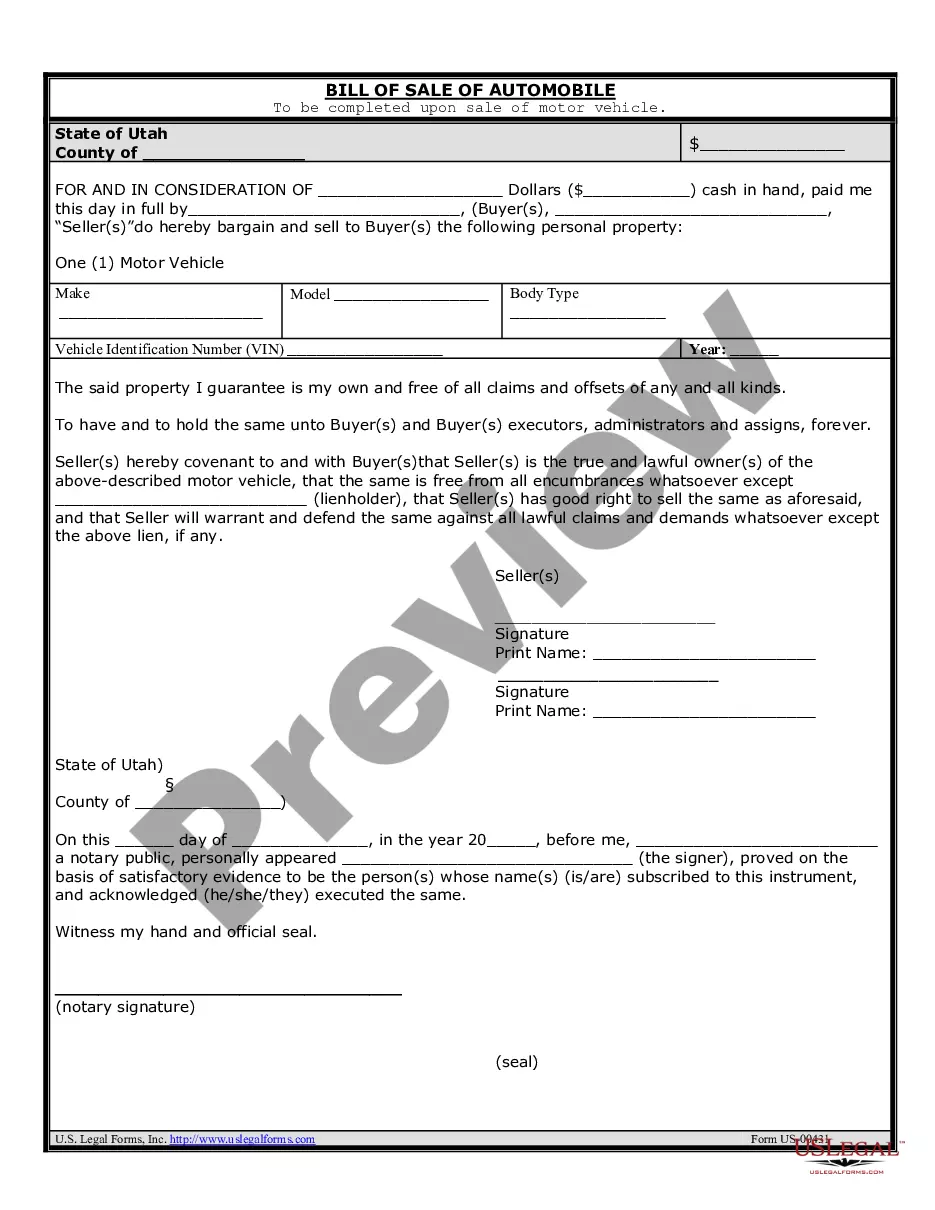

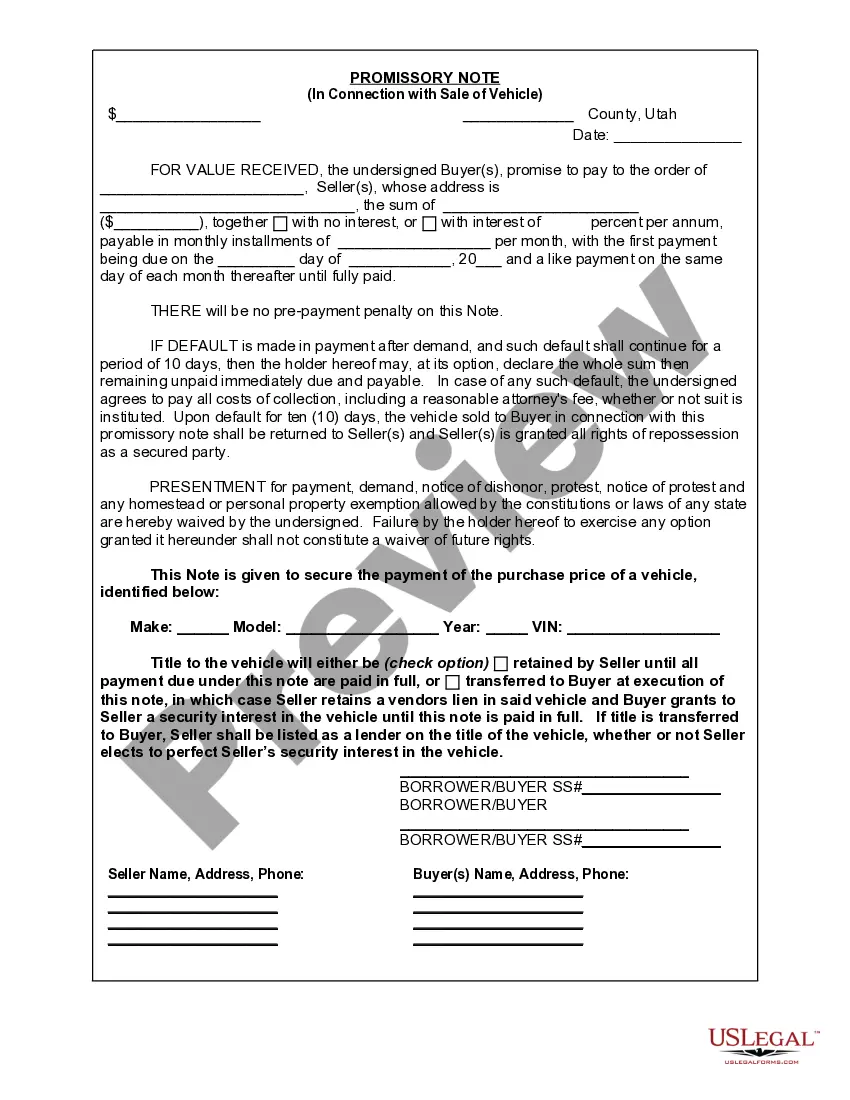

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Salt Lake City Utah Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle. This promissory note is often used when the buyer cannot pay the full amount upfront and agrees to make installment payments to the seller over a specified period of time. This Promissory Note serves as proof of the buyer's promise to repay the loan and includes important details such as the vehicle's description, sale price, payment schedule, interest rate (if applicable), late payment penalties, and any additional terms or conditions agreed upon by both parties. Below are several types of Salt Lake City Utah Promissory Notes commonly used in connection with the sale of a vehicle or automobile: 1. Simple Promissory Note: This type of promissory note establishes a straightforward agreement between the buyer and seller. It outlines the payment terms, including the amount of each installment, due dates, and any penalties for late payments. 2. Secured Promissory Note: In some cases, a seller may require collateral to ensure the buyer's commitment to repay the loan. This type of promissory note includes details regarding the specific collateral (e.g., the vehicle itself) and the seller's rights if the buyer fails to make payments as agreed. 3. Balloon Payment Promissory Note: This promissory note allows the buyer to make smaller monthly payments for a specified period, with a larger final payment, known as a balloon payment, due at the end. This type of arrangement is suitable for buyers who expect to receive a lump sum of money in the future. 4. Promissory Note with Cosigner: If the buyer has a less-than-perfect credit history, the seller may request a cosigner who is responsible for the loan if the buyer defaults. This promissory note includes details of the cosigner's obligations and liabilities. 5. Promissory Note with Interest: If the seller decides to charge interest on the outstanding amount, this type of promissory note specifies the interest rate, how it is calculated, and the total amount payable by the buyer over the loan term. A Salt Lake City Utah Promissory Note in Connection with the Sale of Vehicle or Automobile is a crucial legal document that protects the rights and obligations of both the buyer and seller. It is necessary to consult with a professional or an attorney to ensure all relevant state and local laws are adhered to when drafting and executing such a document.A Salt Lake City Utah Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle. This promissory note is often used when the buyer cannot pay the full amount upfront and agrees to make installment payments to the seller over a specified period of time. This Promissory Note serves as proof of the buyer's promise to repay the loan and includes important details such as the vehicle's description, sale price, payment schedule, interest rate (if applicable), late payment penalties, and any additional terms or conditions agreed upon by both parties. Below are several types of Salt Lake City Utah Promissory Notes commonly used in connection with the sale of a vehicle or automobile: 1. Simple Promissory Note: This type of promissory note establishes a straightforward agreement between the buyer and seller. It outlines the payment terms, including the amount of each installment, due dates, and any penalties for late payments. 2. Secured Promissory Note: In some cases, a seller may require collateral to ensure the buyer's commitment to repay the loan. This type of promissory note includes details regarding the specific collateral (e.g., the vehicle itself) and the seller's rights if the buyer fails to make payments as agreed. 3. Balloon Payment Promissory Note: This promissory note allows the buyer to make smaller monthly payments for a specified period, with a larger final payment, known as a balloon payment, due at the end. This type of arrangement is suitable for buyers who expect to receive a lump sum of money in the future. 4. Promissory Note with Cosigner: If the buyer has a less-than-perfect credit history, the seller may request a cosigner who is responsible for the loan if the buyer defaults. This promissory note includes details of the cosigner's obligations and liabilities. 5. Promissory Note with Interest: If the seller decides to charge interest on the outstanding amount, this type of promissory note specifies the interest rate, how it is calculated, and the total amount payable by the buyer over the loan term. A Salt Lake City Utah Promissory Note in Connection with the Sale of Vehicle or Automobile is a crucial legal document that protects the rights and obligations of both the buyer and seller. It is necessary to consult with a professional or an attorney to ensure all relevant state and local laws are adhered to when drafting and executing such a document.