The Bexar Texas UCC1 National Financial Statement is an essential document used to record and establish priority of security interests in personal property. It is filed with the Bexar County Clerk's office in Texas, adhering to the Uniform Commercial Code (UCC) standards. The UCC1 form provides crucial information about the debtor, secured party, collateral description, and other relevant details. Being a legally binding document, the Bexar Texas UCC1 National Financial Statement serves as an official record of a debtor's existing or potential liabilities and obligations. It enables lenders, creditors, and interested parties to ascertain the status of collateral and any encumbrances related to it. This form helps safeguard the interests of both borrowers and lenders by establishing priority in case of multiple claims on the same collateral. Different types of Bexar Texas UCC1 National Financial Statements include: 1. UCC1 Financing Statement: This is a standard form used to establish a creditor's security interest in personal property. It typically includes information like the debtor's name, address, secured party's name, collateral description, and any additional terms or conditions. 2. UCC1 Amendment: If there are any changes or updates to the original UCC1 Financing Statement, an amendment is filed to reflect the modifications. It may involve updating debtor or secured party information or making changes to the collateral description. 3. UCC1 Continuation Statement: A continuation statement is filed to extend the effectiveness of the initial UCC1 Financing Statement after its expiration, ensuring that the security interest remains valid for an extended period. It indicates the debtor's intention to continue the original filing beyond the initial expiration period. 4. UCC1 Termination Statement: When a debtor has satisfied their obligations or a secured party's interest is terminated, a termination statement is filed to officially release the security interest. This document signifies the end of the security agreement and removes any claims or encumbrances against the collateral. Overall, the Bexar Texas UCC1 National Financial Statement is an indispensable tool for businesses, lenders, and creditors to protect their interests and ensure transparency in financial transactions. Whether it's the initial Financing Statement, an amendment, continuation, or termination, these documents play a vital role in maintaining accurate and up-to-date records of secured transactions.

Bexar Texas UCC1 National Financial Statement

Description

How to fill out Bexar Texas UCC1 National Financial Statement?

Drafting papers for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Bexar UCC1 National Financial Statement without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Bexar UCC1 National Financial Statement by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Bexar UCC1 National Financial Statement:

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

Search for a business entity (Corporation, LLC, Limited Partnership) in Texas by going to the Secretary of State's Website. Preform a lookup by Name, Tax ID Number, or File Number.

But a UCC filing does appear on your credit report, and it could affect whether you will qualify for other financing forms later down the road. For example, say that you receive funding from one lender who filed a UCC lien on some of your assets.

The Uniform Commercial Code allows a creditor, typically a financial institution or lender, to notify other creditors about a debtor's assets used as collateral for a secured transaction by filing a public notice (financing statement) with a particular filing office.

Financing statement. The purpose of the financing statement, which is filed with a public office such as the Secretary of State, is to put other people on notice of the secured party's security interest in the collateral. The UCC specifies what must be contained in a financing statement: the name of the debtor.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

Locate the correct secretary of state's website. These directories provide basic information on whether a UCC filing exists. You can easily find the website for each state's secretary of state by visiting the website of the National Association of Secretaries of State at .

How do you conduct a UCC search? Many states allow you to search filings online. If you want copies of the documents, you must make an official request to the secretary of state's office or local jurisdiction, depending on the state, and pay a fee. Another option is to use a third-party vendor.

How Does a UCC Filing Affect My Credit? A UCC filing won't impact your business credit scores directly because it doesn't indicate anything about your ability to repay your debts. However, it can affect your ability to get credit again in the future.

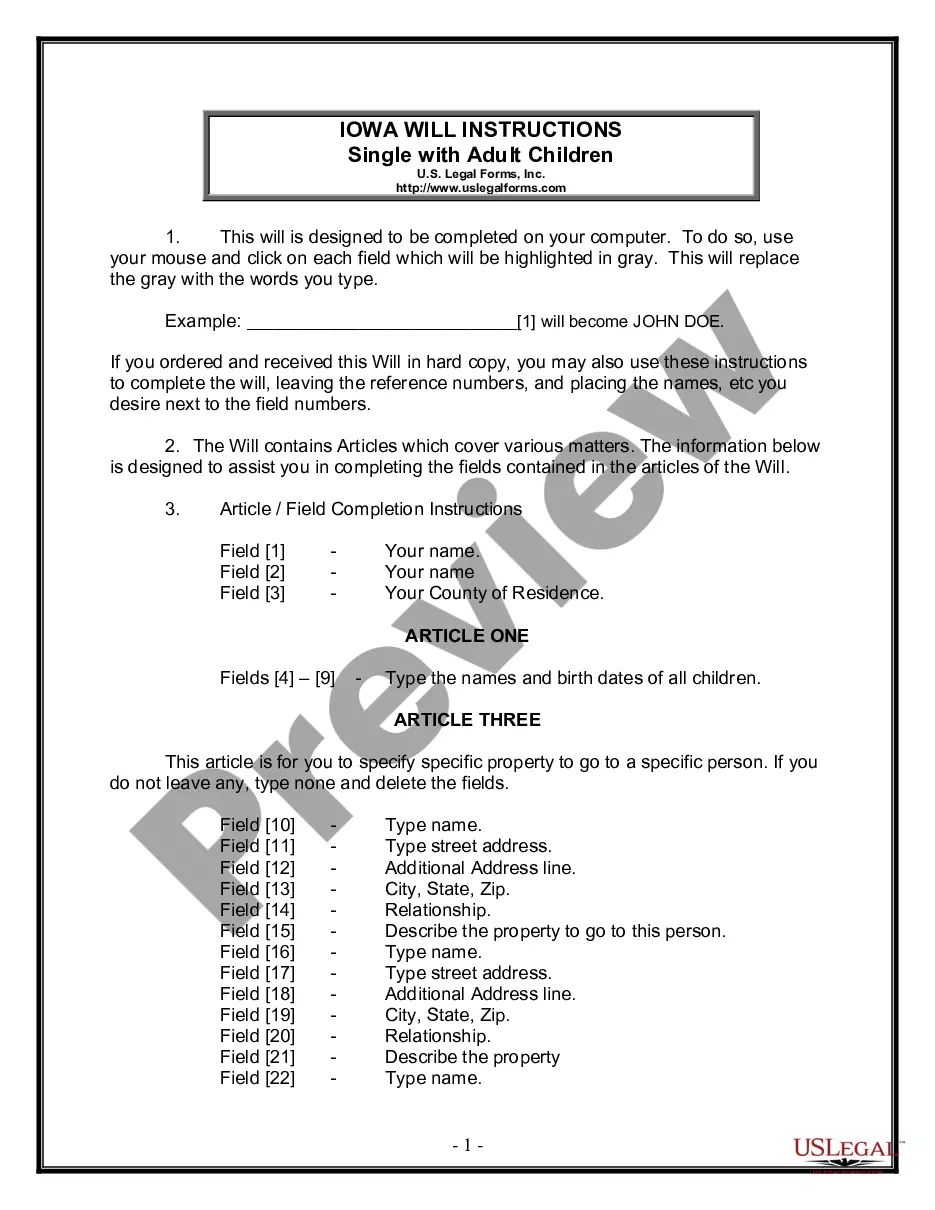

How to complete a UCC1 (Step by Step) Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

You can find Uniform Commercial Code information on any person or corporation in Texas or other states by performing a search on the UCC website of the state or territory where the person resides or the corporation is registered.