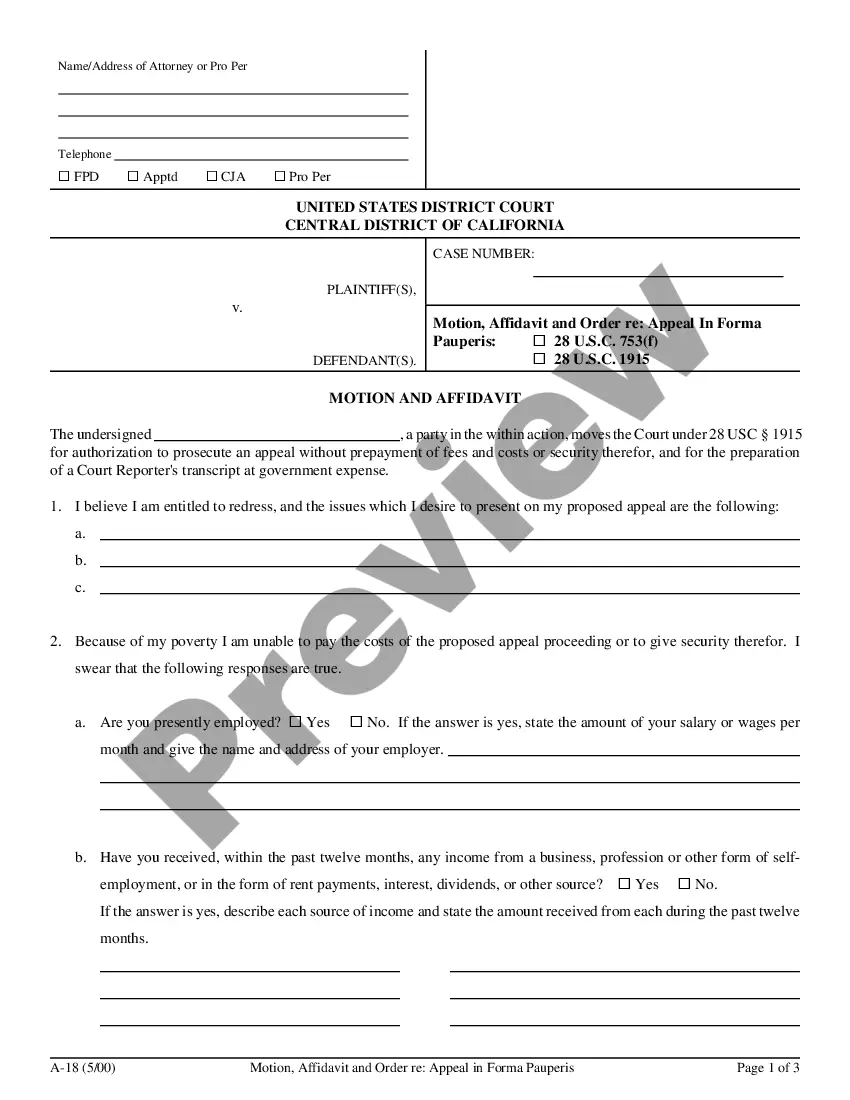

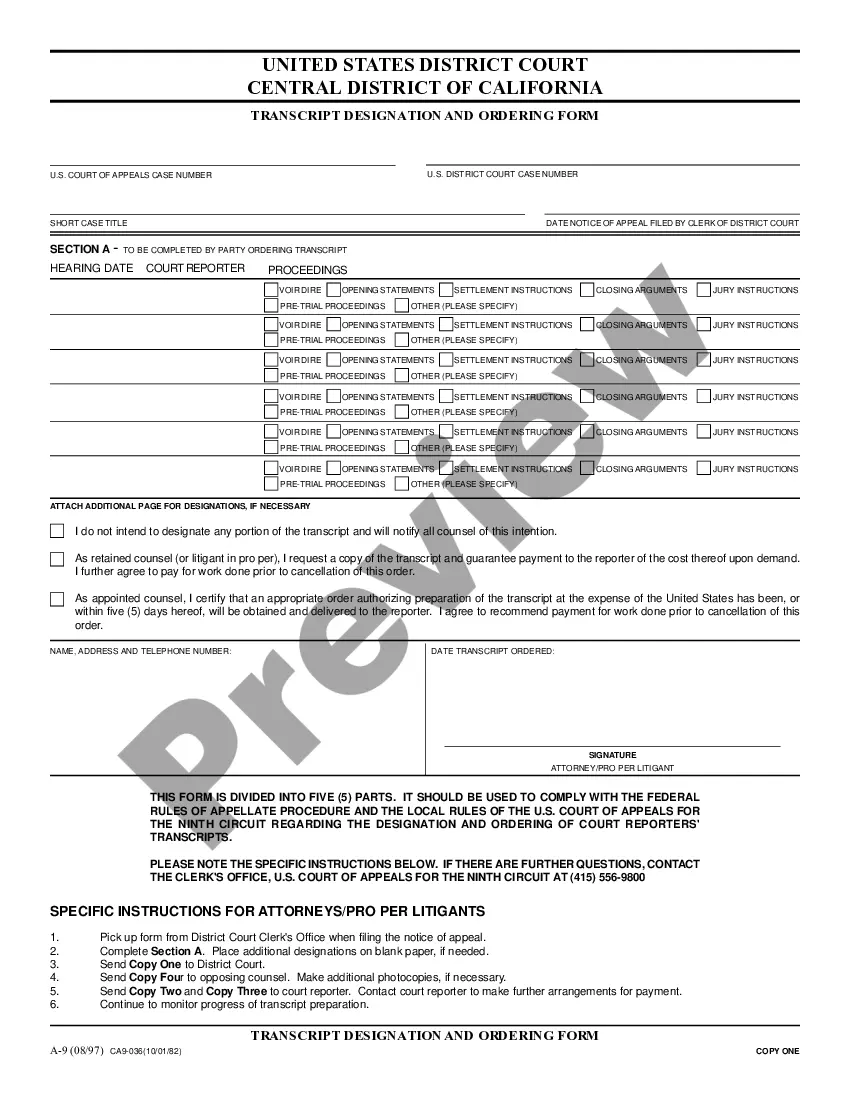

Maricopa, Arizona UCC1 National Financial Statement is a legal document used to create a record of a security interest in personal property. It serves as a public notice indicating that a particular individual or organization has a right to claim a security interest in specific collateral. The UCC1 National Financial Statement provides crucial information related to the secured party, debtor, and collateral involved in a financial transaction. It ensures transparency and allows potential creditors or interested parties to investigate existing security interests when dealing with lenders or borrowers. There are different types of UCC1 National Financial Statements that cater to various purposes and situations. Some of these variants include: 1. Initial UCC1 Statement: This type of statement is filed when a new security interest is established, providing detailed information about the secured party, debtor, and the collateral. 2. Amendment UCC1 Statement: In case of any modifications or changes to an existing UCC1 National Financial Statement, an amendment statement is filed. It updates the information related to the parties involved or alters the description of collateral. 3. Assignee UCC1 Statement: When a secured party transfers their interest or assigns their rights to another individual or organization, an assignee UCC1 statement is filed. This ensures accurate documentation of the new secured party. 4. Termination UCC1 Statement: Once a security interest is fully satisfied, this type of statement is filed to notify the concerned parties that the collateral is no longer encumbered. It effectively releases the secured party's claim on the collateral. 5. Continuation UCC1 Statement: If a UCC1 National Financial Statement's effectiveness is close to expiration or has expired and the secured party wishes to maintain their security interest, they may file a continuation statement to extend its duration. The Maricopa, Arizona UCC1 National Financial Statement is a crucial legal instrument used in financial transactions, providing a transparent record of security interests. It ensures public notice and protects the rights of both secured parties and debtors.

Maricopa Arizona UCC1 National Financial Statement

Description

How to fill out Maricopa Arizona UCC1 National Financial Statement?

Draftwing documents, like Maricopa UCC1 National Financial Statement, to manage your legal matters is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for different scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Maricopa UCC1 National Financial Statement template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Maricopa UCC1 National Financial Statement:

- Make sure that your document is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Maricopa UCC1 National Financial Statement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our service and get the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!