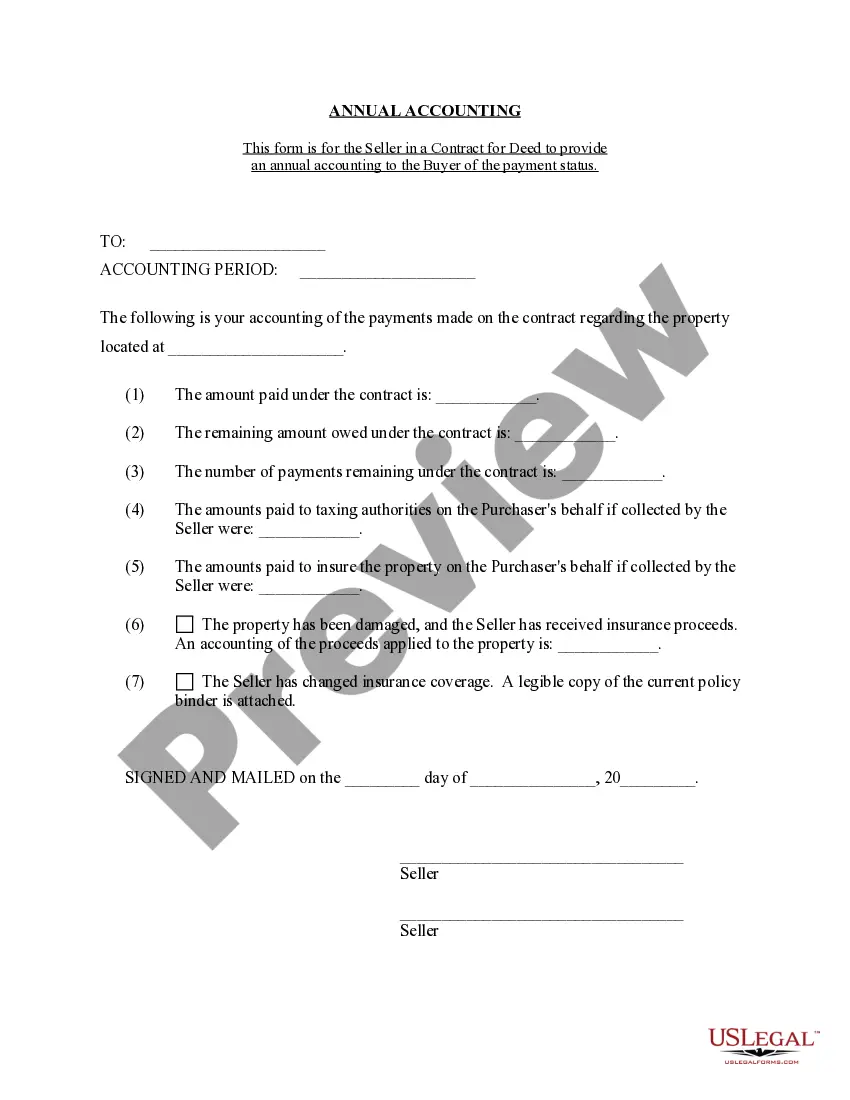

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Provo Utah Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that outlines the detailed financial transactions and records for sellers involved in contract for deed agreements in the Provo, Utah area. This statement serves as an essential tool to maintain transparency and provide a comprehensive overview of the financial dealings between the seller and buyer. The Provo Utah Contract for Deed Seller's Annual Accounting Statement includes various sections that allow the seller to present a clear and organized summary of the financial aspects of the contract for deed arrangement. The statement typically comprises the following key components: 1. Summary of Transactions: This section provides an overview of the financial activities related to the contract for deed, including the total value of payments received from the buyer, any additional fees or charges, principal and interest amounts, and any outstanding balances. 2. Payment Schedule: The statement includes a comprehensive payment schedule that outlines the buyer's payment plan, including the due dates, amount paid on each date, and the remaining balance after each payment. This helps both parties track the progress of the contract for deed. 3. Interest Calculation: In cases where interest is applicable, the statement includes a detailed breakdown of how interest is calculated and applied to the payments made by the buyer. It may also specify any changes in interest rates over time if agreed upon in the contract. 4. Escrow Account Details: If there is an escrow account involved in the contract for deed, the statement provides an account summary, highlighting the funds held in the account, any disbursements made, and the remaining balance. This information ensures transparency and accountability in the handling of escrow funds. 5. Principal Reduction: In some cases, the contract for deed may include provisions for principal reduction. The statement details the principal reduction amount, how it was calculated, and how it affects the balance owed by the buyer. 6. Taxes and Insurance: The statement may include a section dedicated to documenting the payment of property taxes and insurance premiums. This section indicates the amounts paid by the seller on behalf of the buyer and ensures compliance with contractual obligations related to these expenses. 7. Additional Fees or Charges: If the contract for deed agreement involves any additional fees or charges, such as late payment fees or service fees, the statement will clearly detail these, along with any adjustments made. Different types of Provo Utah Contract for Deed Seller's Annual Accounting Statement may include variations based on individual agreements, customizations, or specific requirements. However, irrespective of the specific variations, the primary purpose of this statement remains consistent — to maintain accurate records, provide financial transparency, and ensure a fair and smooth contract for deed transaction for both the seller and buyer involved.The Provo Utah Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that outlines the detailed financial transactions and records for sellers involved in contract for deed agreements in the Provo, Utah area. This statement serves as an essential tool to maintain transparency and provide a comprehensive overview of the financial dealings between the seller and buyer. The Provo Utah Contract for Deed Seller's Annual Accounting Statement includes various sections that allow the seller to present a clear and organized summary of the financial aspects of the contract for deed arrangement. The statement typically comprises the following key components: 1. Summary of Transactions: This section provides an overview of the financial activities related to the contract for deed, including the total value of payments received from the buyer, any additional fees or charges, principal and interest amounts, and any outstanding balances. 2. Payment Schedule: The statement includes a comprehensive payment schedule that outlines the buyer's payment plan, including the due dates, amount paid on each date, and the remaining balance after each payment. This helps both parties track the progress of the contract for deed. 3. Interest Calculation: In cases where interest is applicable, the statement includes a detailed breakdown of how interest is calculated and applied to the payments made by the buyer. It may also specify any changes in interest rates over time if agreed upon in the contract. 4. Escrow Account Details: If there is an escrow account involved in the contract for deed, the statement provides an account summary, highlighting the funds held in the account, any disbursements made, and the remaining balance. This information ensures transparency and accountability in the handling of escrow funds. 5. Principal Reduction: In some cases, the contract for deed may include provisions for principal reduction. The statement details the principal reduction amount, how it was calculated, and how it affects the balance owed by the buyer. 6. Taxes and Insurance: The statement may include a section dedicated to documenting the payment of property taxes and insurance premiums. This section indicates the amounts paid by the seller on behalf of the buyer and ensures compliance with contractual obligations related to these expenses. 7. Additional Fees or Charges: If the contract for deed agreement involves any additional fees or charges, such as late payment fees or service fees, the statement will clearly detail these, along with any adjustments made. Different types of Provo Utah Contract for Deed Seller's Annual Accounting Statement may include variations based on individual agreements, customizations, or specific requirements. However, irrespective of the specific variations, the primary purpose of this statement remains consistent — to maintain accurate records, provide financial transparency, and ensure a fair and smooth contract for deed transaction for both the seller and buyer involved.