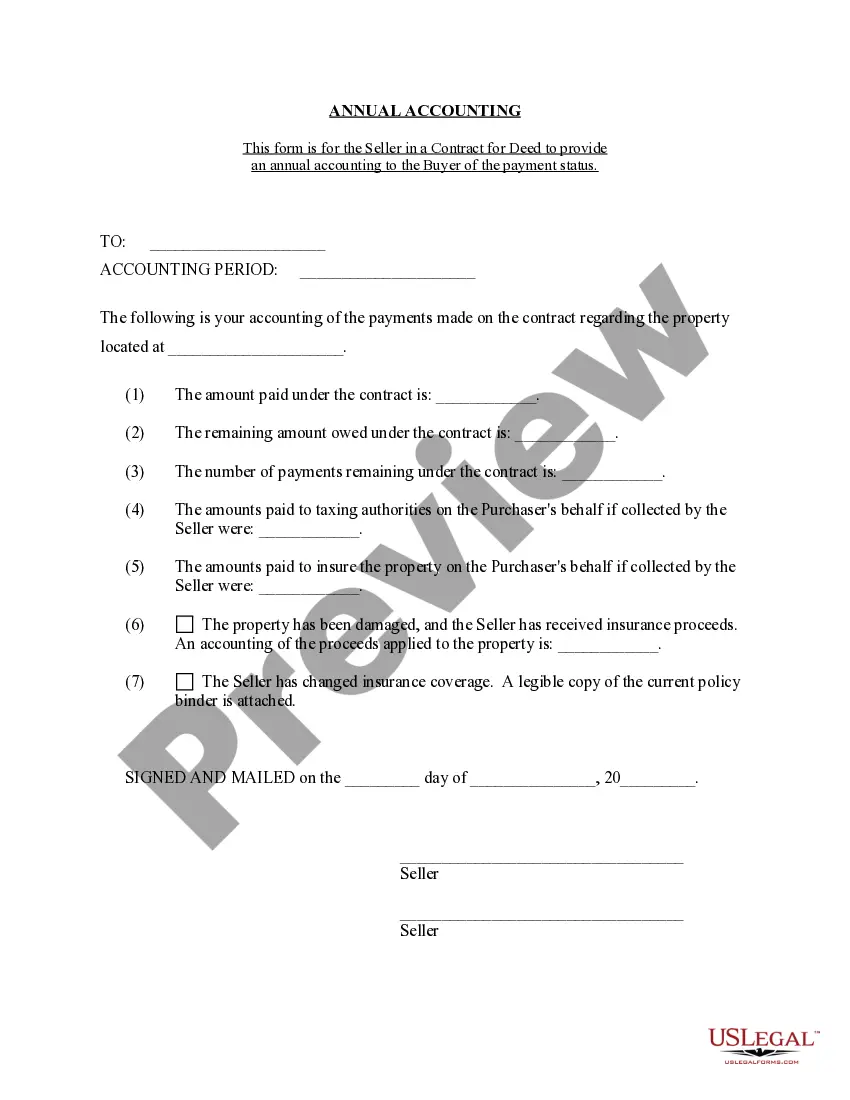

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

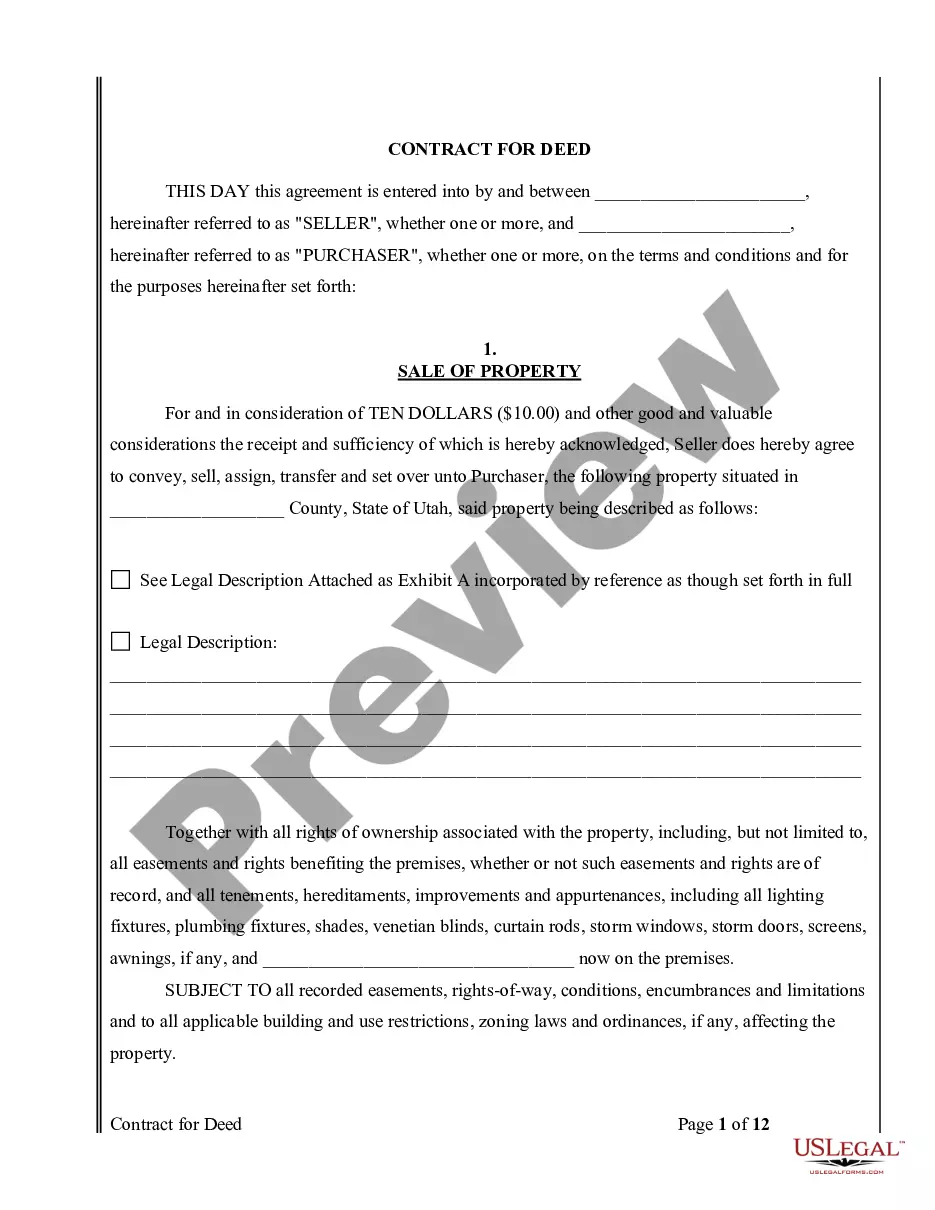

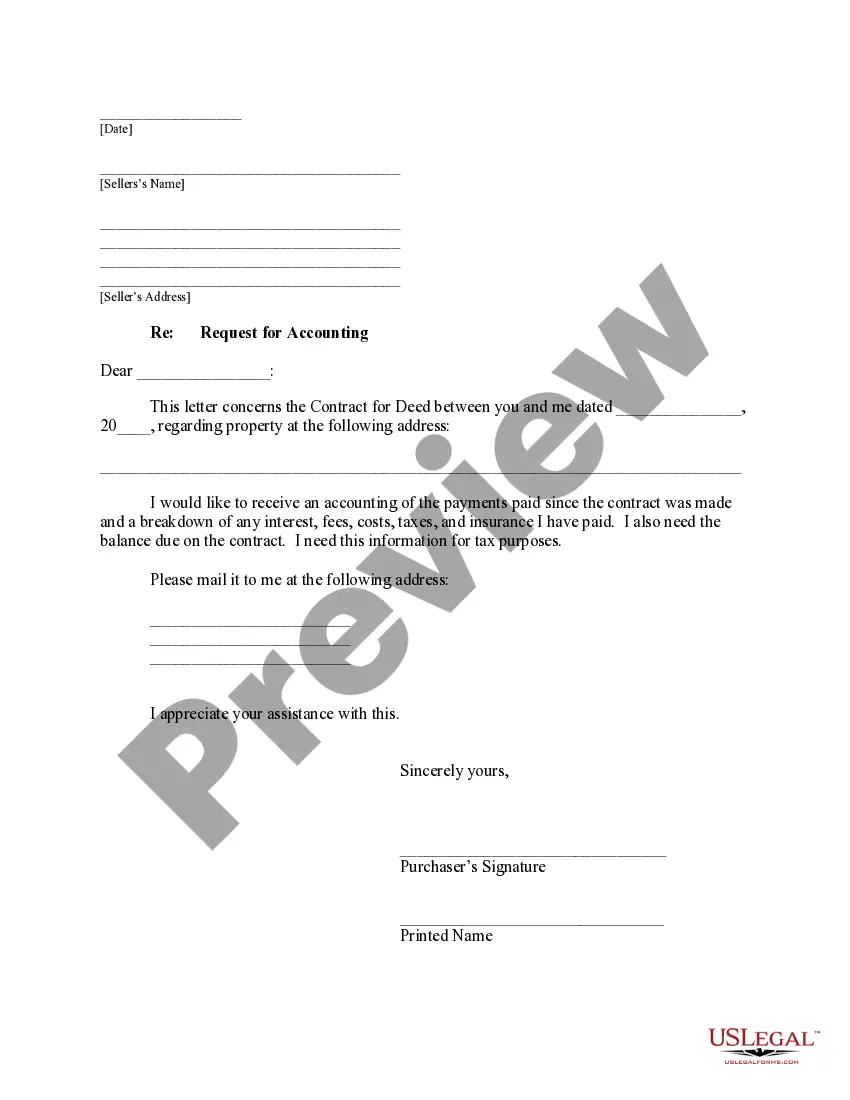

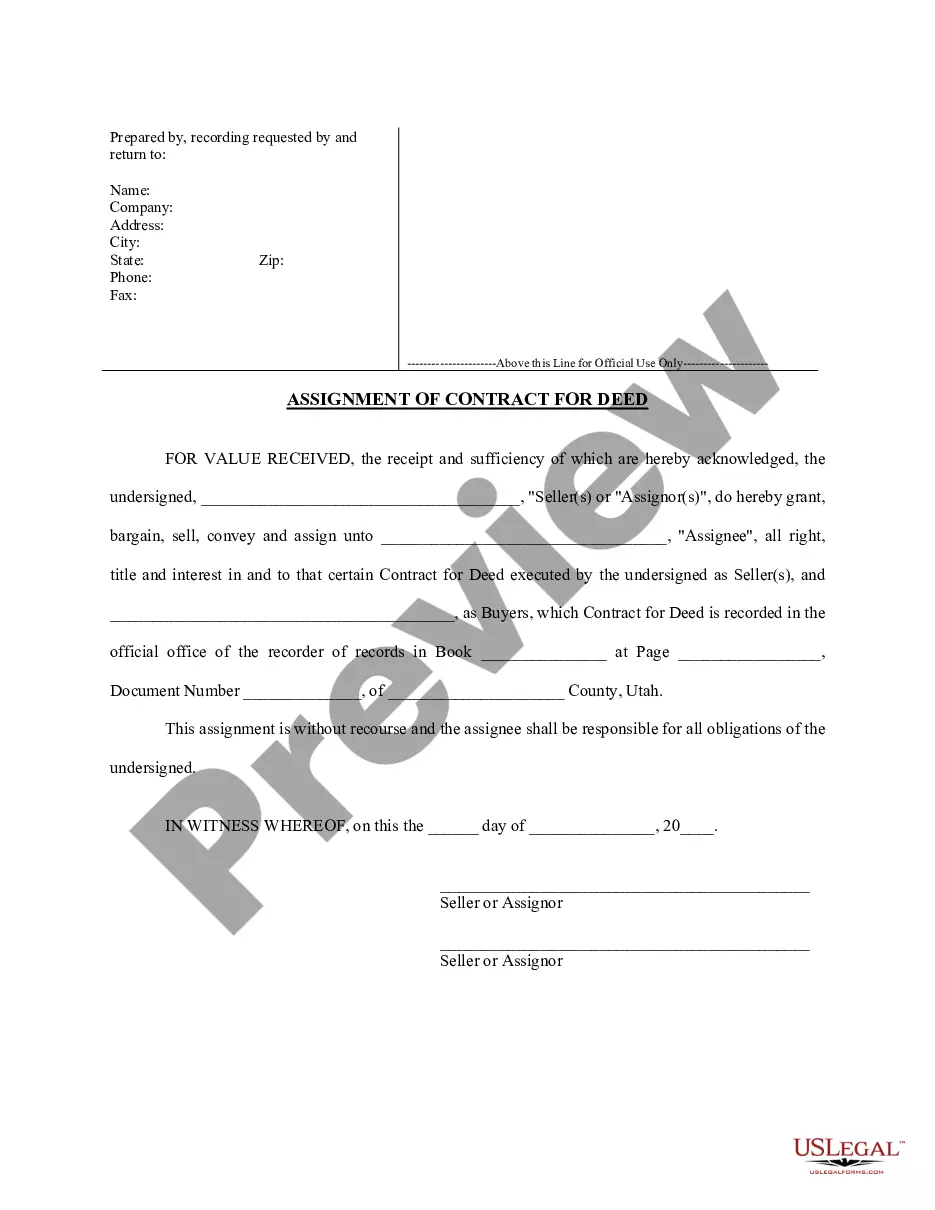

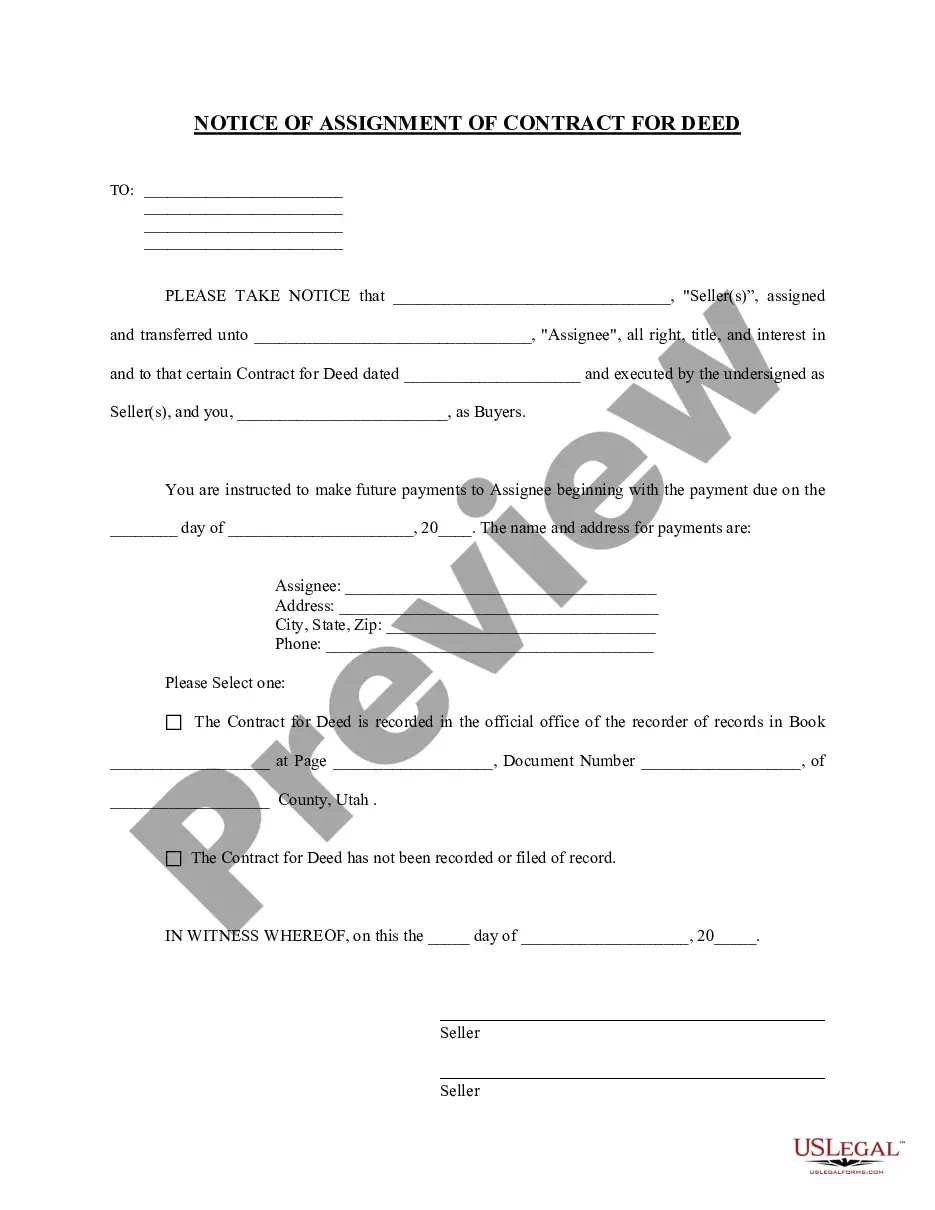

The West Valley City Utah Contract for Deed Seller's Annual Accounting Statement is a crucial document used in real estate transactions. This statement provides an in-depth overview of the financial aspects of a contract for deed agreement, outlining the financial activities and obligations carried out by the seller throughout the year. By offering transparency and accountability, this statement ensures that both the buyer and seller have a clear understanding of the financial status of the contract. Key components of the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement include: 1. Contract Details: This section includes essential information such as the names and contact details of both the buyer and seller, the property address, and the date of the contract. 2. Annual Income Report: The seller's annual accounting statement incorporates a comprehensive breakdown of the income generated from the contract for deed during the stated time period. This includes payments made by the buyer in the form of principal, interest, and any other relevant fees. 3. Expense Report: Sellers are required to provide an itemized expense report, including any expenses related to property taxes, insurance, repairs, or maintenance incurred throughout the year. These costs are subtracted from the income to determine the net profit. 4. Account Balance: This section outlines the financial standing of the contract for deed arrangement. It includes the opening and closing account balances, providing a clear picture of any outstanding amounts owed by the buyer or seller. 5. Delinquency and Overdue Payments: In case of any delinquencies or overdue payments, the annual accounting statement details the amounts outstanding, along with any associated penalties or interest charges. Transparency in this regard ensures that the buyer stays informed about any potential liabilities. Different types of the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement may include variations specific to the terms agreed upon by the buyer and seller. These may include additional provisions relating to the calculation of interest, handling of late payments, or any specific agreements reached when structuring the contract for deed. In conclusion, the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement plays a vital role in facilitating transparency and maintaining financial accountability in a contract for deed agreement. By providing a detailed overview of income, expenses, and account balances, this document ensures that both parties have a clear understanding of the financial status and obligations associated with the contract.The West Valley City Utah Contract for Deed Seller's Annual Accounting Statement is a crucial document used in real estate transactions. This statement provides an in-depth overview of the financial aspects of a contract for deed agreement, outlining the financial activities and obligations carried out by the seller throughout the year. By offering transparency and accountability, this statement ensures that both the buyer and seller have a clear understanding of the financial status of the contract. Key components of the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement include: 1. Contract Details: This section includes essential information such as the names and contact details of both the buyer and seller, the property address, and the date of the contract. 2. Annual Income Report: The seller's annual accounting statement incorporates a comprehensive breakdown of the income generated from the contract for deed during the stated time period. This includes payments made by the buyer in the form of principal, interest, and any other relevant fees. 3. Expense Report: Sellers are required to provide an itemized expense report, including any expenses related to property taxes, insurance, repairs, or maintenance incurred throughout the year. These costs are subtracted from the income to determine the net profit. 4. Account Balance: This section outlines the financial standing of the contract for deed arrangement. It includes the opening and closing account balances, providing a clear picture of any outstanding amounts owed by the buyer or seller. 5. Delinquency and Overdue Payments: In case of any delinquencies or overdue payments, the annual accounting statement details the amounts outstanding, along with any associated penalties or interest charges. Transparency in this regard ensures that the buyer stays informed about any potential liabilities. Different types of the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement may include variations specific to the terms agreed upon by the buyer and seller. These may include additional provisions relating to the calculation of interest, handling of late payments, or any specific agreements reached when structuring the contract for deed. In conclusion, the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement plays a vital role in facilitating transparency and maintaining financial accountability in a contract for deed agreement. By providing a detailed overview of income, expenses, and account balances, this document ensures that both parties have a clear understanding of the financial status and obligations associated with the contract.