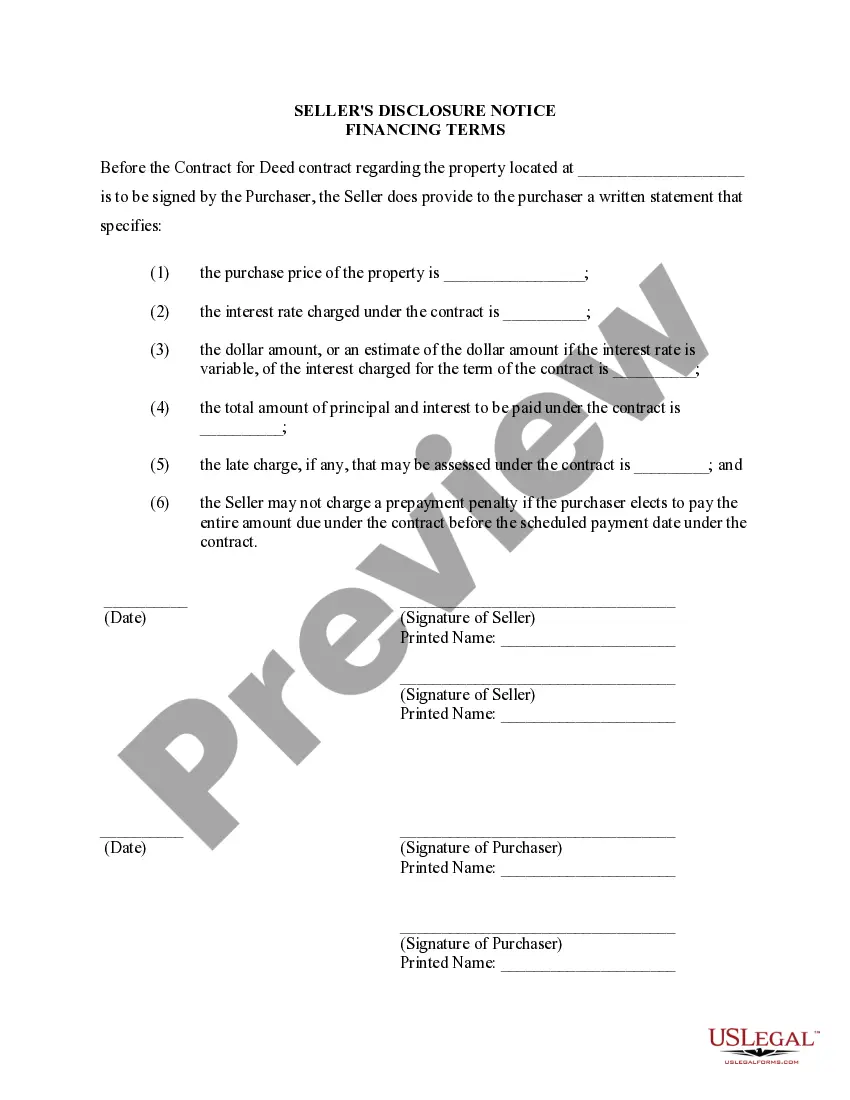

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

In West Jordan, Utah, the Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an essential document for both buyers and sellers involved in a real estate transaction. This disclosure provides crucial information about the financing terms and conditions that apply to the sale of the residential property. The West Jordan Utah Seller's Disclosure of Financing Terms typically includes the following details: 1. Purchase Price: This section outlines the agreed-upon purchase price for the residential property stated in the contract or agreement for deed. It ensures transparency between the buyer and seller regarding the financial aspect of the transaction. 2. Down Payment: The disclosure specifies the amount or percentage of the down payment required from the buyer as part of the financing agreement. This helps the buyer understand the initial investment necessary for the property purchase. 3. Interest Rate: Sellers disclose the interest rate applicable to the financing arrangement. This important detail indicates the cost of borrowing funds for the purchase and must be clearly stated to avoid any misunderstandings. 4. Payment Schedule: The disclosure outlines the payment schedule agreed upon between the buyer and seller. This includes the number of installments, their frequency (e.g., monthly, semi-annually), and the due date for each payment. 5. Late Payment Penalties: Sellers may include relevant late payment penalty provisions to protect their interests in case the buyer fails to make payments on time. This clause outlines the penalty amount or percentage applicable and serves as a deterrent for delayed or missed payments. 6. Balloon Payment: In some West Jordan Utah Seller's Disclosures of Financing Terms, there may be provisions for a balloon payment. This occurs when the buyer must make a large lump-sum payment towards the end of the agreement, typically after a set number of years. 7. Default and Remedies: This section details the consequences if either party defaults on the terms of the financing agreement. It outlines the remedies available to the non-defaulting party, which may include foreclosure, termination of the agreement, or legal action. Different types or variations of West Jordan Utah Seller's Disclosure of Financing Terms for Residential Property may exist based on the specific terms negotiated between the buyer and seller. These variations can include: — Customized Interest Rates: The seller may offer different interest rates based on the buyer's creditworthiness, payment history, or the negotiated terms of the agreement. — Creative Financing Options: Some sellers may offer unique financing options, such as adjustable-rate mortgages, interest-only payments, or rent-to-own arrangements. These scenarios could result in variations to the standard Seller's Disclosure of Financing Terms. It is important for both buyers and sellers to review and understand the West Jordan Utah Seller's Disclosure of Financing Terms thoroughly before entering into any contract or agreement for deed. Seeking legal advice or consulting a real estate professional can help ensure all parties are well-informed and protected throughout the transaction.In West Jordan, Utah, the Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an essential document for both buyers and sellers involved in a real estate transaction. This disclosure provides crucial information about the financing terms and conditions that apply to the sale of the residential property. The West Jordan Utah Seller's Disclosure of Financing Terms typically includes the following details: 1. Purchase Price: This section outlines the agreed-upon purchase price for the residential property stated in the contract or agreement for deed. It ensures transparency between the buyer and seller regarding the financial aspect of the transaction. 2. Down Payment: The disclosure specifies the amount or percentage of the down payment required from the buyer as part of the financing agreement. This helps the buyer understand the initial investment necessary for the property purchase. 3. Interest Rate: Sellers disclose the interest rate applicable to the financing arrangement. This important detail indicates the cost of borrowing funds for the purchase and must be clearly stated to avoid any misunderstandings. 4. Payment Schedule: The disclosure outlines the payment schedule agreed upon between the buyer and seller. This includes the number of installments, their frequency (e.g., monthly, semi-annually), and the due date for each payment. 5. Late Payment Penalties: Sellers may include relevant late payment penalty provisions to protect their interests in case the buyer fails to make payments on time. This clause outlines the penalty amount or percentage applicable and serves as a deterrent for delayed or missed payments. 6. Balloon Payment: In some West Jordan Utah Seller's Disclosures of Financing Terms, there may be provisions for a balloon payment. This occurs when the buyer must make a large lump-sum payment towards the end of the agreement, typically after a set number of years. 7. Default and Remedies: This section details the consequences if either party defaults on the terms of the financing agreement. It outlines the remedies available to the non-defaulting party, which may include foreclosure, termination of the agreement, or legal action. Different types or variations of West Jordan Utah Seller's Disclosure of Financing Terms for Residential Property may exist based on the specific terms negotiated between the buyer and seller. These variations can include: — Customized Interest Rates: The seller may offer different interest rates based on the buyer's creditworthiness, payment history, or the negotiated terms of the agreement. — Creative Financing Options: Some sellers may offer unique financing options, such as adjustable-rate mortgages, interest-only payments, or rent-to-own arrangements. These scenarios could result in variations to the standard Seller's Disclosure of Financing Terms. It is important for both buyers and sellers to review and understand the West Jordan Utah Seller's Disclosure of Financing Terms thoroughly before entering into any contract or agreement for deed. Seeking legal advice or consulting a real estate professional can help ensure all parties are well-informed and protected throughout the transaction.