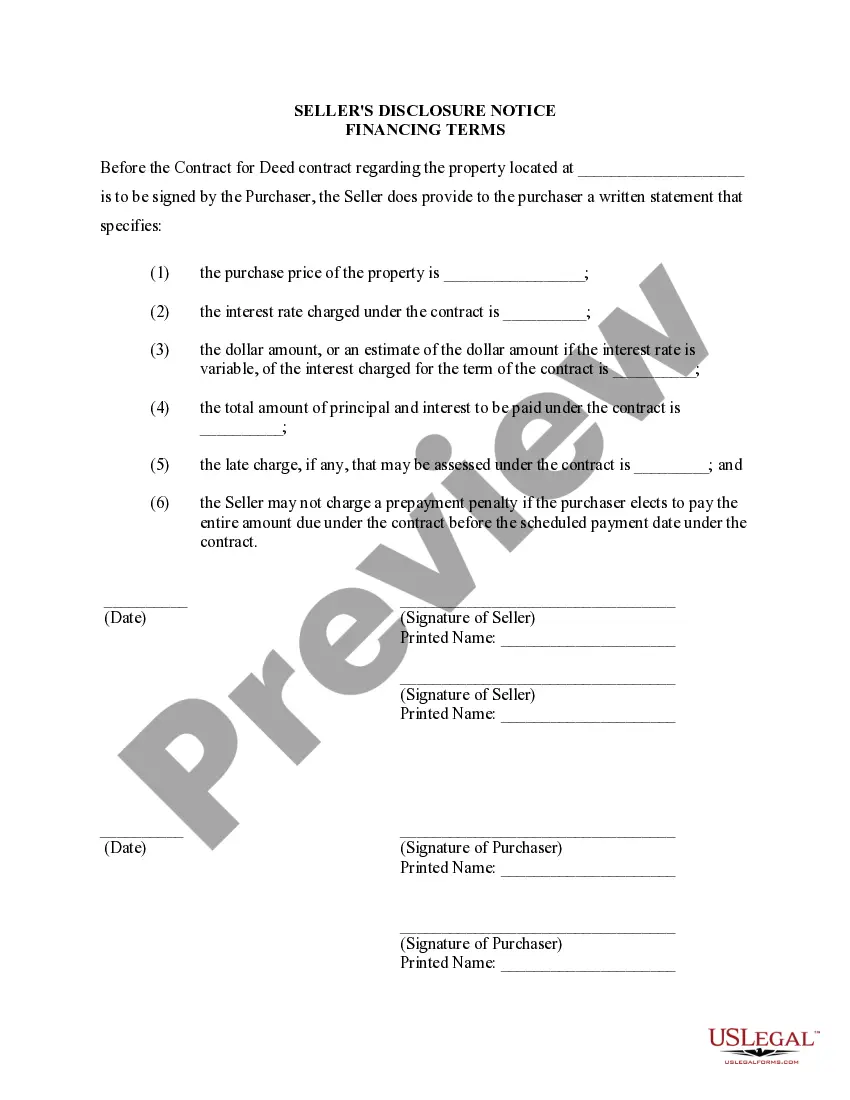

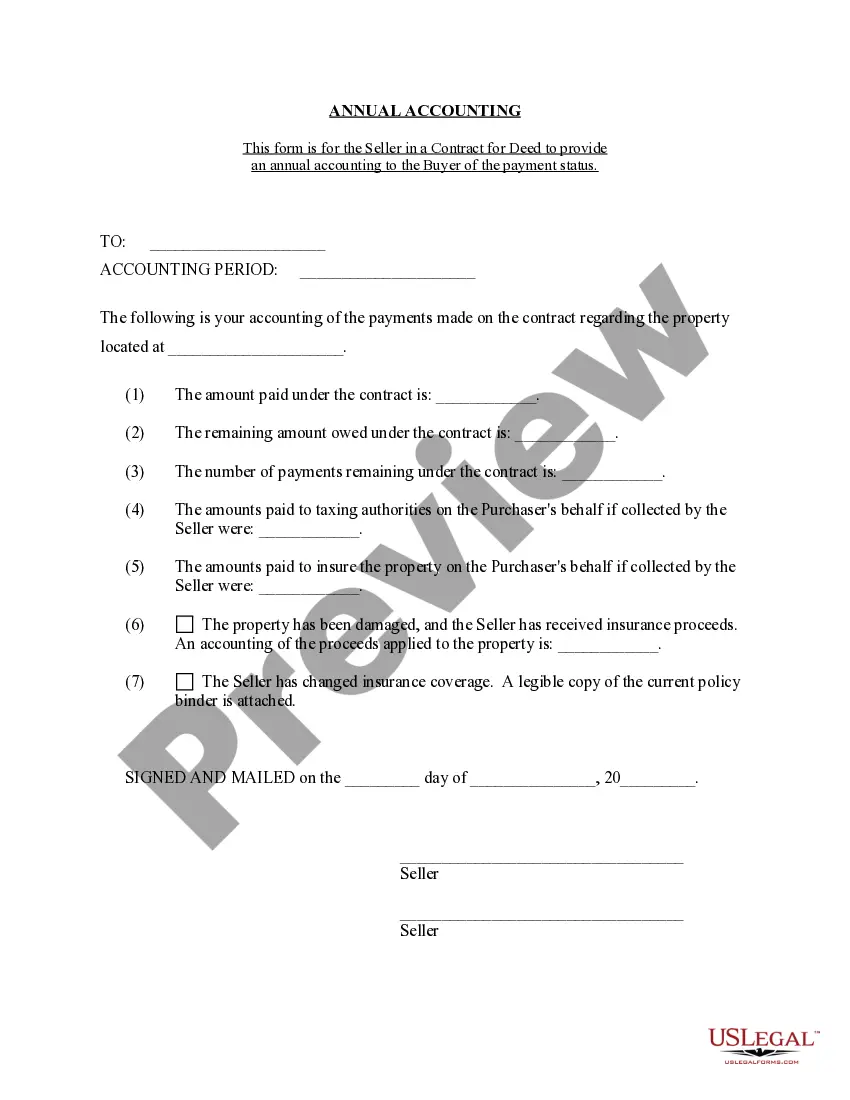

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

West Jordan Utah Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Utah Contract For Deed Seller's Annual Accounting Statement?

Locating authenticated templates tailored to your regional regulations can be challenging unless you access the US Legal Forms repository.

It’s an internet collection of over 85,000 legal documents for both individual and professional requirements and various real-life scenarios.

All the forms are correctly categorized by application area and jurisdiction, making the search for the West Jordan Utah Contract for Deed Seller's Annual Accounting Statement as quick and straightforward as ABC.

Maintaining documentation organized and compliant with legal standards is of utmost importance. Take advantage of the US Legal Forms repository to always have vital document templates for any requirements readily available!

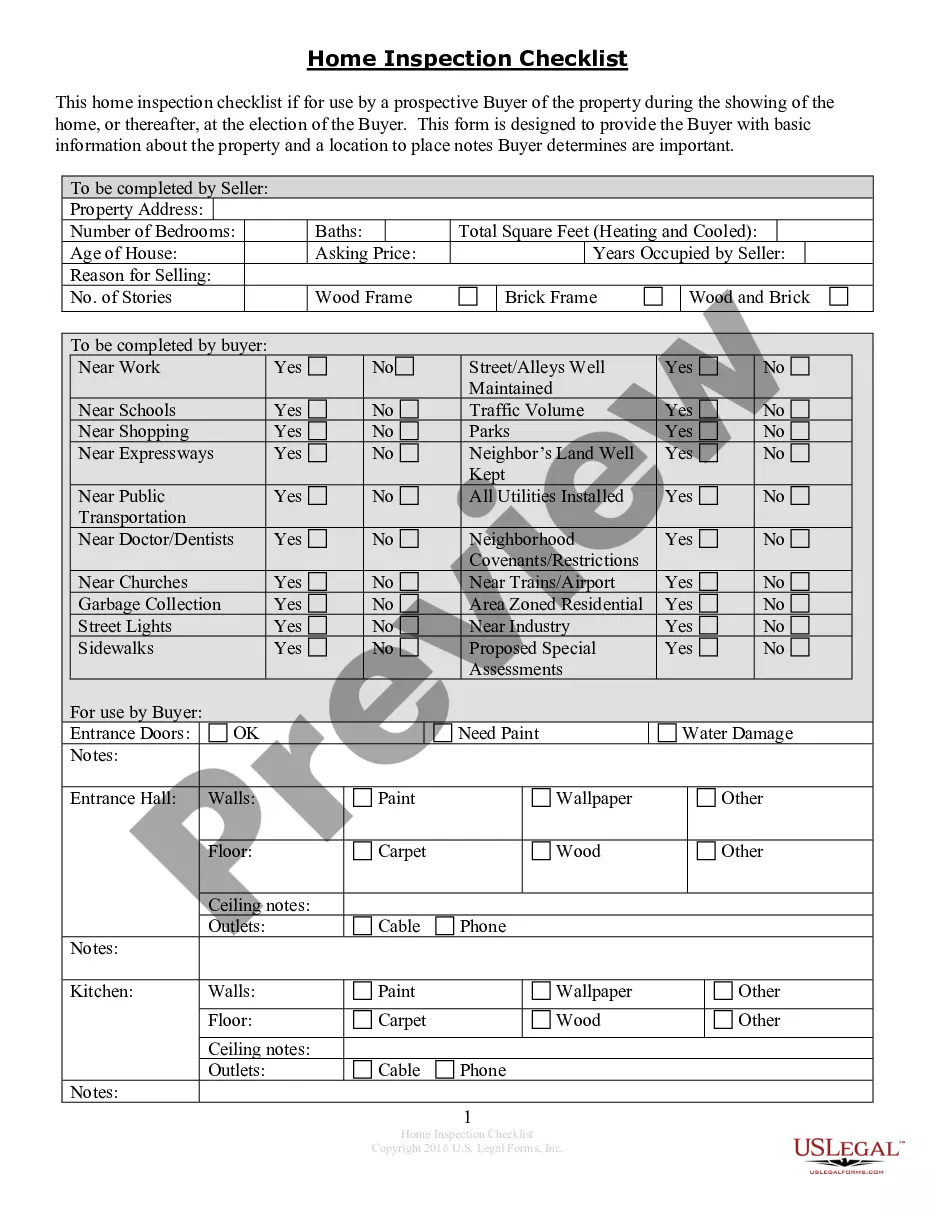

- Examine the Preview mode and form description.

- Ensure you’ve chosen the correct one that satisfies your needs and fully aligns with your local jurisdiction mandates.

- Search for another template, if required.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your needs, proceed to the next phase.

- Purchase the document.

Form popularity

FAQ

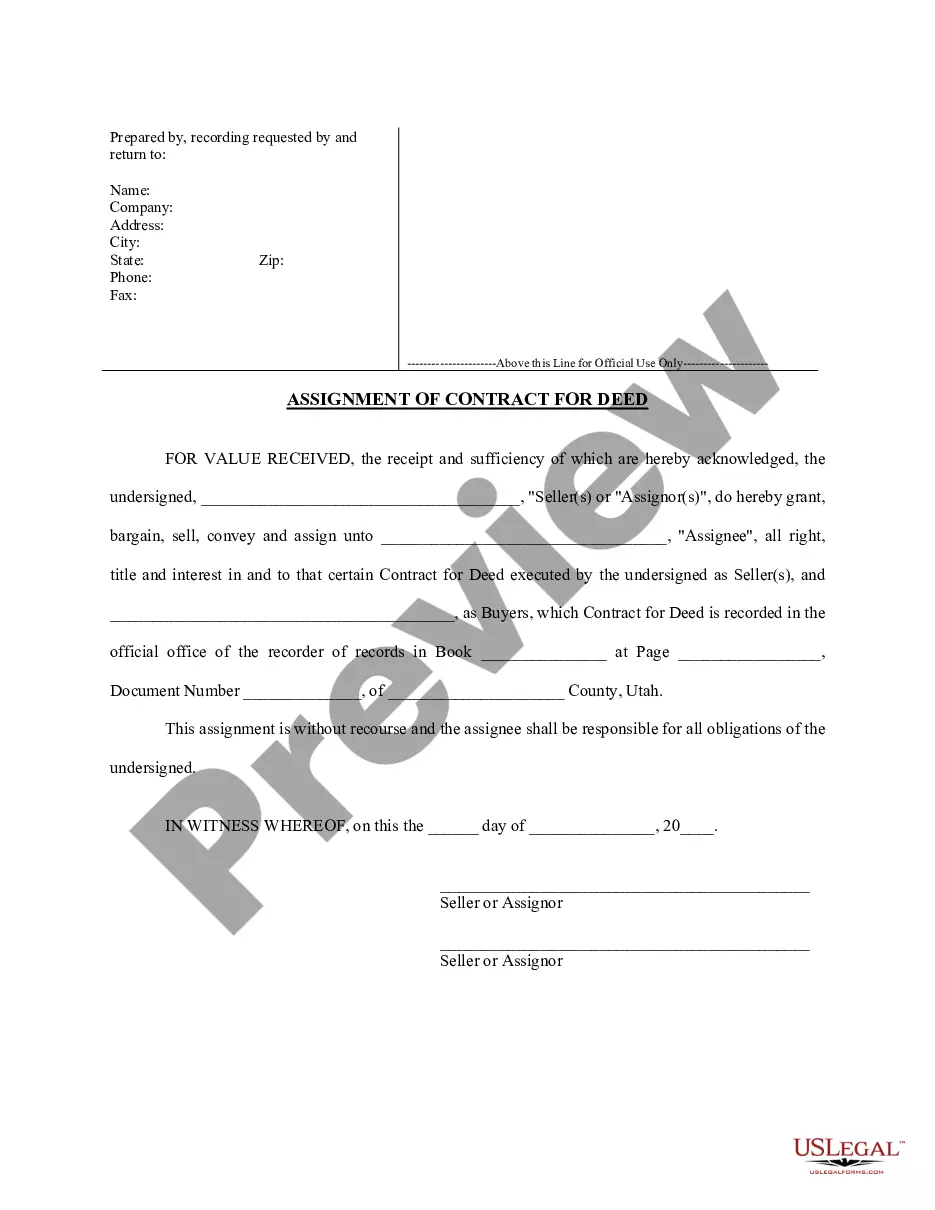

A Contract for Deed is a way to buy a house that doesn't involve a bank. The seller finances the property for the buyer. The buyer moves in when the contract is signed. The buyer pays the seller monthly payments that go towards payment for the home.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Pros And Cons Of A Land Contract Pro: It's Easier To Get Financing.Pro: It's A Win-Win For Sellers.Pro: There Are More Opportunities To Purchase.Con: The Buyer Depends On The Seller.Con: Contract Vagueness.Con: Higher Interest Rates.Con: Homeownership Gray Area.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

A contract for deed (sometimes called an installment purchase contract or installment sale agreement) is a real estate transaction in which the purchase of the property is financed by the seller rather than a third party such as a bank, credit union or other mortgage lender.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.