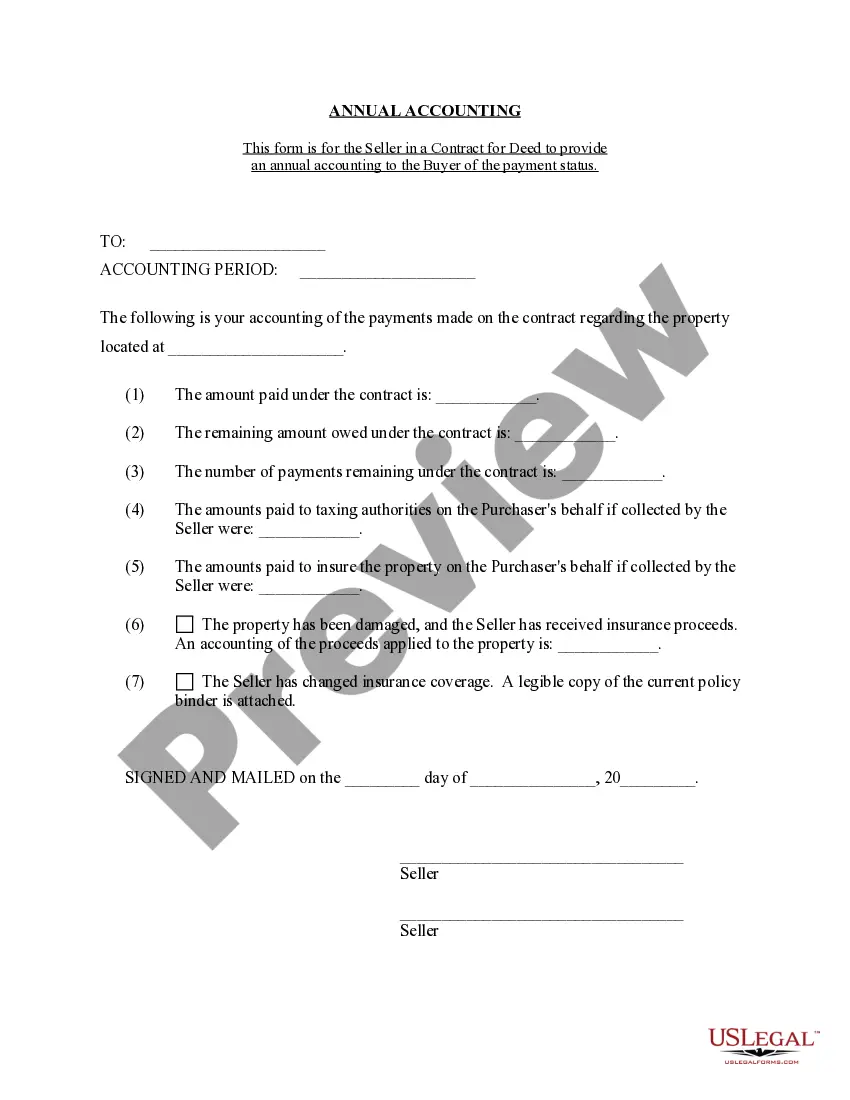

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statement is a document prepared by the seller of a property that has been sold using a contract for deed arrangement. This statement provides a detailed summary of the financial transactions and obligations related to the contract for deed between the seller and the buyer. The Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statement showcases various important information, including the total amount paid by the buyer towards the property's purchase price, the remaining balance owed on the contract, and any interest or fees accrued over the year. Additionally, this statement outlines the payments received by the seller, the breakdown of principal and interest, and the date of each payment made by the buyer. It also specifies the amount allocated towards property taxes, insurance, and other expenses if applicable. The statement may further detail any escrow accounts set up for these expenses. Different types of Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statements may include: 1. Basic Annual Accounting Statement: This type of statement would cover the essential financial details, including the principal and interest breakdown, payments received, and the remaining balance. 2. Comprehensive Annual Accounting Statement: This statement would provide a more detailed breakdown of expenses, including property taxes, insurance, and any other costs associated with the property. 3. Escrow Annual Accounting Statement: This type of statement specifically focuses on the management of escrow accounts, providing information about funds deposited, disbursed, and any interest earned. 4. Delinquency or Default Annual Accounting Statement: This statement is issued when the buyer fails to make timely payments or defaults on the contract, outlining the outstanding balance, late fees charged, and any potential legal actions. 5. Final Annual Accounting Statement: This statement is prepared and issued upon the completion of all payment obligations, indicating the full satisfaction of the contract for deed and transfer of property ownership. It is important for both the buyer and the seller to review the Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statement and ensure accuracy in financial calculations and disclosures. This document serves as a transparent record, allowing both parties to track the progress of the contract for deed and maintain a clear understanding of their financial obligations.Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statement is a document prepared by the seller of a property that has been sold using a contract for deed arrangement. This statement provides a detailed summary of the financial transactions and obligations related to the contract for deed between the seller and the buyer. The Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statement showcases various important information, including the total amount paid by the buyer towards the property's purchase price, the remaining balance owed on the contract, and any interest or fees accrued over the year. Additionally, this statement outlines the payments received by the seller, the breakdown of principal and interest, and the date of each payment made by the buyer. It also specifies the amount allocated towards property taxes, insurance, and other expenses if applicable. The statement may further detail any escrow accounts set up for these expenses. Different types of Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statements may include: 1. Basic Annual Accounting Statement: This type of statement would cover the essential financial details, including the principal and interest breakdown, payments received, and the remaining balance. 2. Comprehensive Annual Accounting Statement: This statement would provide a more detailed breakdown of expenses, including property taxes, insurance, and any other costs associated with the property. 3. Escrow Annual Accounting Statement: This type of statement specifically focuses on the management of escrow accounts, providing information about funds deposited, disbursed, and any interest earned. 4. Delinquency or Default Annual Accounting Statement: This statement is issued when the buyer fails to make timely payments or defaults on the contract, outlining the outstanding balance, late fees charged, and any potential legal actions. 5. Final Annual Accounting Statement: This statement is prepared and issued upon the completion of all payment obligations, indicating the full satisfaction of the contract for deed and transfer of property ownership. It is important for both the buyer and the seller to review the Salt Lake City Utah Contract for Deed Seller's Annual Accounting Statement and ensure accuracy in financial calculations and disclosures. This document serves as a transparent record, allowing both parties to track the progress of the contract for deed and maintain a clear understanding of their financial obligations.