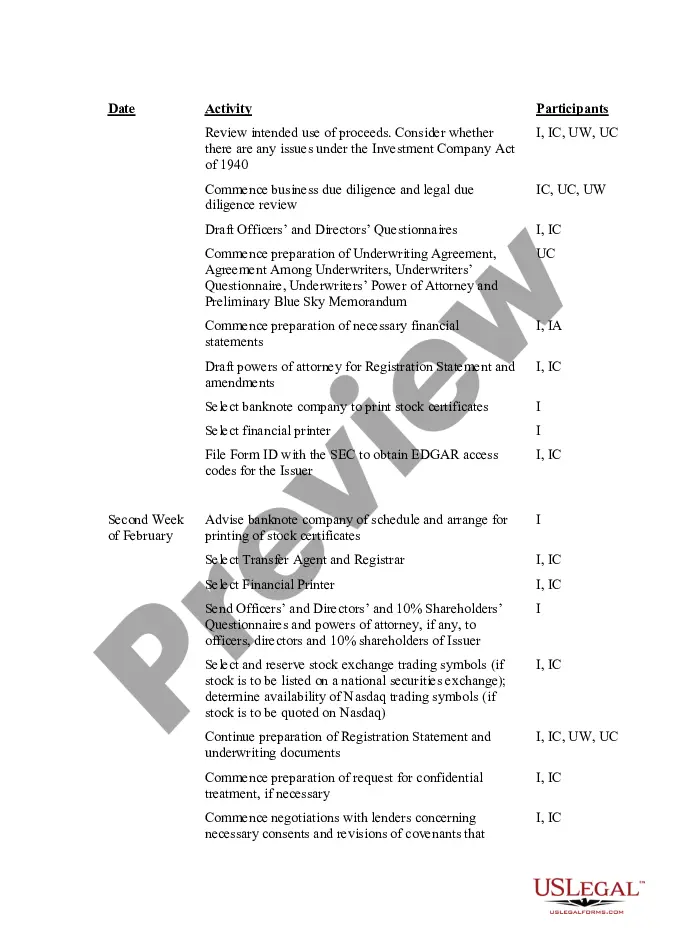

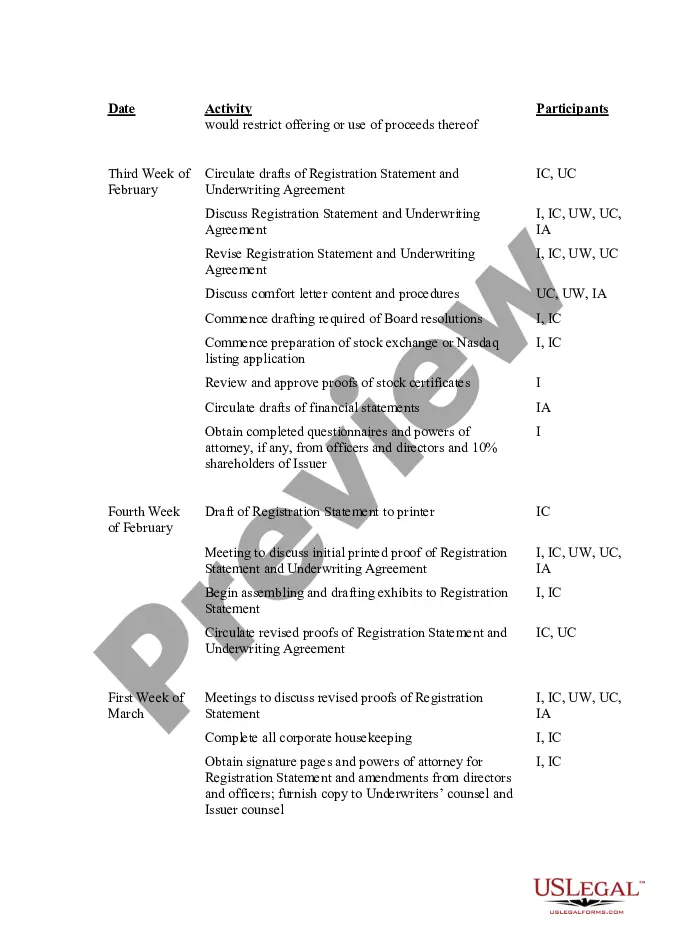

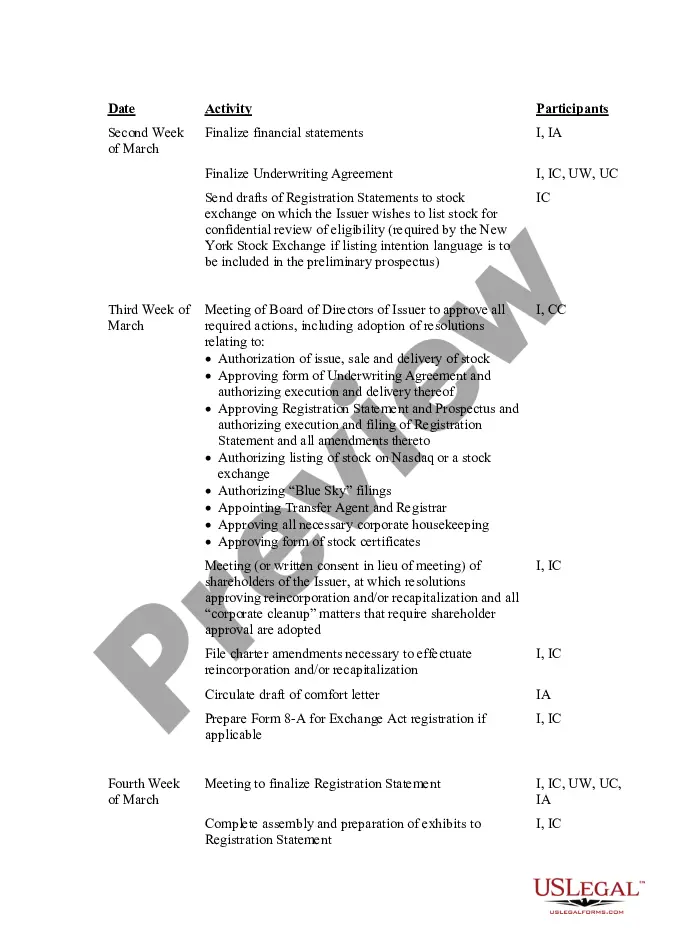

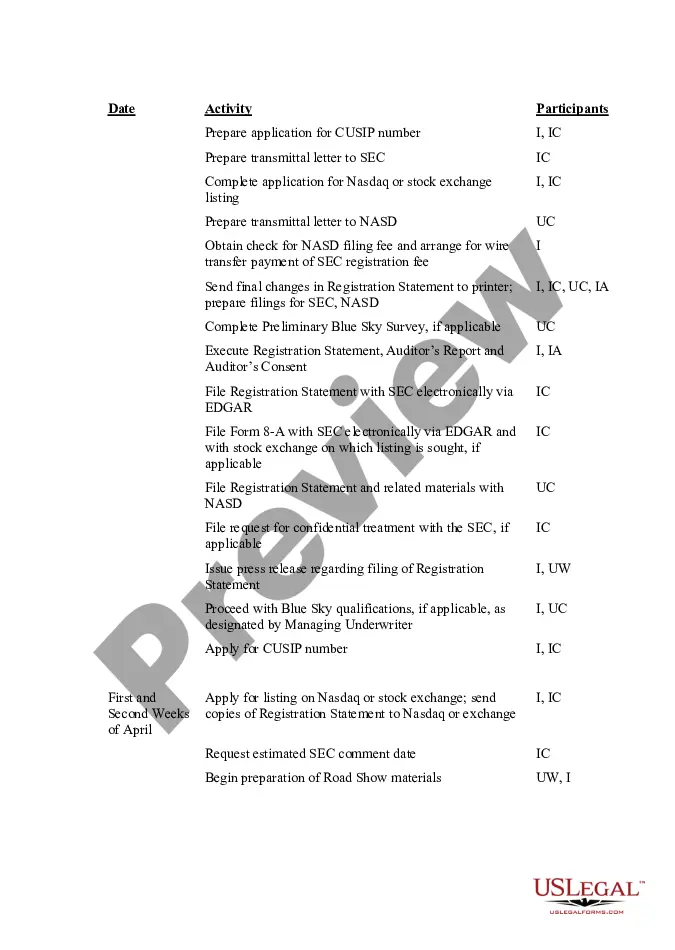

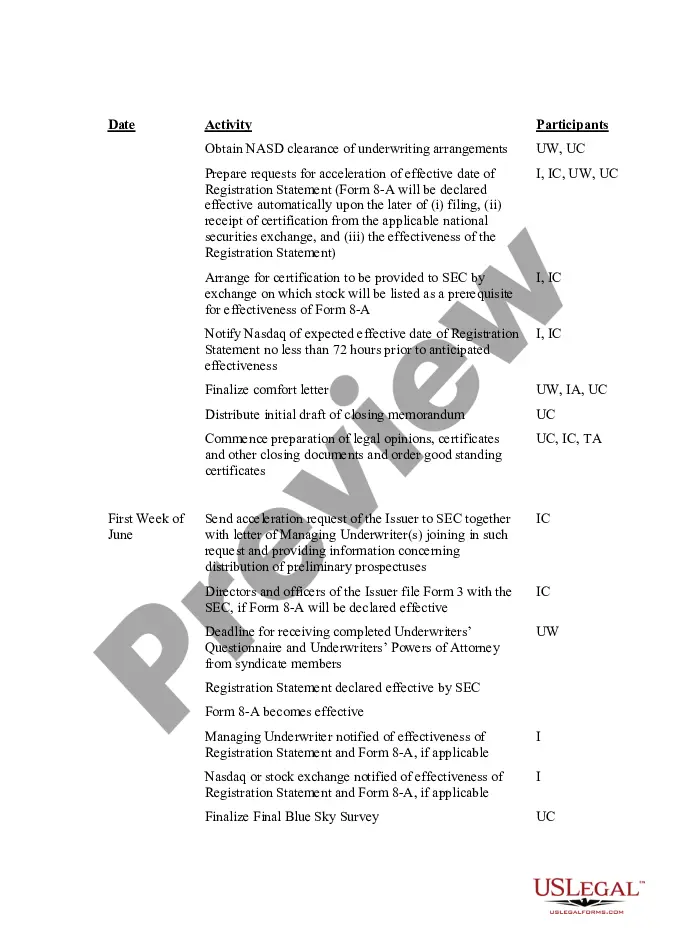

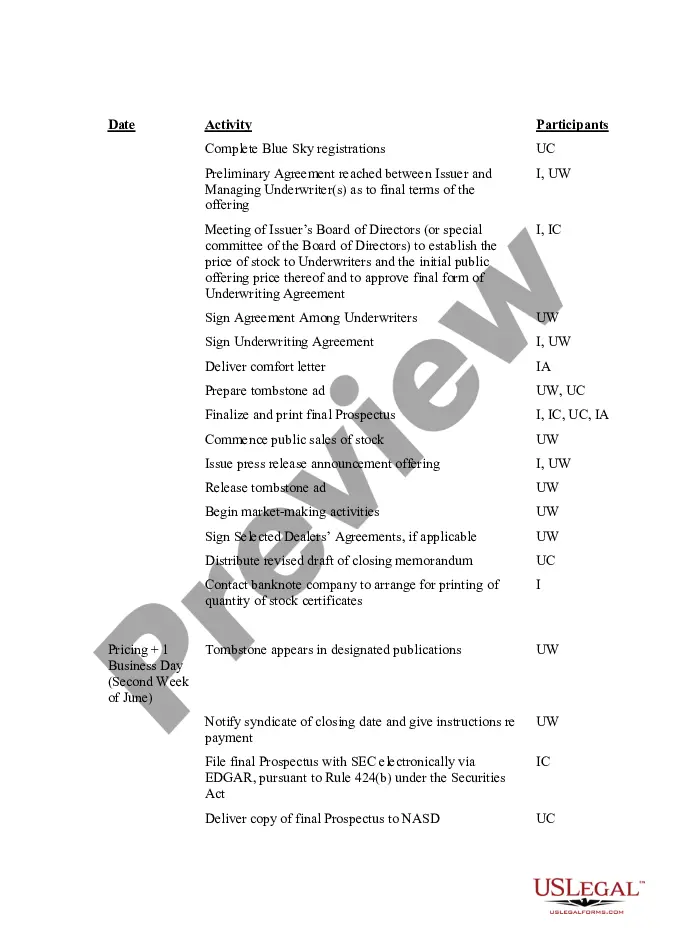

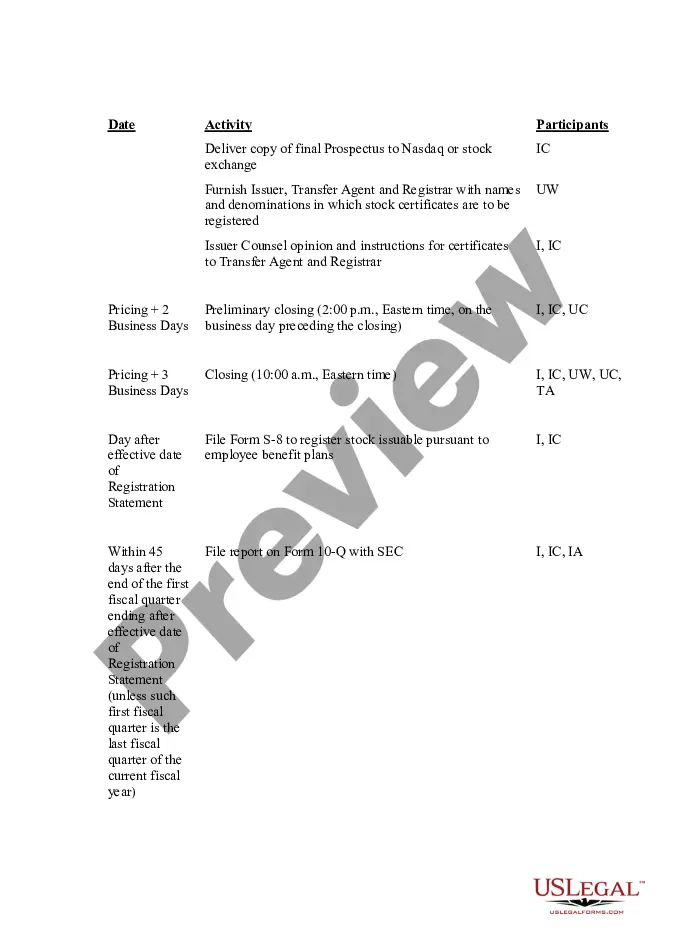

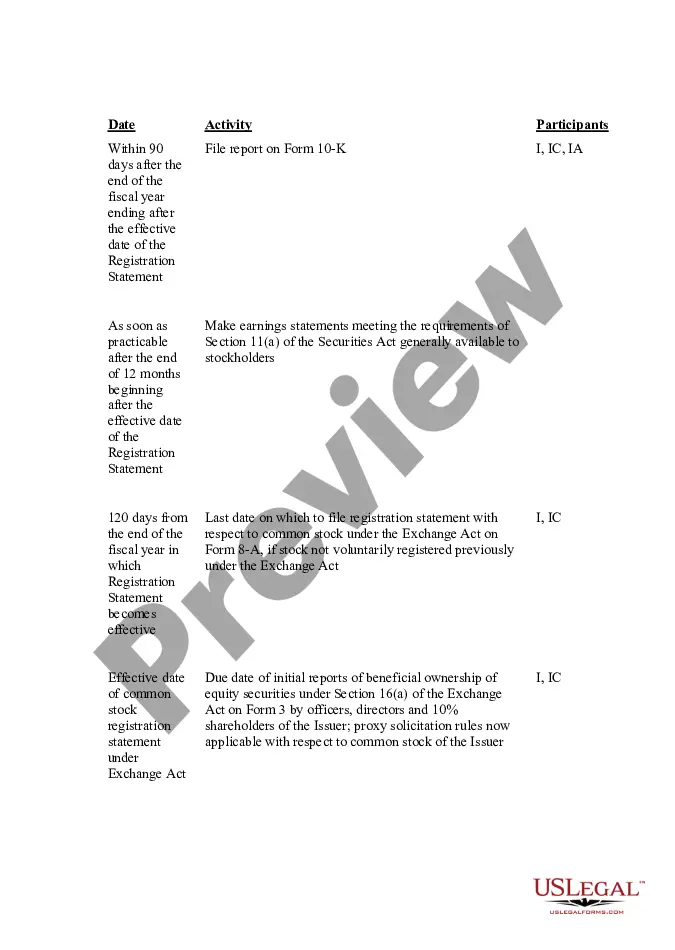

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

The Phoenix Arizona IPO Time and Responsibility Schedule is an essential framework that outlines the timeline and obligations involved in the Initial Public Offering (IPO) process for companies based in Phoenix, Arizona. This schedule encompasses various stages of the IPO, ensuring a clear and organized path for companies looking to go public. Key phrases: Phoenix Arizona, IPO Time and Responsibility Schedule, Initial Public Offering, timeline, obligations, companies, public. The Phoenix Arizona IPO Time and Responsibility Schedule includes the following phases: 1. Preparatory Stage: During this phase, companies focus on crucial tasks necessary to pave the way for a successful IPO. It involves extensive preparation, documentation, and due diligence. Companies outline their financials, business plans, and legal compliance. Prior to filing the IPO, management engages with legal advisors, investment banks, and auditing services to strengthen their position in the market. 2. Securities and Exchange Commission (SEC) Review: Once the IPO registration statement is filed with the SEC, a comprehensive review is conducted to ensure compliance with federal securities laws. This phase can be time-consuming as the SEC meticulously evaluates the submitted documents, prospectus, financial statements, and market strategy. Companies must address any clarifications or concerns raised by the SEC during the review process. 3. Roadshow Preparation: Companies preparing for an IPO need to undertake an extensive roadshow, where they present their investment opportunity to potential investors. During this phase, management teams collaborate with underwriters to prepare presentations, financial models, and promotional materials. Companies often travel to different cities conducting roadshow meetings to generate interest and attract institutional investors. 4. Pricing and Book Building: Once the roadshow concludes, the underwriters lead the pricing phase. They assess the demand generated during the roadshow and determine the offering price and number of shares to be issued. The underwriters work closely with the company's management, taking into account market conditions and investor feedback, to set a competitive price that aims to maximize proceeds while maintaining investor interest. 5. Stock Exchange Listing: After determining the IPO price, the company's shares are listed on a stock exchange. Phoenix-based companies may choose national stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ, depending on their specific requirements. The listing process involves fulfilling the exchange guidelines and meeting regulatory standards, after which the company's shares become publicly tradable. Types of Phoenix Arizona IPO Time and Responsibility Schedule can include variations based on industry, company size, and financial goals. For example: 1. Technology IPO Time and Responsibility Schedule: Tailored for technology companies aiming to go public, highlighting industry-specific considerations, such as intellectual property protection, emerging market trends, and innovation pipelines. 2. Real Estate IPO Time and Responsibility Schedule: Focused on companies involved in the real estate sector, considering property valuation, market dynamics, regulatory compliance, and project pipeline as significant factors influencing the IPO process. 3. Biotechnology IPO Time and Responsibility Schedule: Specifically tailored for biotech companies, emphasizing aspects like clinical trials, patent portfolio, regulatory approvals, and partnerships with pharmaceutical firms. In summary, the Phoenix Arizona IPO Time and Responsibility Schedule is a comprehensive framework that outlines the key stages and obligations involved in going public from the region. Whether it's technology, real estate, or biotechnology, companies can adapt this schedule to industry-specific nuances to achieve a successful IPO.The Phoenix Arizona IPO Time and Responsibility Schedule is an essential framework that outlines the timeline and obligations involved in the Initial Public Offering (IPO) process for companies based in Phoenix, Arizona. This schedule encompasses various stages of the IPO, ensuring a clear and organized path for companies looking to go public. Key phrases: Phoenix Arizona, IPO Time and Responsibility Schedule, Initial Public Offering, timeline, obligations, companies, public. The Phoenix Arizona IPO Time and Responsibility Schedule includes the following phases: 1. Preparatory Stage: During this phase, companies focus on crucial tasks necessary to pave the way for a successful IPO. It involves extensive preparation, documentation, and due diligence. Companies outline their financials, business plans, and legal compliance. Prior to filing the IPO, management engages with legal advisors, investment banks, and auditing services to strengthen their position in the market. 2. Securities and Exchange Commission (SEC) Review: Once the IPO registration statement is filed with the SEC, a comprehensive review is conducted to ensure compliance with federal securities laws. This phase can be time-consuming as the SEC meticulously evaluates the submitted documents, prospectus, financial statements, and market strategy. Companies must address any clarifications or concerns raised by the SEC during the review process. 3. Roadshow Preparation: Companies preparing for an IPO need to undertake an extensive roadshow, where they present their investment opportunity to potential investors. During this phase, management teams collaborate with underwriters to prepare presentations, financial models, and promotional materials. Companies often travel to different cities conducting roadshow meetings to generate interest and attract institutional investors. 4. Pricing and Book Building: Once the roadshow concludes, the underwriters lead the pricing phase. They assess the demand generated during the roadshow and determine the offering price and number of shares to be issued. The underwriters work closely with the company's management, taking into account market conditions and investor feedback, to set a competitive price that aims to maximize proceeds while maintaining investor interest. 5. Stock Exchange Listing: After determining the IPO price, the company's shares are listed on a stock exchange. Phoenix-based companies may choose national stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ, depending on their specific requirements. The listing process involves fulfilling the exchange guidelines and meeting regulatory standards, after which the company's shares become publicly tradable. Types of Phoenix Arizona IPO Time and Responsibility Schedule can include variations based on industry, company size, and financial goals. For example: 1. Technology IPO Time and Responsibility Schedule: Tailored for technology companies aiming to go public, highlighting industry-specific considerations, such as intellectual property protection, emerging market trends, and innovation pipelines. 2. Real Estate IPO Time and Responsibility Schedule: Focused on companies involved in the real estate sector, considering property valuation, market dynamics, regulatory compliance, and project pipeline as significant factors influencing the IPO process. 3. Biotechnology IPO Time and Responsibility Schedule: Specifically tailored for biotech companies, emphasizing aspects like clinical trials, patent portfolio, regulatory approvals, and partnerships with pharmaceutical firms. In summary, the Phoenix Arizona IPO Time and Responsibility Schedule is a comprehensive framework that outlines the key stages and obligations involved in going public from the region. Whether it's technology, real estate, or biotechnology, companies can adapt this schedule to industry-specific nuances to achieve a successful IPO.