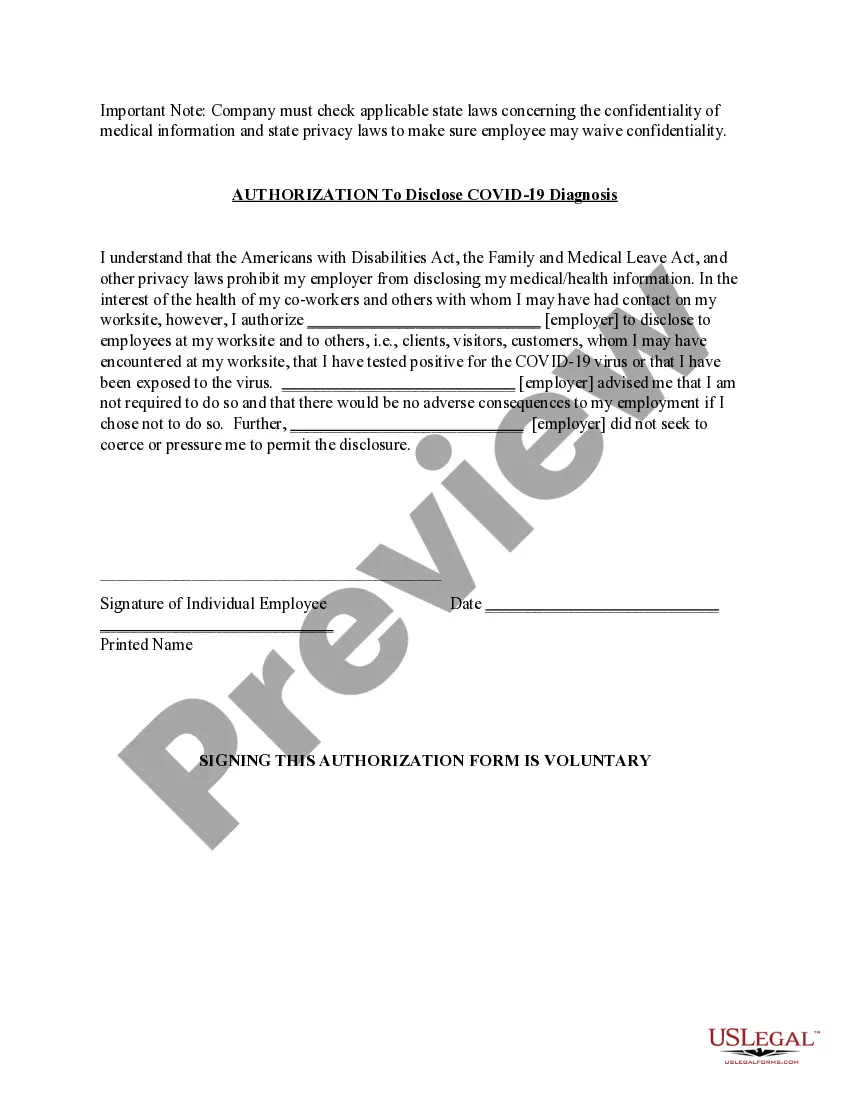

The Cook Illinois UCC1 National Financial Statement is a standardized document used to disclose financial information about businesses in Cook County, Illinois, in compliance with the Uniform Commercial Code (UCC) regulations. This statement is pivotal in securing loans, establishing creditworthiness, and protecting the interests of lenders and creditors. The Cook Illinois UCC1 National Financial Statement provides a comprehensive overview of a business's financial health and liabilities. It contains critical information, such as the company's assets, liabilities, income statements, cash flow statements, and a breakdown of their financial ratios. These ratios include liquidity ratios, debt ratios, profitability ratios, and efficiency ratios, which allow lenders to assess the financial stability and viability of the business. This financial statement is primarily utilized by lenders, creditors, and potential investors to determine the creditworthiness of a business seeking funds. It reveals the company's ability to meet its obligations and repay any borrowed funds, as well as showcases its overall financial performance. In addition to the standard Cook Illinois UCC1 National Financial Statement, there may be variations or specific types of statements tailored to different purposes. Some of these include: 1. UCC1 Secured Party's Specific Financial Statement: This statement is prepared by a secured party, such as a lender or creditor. It highlights the financial position and collateral ownership of the secured party in relation to the borrower. 2. UCC1 Subordination Agreement: This agreement outlines the conditions for subordination of potential creditors' interests in favor of existing creditors. It ensures that certain creditors have a priority claim on assets during liquidation or bankruptcy proceedings. 3. UCC1 Financing Statement: While not a financial statement itself, this form is crucial in conjunction with the Cook Illinois UCC1 National Financial Statement. It serves as public notice for a secured party's interest in a debtor's assets. 4. UCC1 Fixture Filing: This specific filing is used to record a secured party's interest in fixtures — assets that are affixed to a property, such as machinery or equipment. 5. UCC1 Amendment: This form is used to make changes or updates to a previously filed UCC1 statement, ensuring accurate and up-to-date information. Overall, the Cook Illinois UCC1 National Financial Statement and its related forms are essential tools for assessing a business's financial stability, enabling lenders and creditors to make informed decisions regarding credit extensions, loan approvals, and investment opportunities.

Cook Illinois UCC1 National Financial Statement

Description

How to fill out Cook Illinois UCC1 National Financial Statement?

Preparing documents for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Cook UCC1 National Financial Statement without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Cook UCC1 National Financial Statement by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

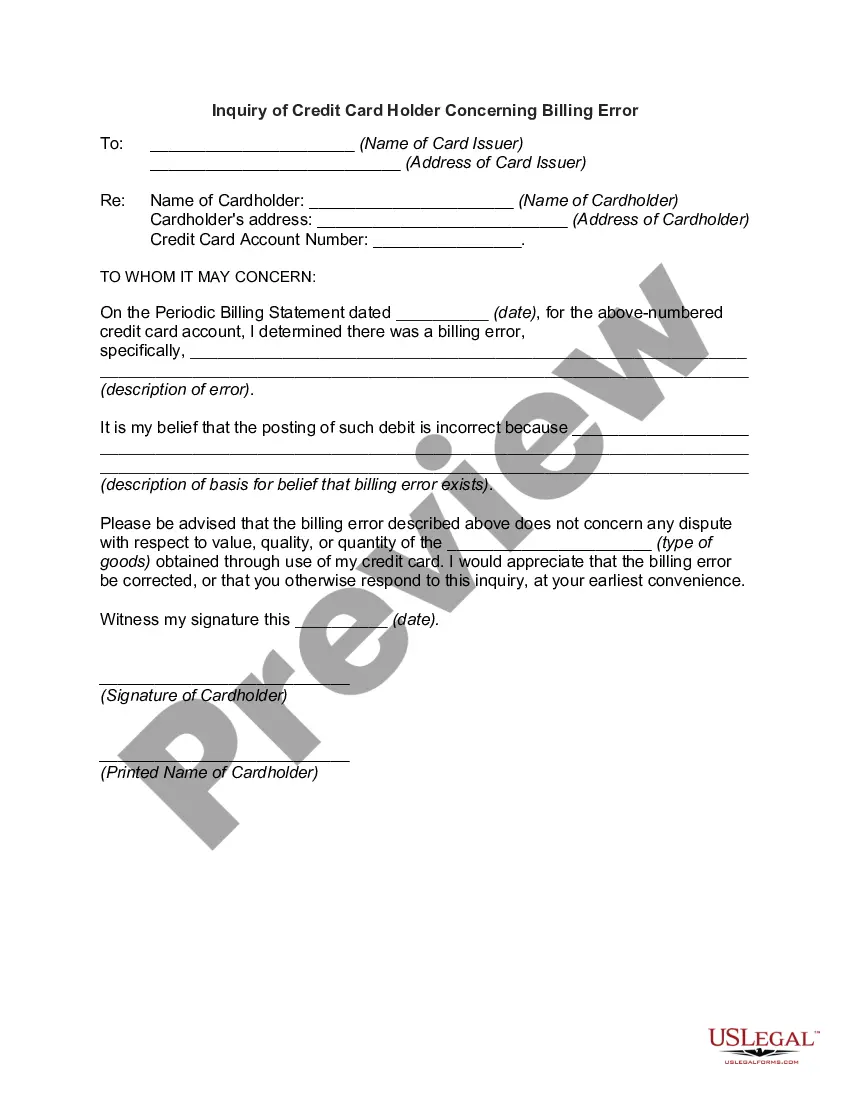

In case you still don't have a subscription, follow the step-by-step instruction below to get the Cook UCC1 National Financial Statement:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

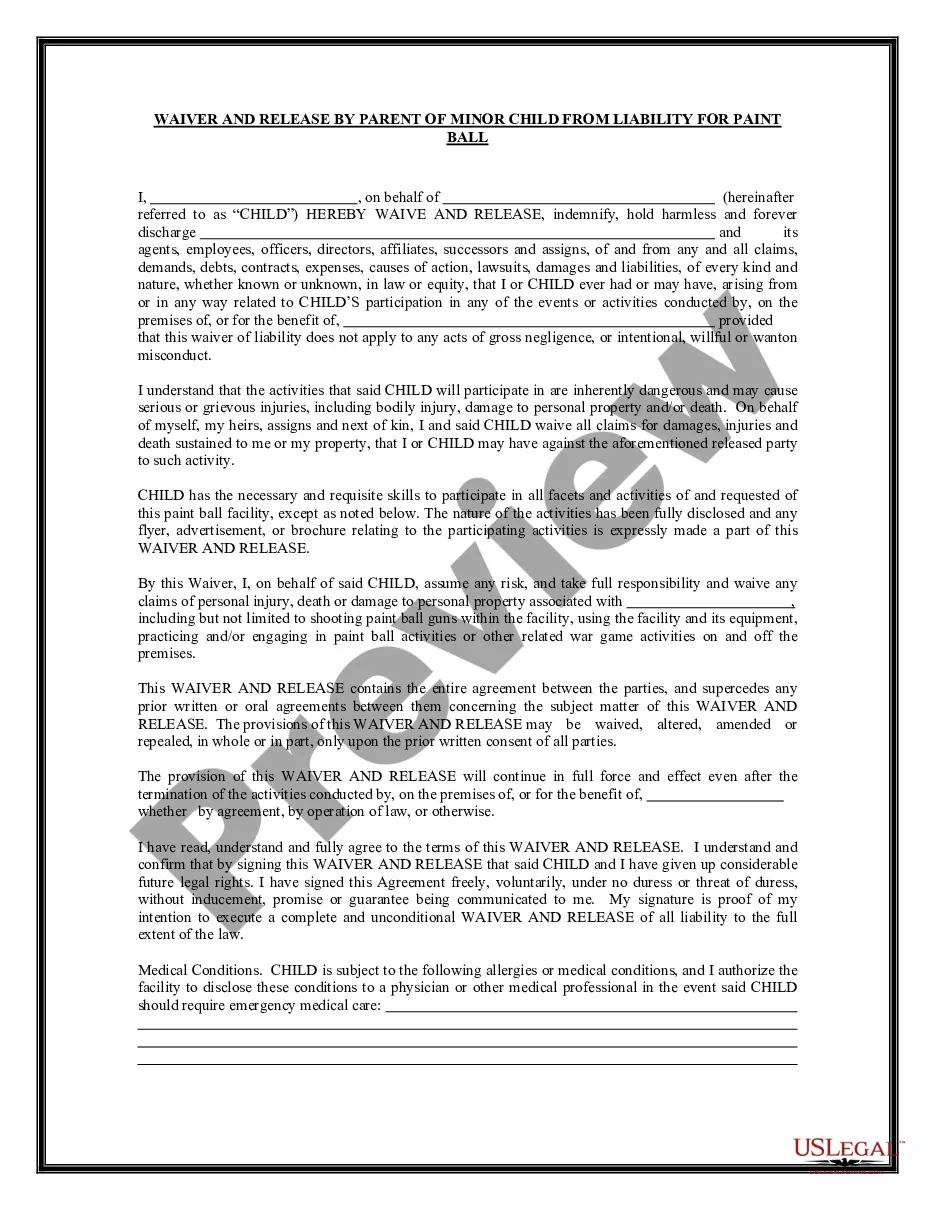

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!