Dallas Texas UCC3-AD Financing Statement Amendment Addendum — Revised 7-29-98 is a legal document that contains specific information about changes made to a financing statement. It is an essential tool used in commercial transactions to update and modify existing UCC3-AD financing statements, ensuring accuracy and transparency in the business world. The revised version, dated 7-29-98, signifies that this addendum follows the latest guidelines and regulations set forth in Dallas, Texas. Under the UCC3-AD Financing Statement Amendment Addendum, there may be several types, each serving a unique purpose. Some common types include: 1. UCC3-AD Financing Statement Termination Addendum: This addendum is used when a financing statement needs to be terminated, indicating that the debtor no longer owes any debt to the secured party. 2. UCC3-AD Financing Statement Assignment Addendum: When a financing statement needs to be transferred or assigned from one secured party to another, this addendum is utilized to document the change in ownership or control. 3. UCC3-AD Financing Statement Amendment Addendum — Collateral Addition: This addendum comes into play when changes need to be made to the collateral description included in the original financing statement. It serves the purpose of adding new collateral or modifying existing descriptions. 4. UCC3-AD Financing Statement Amendment Addendum — Debtor Information Update: If there is a need to revise or update debtor-related information such as name, address, or legal entity status, this addendum is used to reflect the changes accurately. 5. UCC3-AD Financing Statement Amendment Addendum — Secured Party Information Update: In cases where the secured party's details have changed, such as name, address, or contact information, this addendum is employed to ensure the accuracy of the information presented in the financing statement. Using the Dallas Texas UCC3-AD Financing Statement Amendment Addendum — Revised 7-29-98 is crucial for maintaining the validity and enforceability of financing statements. It allows parties involved in commercial transactions to make necessary adjustments and keep the public record updated accurately. The precise documentation provided by this addendum reinforces trust and confidence among lenders, borrowers, and other stakeholders in the business community.

Dallas Texas UCC3-AD Financing Statement Amendment Addendum

Description

How to fill out Dallas Texas UCC3-AD Financing Statement Amendment Addendum?

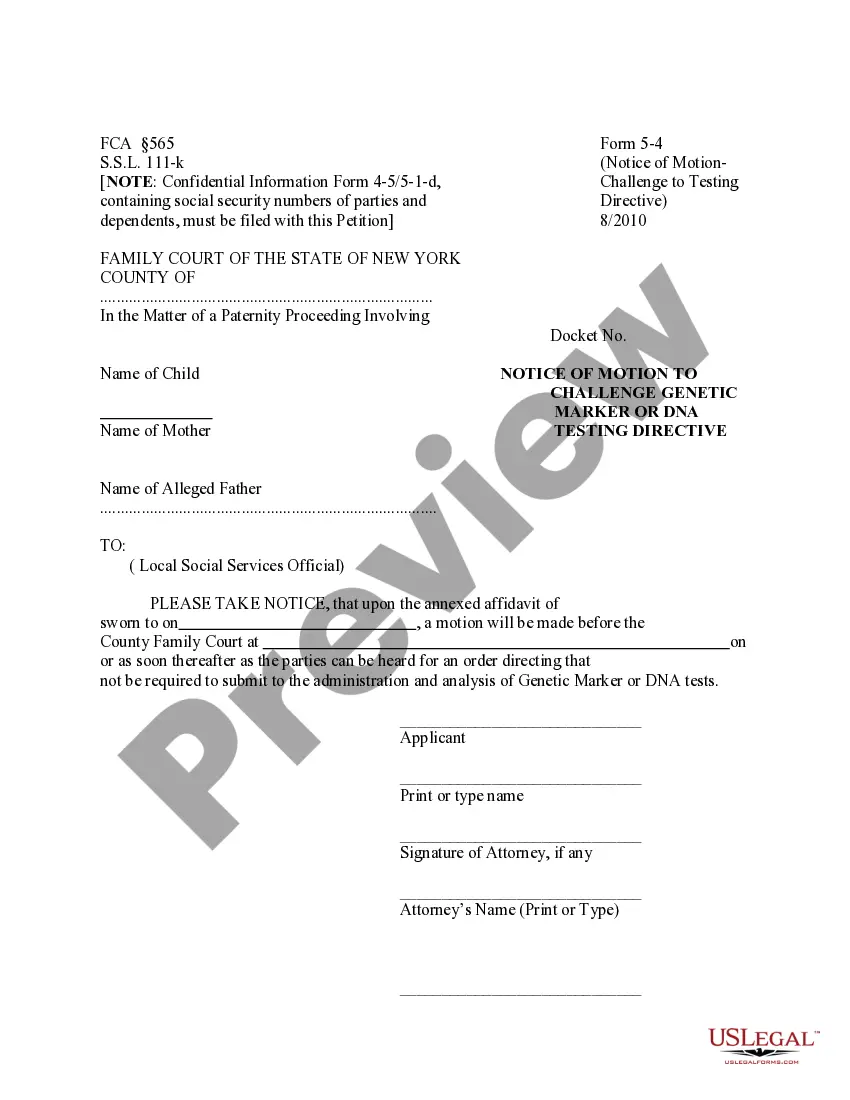

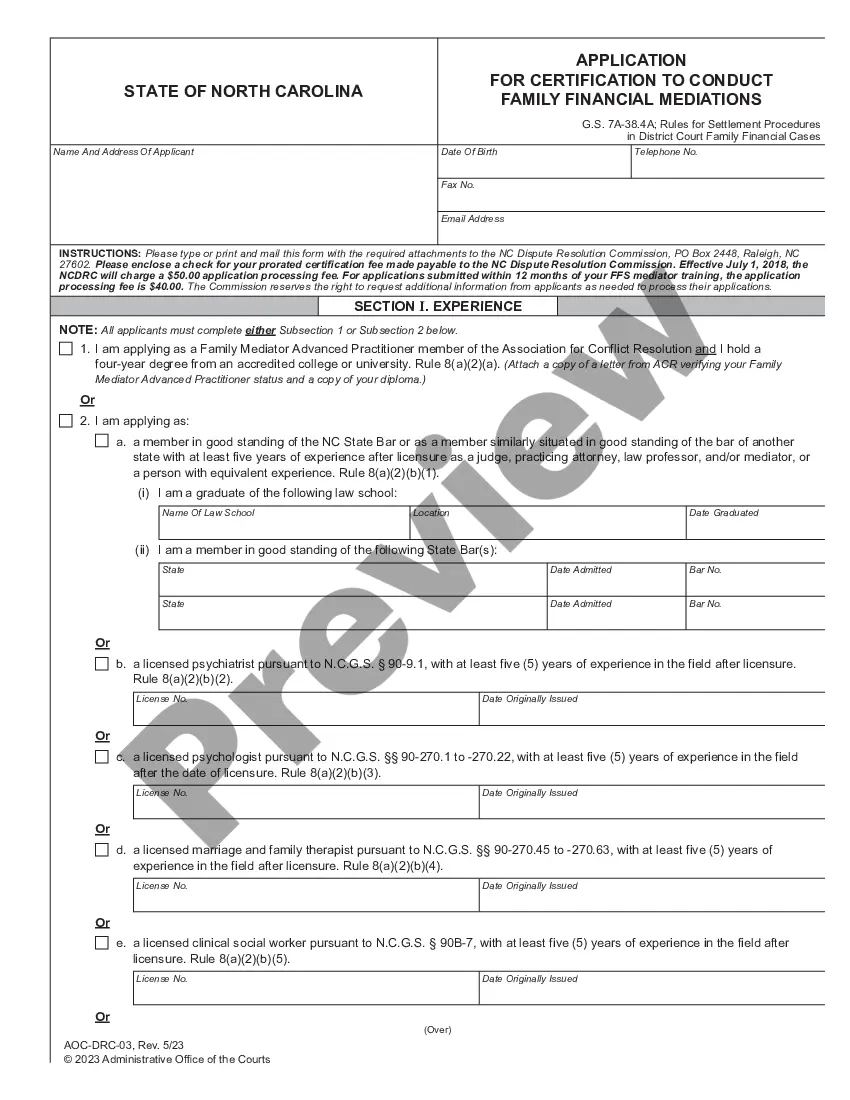

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Dallas UCC3-AD Financing Statement Amendment Addendum - Revised 7-29-98 is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Dallas UCC3-AD Financing Statement Amendment Addendum - Revised 7-29-98. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas UCC3-AD Financing Statement Amendment Addendum - Revised 7-29-98 in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

What is UCC3 Termination? UCC-3 Filing step-by-step - YouTube YouTube Start of suggested clip End of suggested clip You should also include a copy of the original UCC. Filing. So the lender can reference it quickly IMoreYou should also include a copy of the original UCC. Filing. So the lender can reference it quickly I like to do steps number one and two simultaneously.

If a lender is making a loan that includes real estate and other company assets of the business they will file both a deed of trust in the local courthouse and a UCC-1 Financing Statement with the Texas Secretary of State's office.

Although Article 9 was intended to make this process uniform, UCC filing rules can vary in each state. Pay attention to detail in debtor name requirements.Decide where to file UCC financing statements by location of the debtor.Allow ample filing time depending on jurisdiction.Ensure all relevant records are uncovered.

To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

If you need to remove a UCC filing form your credit report, ask the lender to file for its removal. In order to do this, they need to file a UCC-3 Financing Statement Amendment. You can also just wait it out. Depending on how long you have been with the lender, the filing may be removed within a few months.

A secured party can perfect a security interest by filing a financing statement with the appropriate state or local office. (3) a description of the collateral by item or type.

All other types of amendment filings would require the filing of a financing statement in the Office of the Secretary of State. Documents pertaining to real estate records are to be filed in the Office of the County Clerk. Please obtain legal advice prior to filing documents in the Office of the County Clerk.

To amend your collateral description, click the button labeled View/Amend Collateral. After clicking this button, a pop-up will appear and will display the current collateral description and provide options to Add Collateral, Delete Collateral or Change Collateral.

Whether you are amending a filing or terminating a filing, if you are redirected to the UCC Services Request form, complete all tabs of the service request you can do this by making the changes and then clicking Next on the bottom right of the screen. Next till you can't next no more! and then click Submit.

UCC. A UCC3 is a change statement to a UCC1. It's an amendment filing to an original UCC1 financing statement that changes or adds information to the originally filed UCC1. It's a filing tool secured parties use to manage their UCC portfolio to maintain their perfected security interests.