The Wake North Carolina Agreement for Rights under Third Party Deed of Trust is a legally binding document that outlines the rights and obligations of all parties involved in a real estate transaction. This agreement specifically pertains to properties located in Wake County, North Carolina. Under this agreement, the "third party" refers to an individual or entity that holds a deed of trust on the property, typically a lender or a mortgage company. The purpose of the agreement is to establish the rights and responsibilities of this third party in relation to the property and any future transactions or legal proceedings involving the property. This agreement details the specific rights granted to the third party, including the ability to enforce the terms of the deed of trust, such as foreclosure in the event of default. It also outlines the obligations of the third party, such as maintaining proper documentation and providing notice to the property owner in case of any actions taken under the deed of trust. Different types of Wake North Carolina Agreement for Rights under Third Party Deed of Trust may include variations based on the specific terms and conditions agreed upon by the parties involved. These variations could include provisions related to interest rates, repayment terms, and other specific details that may vary from one agreement to another. In summary, the Wake North Carolina Agreement for Rights under Third Party Deed of Trust is an important legal document that ensures clarity and protection for all parties involved in a real estate transaction in Wake County. It safeguards the rights of the third party holding the deed of trust and outlines the obligations and responsibilities associated with that role.

Wake North Carolina Agreement for Rights under Third Party Deed of Trust

Description

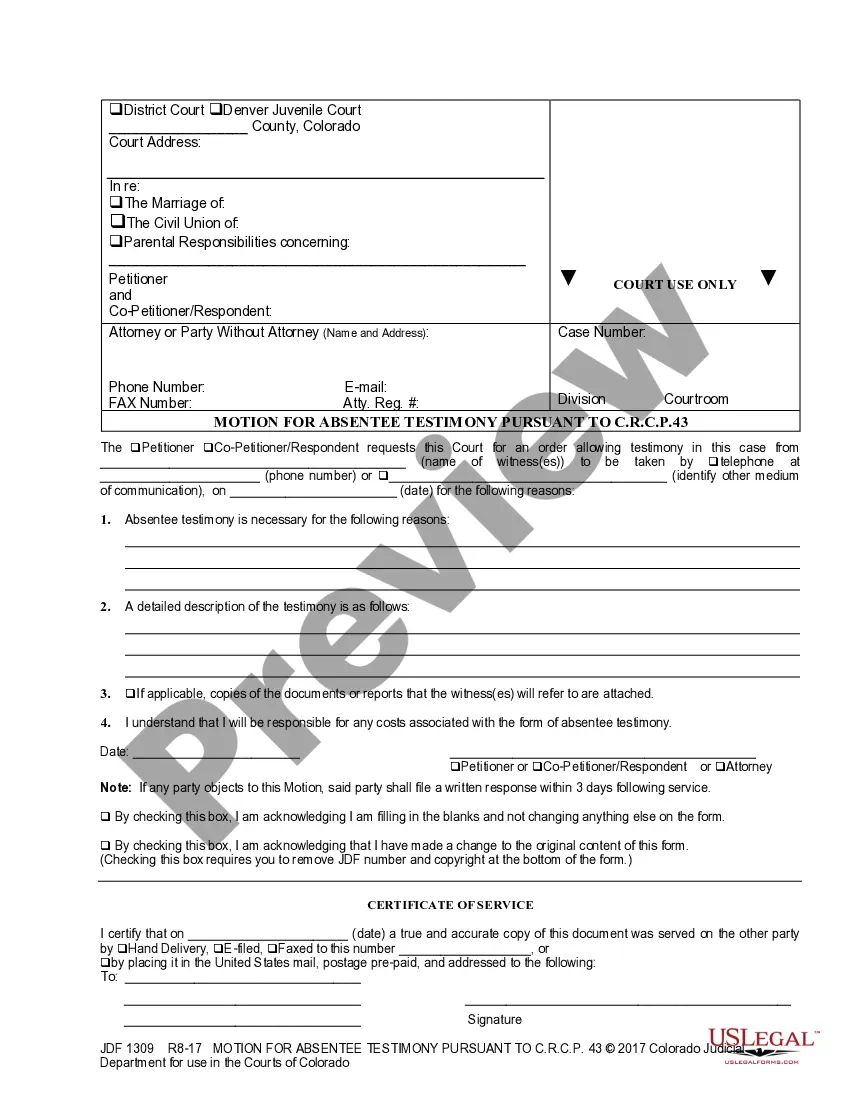

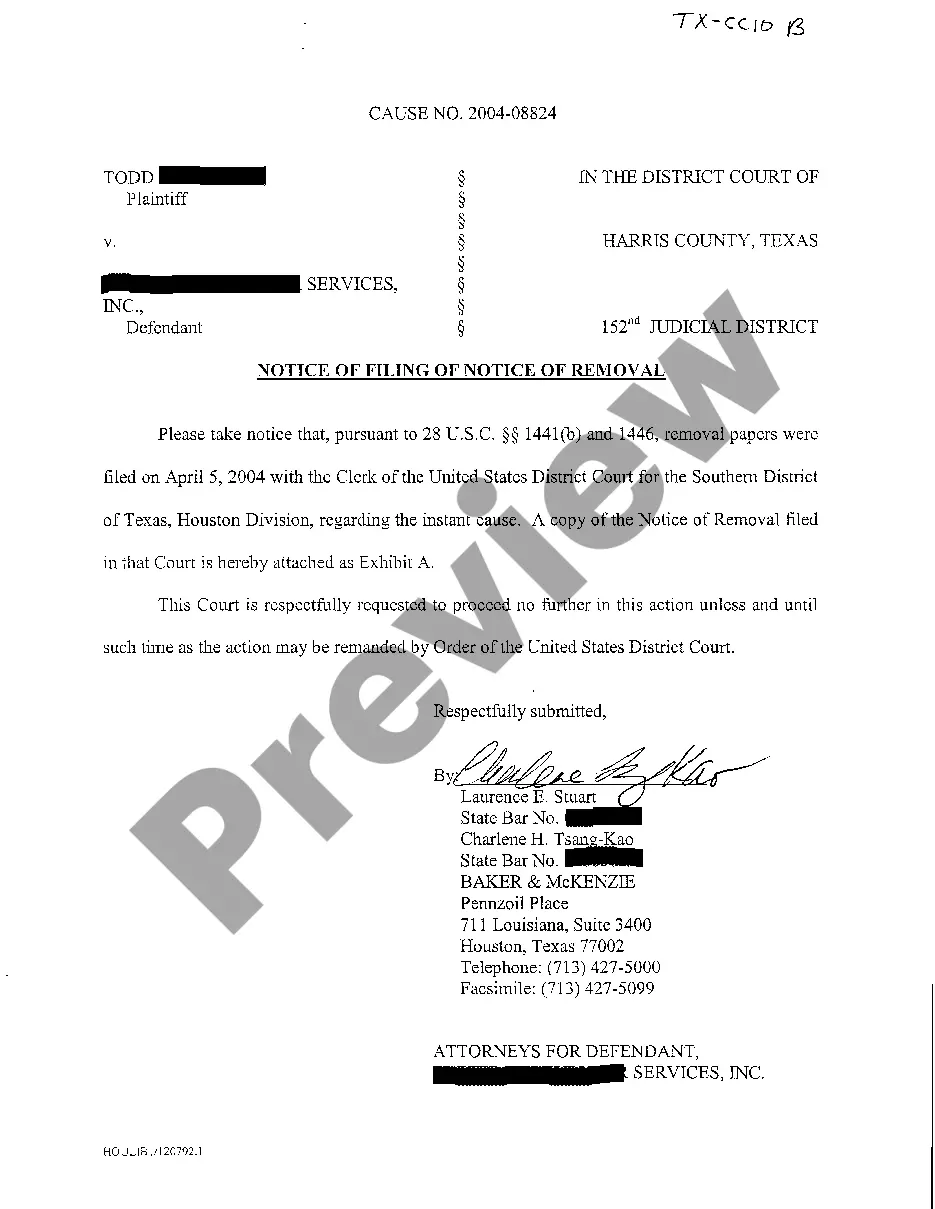

How to fill out Wake North Carolina Agreement For Rights Under Third Party Deed Of Trust?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Wake Agreement for Rights under Third Party Deed of Trust, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Wake Agreement for Rights under Third Party Deed of Trust, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wake Agreement for Rights under Third Party Deed of Trust:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Wake Agreement for Rights under Third Party Deed of Trust and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

While a mortgage involves two parties, a deed of trust involves three: the trustor (the borrower) the lender (sometimes called a "beneficiary"), and. the trustee.

The deed of trust is the security for the amount loaned to finance the real estate purchase, and is secured by the underlying piece of real estate. The deed of trust is what secures the promissory note.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

The trustee's primary function is to hold and maintain a property title for the borrower and the lender for the duration of the loan. Therefore, it is the trustee who retains factual ownership and control of the property in question, not the lender.

Deed of Trust Versus Promissory Note While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt. A borrower signs the promissory note in favor of a lender.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

What type of foreclosure is commonly used when a deed of trust is the security instrument? Because the right to sell in the event of a default is part of the deed of trust's language, a non-judicial foreclosure may be used.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a trustee. The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.