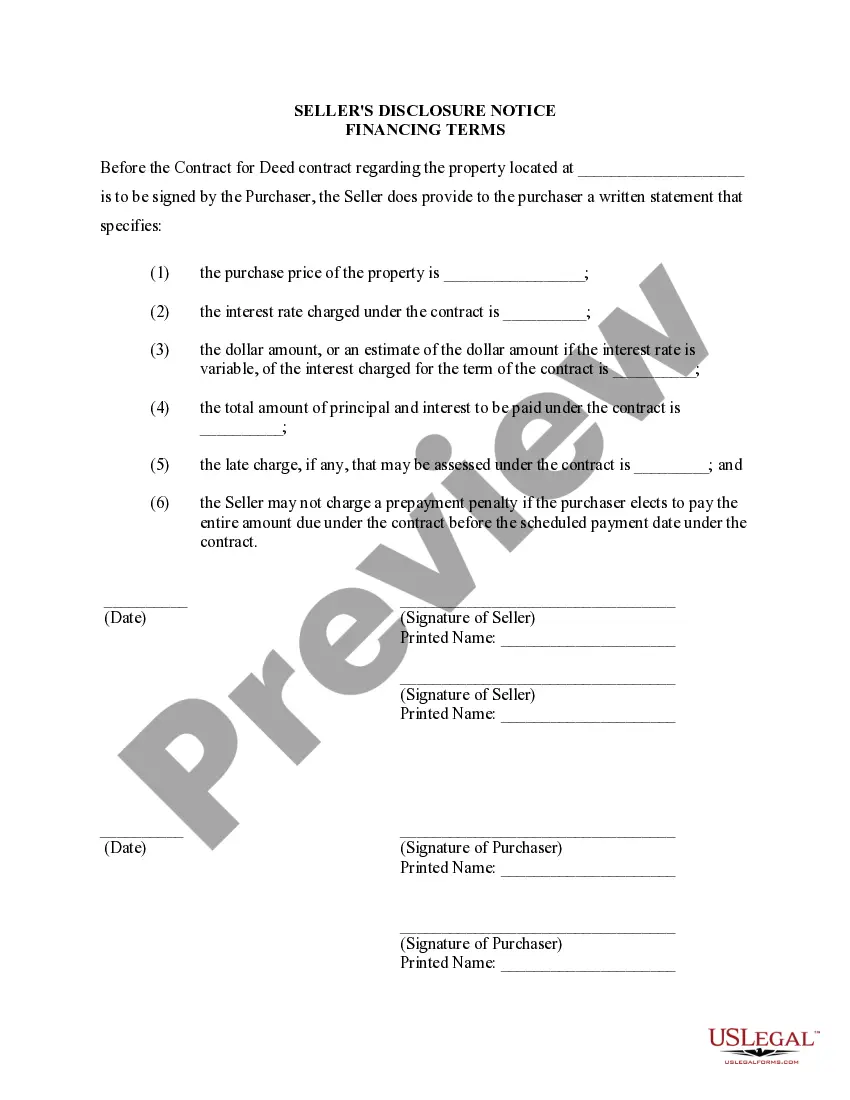

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property is a crucial document that provides transparency and protection for both the buyer and seller involved in a Contract or Agreement for Deed, also known as a Land Contract. This disclosure plays a significant role in ensuring that all parties are aware of the financing terms and conditions of the property being sold. The Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property includes essential information such as the purchase price, down payment amount, interest rate, payment schedule, and any additional fees or charges associated with the financing agreement. This disclosure is designed to inform the buyer about the terms they are entering into and help them make an informed decision. In addition to the standard Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property, there may be variations or specific types depending on the specific circumstances of the transaction. Some possible variations include: 1. Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property with a Balloon Payment: This type of disclosure is used when the financing agreement includes a balloon payment, which means that a large portion of the principal balance becomes due at the end of a specific term. 2. Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property with Adjustable Rate Mortgage (ARM): In this type of disclosure, the financing terms include an adjustable interest rate that may vary over the life of the loan. The disclosure will detail how the interest rate is determined and when adjustments can occur. 3. Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property with Seller Financing: If the seller is providing the financing for the property, this form will outline the specific terms and conditions agreed upon by both parties. It will include information on the interest rate, repayment schedule, and any other relevant terms. It is crucial for both buyers and sellers to carefully review the Salt Lake Utah Seller's Disclosure of Financing Terms for Residential Property to ensure they fully understand the financial obligations and implications of the agreement. Furthermore, it is recommended to seek legal advice or consult with a real estate professional if any questions or concerns arise during the process.