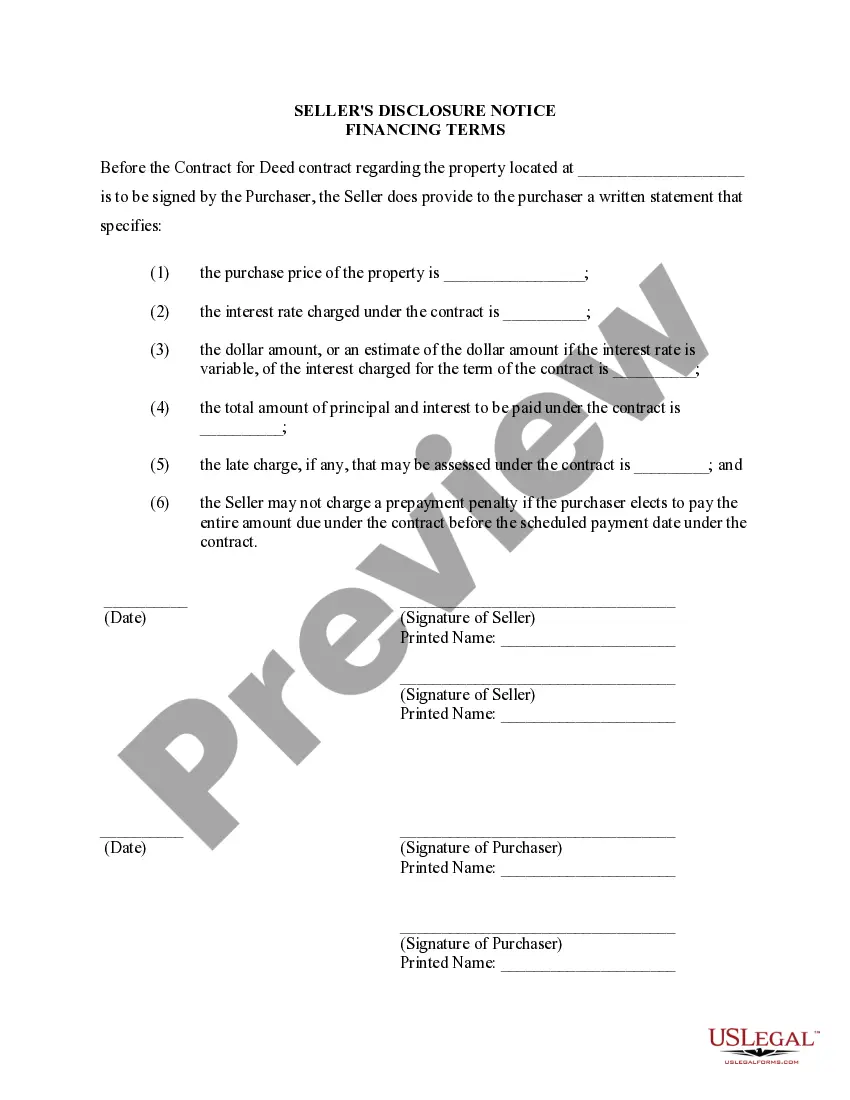

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The West Valley City Utah Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the specific financing terms and conditions between the seller (or vendor) and the buyer (or Vendée) of a residential property. It serves as a disclosure statement to ensure transparency and clarity regarding the financial aspects of the transaction. The disclosure typically covers several key points, including: 1. Purchase Price: The agreement must clearly specify the total purchase price of the property, including any down payment and financing arrangements agreed upon by both parties. 2. Installment Payments: If the purchase is structured as an agreement for deed or land contract, the disclosure should outline the installment payment schedule, including the frequency, amount, and duration of payments. 3. Interest Rate: The agreed-upon interest rate should be explicitly stated in the disclosure, ensuring both parties are aware of the financial implications of the transaction. It is essential to clarify whether the rate is fixed or adjustable. 4. Late Payment Penalties: The disclosure necessarily includes any penalties or charges applicable in the event of late payments or default by the Vendée, providing clarity regarding potential consequences and added costs. 5. Grace Period: If the buyer has a grace period before late fees or penalties are assessed, this should be clearly stated in the disclosure to ensure transparency and outline the terms of the agreement. 6. Assignment: The disclosure may include terms related to the assignment of the contract, explaining whether the Vendée has the right to assign the agreement to another party or if the consent of the vendor is required. 7. Property Taxes and Insurance: It is vital to address the payment responsibilities for property taxes and insurance premiums in the disclosure, specifying if they are included in the installment payments or if they are the sole responsibility of the Vendée. 8. Default and Remedies: The disclosure should provide information on the consequences of defaulting on the agreement, including the remedies available to the vendor and any potential loss of equity or property rights for the Vendée. 9. Rights and Obligations: The document may detail the rights and obligations of both parties, including maintenance responsibilities, improvements, and any restrictions on the use of the property during the contract term. Different variations or types of the West Valley City Utah Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may exist depending on specific variations in state law, local regulations, or specific contractual arrangements entered into by the parties. It is crucial to consult with legal professionals or experts familiar with local real estate practices ensuring compliance with the relevant laws and regulations.The West Valley City Utah Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the specific financing terms and conditions between the seller (or vendor) and the buyer (or Vendée) of a residential property. It serves as a disclosure statement to ensure transparency and clarity regarding the financial aspects of the transaction. The disclosure typically covers several key points, including: 1. Purchase Price: The agreement must clearly specify the total purchase price of the property, including any down payment and financing arrangements agreed upon by both parties. 2. Installment Payments: If the purchase is structured as an agreement for deed or land contract, the disclosure should outline the installment payment schedule, including the frequency, amount, and duration of payments. 3. Interest Rate: The agreed-upon interest rate should be explicitly stated in the disclosure, ensuring both parties are aware of the financial implications of the transaction. It is essential to clarify whether the rate is fixed or adjustable. 4. Late Payment Penalties: The disclosure necessarily includes any penalties or charges applicable in the event of late payments or default by the Vendée, providing clarity regarding potential consequences and added costs. 5. Grace Period: If the buyer has a grace period before late fees or penalties are assessed, this should be clearly stated in the disclosure to ensure transparency and outline the terms of the agreement. 6. Assignment: The disclosure may include terms related to the assignment of the contract, explaining whether the Vendée has the right to assign the agreement to another party or if the consent of the vendor is required. 7. Property Taxes and Insurance: It is vital to address the payment responsibilities for property taxes and insurance premiums in the disclosure, specifying if they are included in the installment payments or if they are the sole responsibility of the Vendée. 8. Default and Remedies: The disclosure should provide information on the consequences of defaulting on the agreement, including the remedies available to the vendor and any potential loss of equity or property rights for the Vendée. 9. Rights and Obligations: The document may detail the rights and obligations of both parties, including maintenance responsibilities, improvements, and any restrictions on the use of the property during the contract term. Different variations or types of the West Valley City Utah Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may exist depending on specific variations in state law, local regulations, or specific contractual arrangements entered into by the parties. It is crucial to consult with legal professionals or experts familiar with local real estate practices ensuring compliance with the relevant laws and regulations.